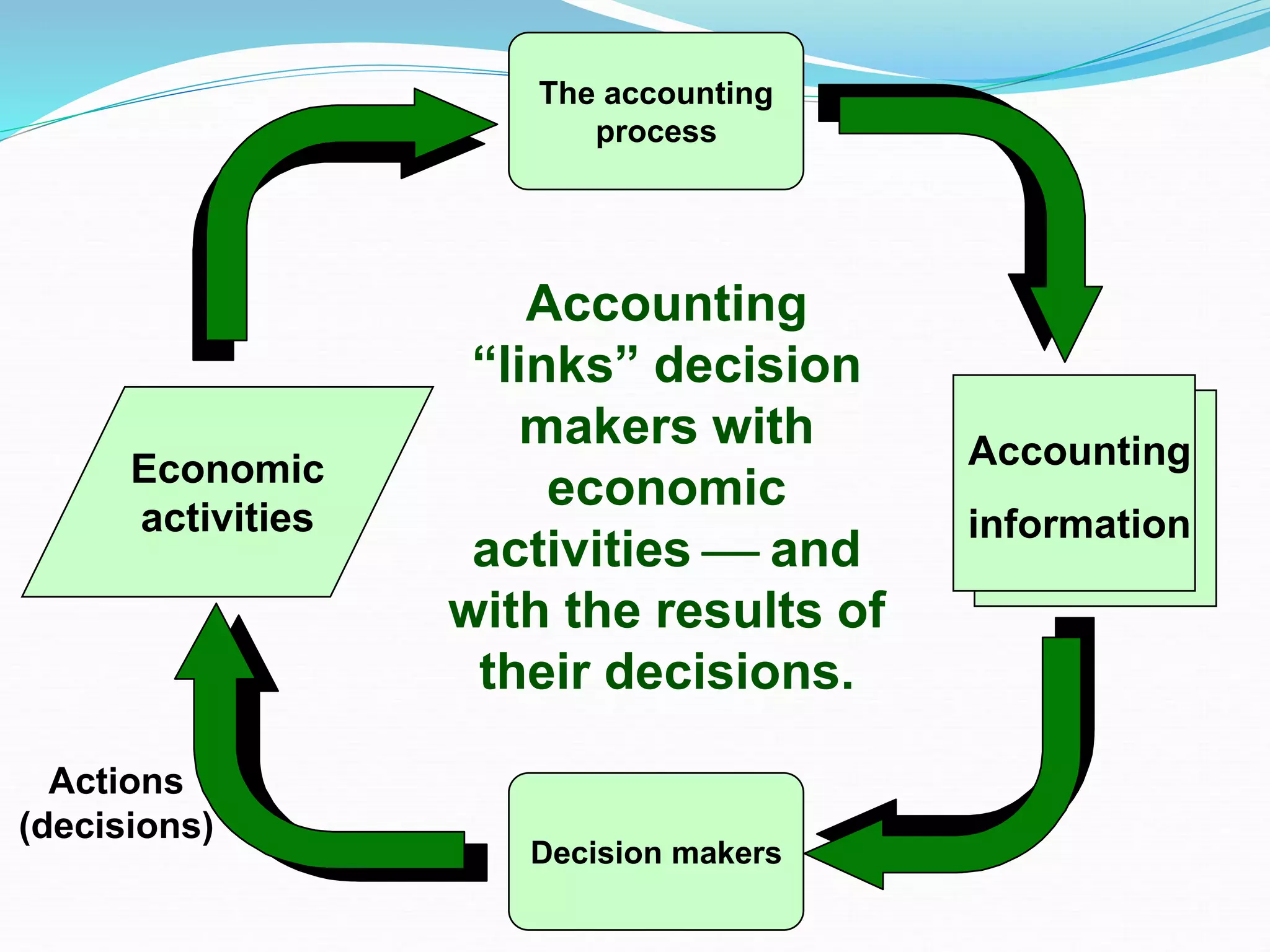

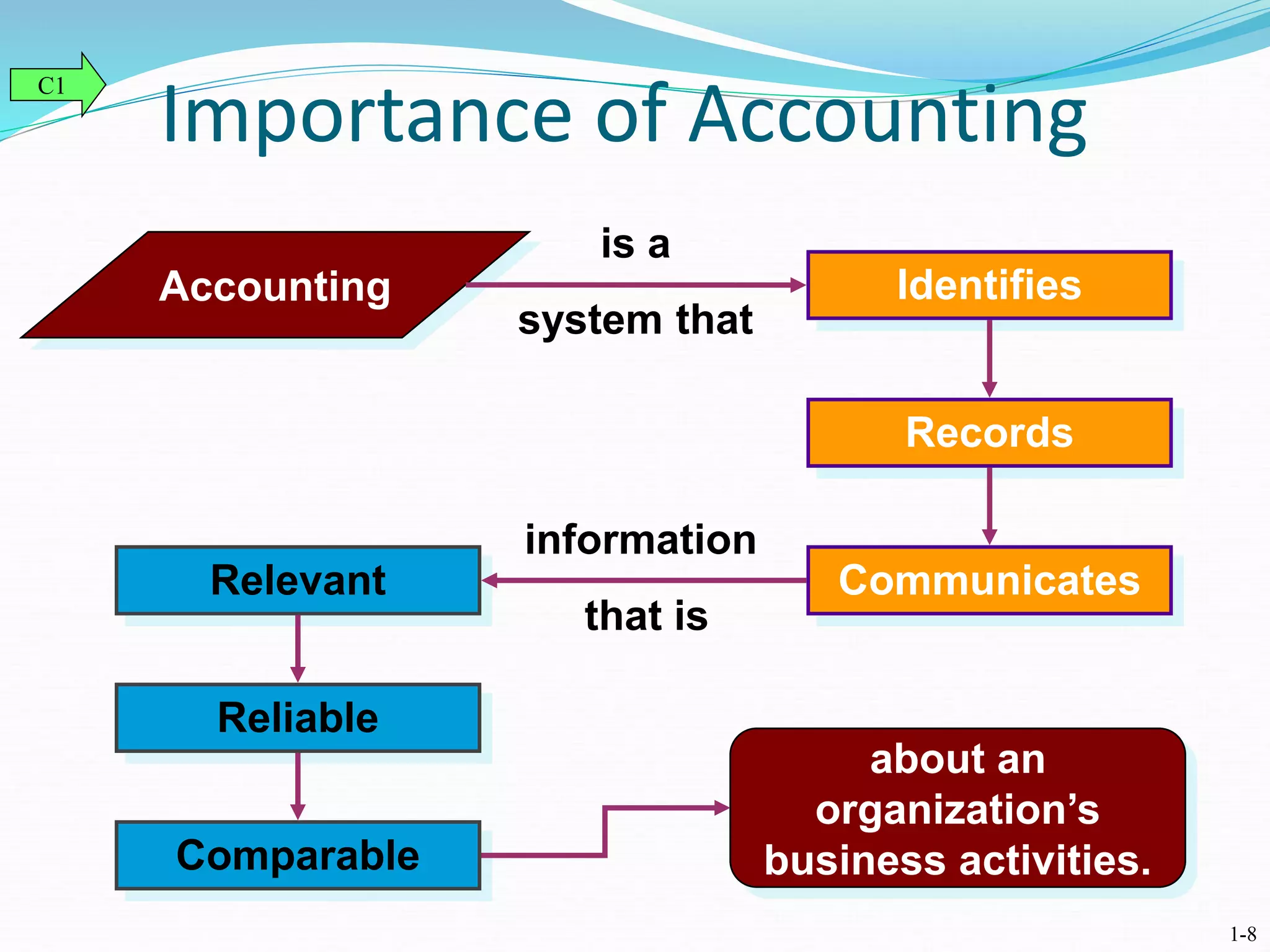

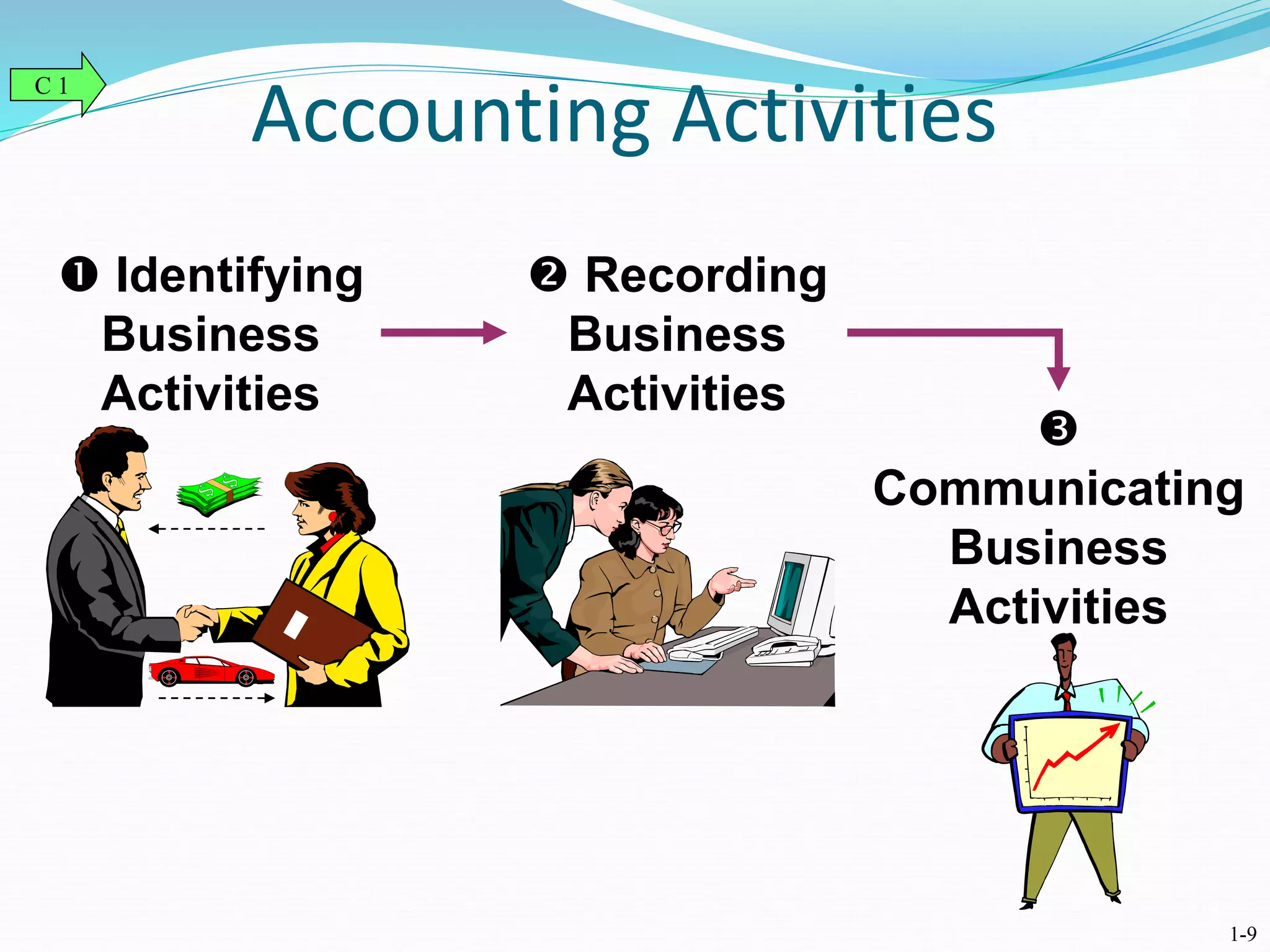

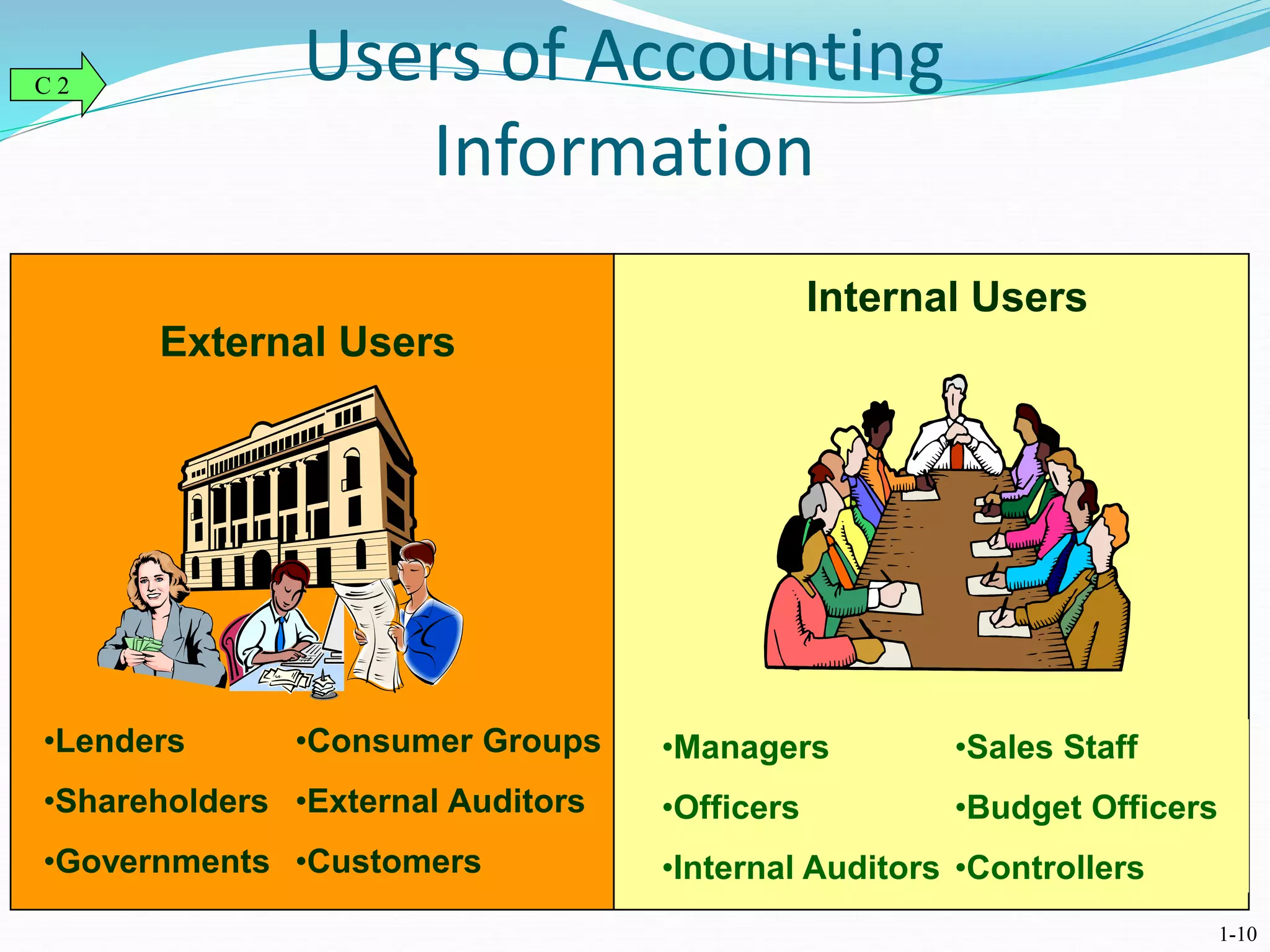

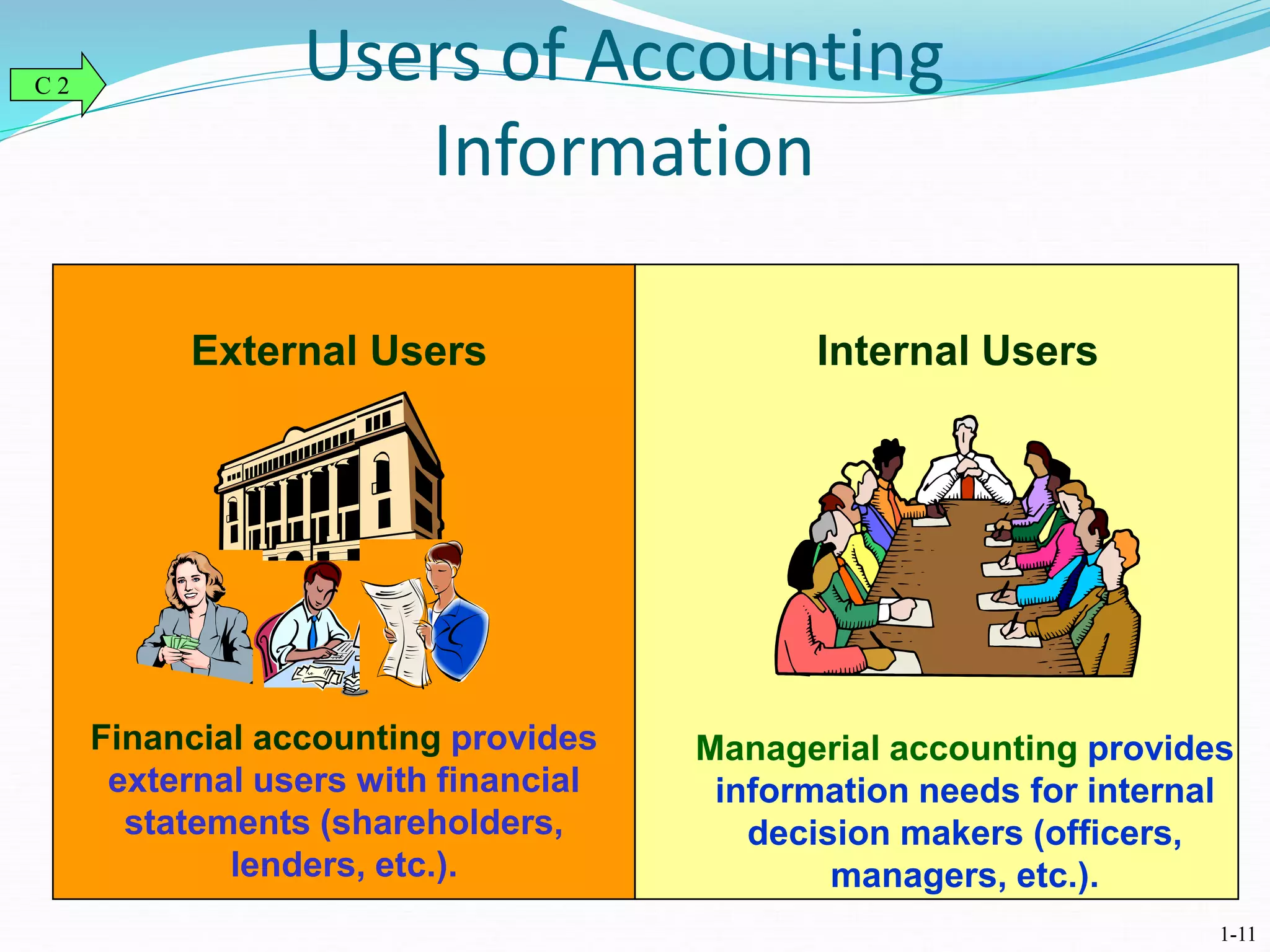

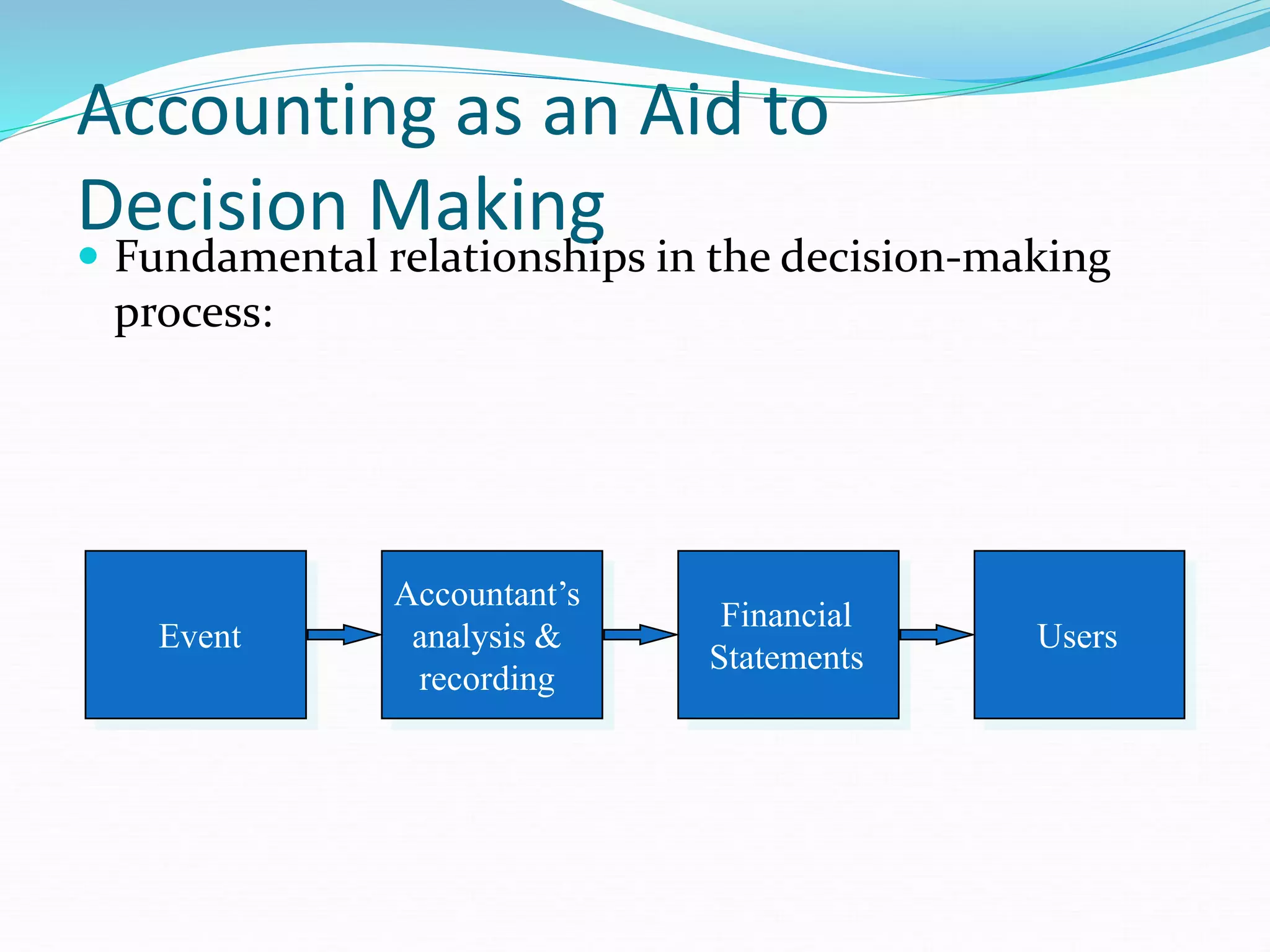

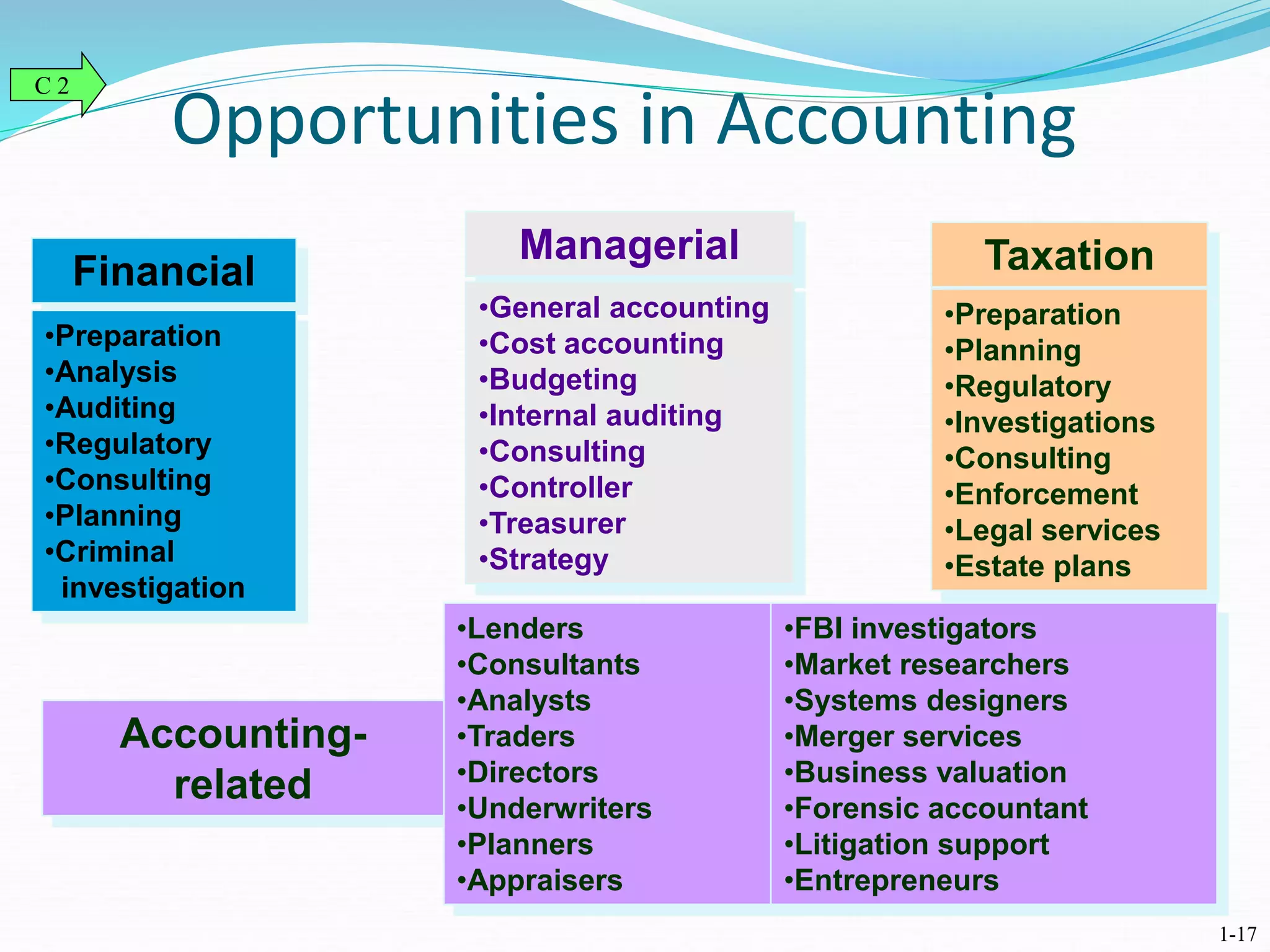

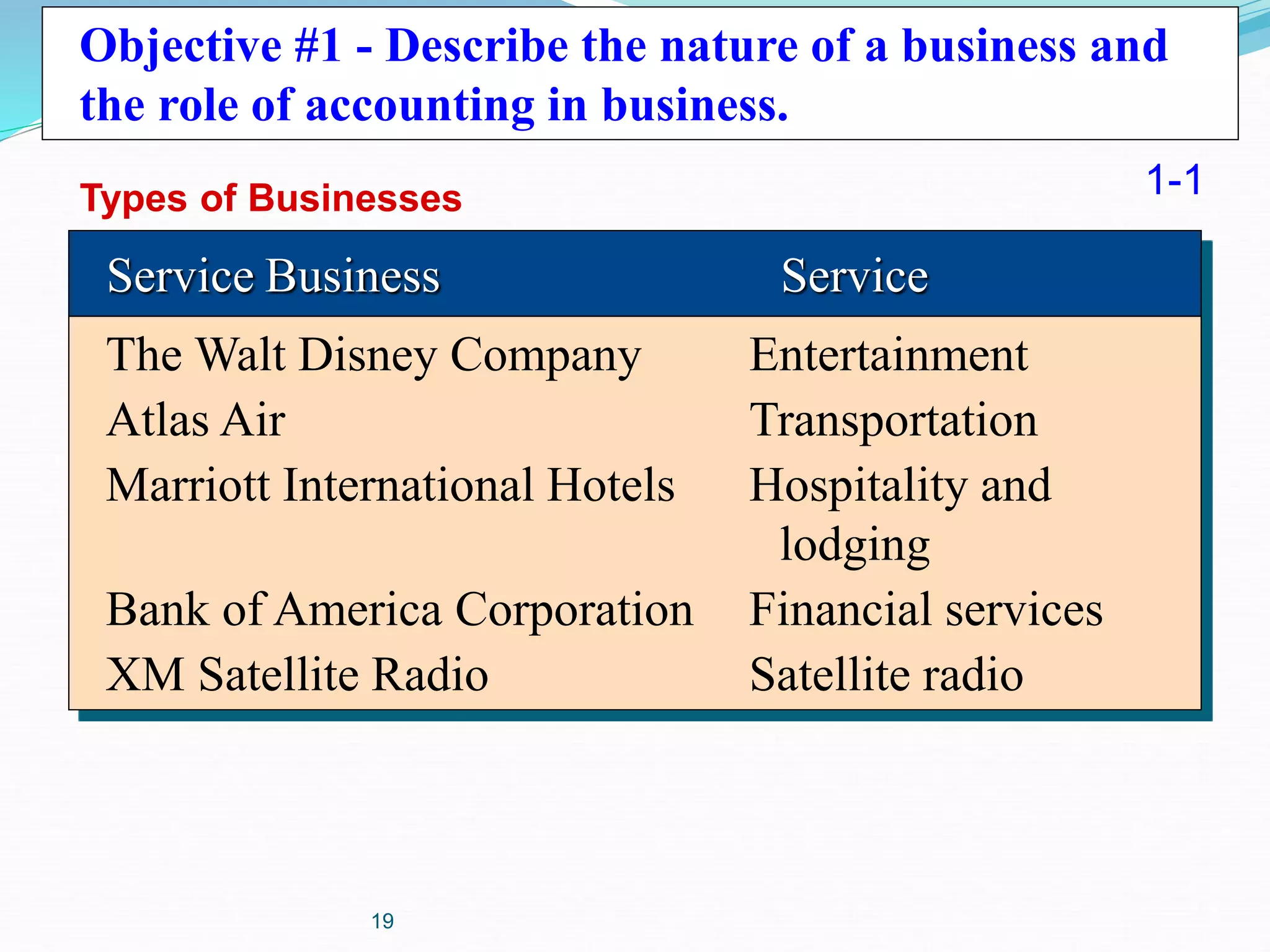

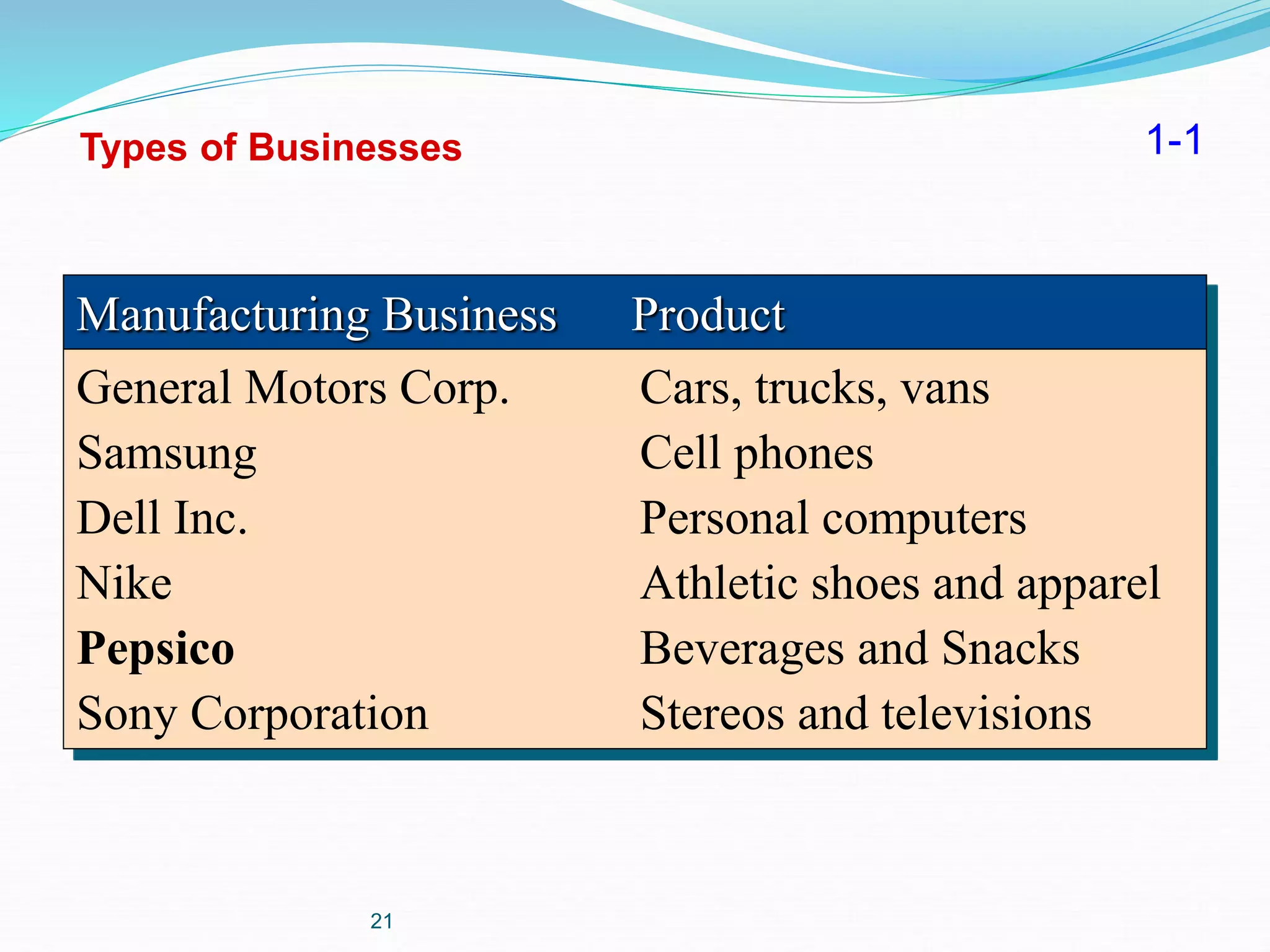

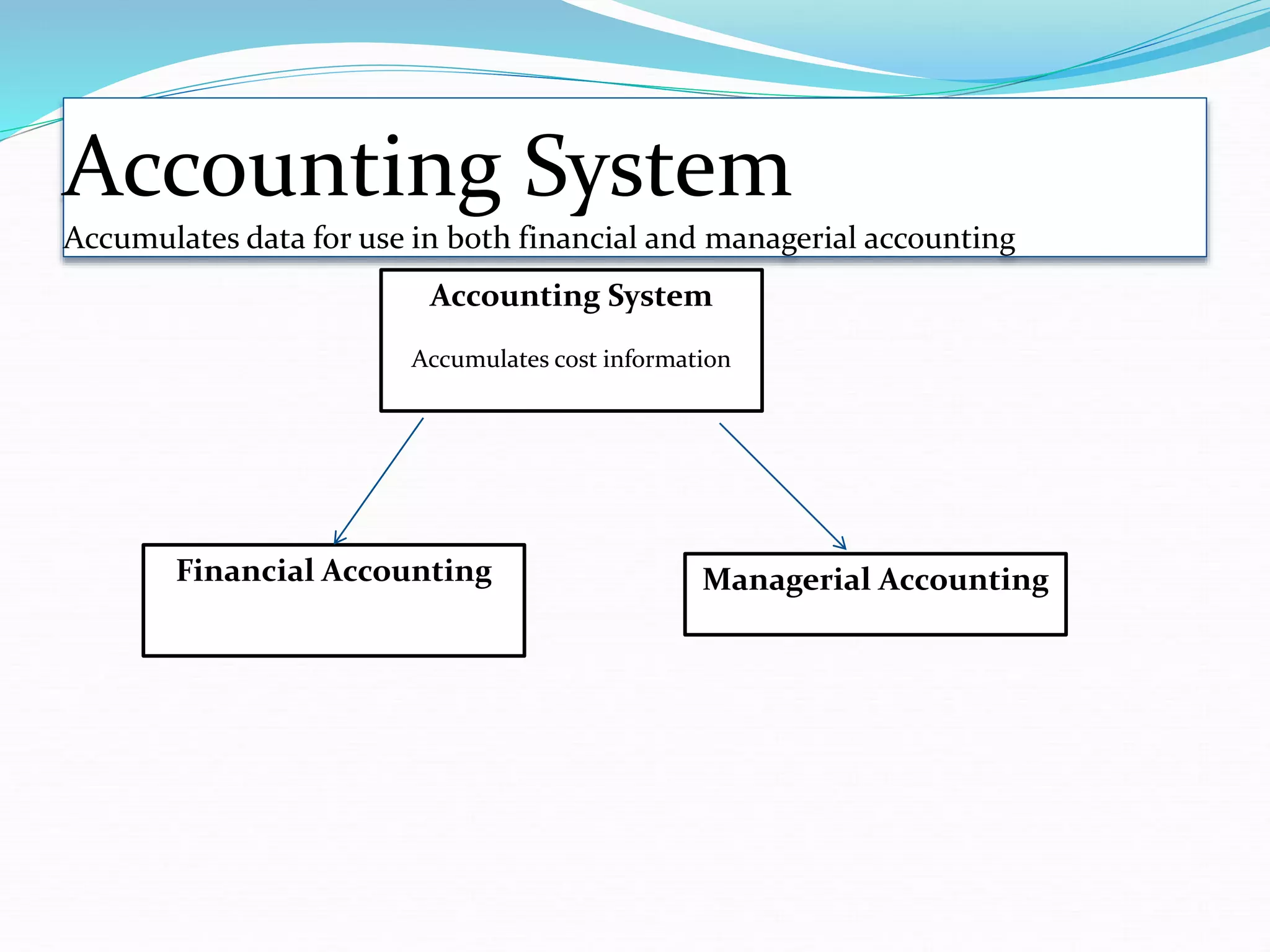

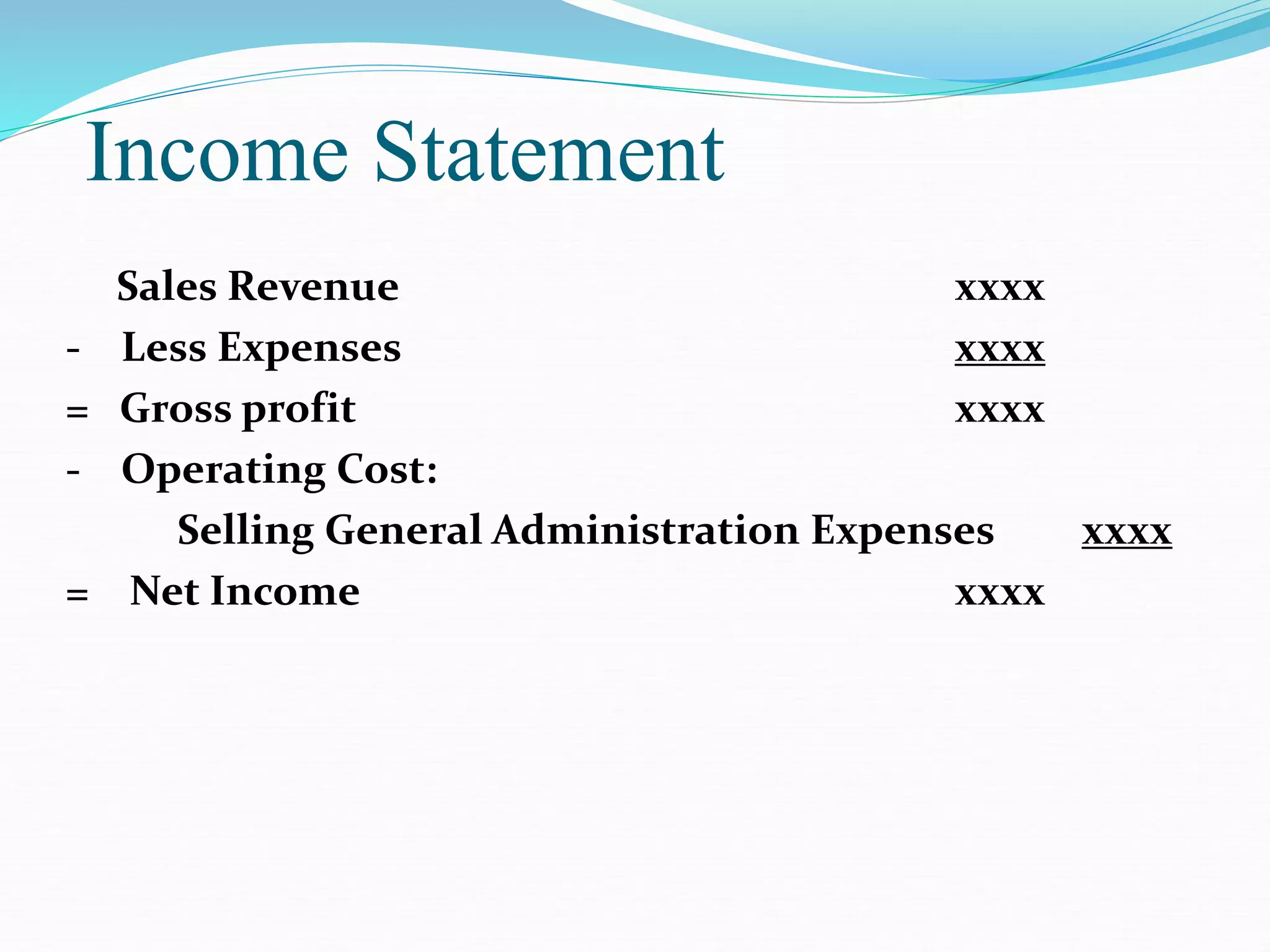

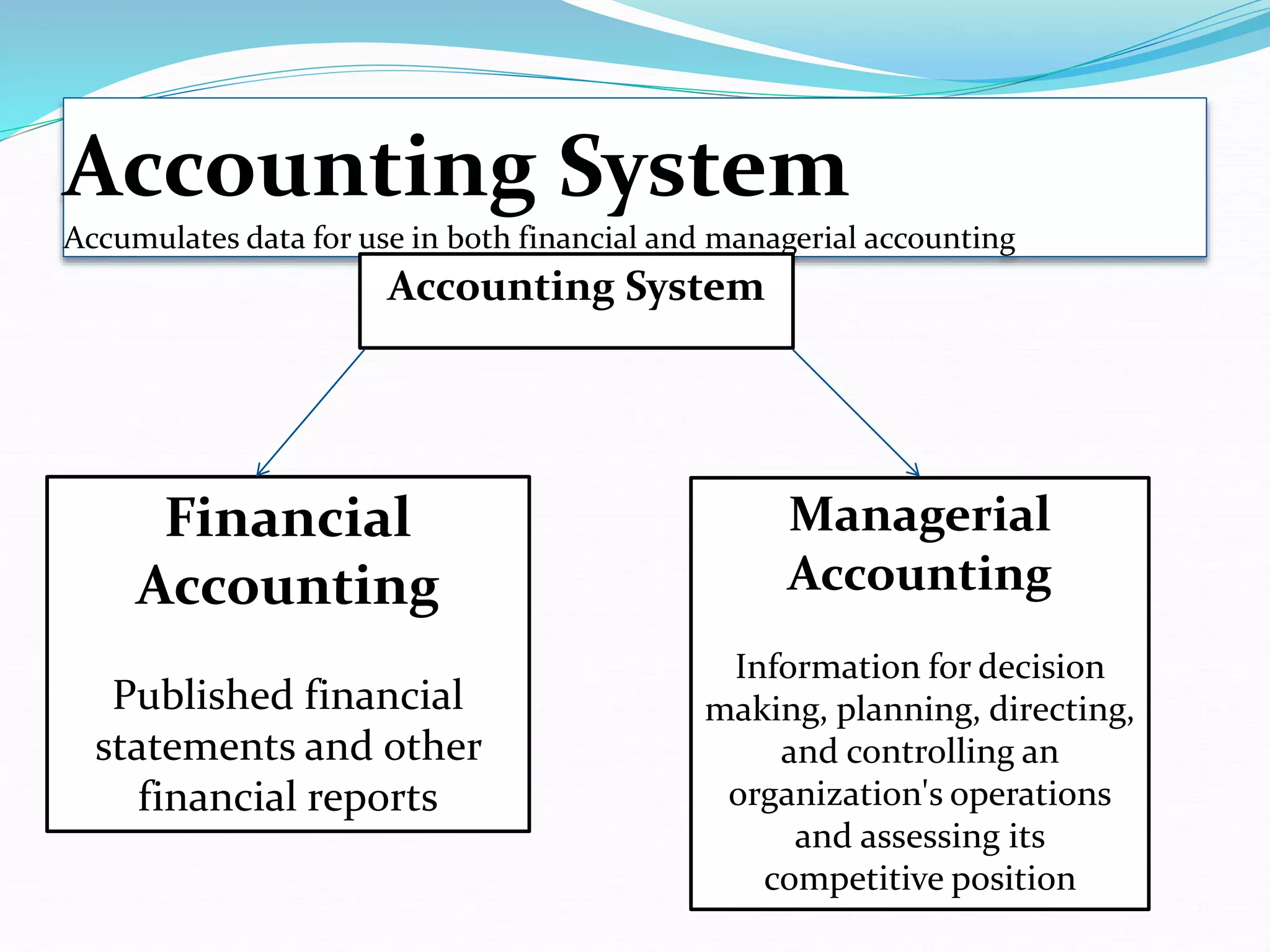

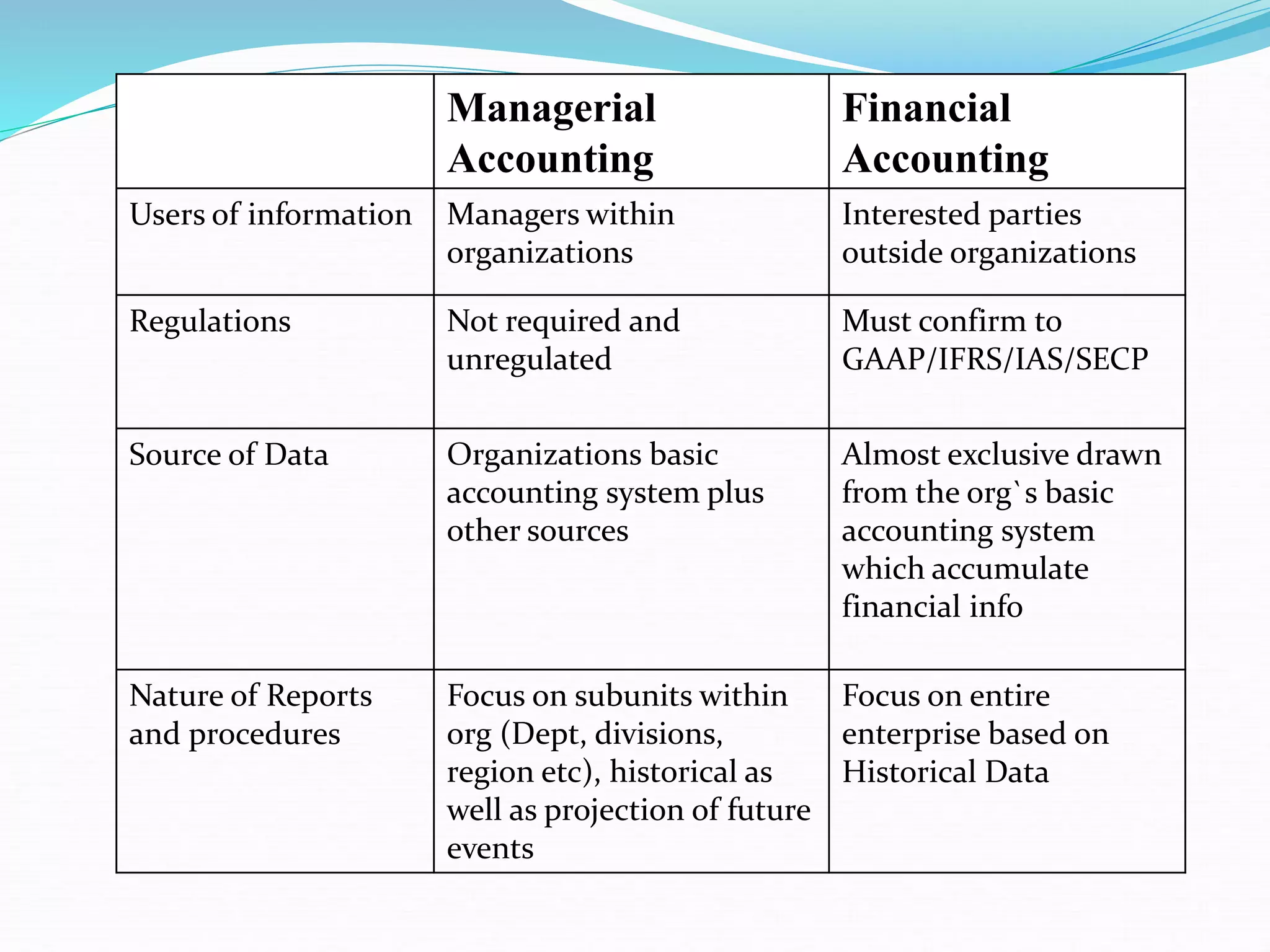

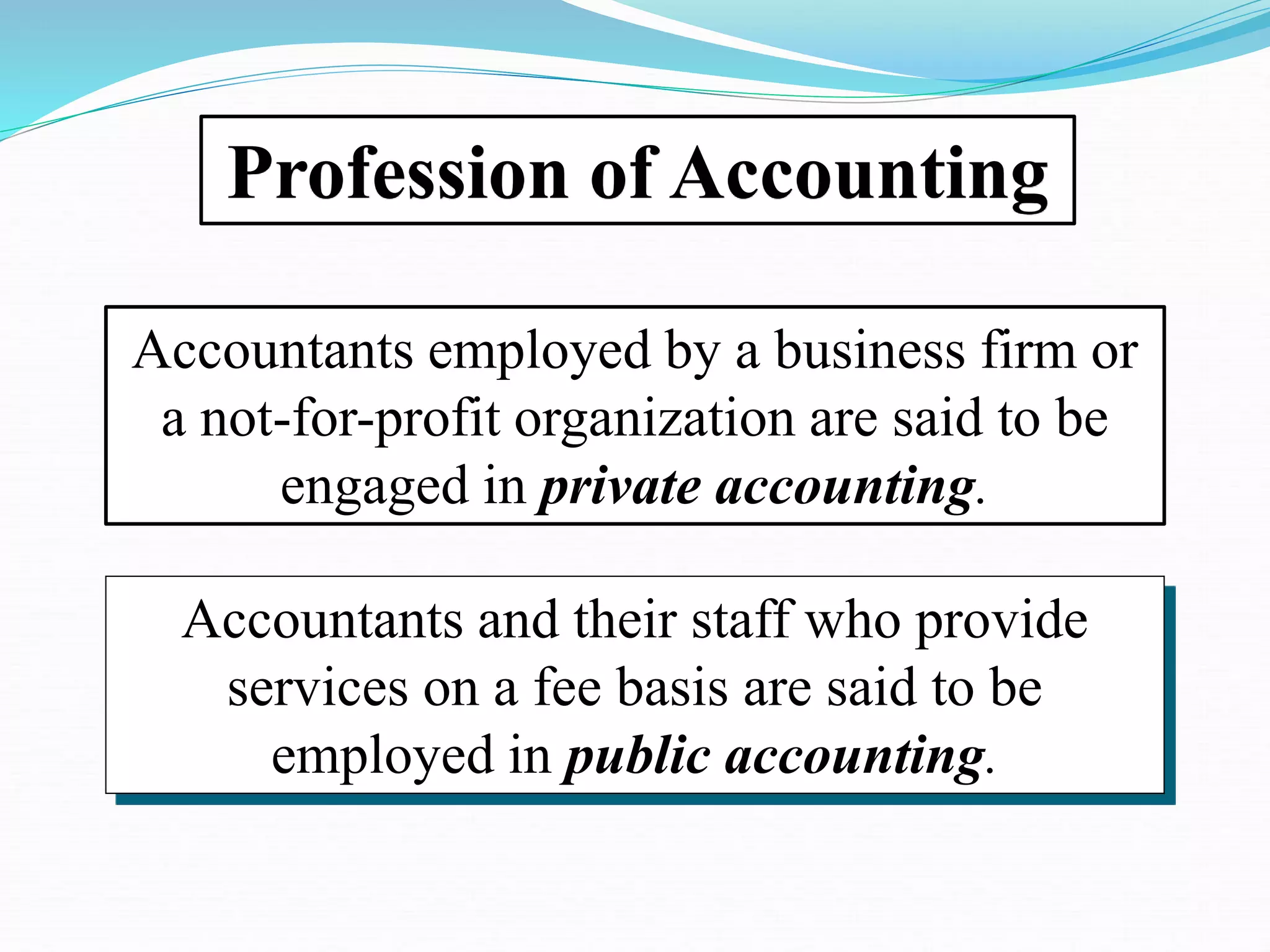

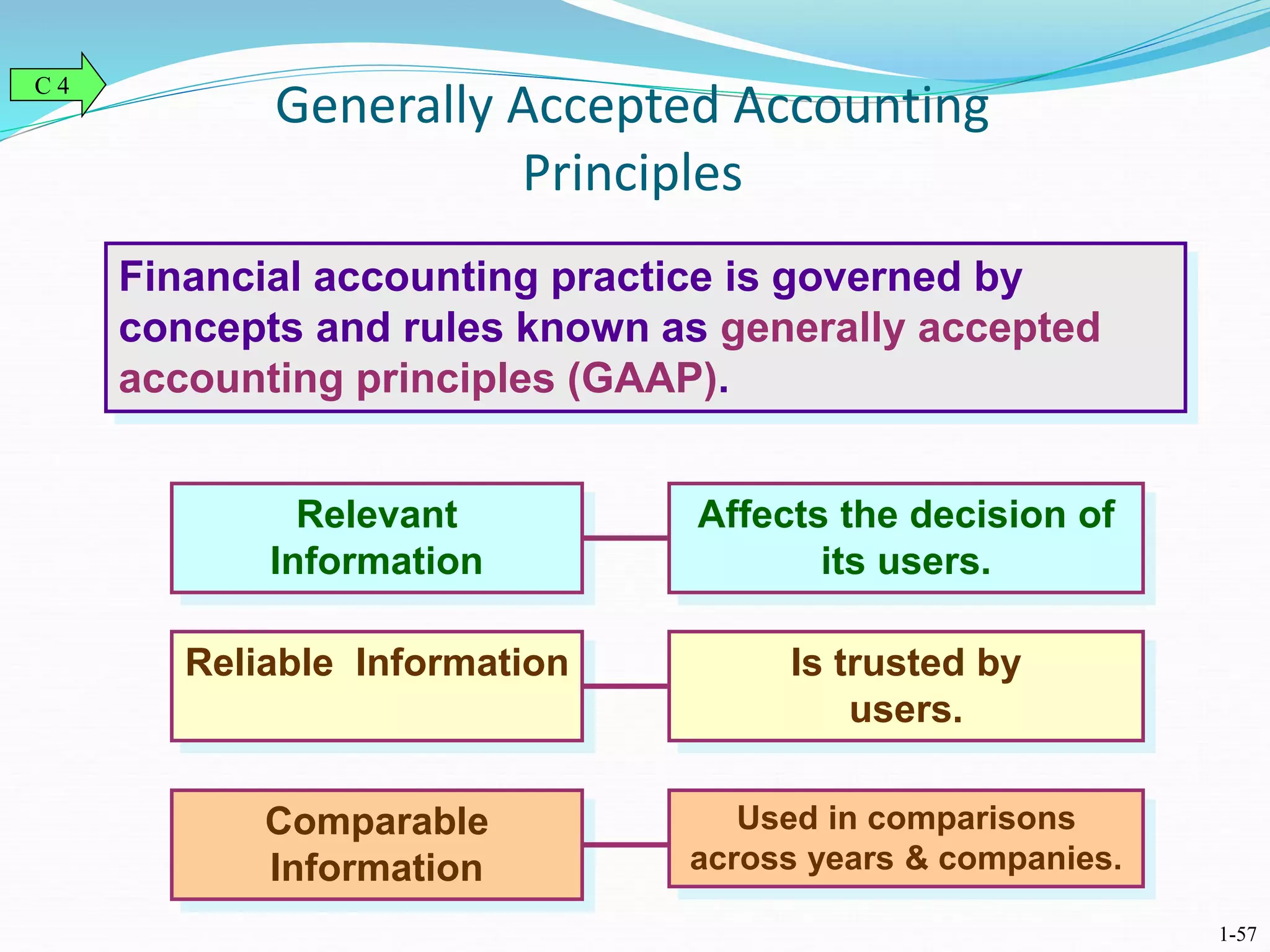

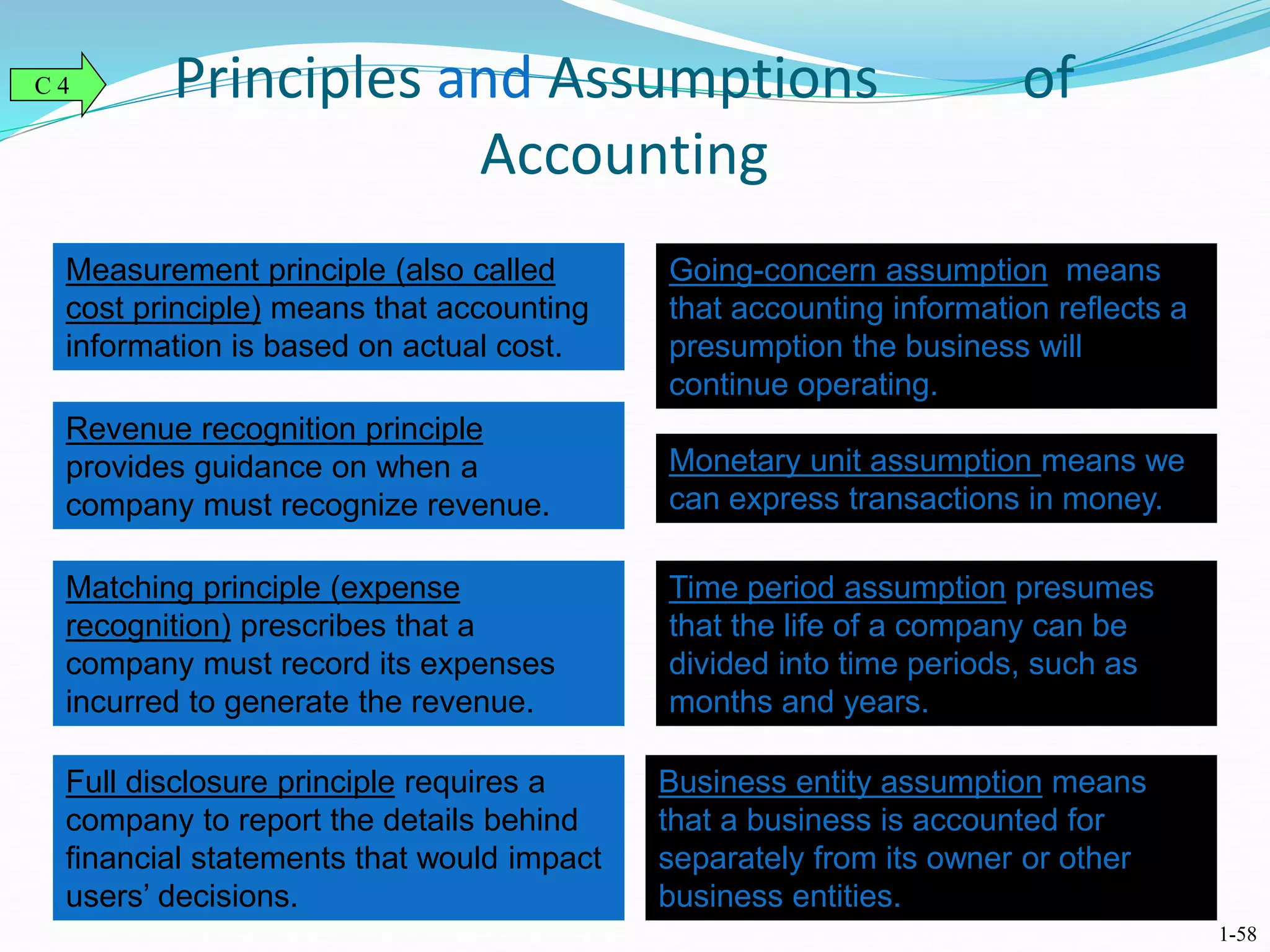

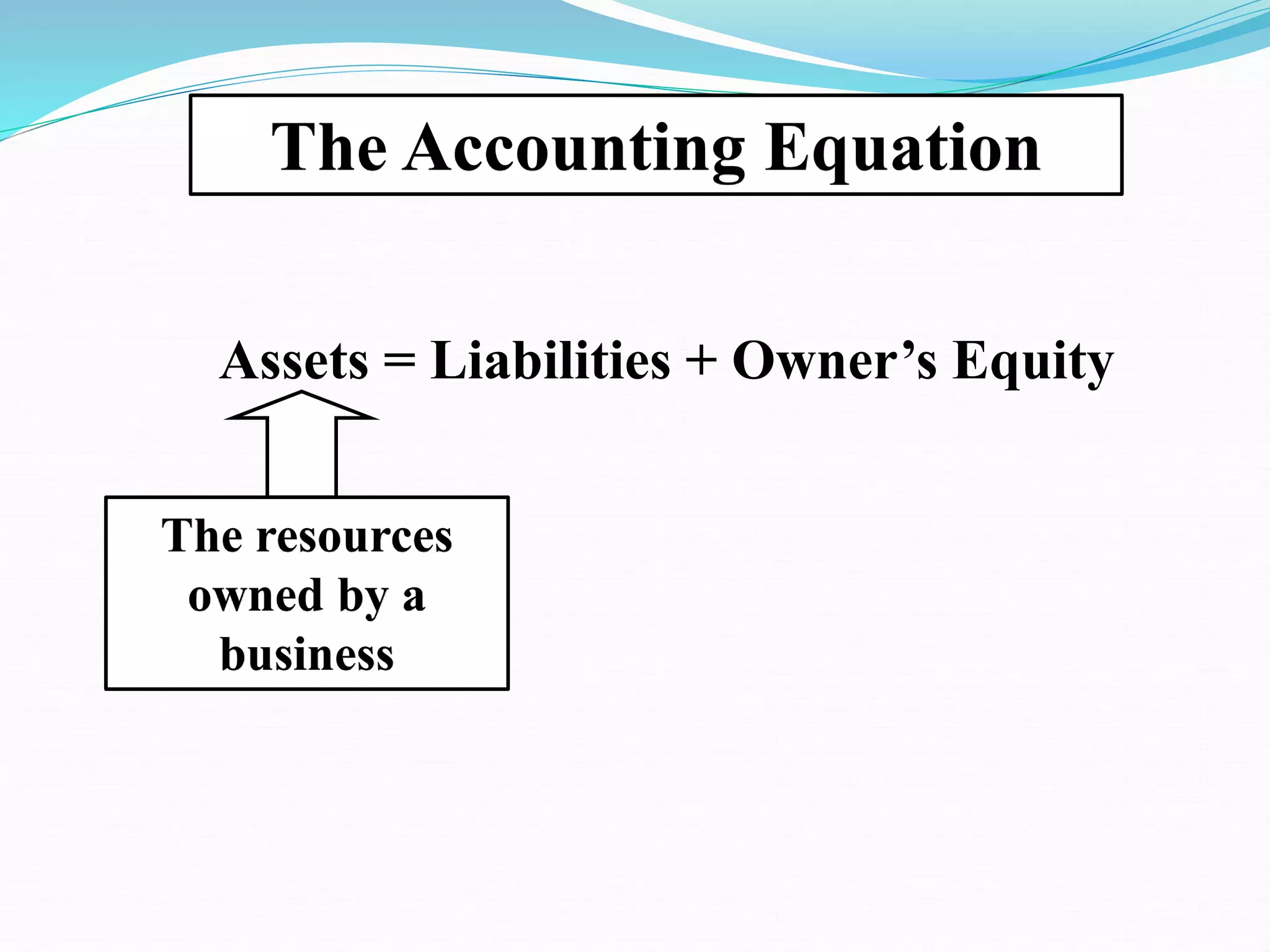

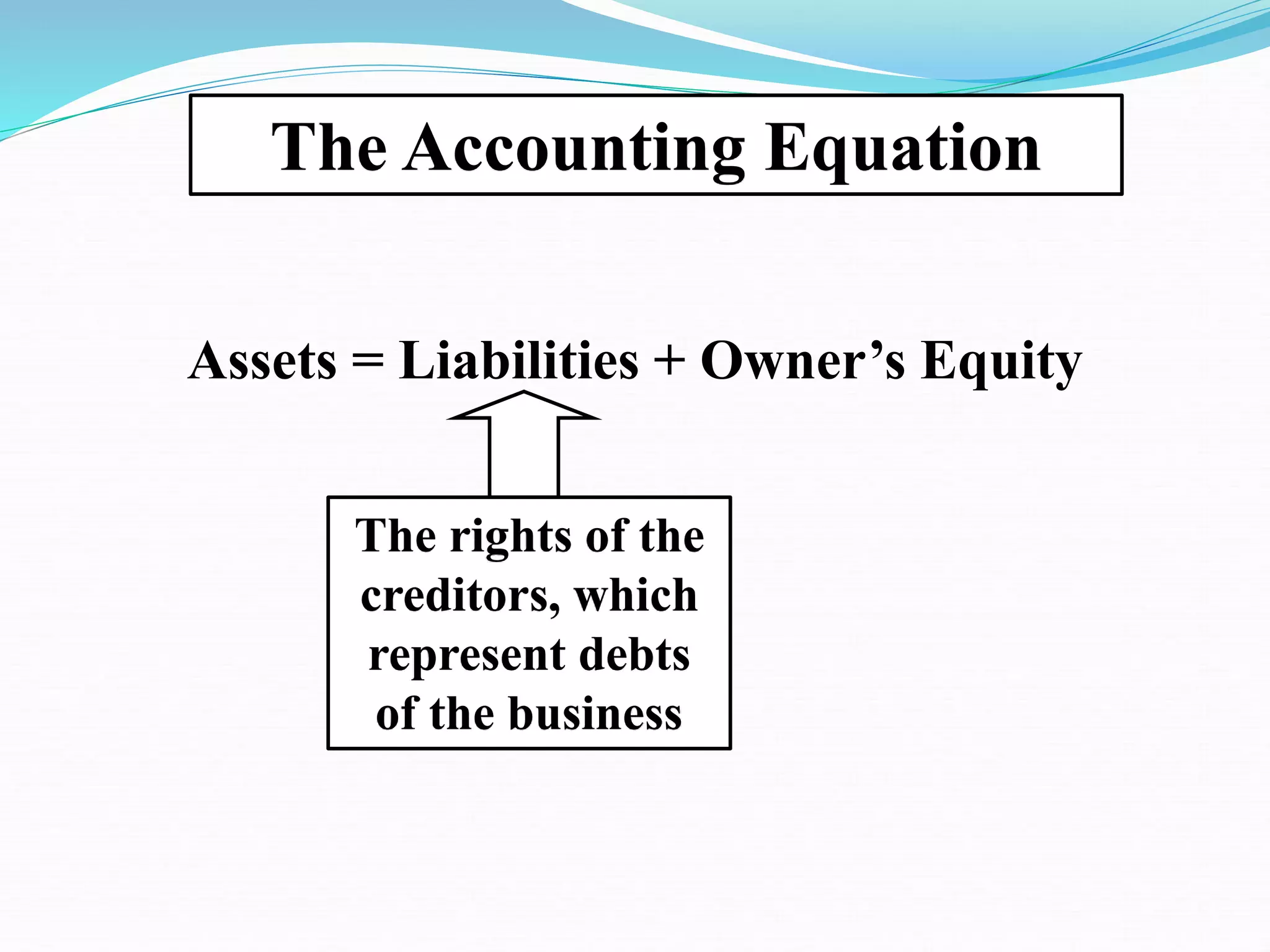

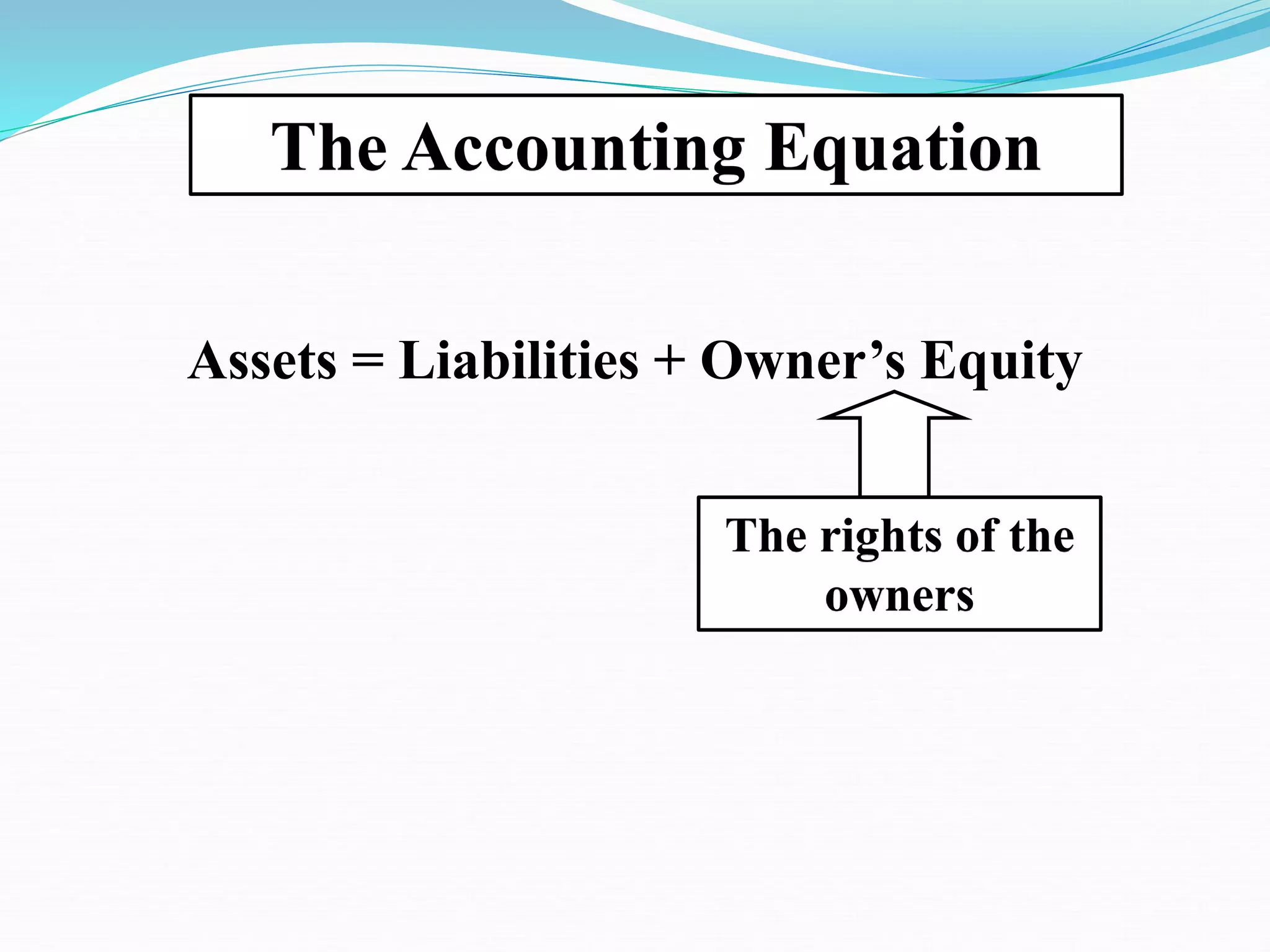

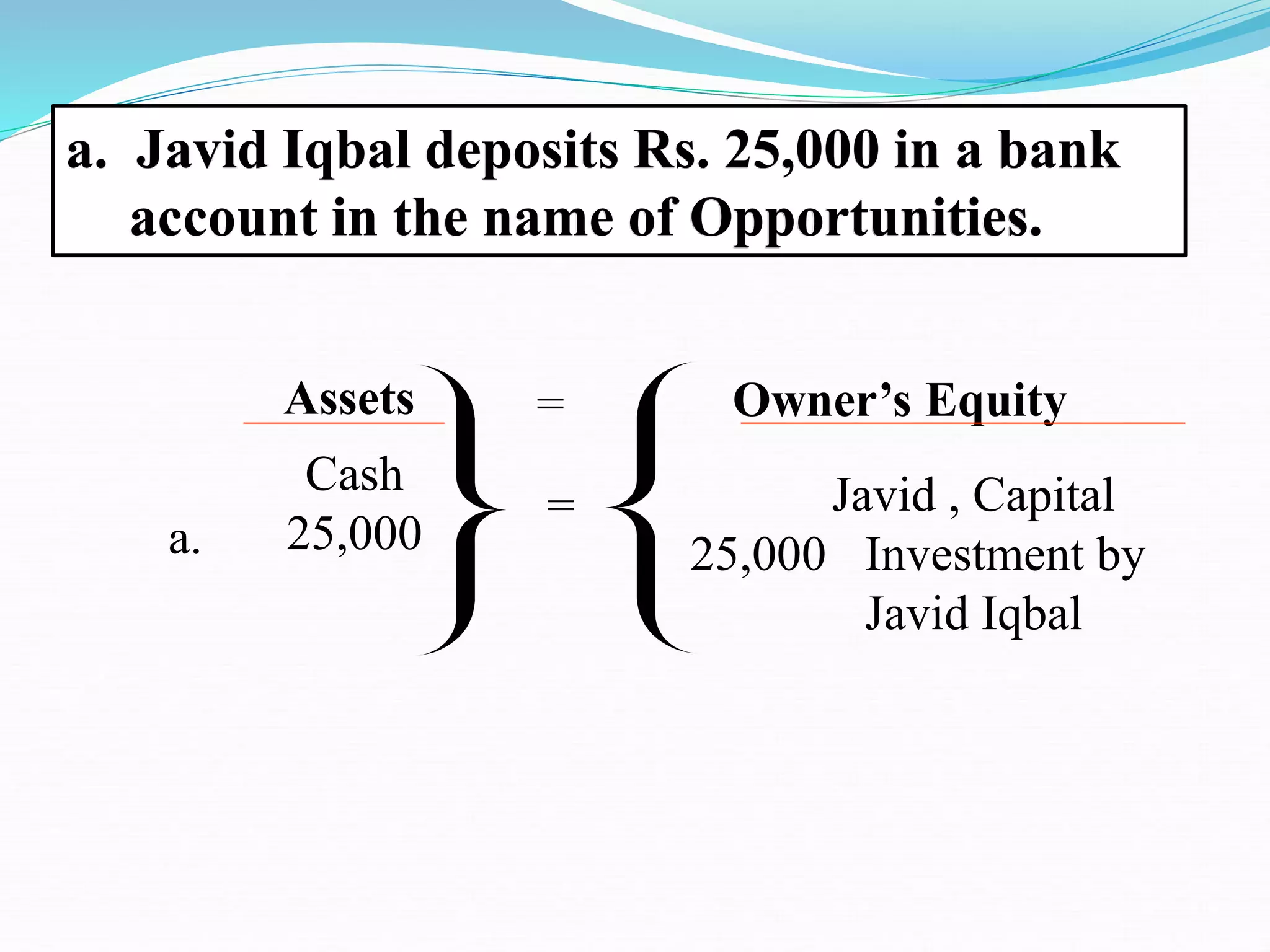

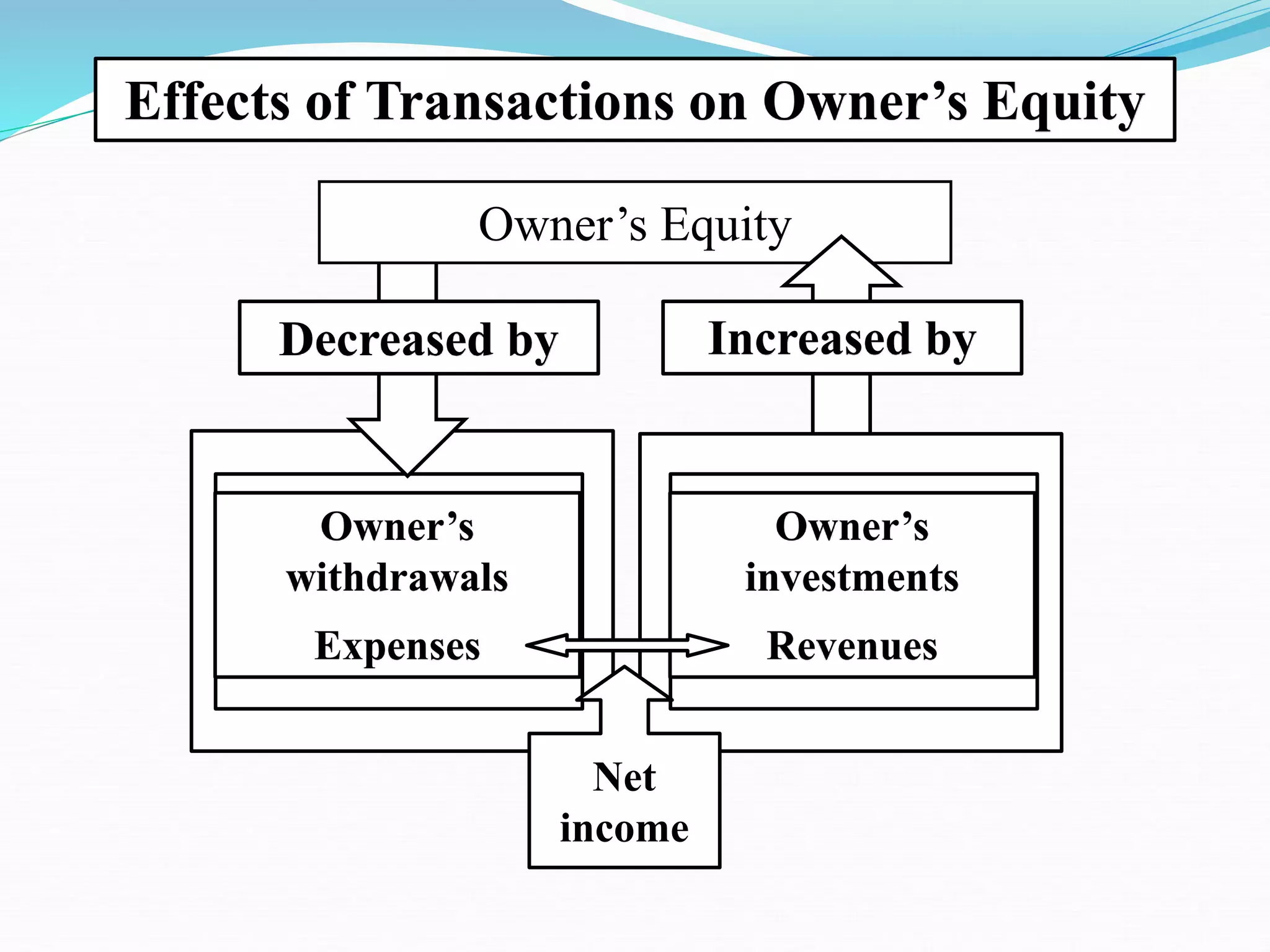

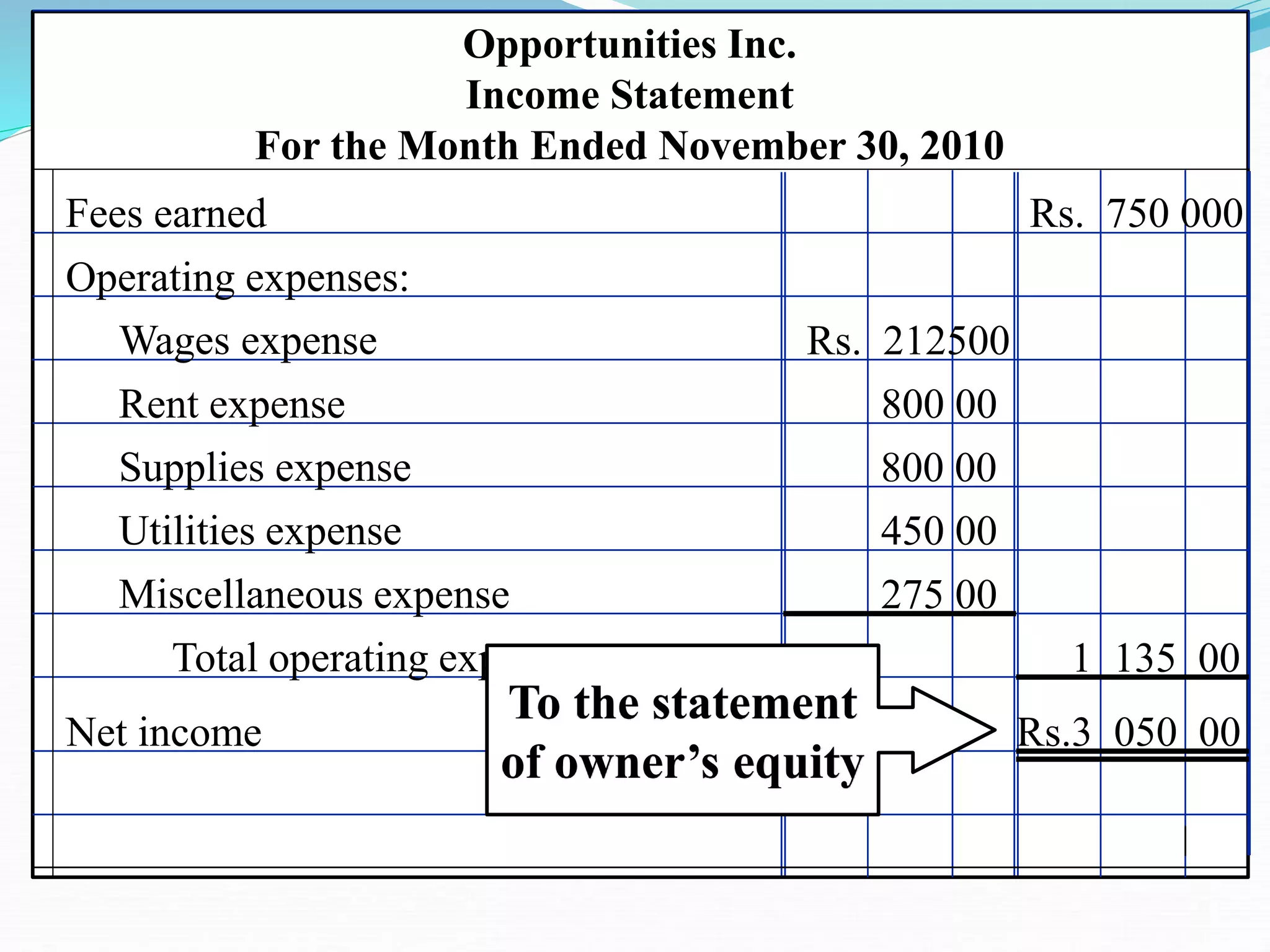

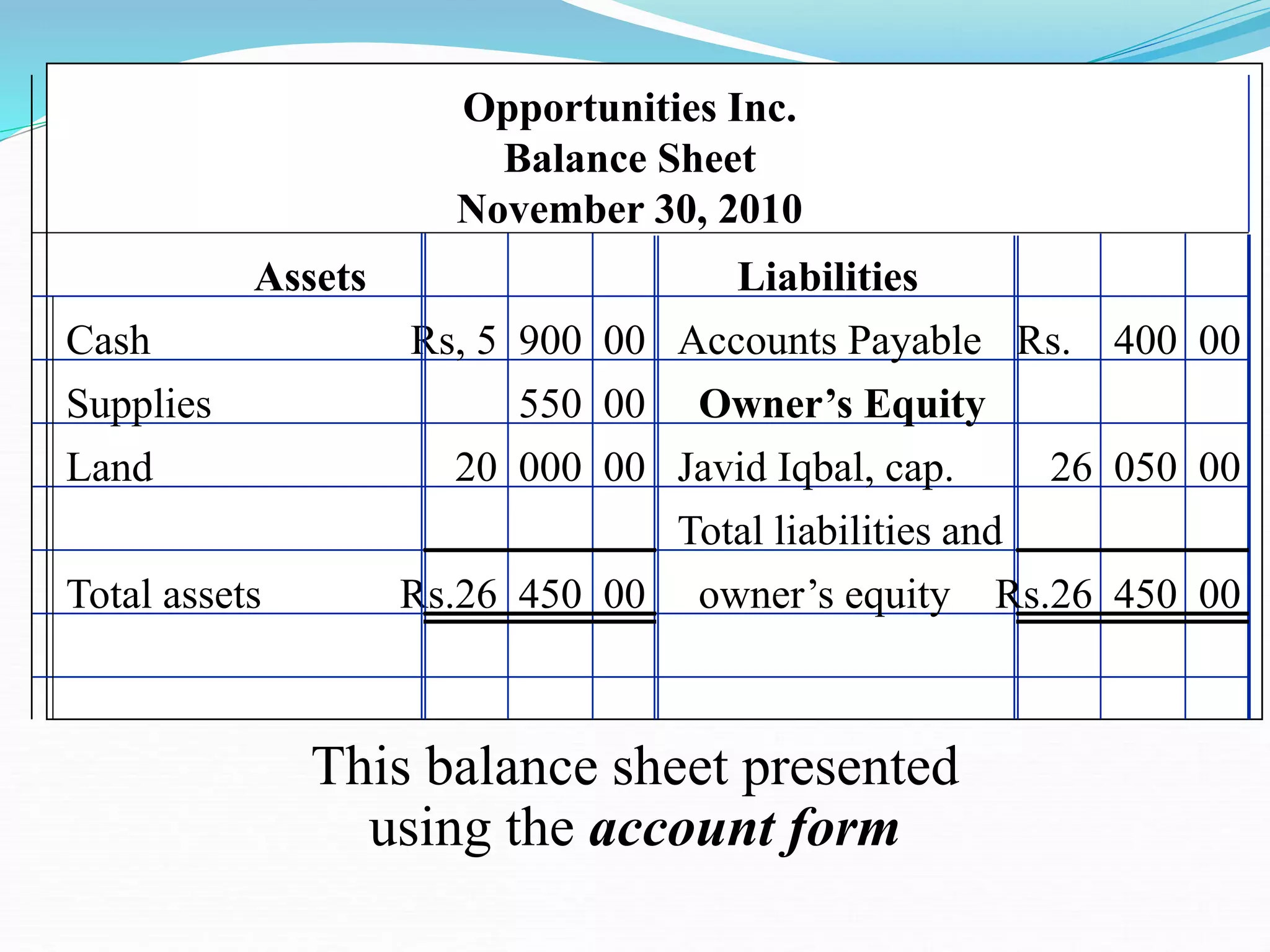

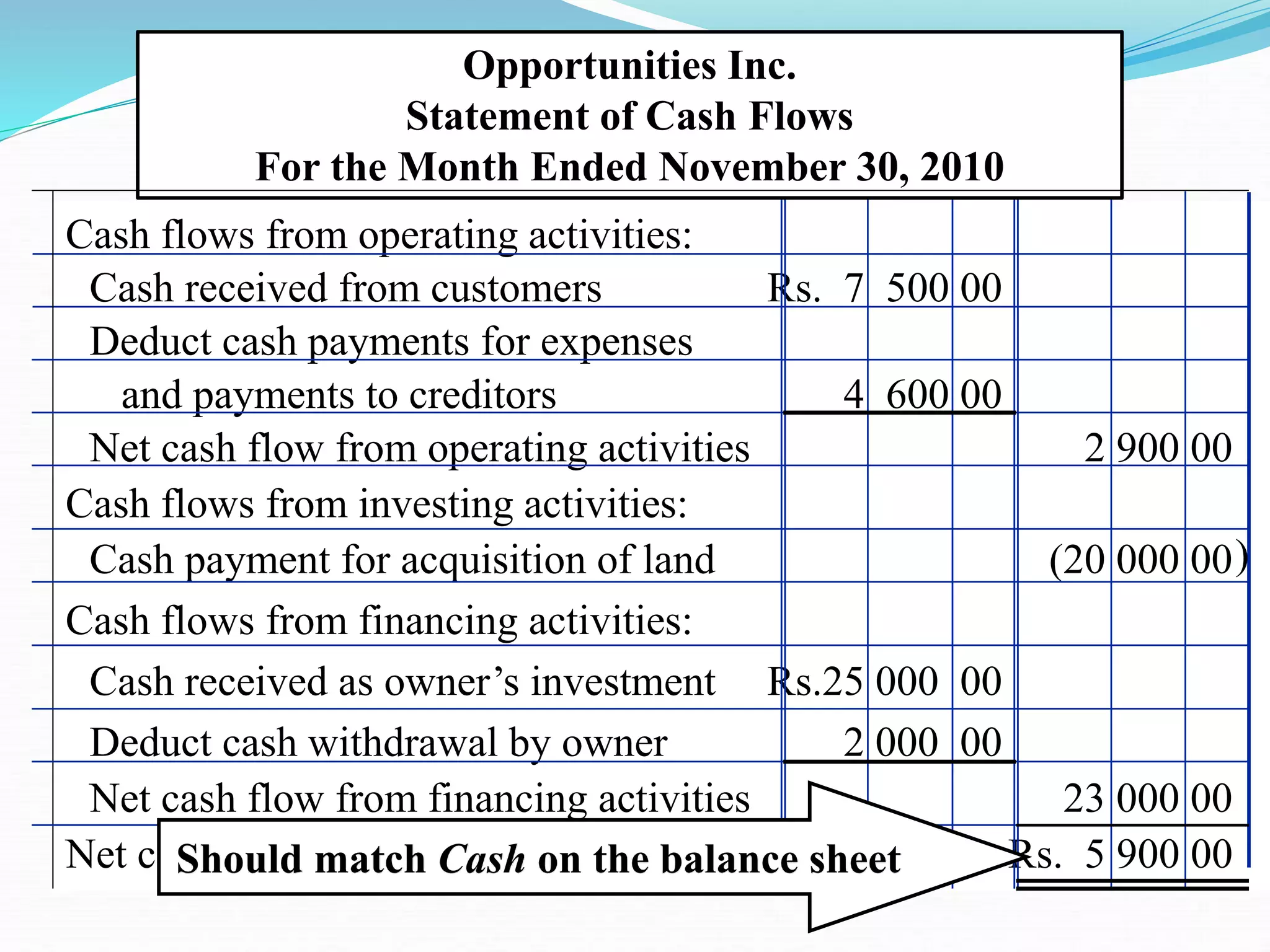

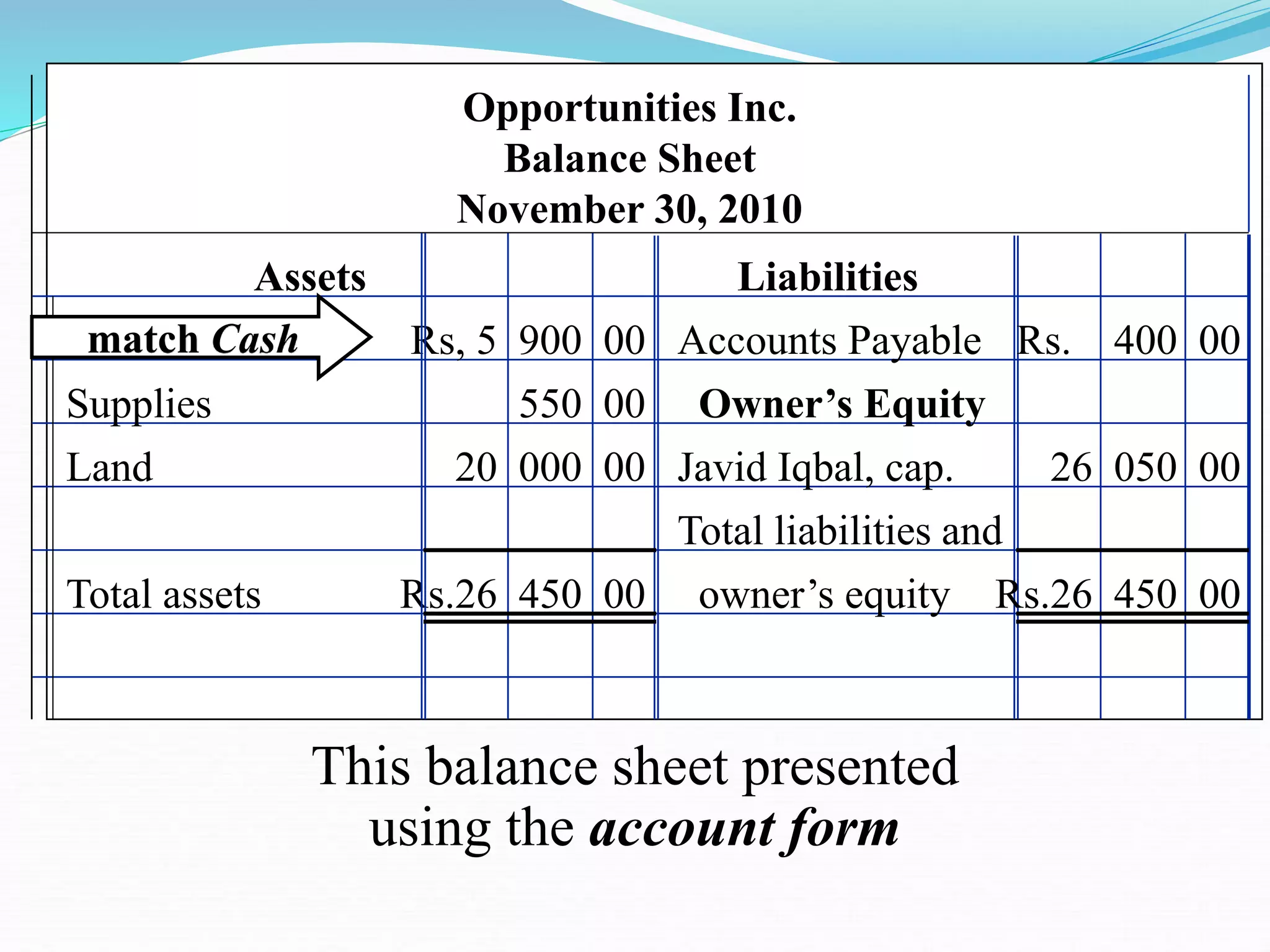

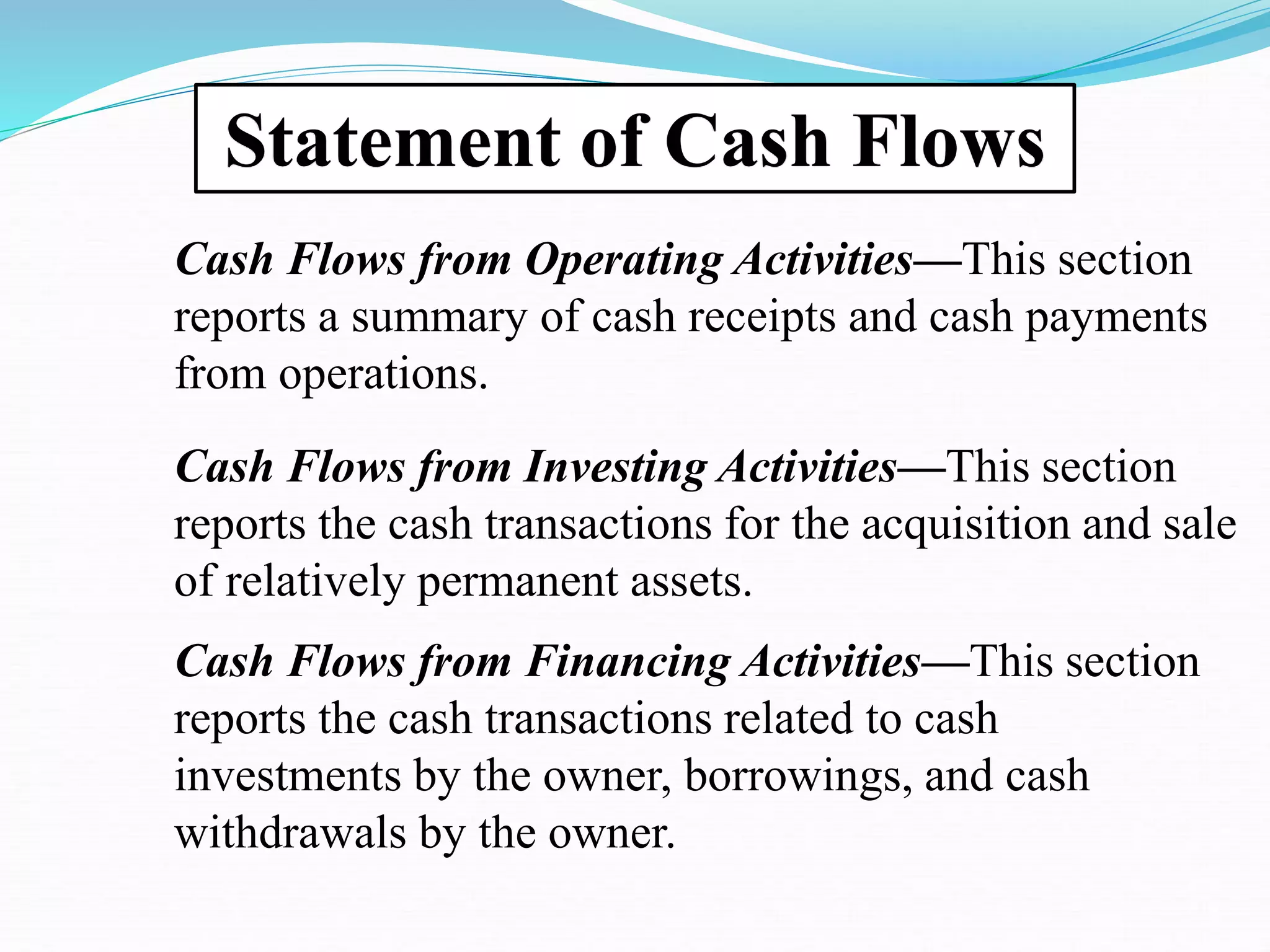

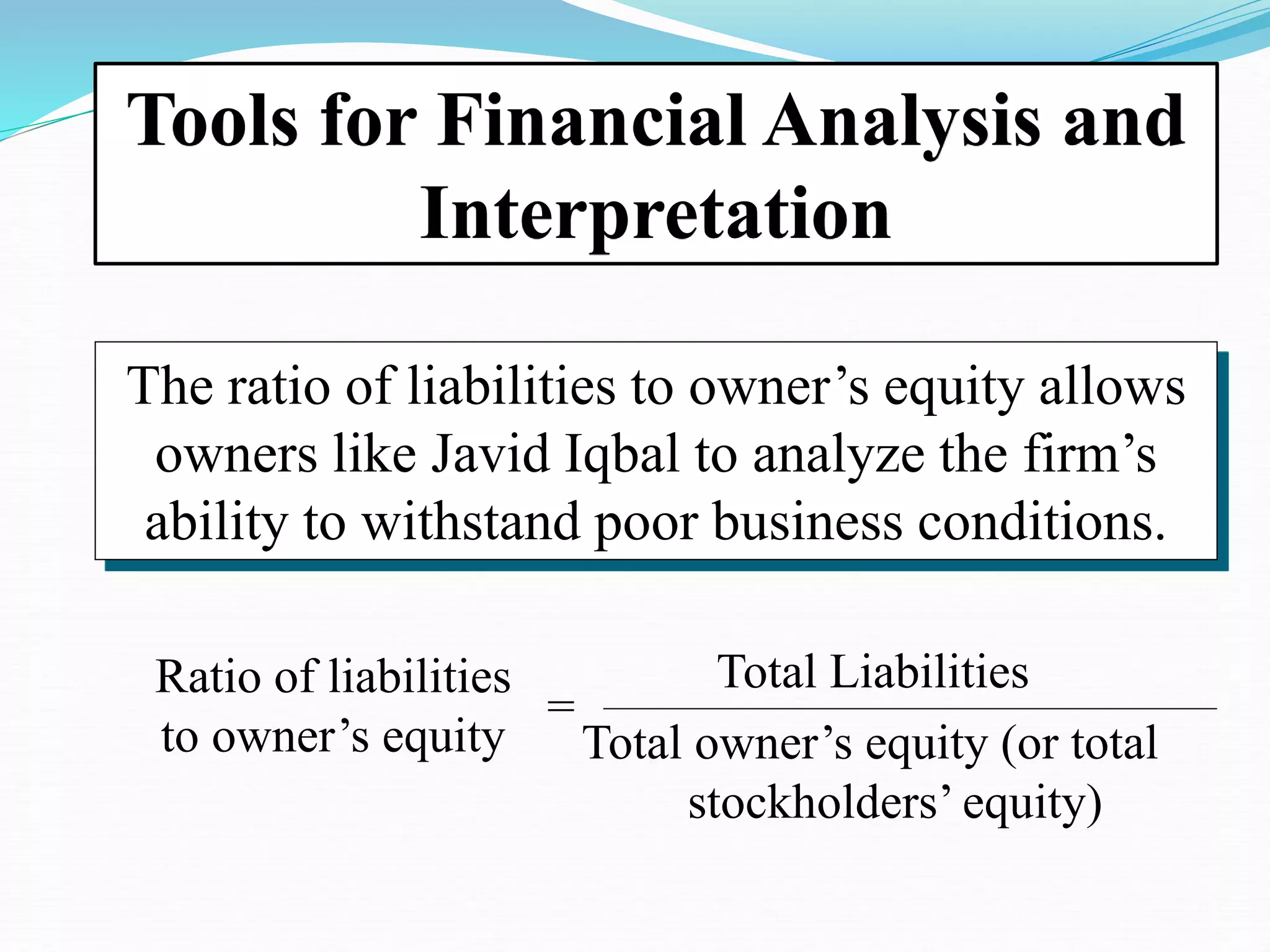

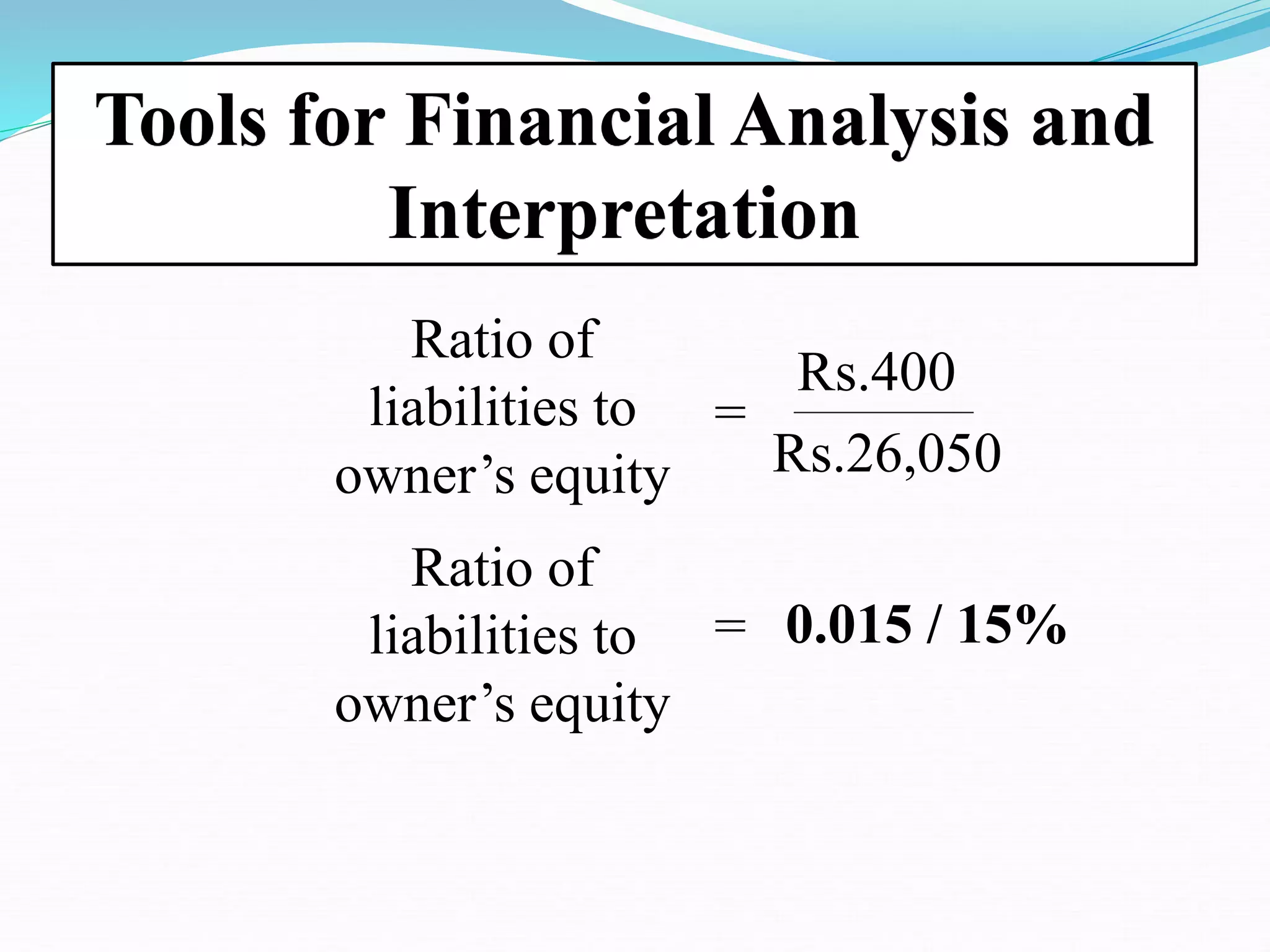

This document provides an overview of accounting concepts and principles for a business course. It defines accounting as a system that identifies, records, summarizes, and reports on a business's financial activities and transactions. The key topics covered include the accounting equation, the three main financial statements (balance sheet, income statement, cash flow statement), the differences between financial and managerial accounting, generally accepted accounting principles (GAAP), and how business transactions affect the accounting equation. The goal of the document is to explain the basic framework and purpose of accounting.