This document discusses GST (Goods and Services Tax) in Australia and the Business Activity Statement (BAS). It provides the following key points:

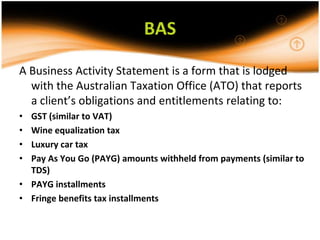

1. GST is a 10% tax on most goods and services in Australia that replaced sales taxes on July 1, 2000. The BAS is a form businesses file with the ATO to report GST obligations and payments.

2. The BAS is used to report GST, wine tax, luxury car tax, and Pay As You Go (PAYG) withholding amounts from payments similar to TDS in India. Businesses can choose to lodge BAS forms quarterly or monthly depending on annual turnover.

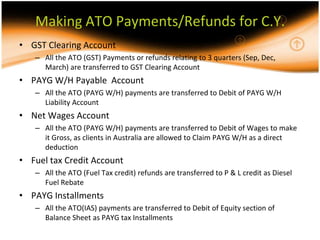

3. Accounting for GST involves credit