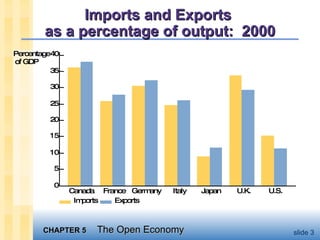

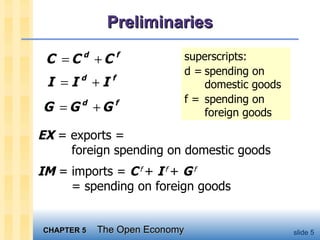

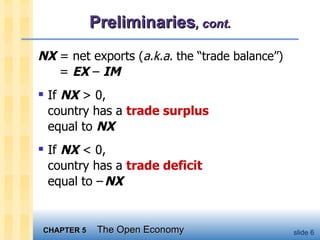

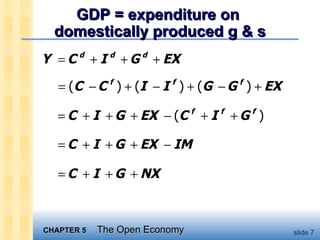

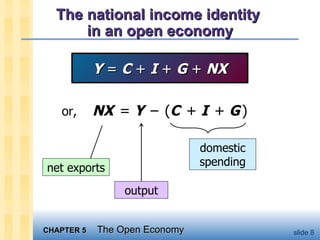

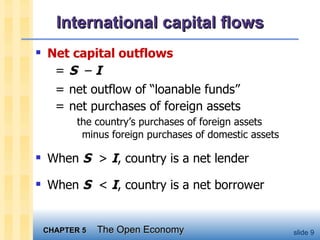

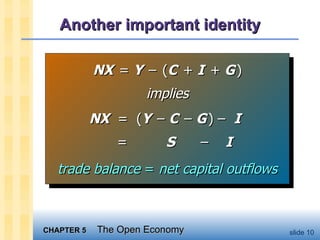

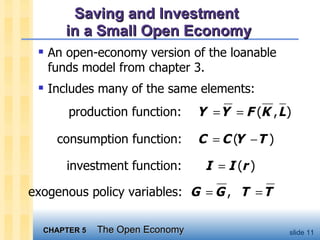

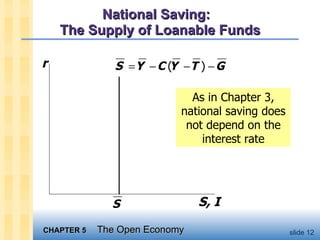

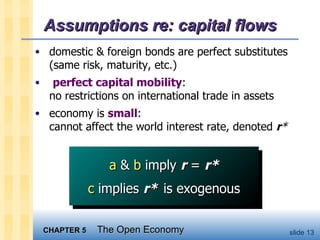

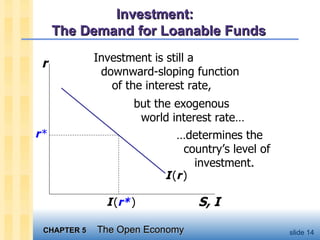

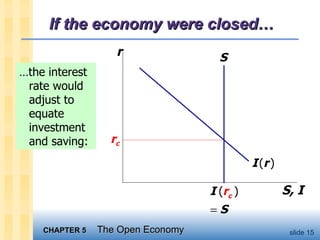

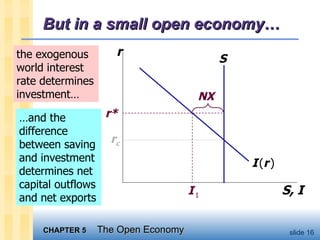

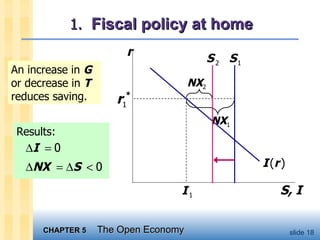

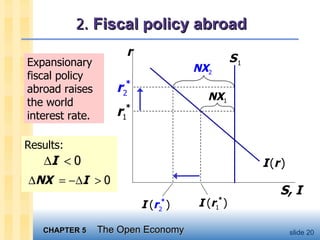

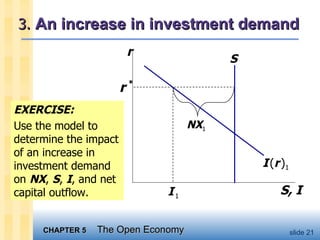

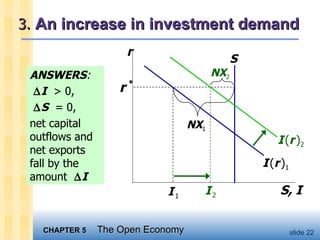

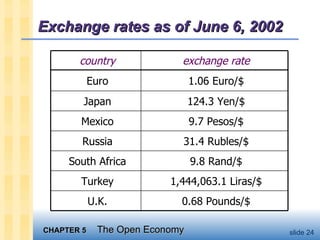

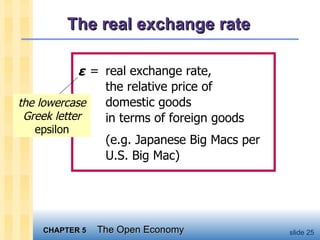

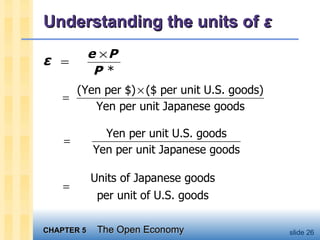

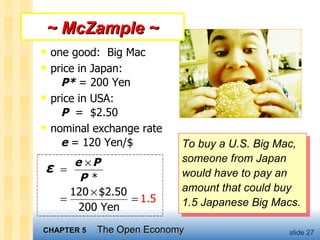

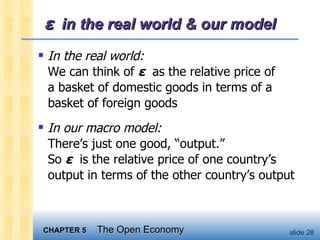

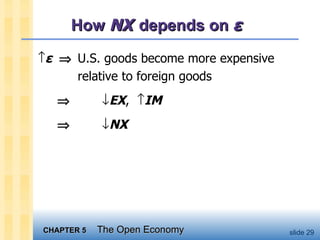

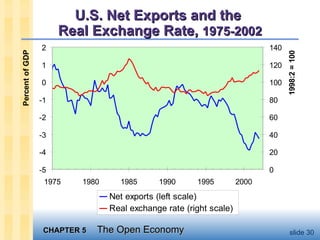

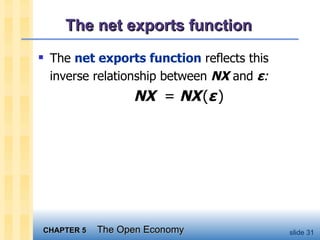

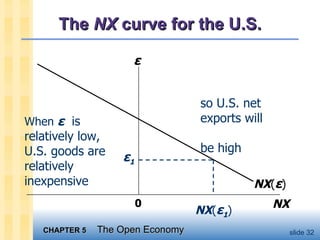

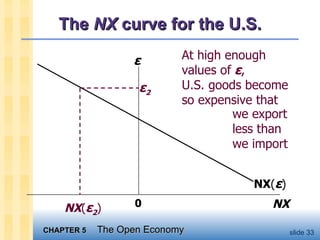

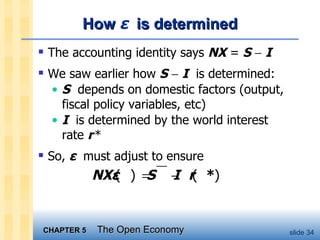

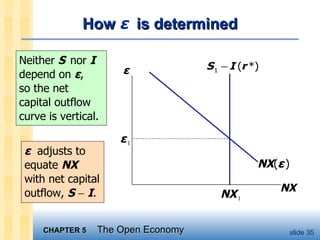

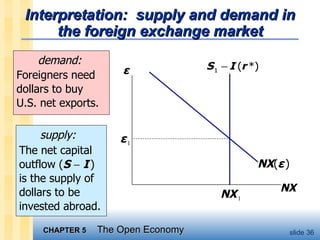

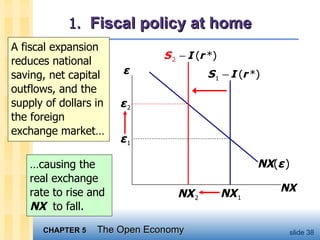

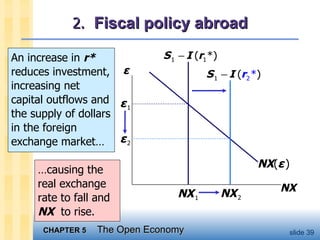

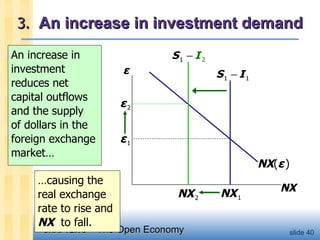

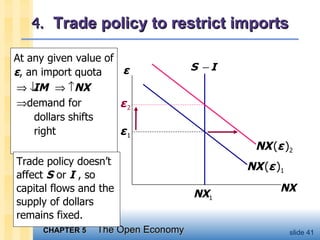

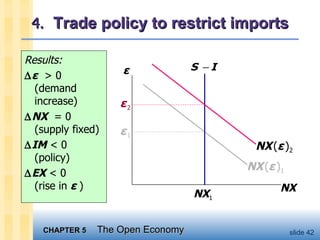

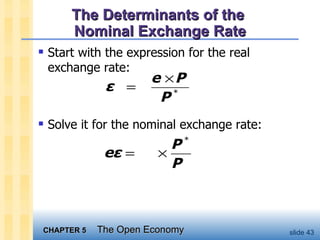

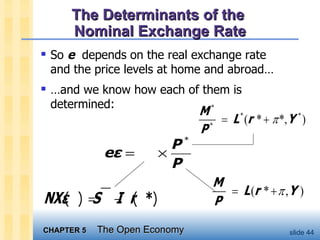

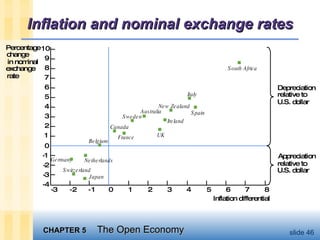

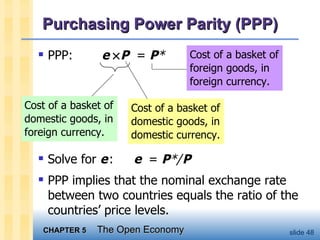

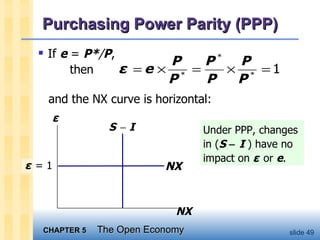

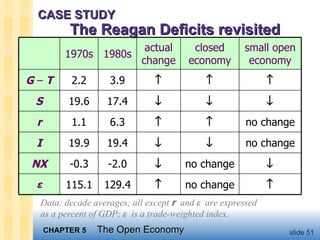

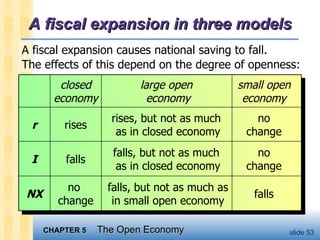

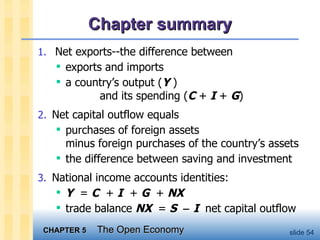

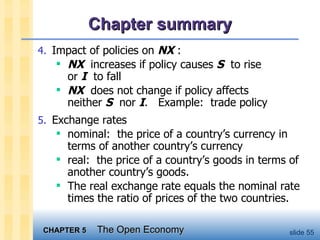

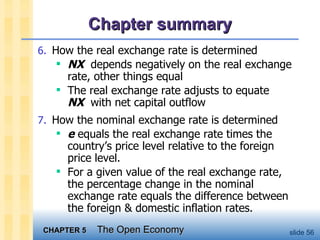

This chapter discusses key concepts in open economy macroeconomics including imports, exports, the trade balance, exchange rates, and how fiscal and monetary policies can impact these variables. It introduces accounting identities that relate gross domestic product (GDP), consumption (C), investment (I), government spending (G), net exports (NX), and net capital outflows. It also presents models of a small open economy and how exchange rates adjust to equate the trade balance with capital flows.