The document presents an overview of the effects of demonetization in India, initiated on November 8, 2016, highlighting its impact on currency circulation and the immediate reactions from various sectors. It discusses strategies for managing old high denomination notes (HDNs) and the related implications for tax reporting and compliance, while also addressing potential penalties under the Income Tax Act and the Prevention of Money Laundering Act. The author, CA Amit Doshi, provides insights gained from his extensive experience in tax advisory and compliance.

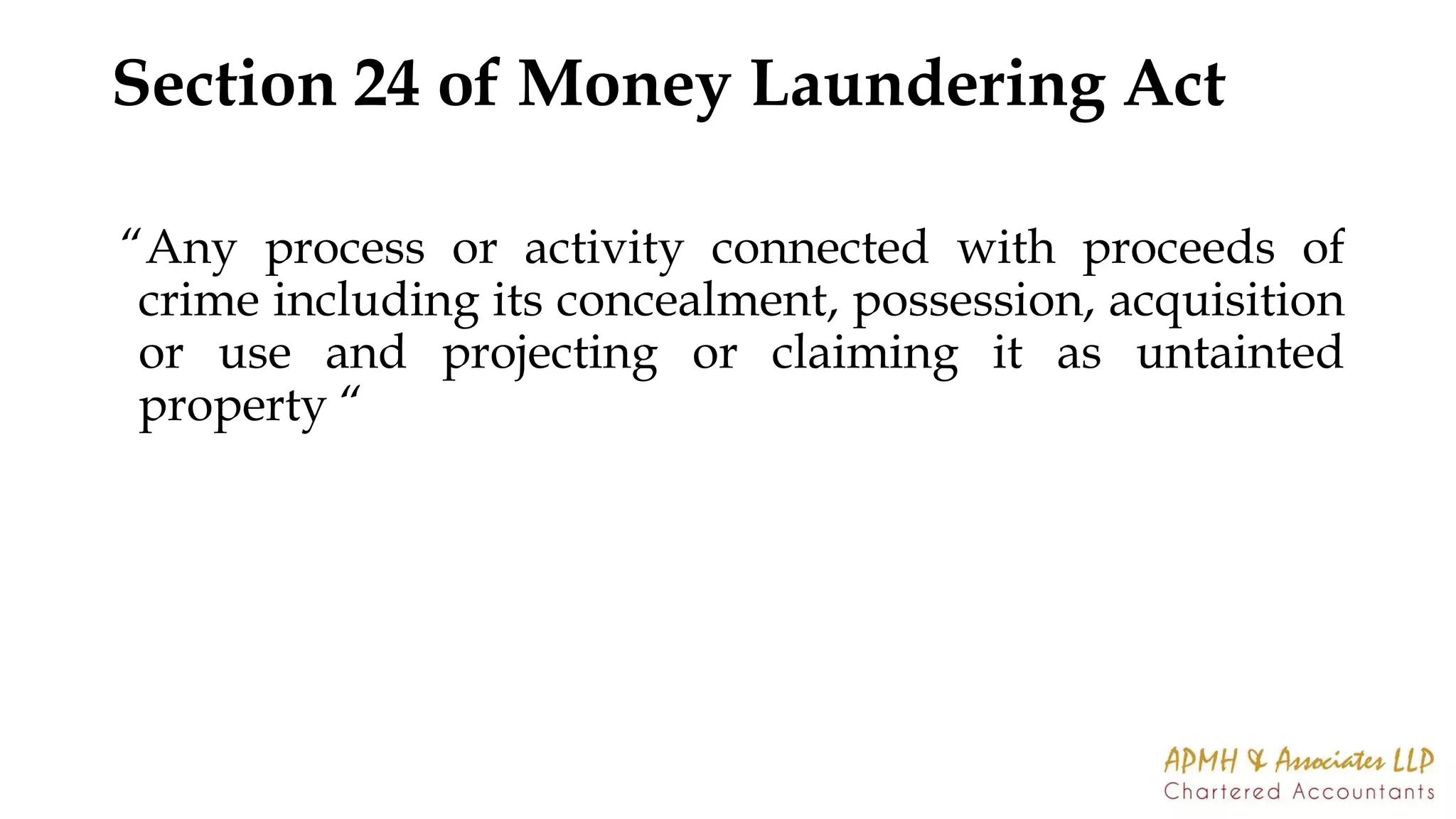

![FAQ of Money Laundering (Contd)

Q28. What is burden of proof in any proceedings relating to

proceeds of crime under MLA, 2002?

(a) In the case of a person charged with the offence of money-

laundering under section 3, the Authority or Court shall,

unless the contrary is proved, presume that such proceeds of

crime are involved in money-laundering; and

(b) In the case of any other person the Authority or Court, may

presume that such proceeds of crime are involved in money-

laundering [Section 24].](https://image.slidesharecdn.com/demonetisationpptrotaryclub-161125092931/75/Effects-of-Demonetisation-24-2048.jpg)