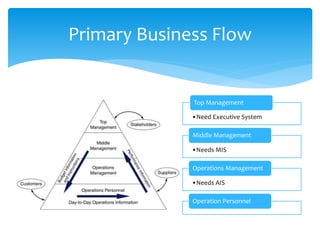

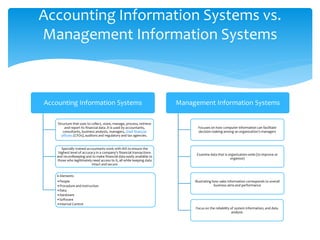

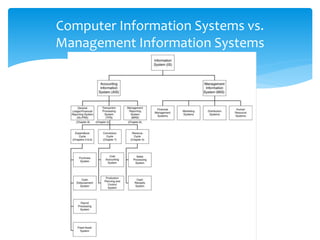

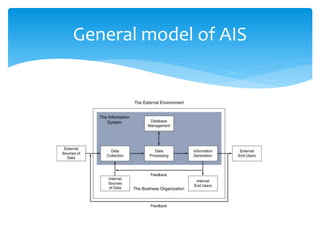

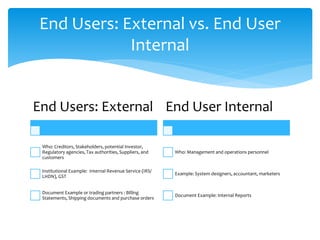

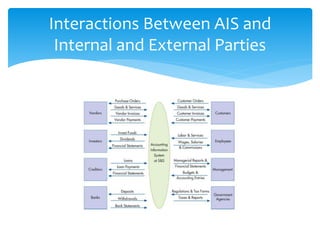

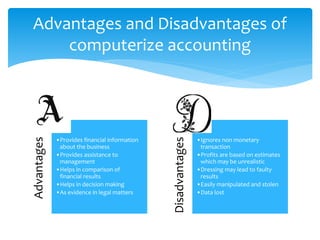

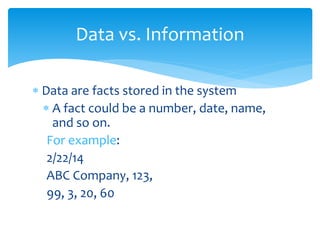

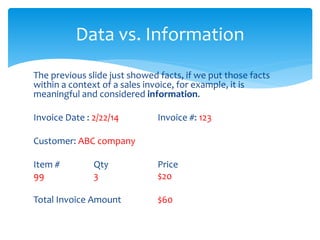

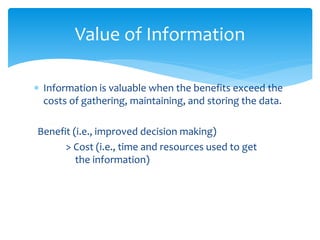

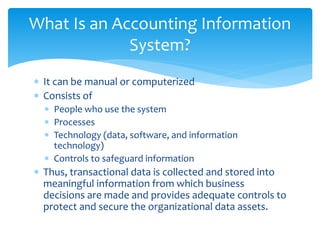

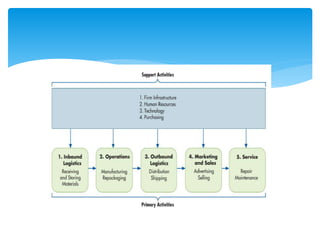

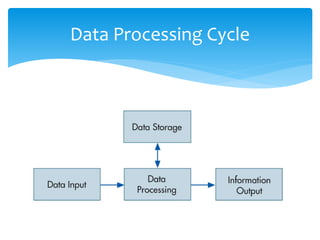

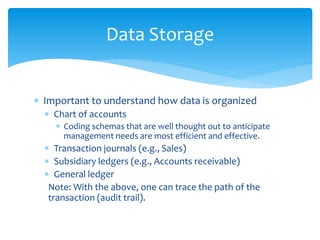

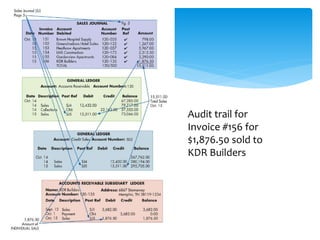

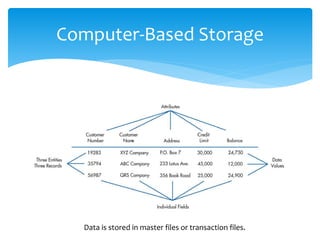

This document provides an overview of an accounting information systems course. It defines accounting information systems and management information systems, and distinguishes between the two. It describes the primary business flows within a company and how different user groups require different types of information. The document outlines the data processing cycle, including data input, storage, processing, and output. It also discusses transaction processing systems and enterprise resource planning systems, outlining their advantages and disadvantages.