This document discusses management information systems and keys to successful record keeping. It contains the following main points:

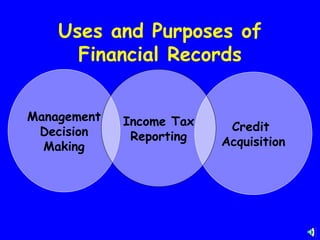

1) Management involves planning, organizing, directing, and controlling a business, with controlling being the most important and challenging aspect. Financial and production records provide valuable information for business decisions.

2) Effective record keeping systems are needed that allow for necessary record keeping while providing summary information for daily decisions. Records should be simple yet useful and meet specific needs and limitations.

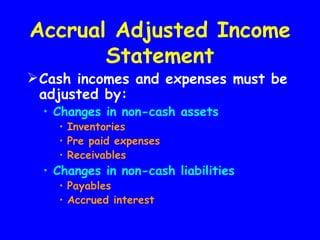

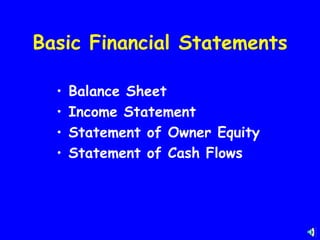

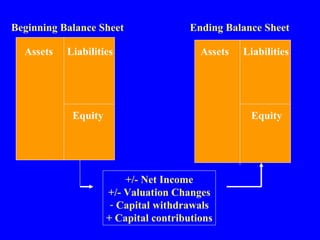

3) Financial analysis requires a basic set of financial statements including a balance sheet, income statement, statement of owner equity, and statement of cash flows to understand and interpret a business's financial condition and performance.