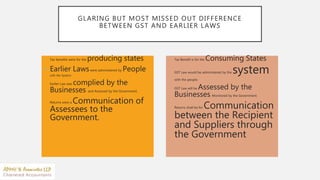

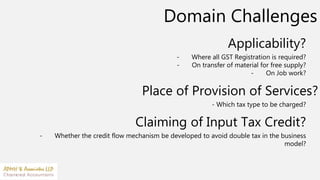

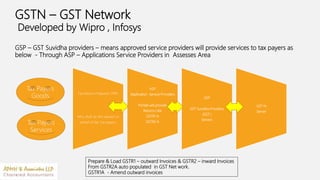

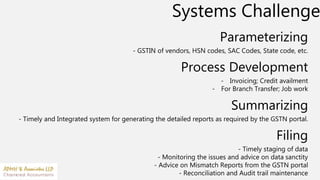

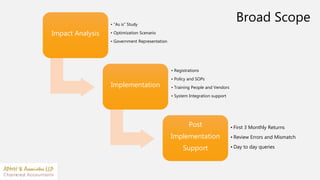

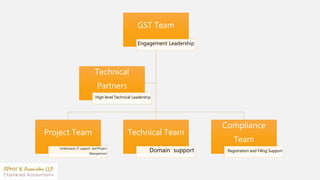

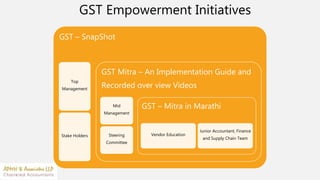

The document outlines the differences between GST and earlier tax laws, emphasizing the change in tax benefits from producing to consuming states, and the shift in compliance responsibility from the government to businesses. It highlights implementation challenges, such as service provision and input tax credit claiming, and details the support structure through GSTN and GST Suvidha Providers for tax filing. Additionally, it describes the roles and expertise of the engagement teams involved in GST implementation and compliance support.