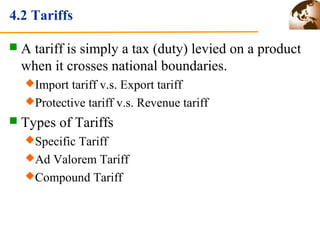

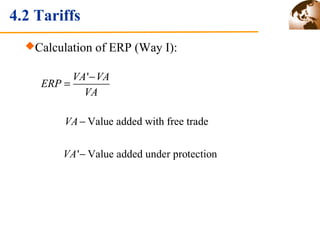

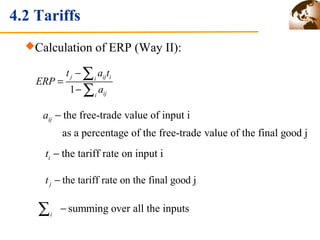

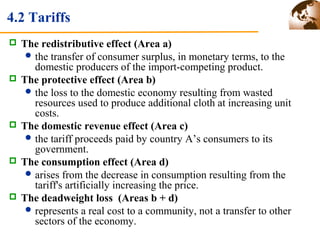

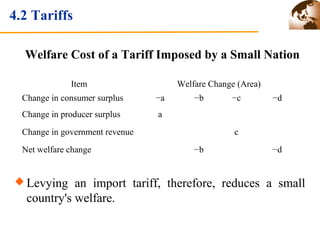

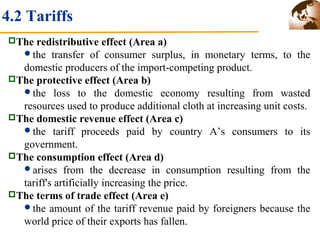

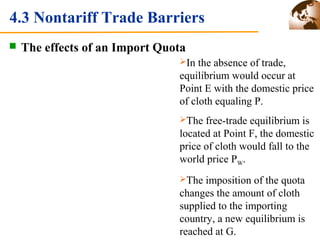

This document summarizes key concepts from Chapter 4 of an International Economics textbook. It covers theories for trade protection such as the infant industry argument. It then discusses tariffs, including import/export tariffs and calculations of effective rates of protection. Finally, it examines nontariff barriers such as import quotas, tariff-rate quotas, and subsidies. For quotas and tariffs, it outlines the impacts on consumer surplus, producer surplus, and government revenue. The chapter suggests quotas impose larger losses than equivalent tariffs due to restrictions on consumption.