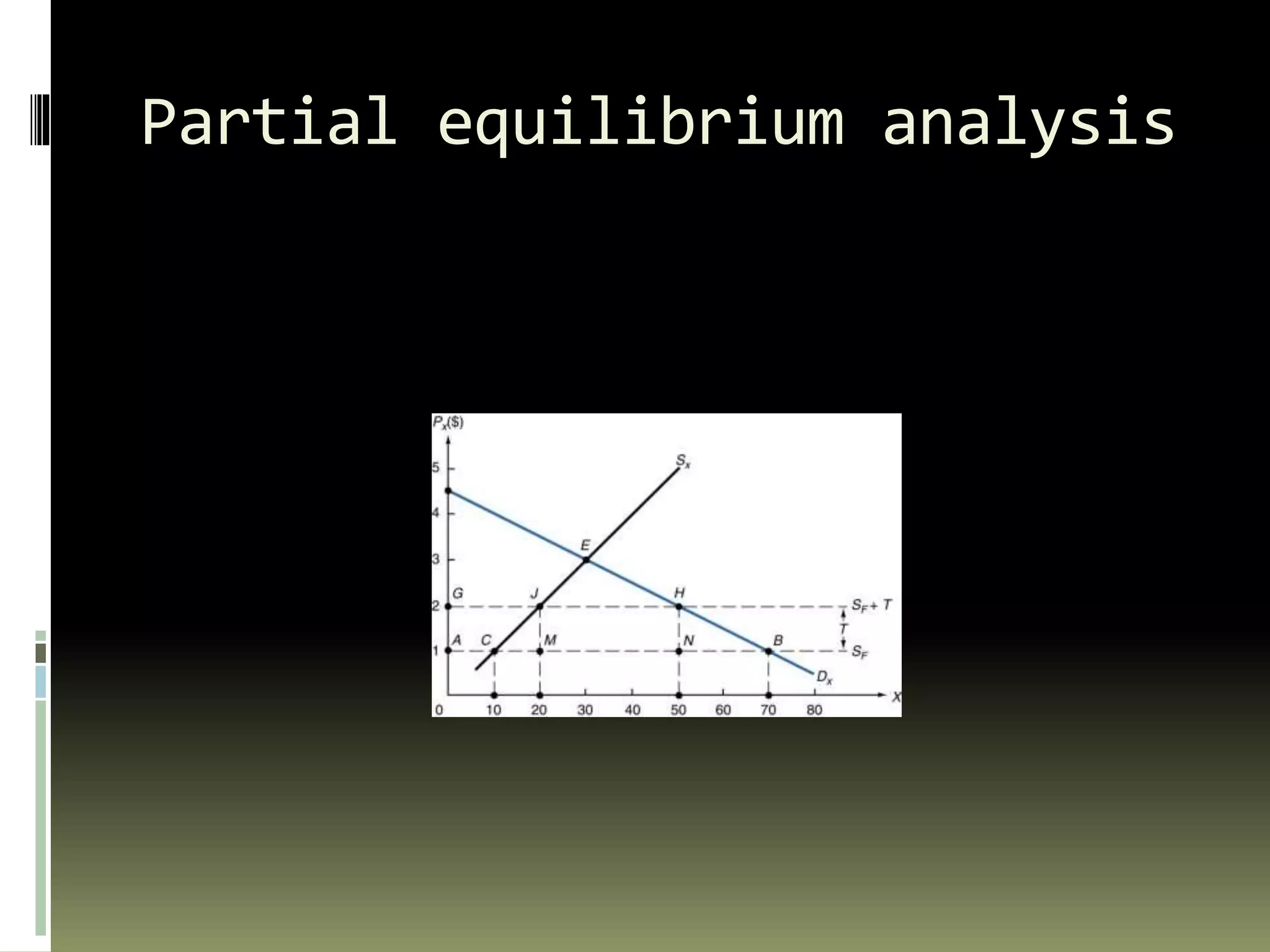

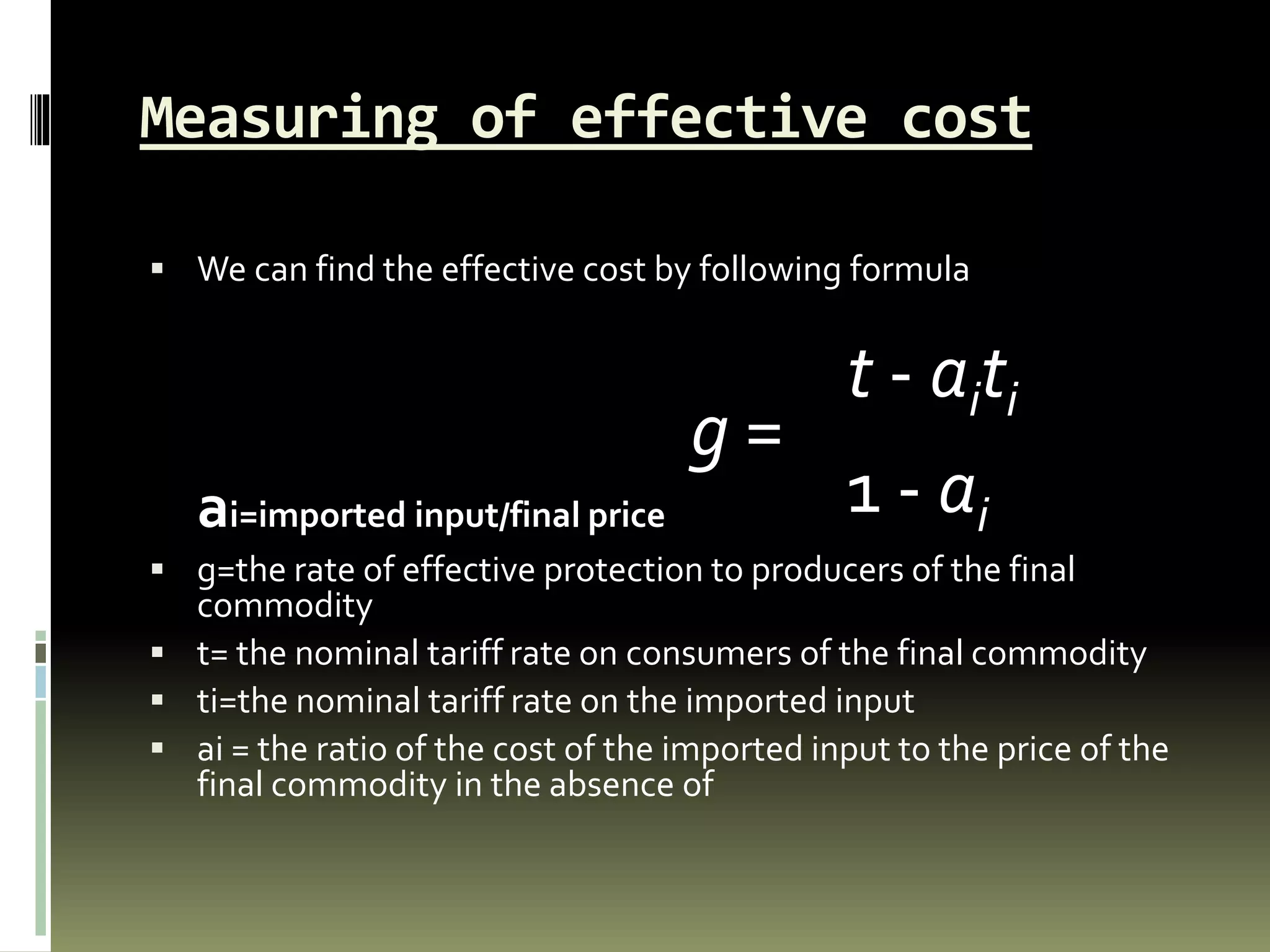

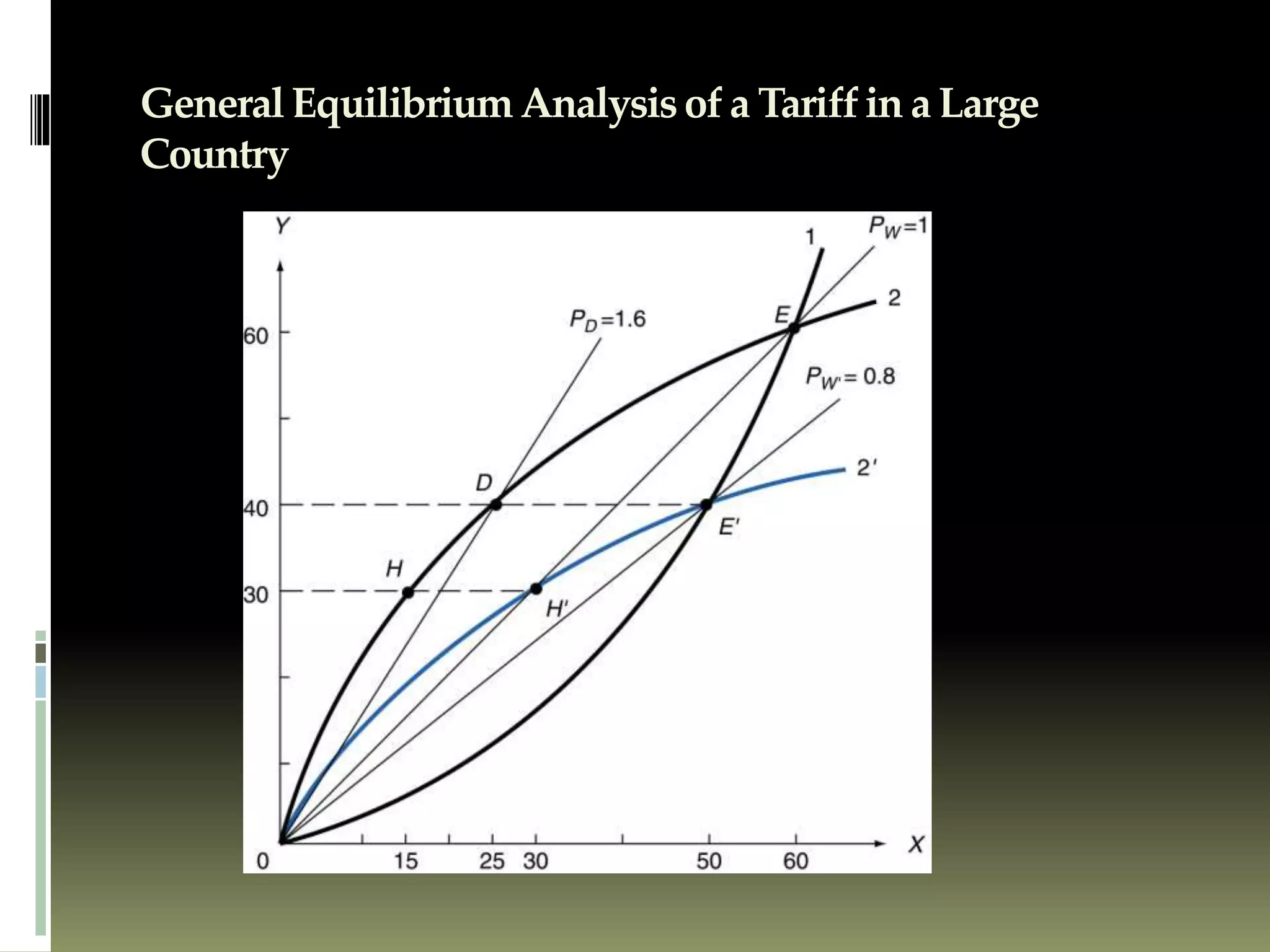

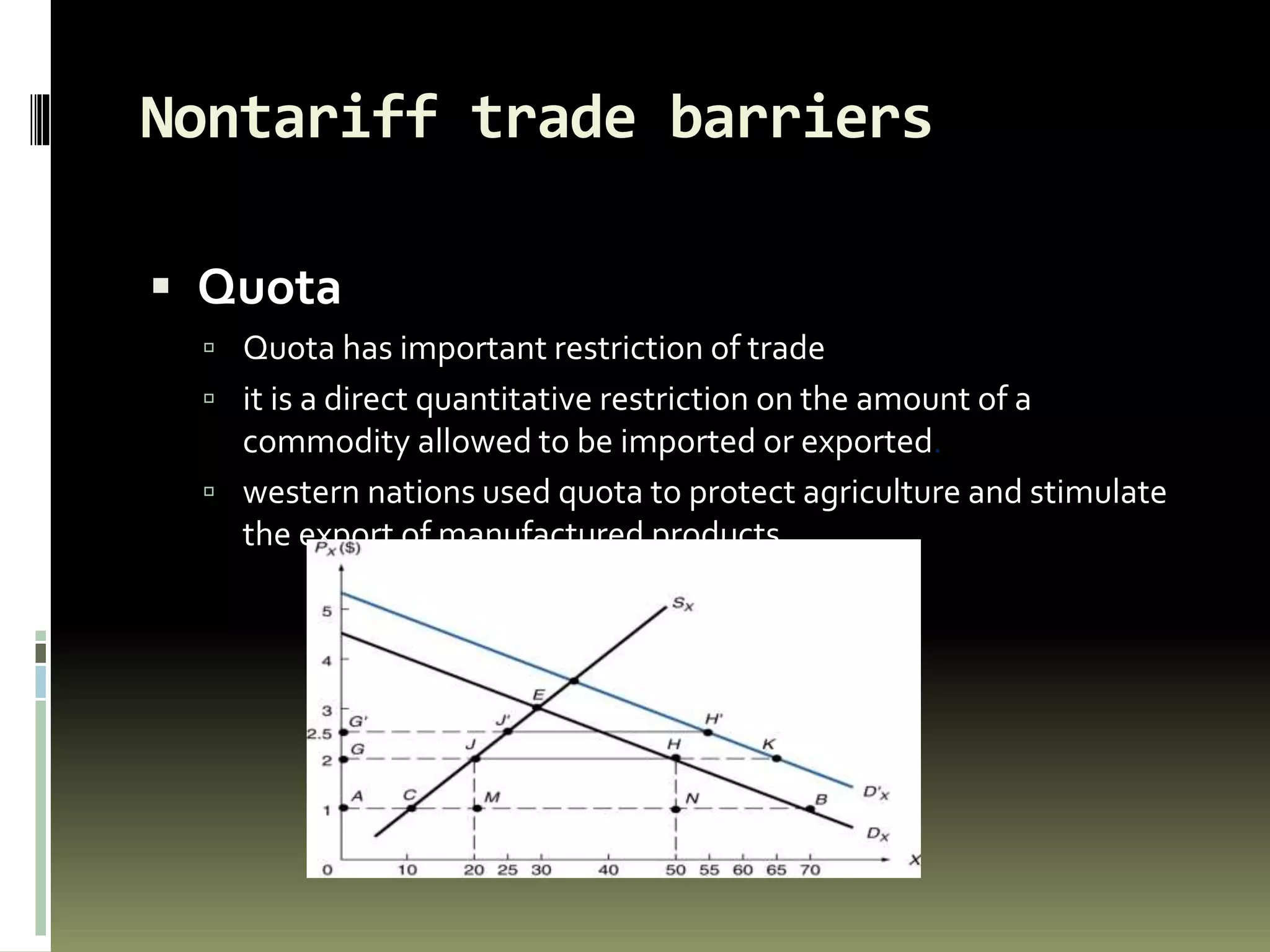

This document discusses tariffs and their economic effects. It defines tariffs as taxes on imports and describes different types of tariffs such as ad valorem and specific tariffs. The document then analyzes the consumption, production, trade, and revenue effects of imposing a tariff using a partial equilibrium model. It also discusses the impact of tariffs on consumer and producer surplus. Finally, it provides an example comparing the effects of a tariff versus an import quota.