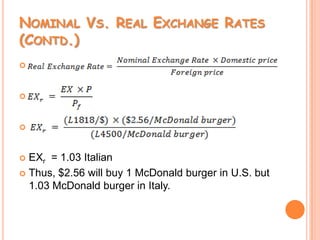

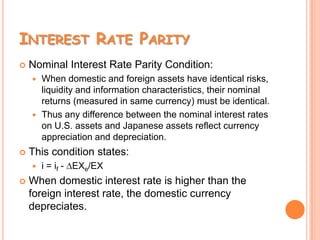

This presentation discusses foreign exchange (FOREX) markets. It begins by defining FOREX as the global market for trading currencies, and explains that fluctuations in exchange rates are influenced by economic, political, and social factors among countries. It then compares currency trading to stock trading, noting benefits of currency trading like lower costs, higher liquidity, and opportunities to profit from both rising and falling exchange rates. The document also covers nominal vs real exchange rates, and theories for determining exchange rates in the long run like purchasing power parity and interest rate parity.