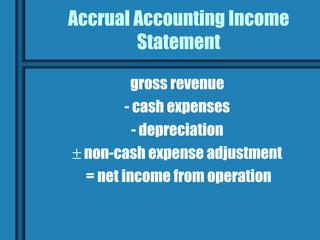

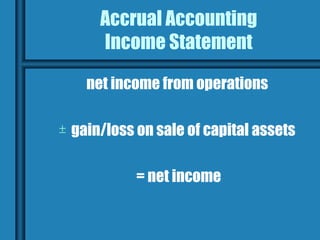

This document discusses income statements and their importance for measuring business performance. It defines revenue as cash receipts from product sales or interest income, and expenses as operating costs, interest, and non-cash adjustments. Income statements are used to determine if a business made a profit or loss for a given period, usually annually, and to explain changes in owner equity. They summarize revenues and expenses and can be used to calculate financial measures and support loan applications.