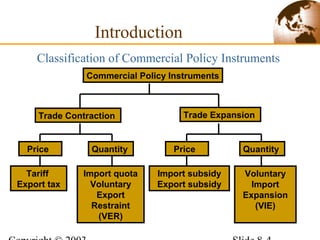

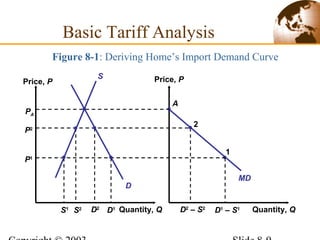

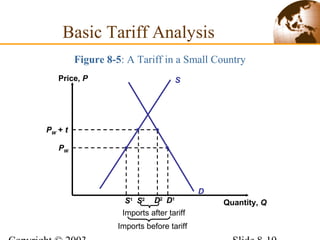

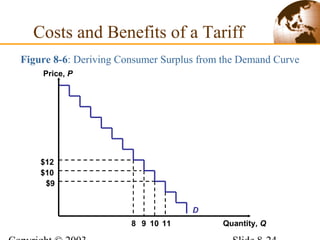

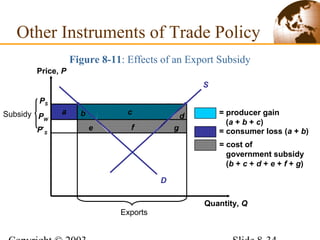

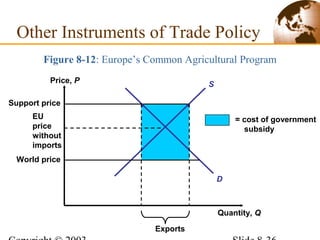

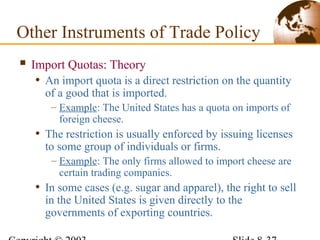

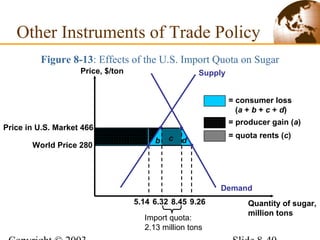

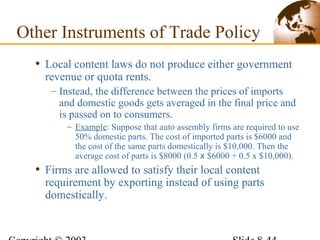

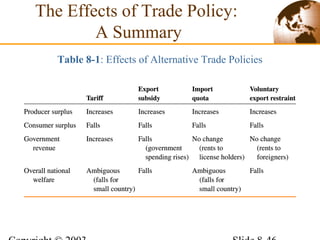

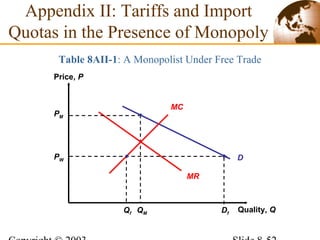

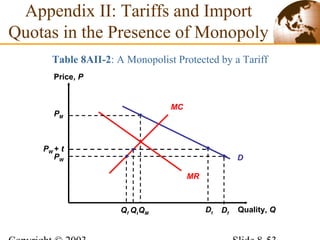

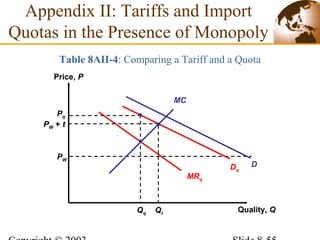

This document provides an overview of different trade policy instruments, including tariffs, quotas, subsidies, and voluntary export restraints. It discusses how each instrument affects prices and trade flows. Tariffs raise domestic prices in the importing country and lower prices abroad. Quotas also raise domestic prices by creating quota rents for license holders. Export subsidies lower foreign prices but worsen the terms of trade, providing no benefits. Voluntary export restraints are costly for importers as the rents go to foreign firms. The document analyzes the costs and benefits of protection for consumers, producers and governments.