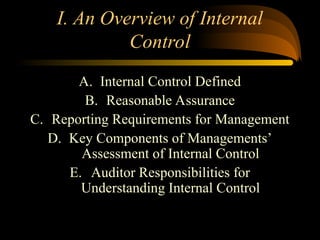

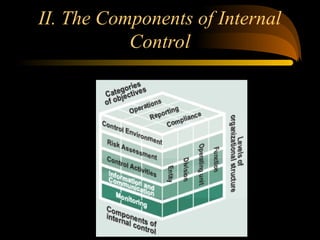

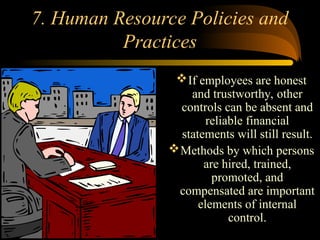

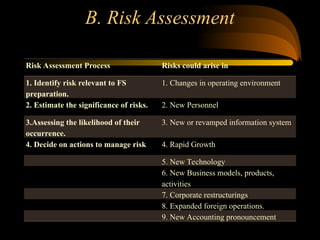

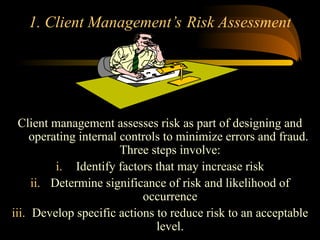

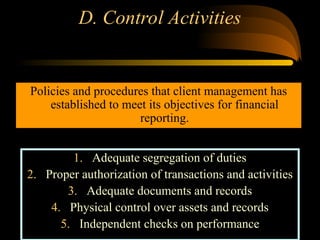

The document provides an overview of internal control, detailing its definition, components, and the responsibilities of management and auditors in ensuring effective internal control within organizations. It highlights the importance of key components such as the control environment, risk assessment, control activities, information and communication, and monitoring. Additionally, it discusses the reporting requirements under the Sarbanes-Oxley Act and the necessity for management to assess and report on the effectiveness of internal controls for financial reporting.