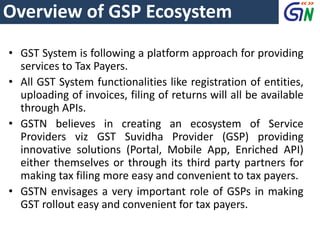

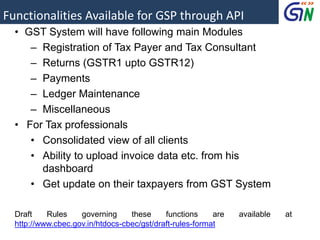

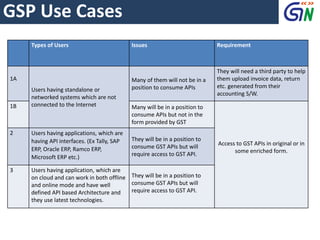

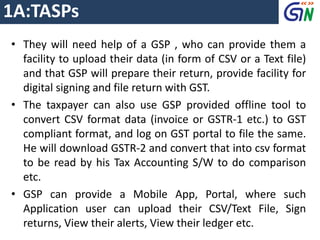

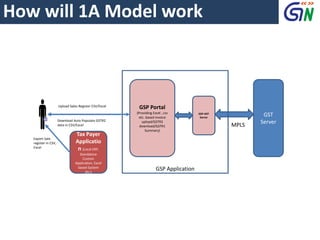

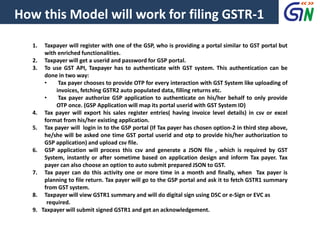

The document outlines the GST Suvidha Provider (GSP) implementation framework, emphasizing the need for automation in tax filing through APIs for various functionalities like registration, returns, payments, and ledger maintenance. It highlights the challenges faced by taxpayers in adapting to the GST system and the critical role GSPs will play in easing these processes. Additionally, it discusses the types of users and the different integration approaches needed for effective usage of GSP services.

![• They will need help of a GSP, who will provide them enrich APIs like uploading of invoice data in

form of CSV or a Text file, APIs to compare GSTR2 downloaded data with their purchase register

data in csv format etc.

• These application will also need access to GST System’s published APIs for knowing various other

thing like ledger balance etc. and keep their system updated.

• GSP can provide combination of Enriched as well as original APIs.

• They will fit in below model.

GST

System

GSP-

GST

Server

MPL

S

GSP Enriched

API Server

[uploadInvoice(csv format),

compareGSTR2(GSTR2 Json,

purchaseRegisterCSV)]

Tax Payer

Custom

Application

Cloud and Mobile

Application by

Startuos and small

companies

Payload

Encrypted Using

Session Key

GSP Application

API Calls

For 1B Type TASPs](https://image.slidesharecdn.com/gstsuvidhaprovidermodel-161028071115/85/GST-Suvidha-Provider-GSP-Model-18-320.jpg)