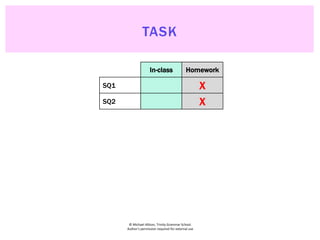

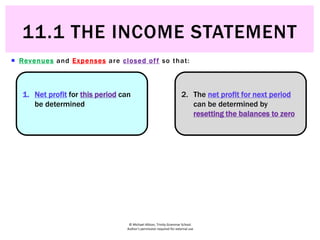

The document discusses the income statement, which summarizes a company's revenues and expenses over a period of time. It notes that at the end of each reporting period, all revenues and expenses are closed out to the profit and loss summary account. While this account shows whether there was a net profit or loss, it does not present the information in a clear and understandable way. Therefore, companies prepare an income statement, which lists revenues, expenses, and net profit/loss in a format that is easier for outsiders to comprehend. The income statement presents the information needed to determine the financial performance and results of operations of a company for a given period.

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

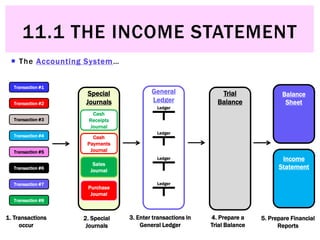

At the end of each reporting period all Revenues and Expenses are closed off

to the Profit & Loss Summary account…

Closing

The balance of the account is reset to zero at the end of the period

Sales [R]

30/6 Cash at Bank 35000

30/6 Profit and Loss Summary 53000 30/6 Debtors Control 18000

53000 53000

Revenue

Expenses

Sales [R]

30/6 Cash at Bank 35000

30/6 Profit and Loss Summary 53000 30/6 Debtors Control 18000

53000 53000

Sales [R]

30/6 Cash at Bank 35000

30/6 Profit and Loss Summary 53000 30/6 Debtors Control 18000

53000 53000

Sales [R]

30/6 Cash at Bank 35000

30/6 Profit and Loss Summary 53000 30/6 Debtors Control 18000

53000 53000

11.1 THE INCOME STATEMENT](https://image.slidesharecdn.com/11-150514052457-lva1-app6892/85/11-1-The-Income-Statement-3-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The Profit and Loss Summary account enables the firm to determine whether it

has made either a…

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

Net Profit Net Loss

Revenue

- Expenses

= Net Profit (Loss)

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

9400

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

5100

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

30/6 Capital 4300

9400 9400

4300

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

Revenue

- Expenses

= Net Profit (Loss)

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

5900

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

7800

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

30/6 Capital 1900

7800 7800

(1900)

11.1 THE INCOME STATEMENT](https://image.slidesharecdn.com/11-150514052457-lva1-app6892/85/11-1-The-Income-Statement-5-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

While the Profit and Loss Summary account shows whether the firm made a

Net Profit or a Net Loss, it is not easy to understand

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

Information is understandable if:

• Users can comprehend its meaning easily (assuming a reasonable

knowledge of business and economics)

11.1 THE INCOME STATEMENT](https://image.slidesharecdn.com/11-150514052457-lva1-app6892/85/11-1-The-Income-Statement-6-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

To someone who isn’t an accountant or familiar with this account, the firm’s

profit is not easily understandable or easy to calculate

A report is needed to set out this information in a more understandable

manner

This report is called the…

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

Income Statement

11.1 THE INCOME STATEMENT](https://image.slidesharecdn.com/11-150514052457-lva1-app6892/85/11-1-The-Income-Statement-7-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

Income Statement for the month ended 30 June 2015

$ $

Revenue

Cash sales 6000

Credit sales 3400 9400

less Expenses

Wages 2000

Rent 3000

Insurance 100 5100

Net Profit 4300

Income Statement for the month ended 30 June 2015

$ $

Revenue

Cash sales 6000

Credit sales 3400 9400

less Expenses

Wages 2000

Rent 3000

Insurance 100 5100

Net Profit 4300

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

Income Statement for the month ended 30 June 2015

$ $

Revenue

Cash sales 6000

Credit sales 3400 9400

less Expenses

Wages 2000

Rent 3000

Insurance 100 5100

Net Profit 4300

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

Income Statement for the month ended 30 June 2015

$ $

Revenue

Cash sales 6000

Credit sales 3400 9400

less Expenses

Wages 2000

Rent 3000

Insurance 100 5100

Net Profit 4300

Profit and Loss Summary [OE]

30 Jun Expense accounts 5100 30 Jun Revenue accounts 9400

30 Jun Capital 4300

9400 9400

11.1 THE INCOME STATEMENT](https://image.slidesharecdn.com/11-150514052457-lva1-app6892/85/11-1-The-Income-Statement-8-320.jpg)