This document provides an overview of topics related to tariffs and global agri-food trade, including:

- Types of commercial policies such as tariffs, quotas, subsidies, and non-tariff barriers.

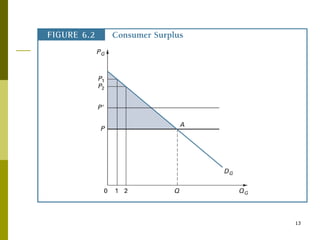

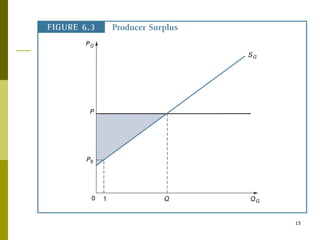

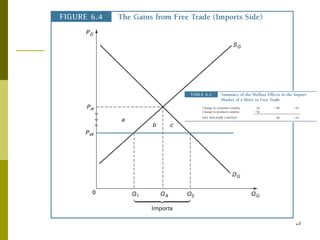

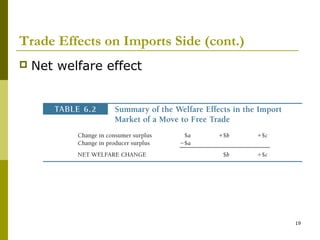

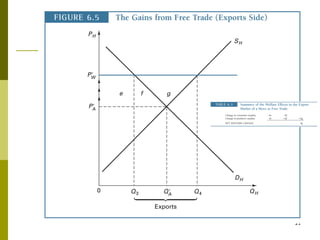

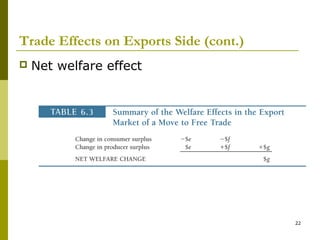

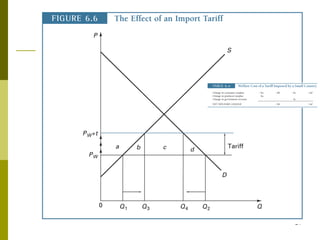

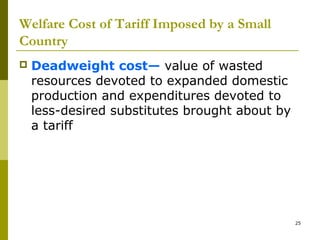

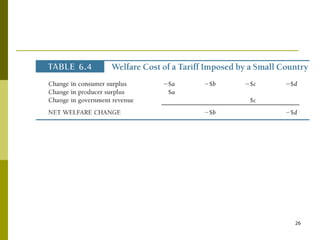

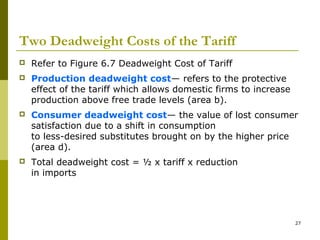

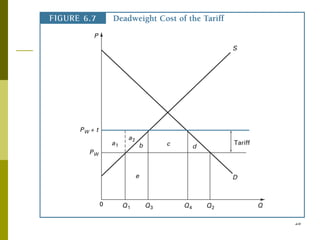

- Definitions and effects of tariffs, including consumer surplus, producer surplus, deadweight costs for small countries.

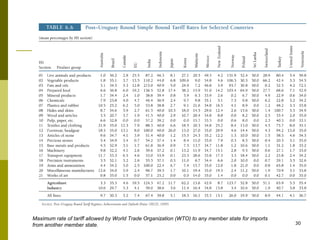

- Maximum bound tariff rates that countries can impose according to the World Trade Organization, which generally are lower for high-income countries and higher for developing countries.