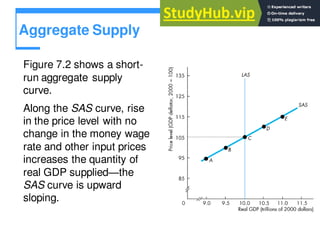

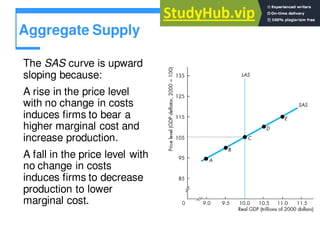

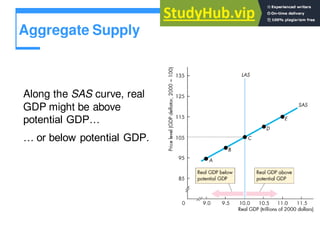

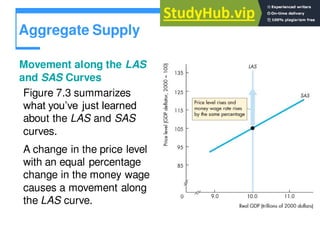

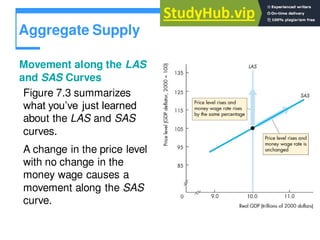

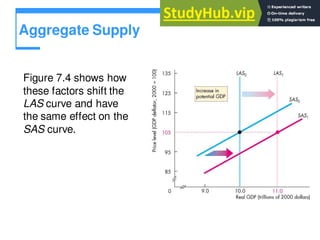

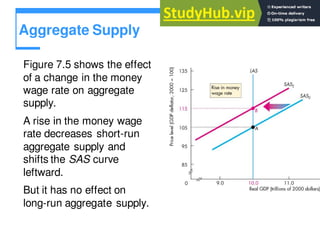

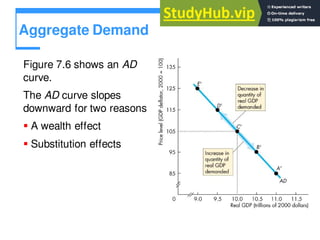

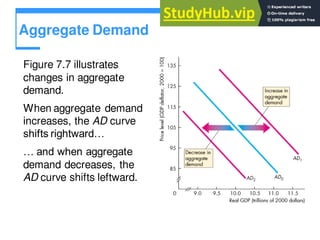

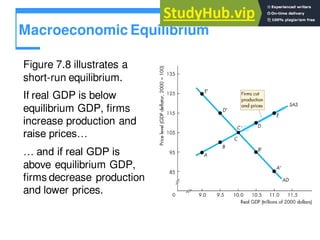

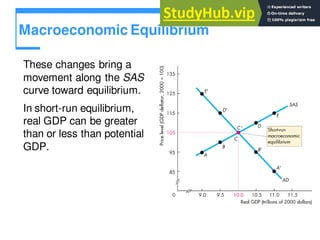

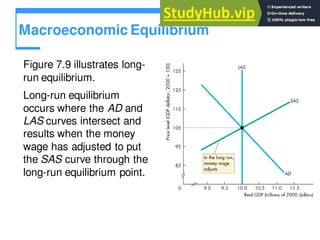

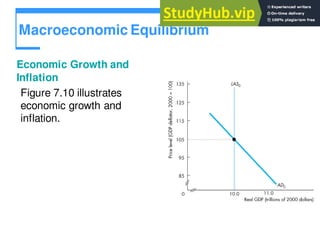

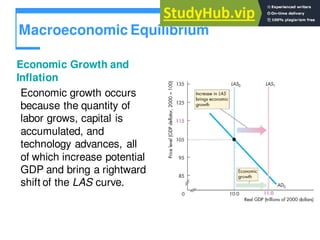

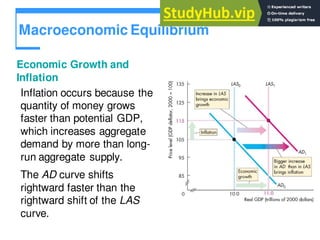

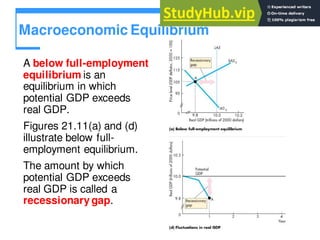

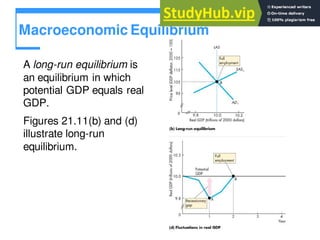

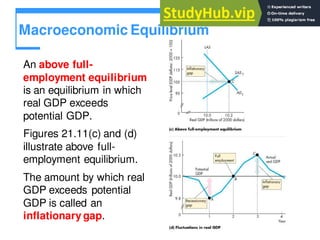

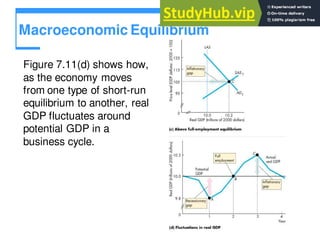

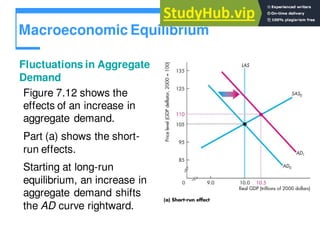

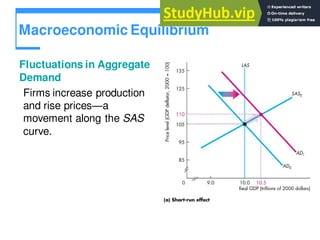

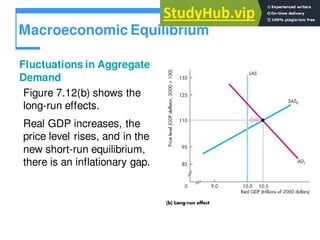

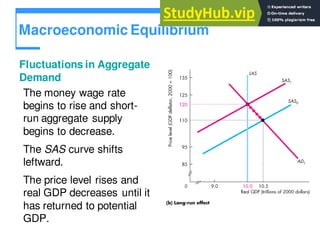

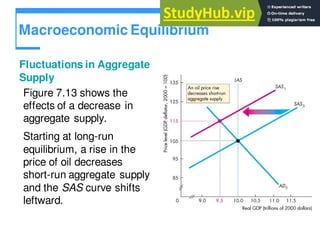

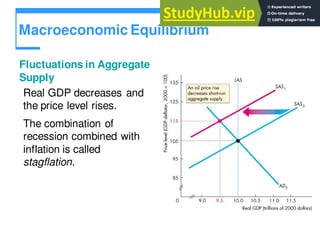

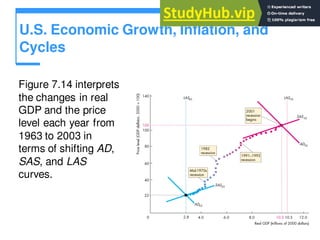

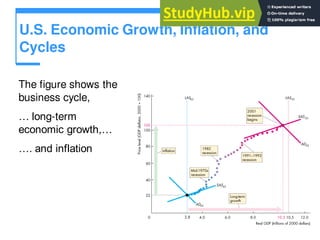

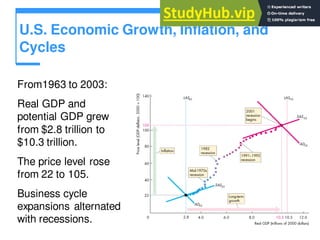

Aggregate demand and aggregate supply determine macroeconomic equilibrium. Aggregate supply depends on labor, capital, and technology and can be either long-run or short-run. Aggregate demand depends on consumption, investment, government spending, and net exports. The intersection of the aggregate demand and supply curves determines equilibrium output and price levels in the short-run. Changes in factors like expectations, fiscal policy, and the world economy cause the aggregate demand curve to shift, affecting equilibrium.