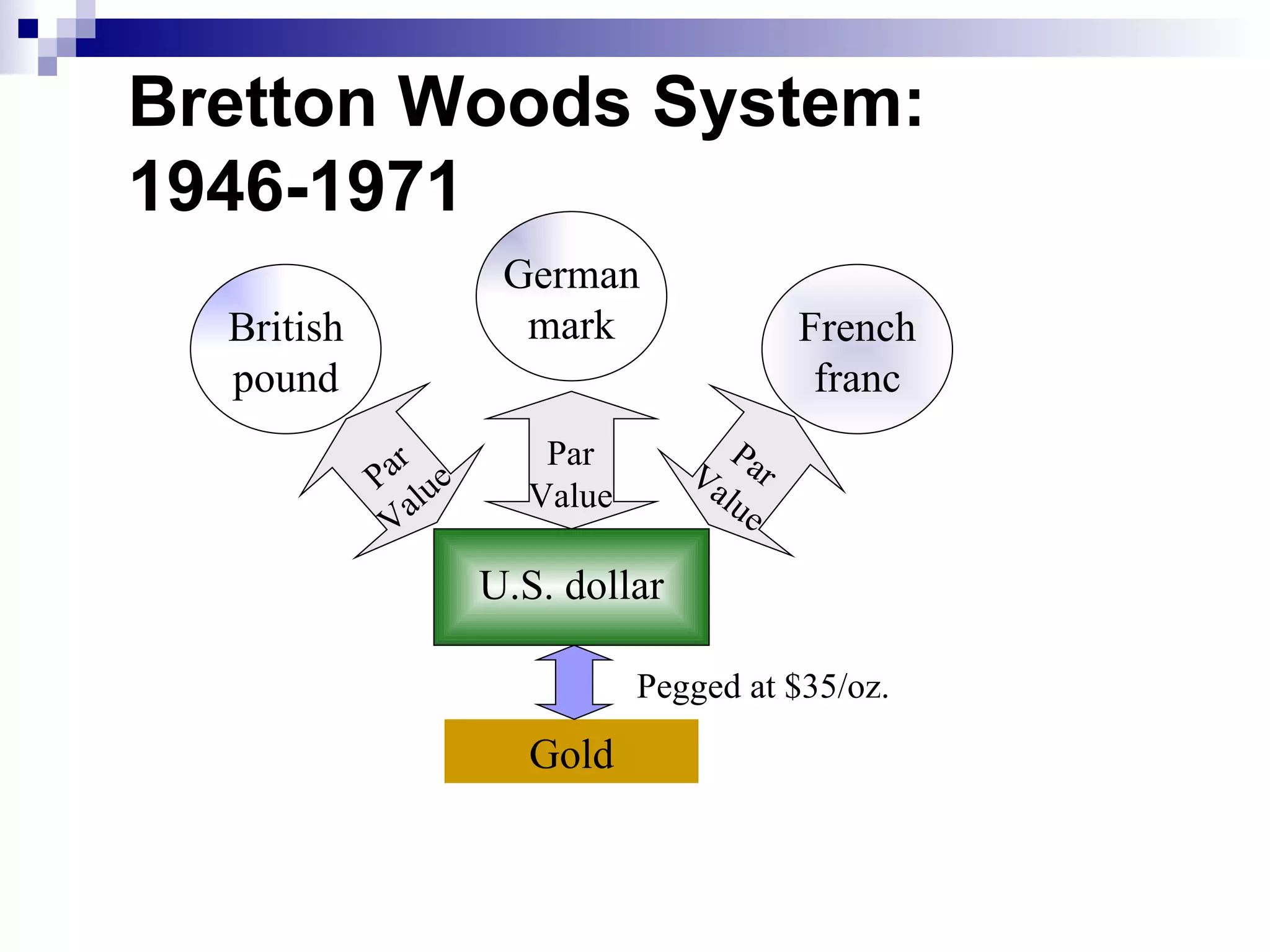

There are different exchange rate systems that determine how currencies relate to one another. These include freely floating rates set by supply and demand, managed floats where central banks intervene in volatile markets, target zones where rates are kept within an agreed upon range, and fixed rates where one currency is pegged to another. Historically many currencies were backed by gold or silver, tying exchange rates directly to the value of the commodities, but most currencies now have no intrinsic value.