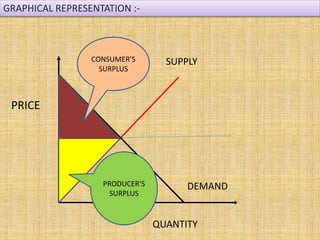

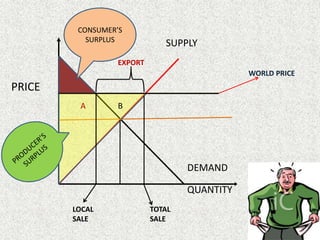

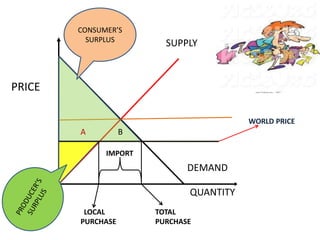

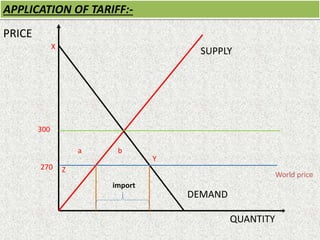

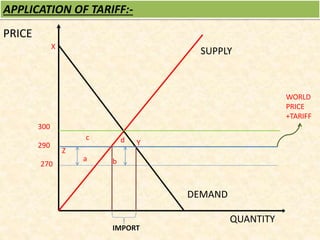

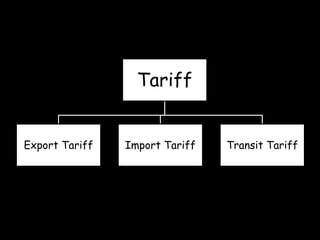

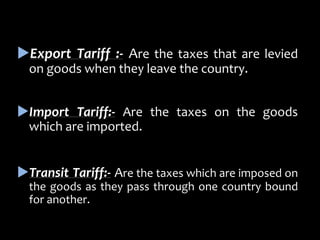

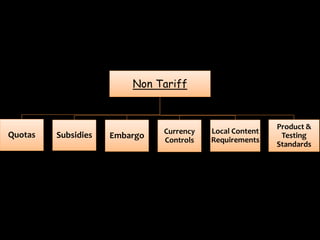

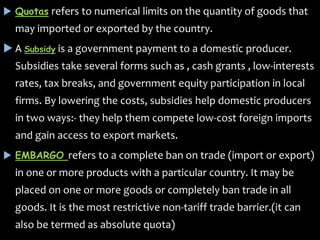

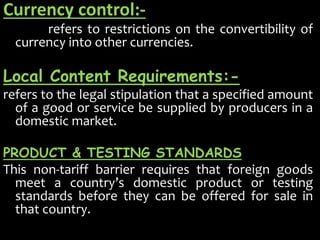

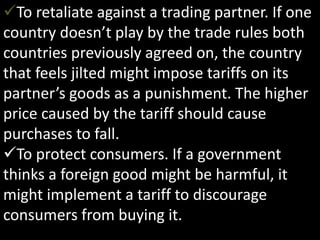

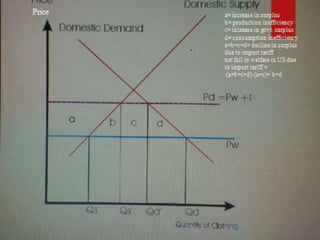

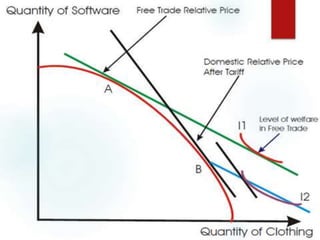

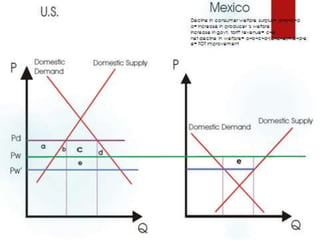

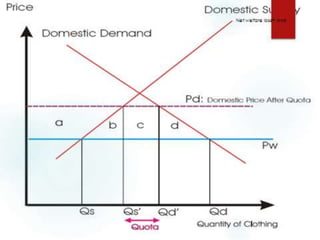

This document provides an overview of tariffs and international trade concepts. It defines tariffs as taxes on imported goods that make them more expensive for consumers. It then discusses key economic concepts related to international trade such as market price, consumer surplus, producer surplus, supply and demand curves. The document outlines different types of tariffs and non-tariff barriers. It also provides justifications for tariffs and discusses their analysis from both small and large economy perspectives. Finally, it briefly summarizes the role of the GATT and its replacement by the World Trade Organization.