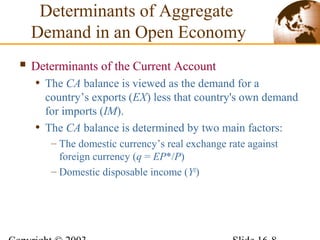

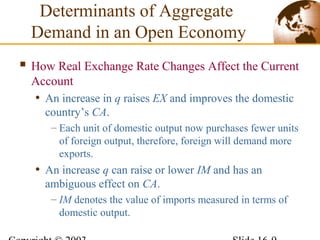

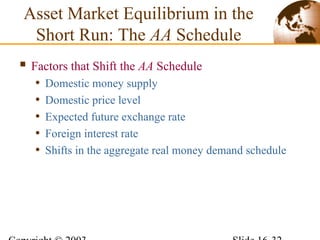

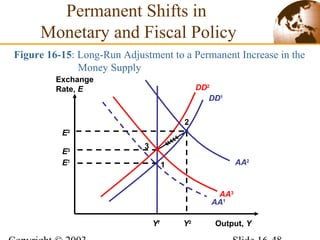

This chapter discusses output and exchange rates in the short run for an open economy. It introduces models of aggregate demand and asset market equilibrium. The DD schedule shows combinations of output and exchange rates where the output market is in equilibrium. The AA schedule shows combinations where the money and foreign exchange markets are in equilibrium. Short-run macroeconomic equilibrium occurs at the intersection of the DD and AA schedules. The effects of temporary and permanent monetary and fiscal policy shifts are analyzed using the model. Policy tools can be used to maintain full employment in response to short-run disturbances.