This chapter discusses different types of international factor movements:

- International labor mobility allows workers to move between countries, equalizing wages globally.

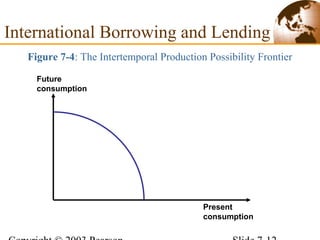

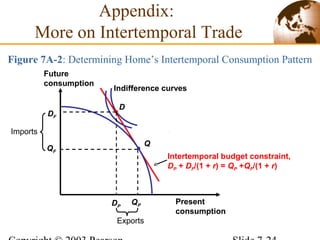

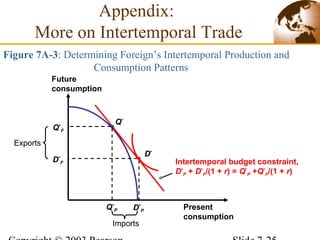

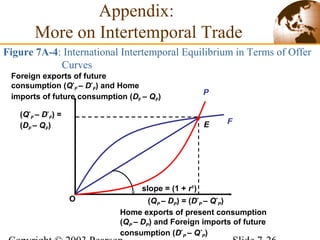

- International borrowing and lending refers to capital transfers between countries and can be seen as intertemporal trade.

- Direct foreign investment and multinational firms allow firms to control production in multiple countries, driven by location and internalization motives like accessing resources or transferring technology.