Embed presentation

Downloaded 87 times

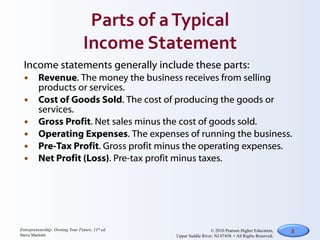

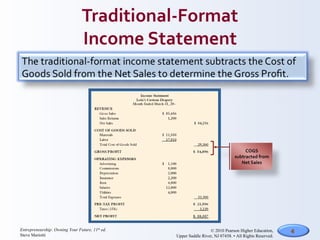

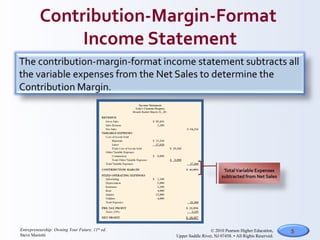

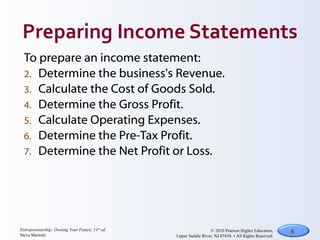

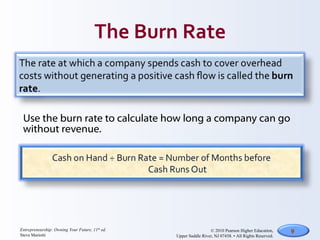

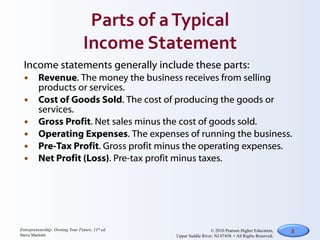

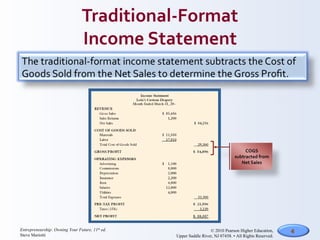

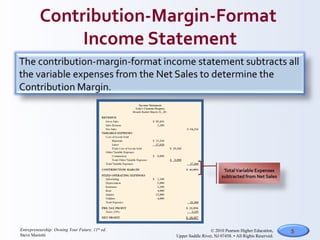

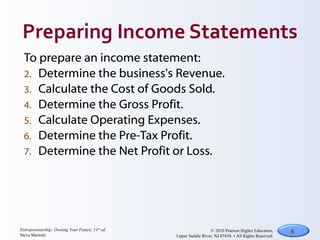

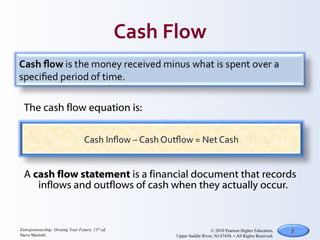

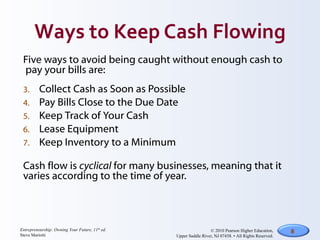

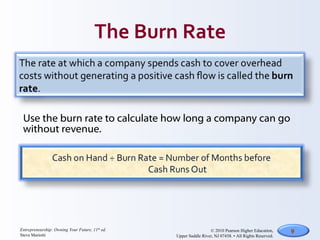

The document discusses income statements, their purpose and key components. It explains that income statements are prepared periodically to show business performance and include revenue, costs of goods sold, gross profit, operating expenses, pre-tax profit and net profit. It also discusses the importance of cash flow for entrepreneurs and calculating a company's burn rate to understand how long it can operate without generating revenue.