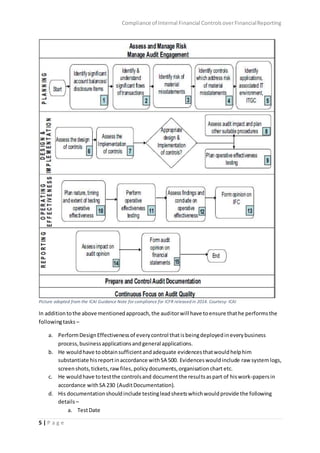

The document discusses the necessity for enhanced internal financial controls over financial reporting, primarily motivated by past corporate scandals like Satyam and Enron. It outlines the regulatory frameworks in India, particularly the Companies Act of 2013, which mandates management and auditors to ensure and report on the effectiveness of these internal controls. The piece emphasizes the management's responsibilities in designing and monitoring these controls to protect shareholder interests and maintain public trust.