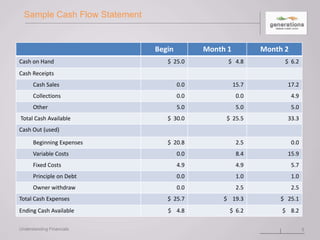

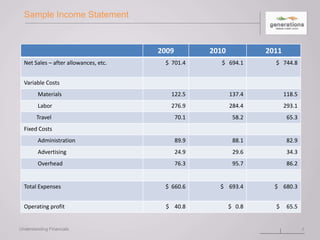

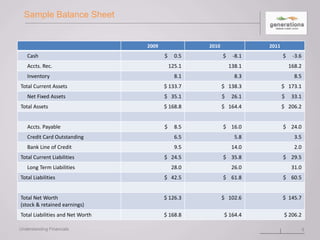

The document provides an overview of essential financial statements including cash flow statements, income statements, and balance sheets, explaining their purposes and how to utilize them for business management. It emphasizes the importance of planning, checking actuals against plans, and taking corrective actions where necessary. Additionally, it offers resources for obtaining accounting help and software for effective financial management.