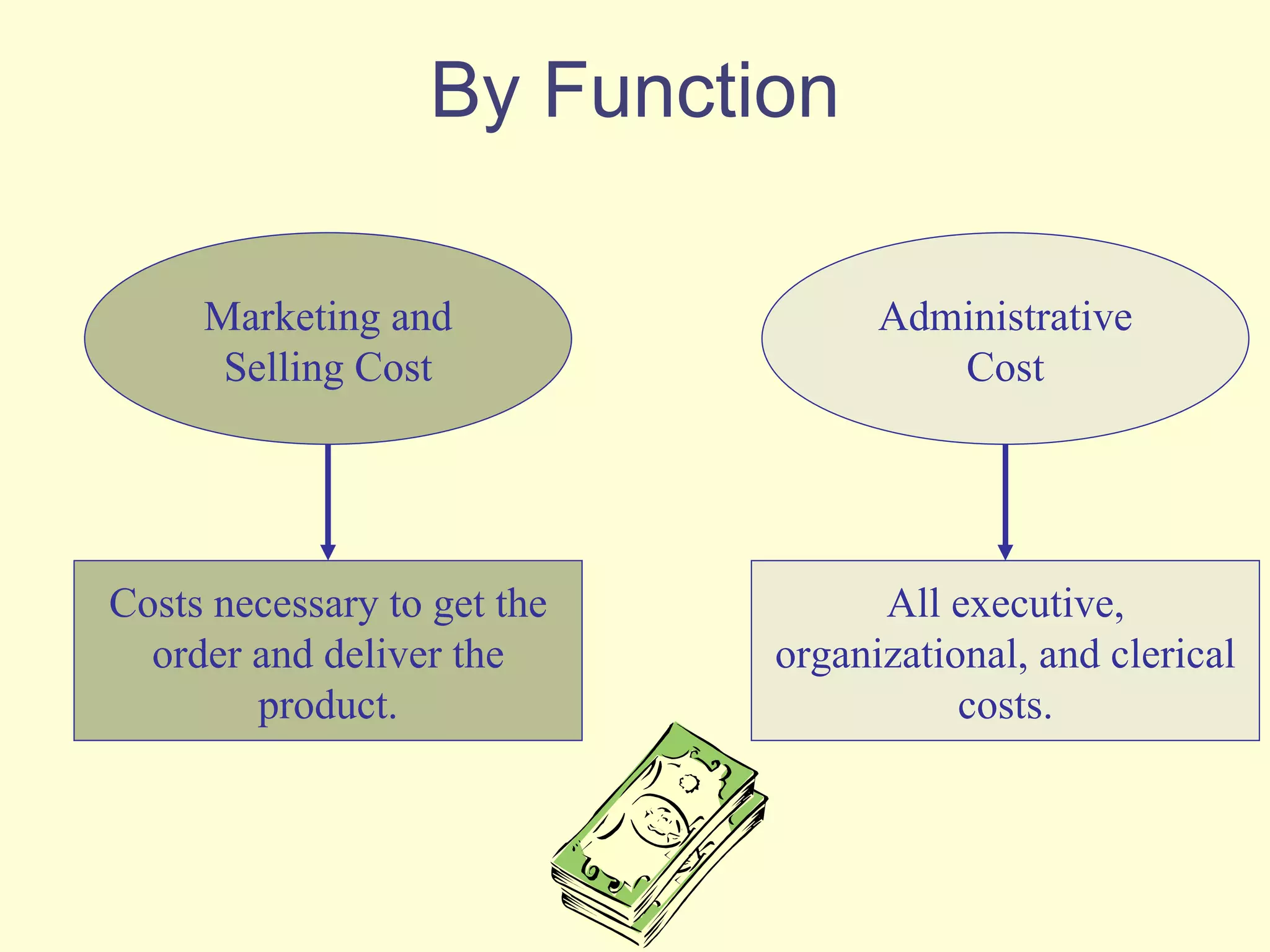

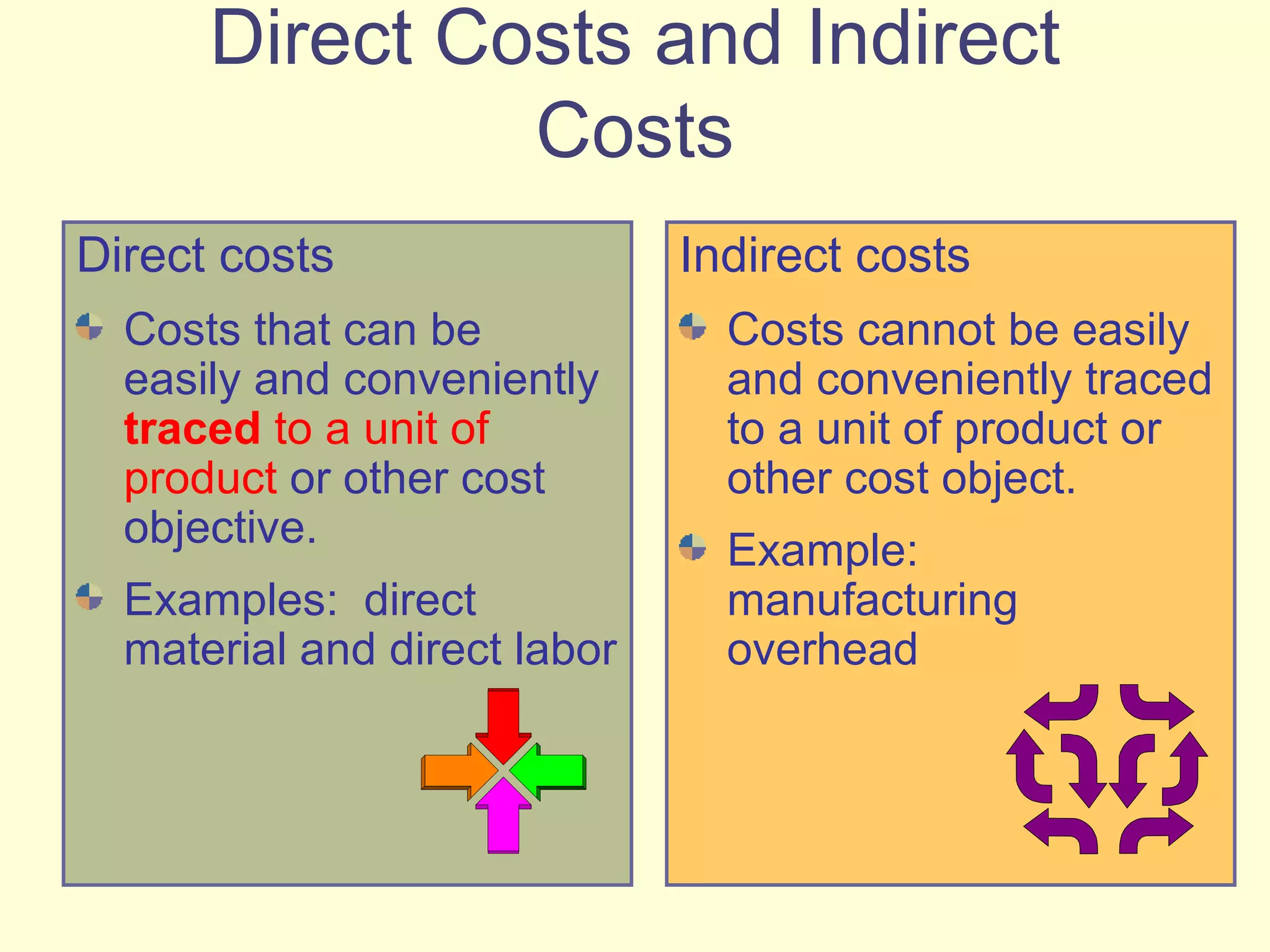

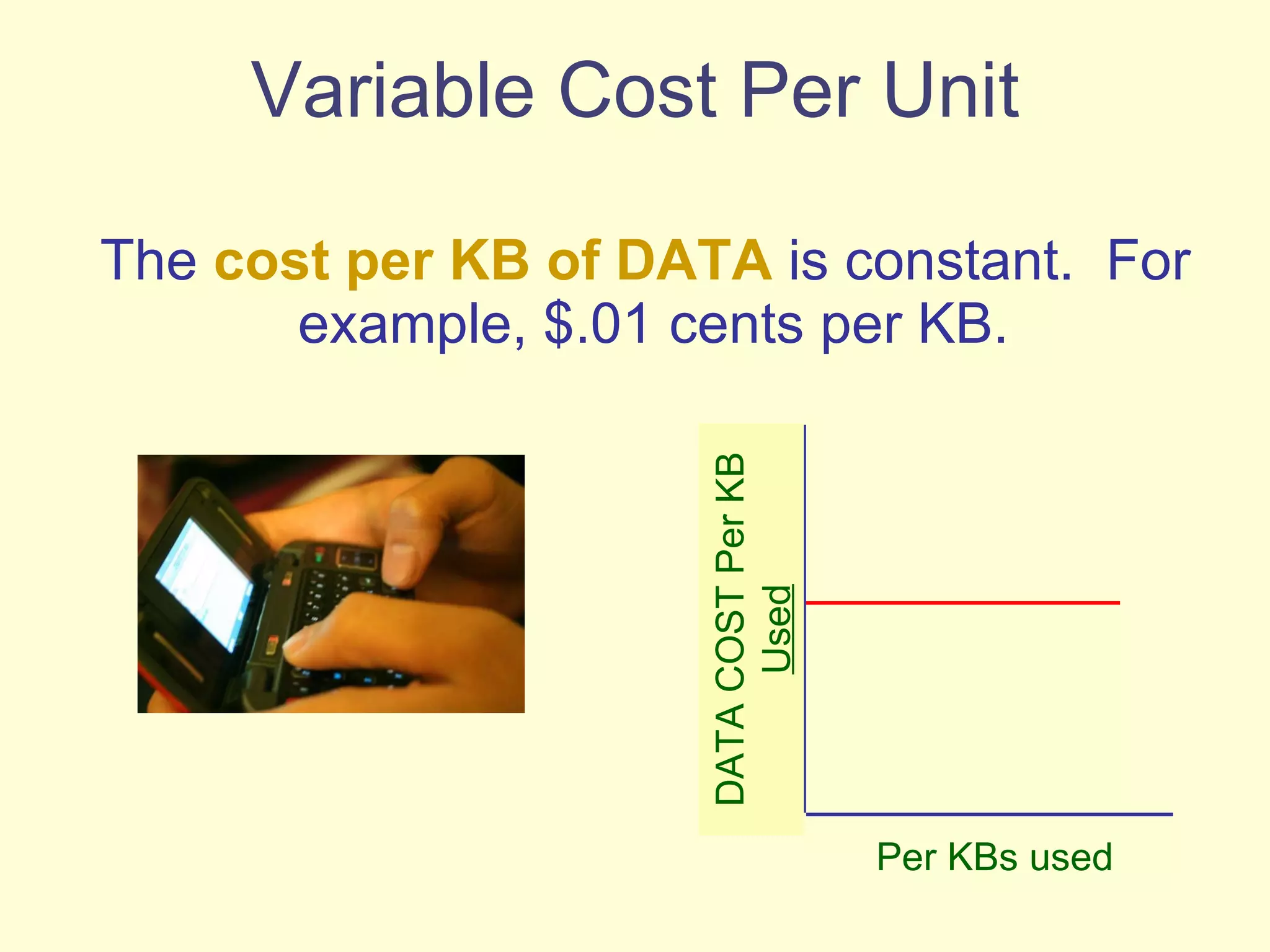

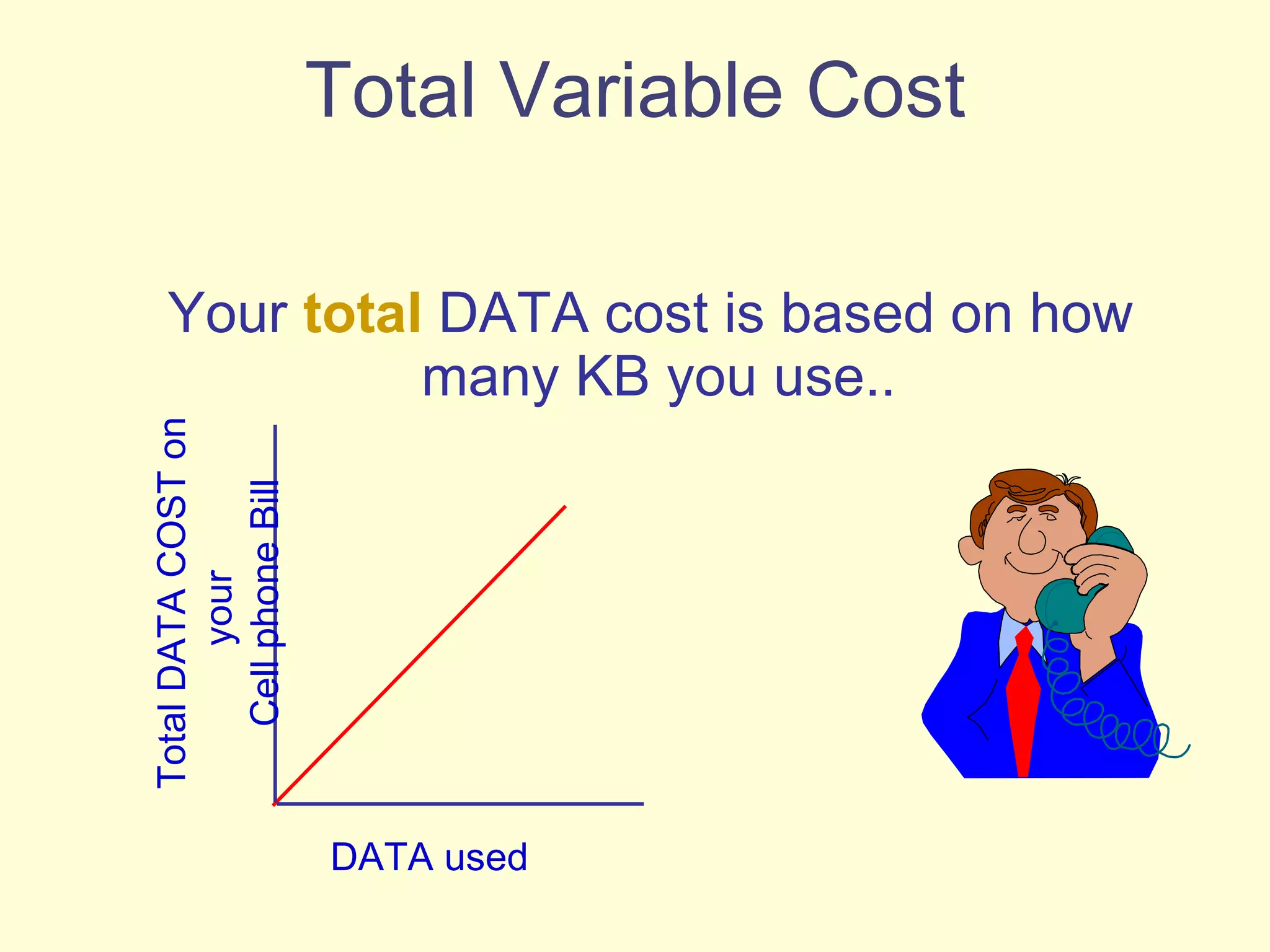

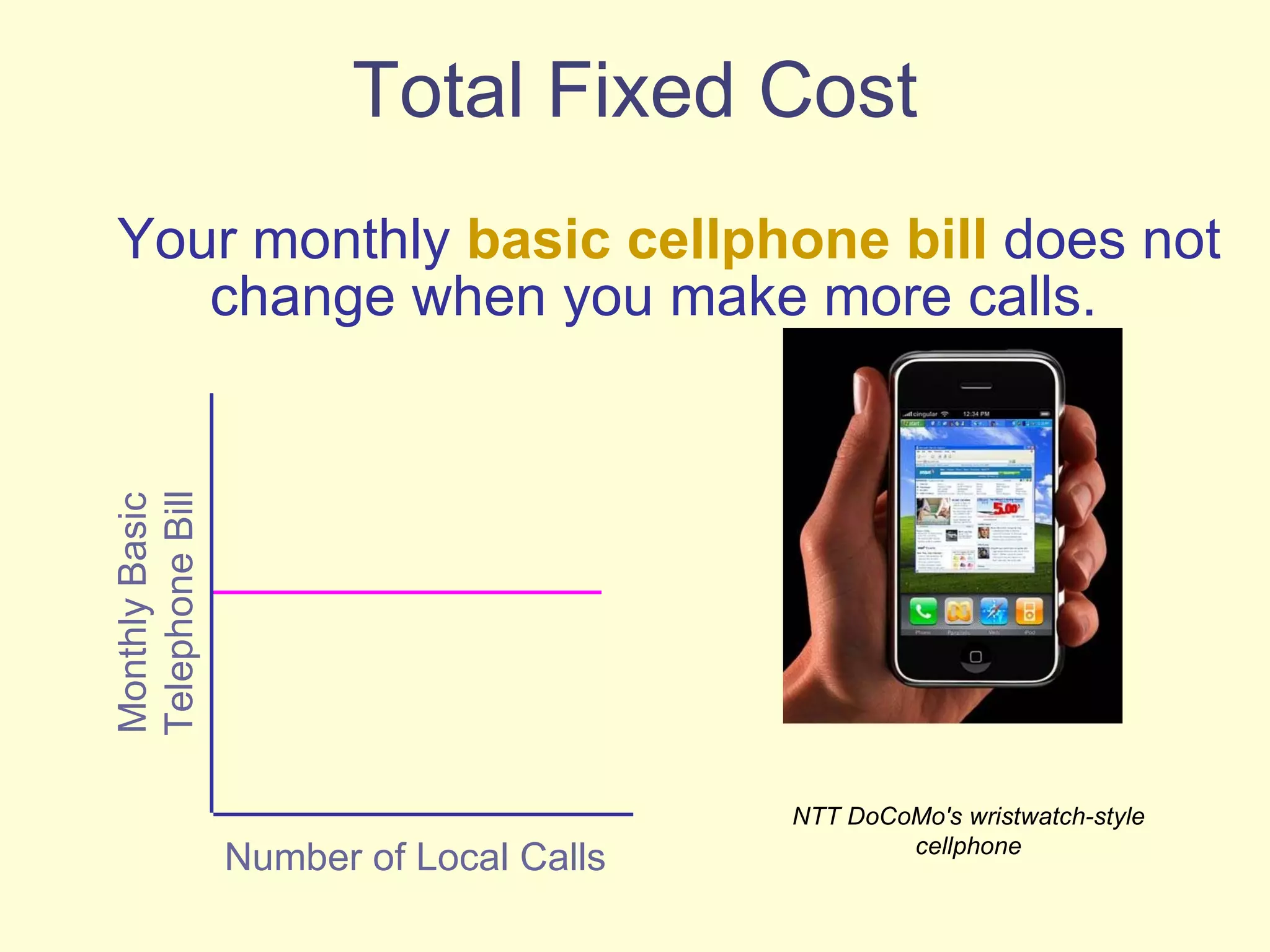

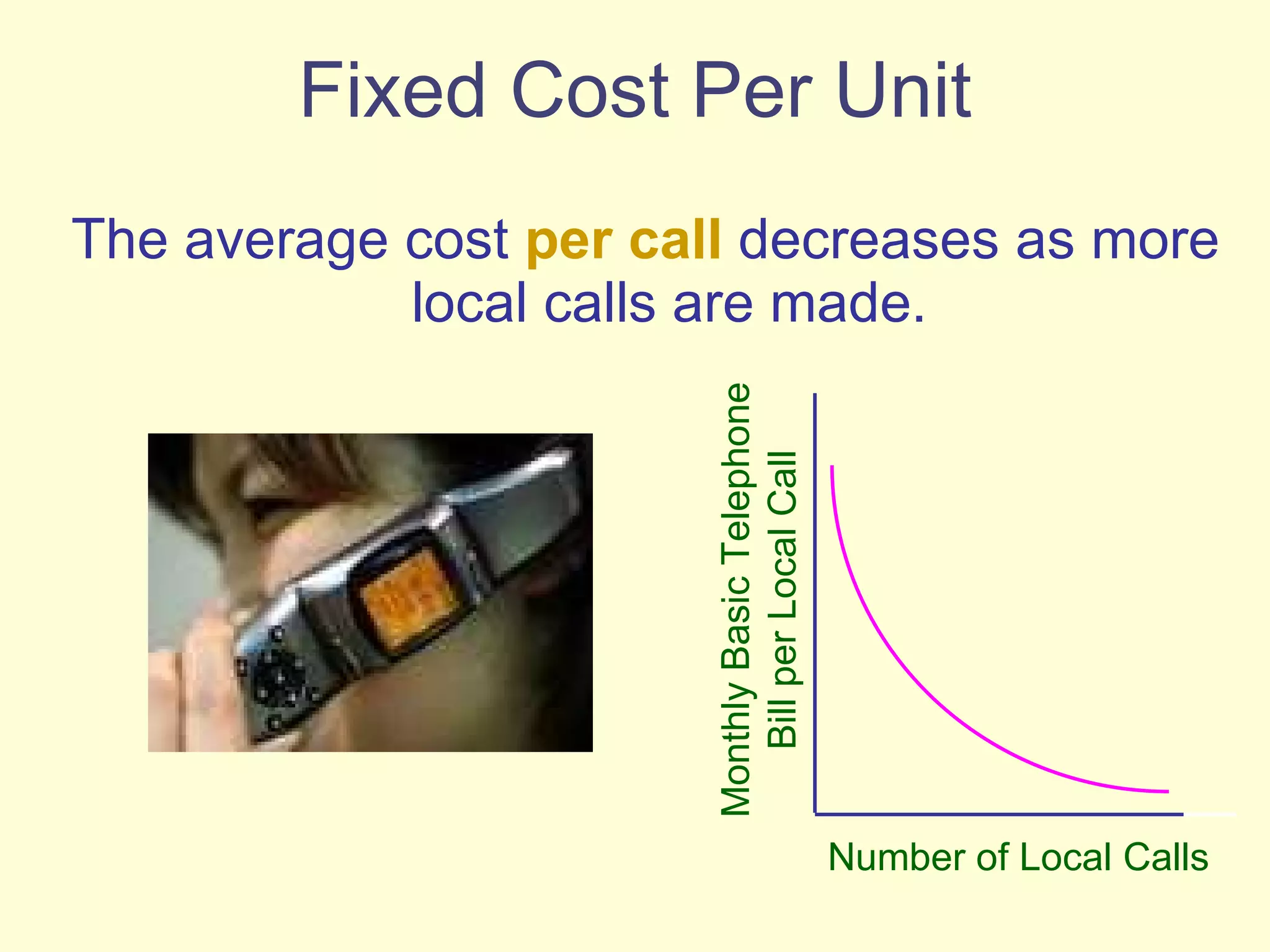

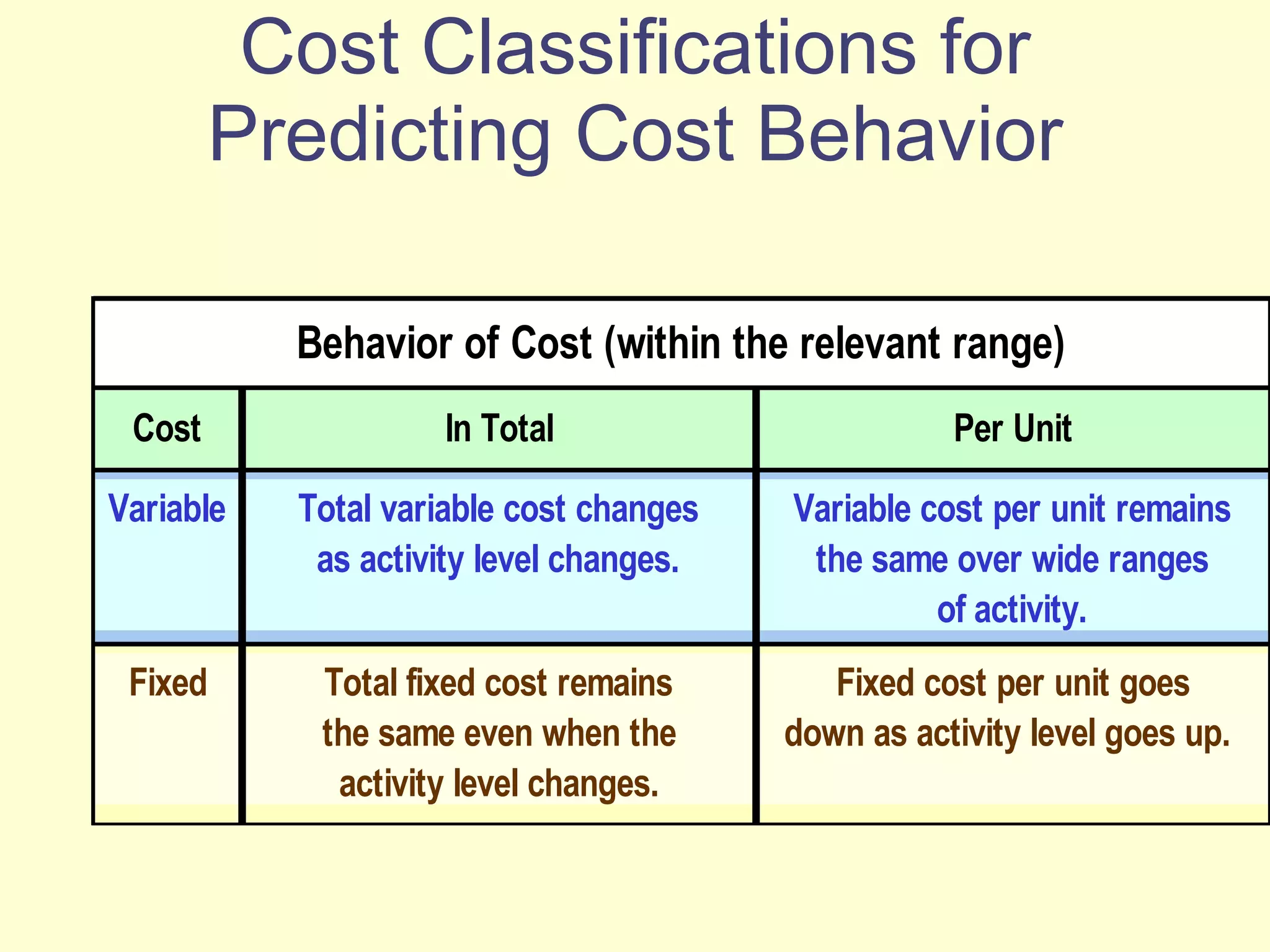

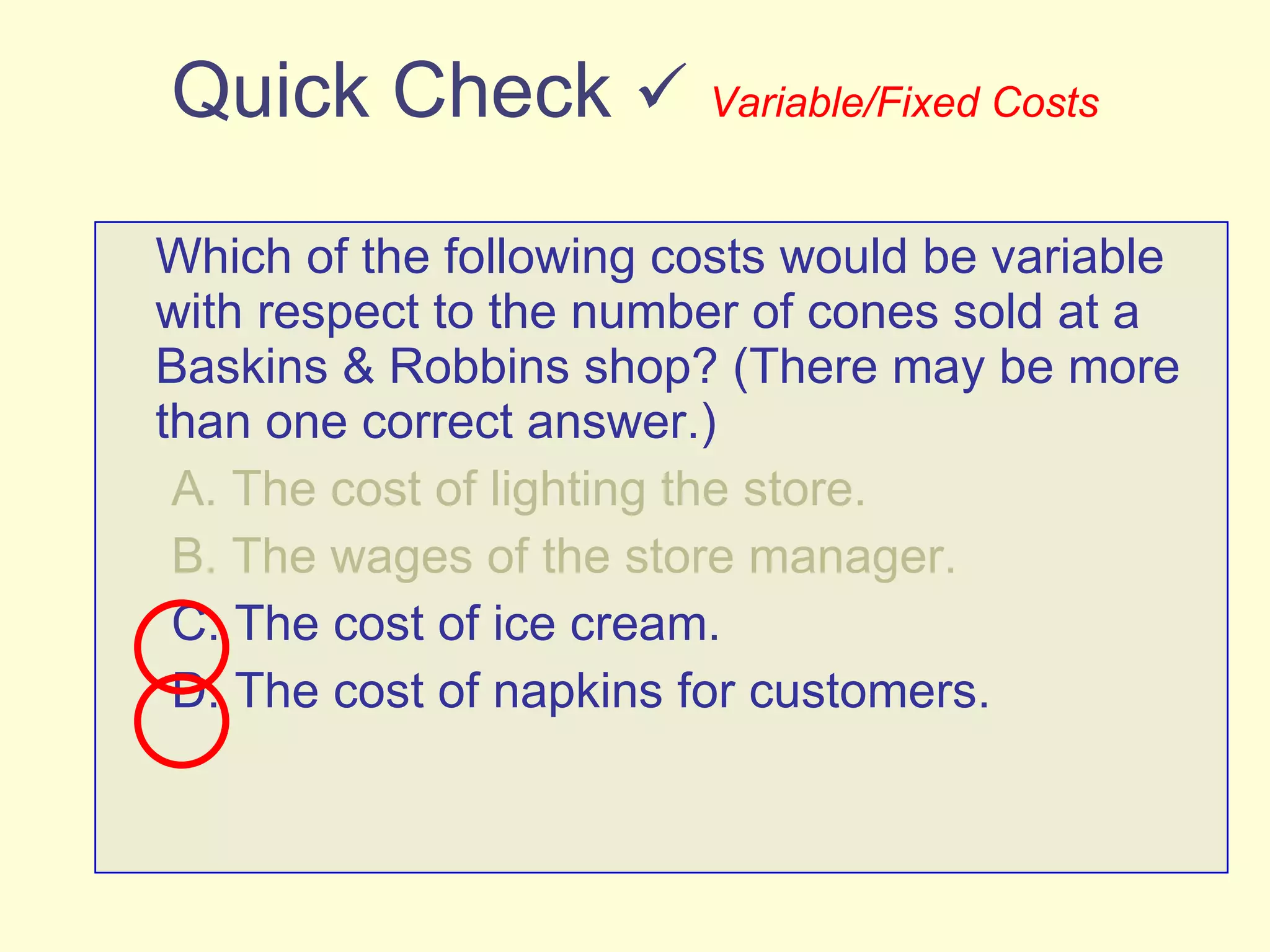

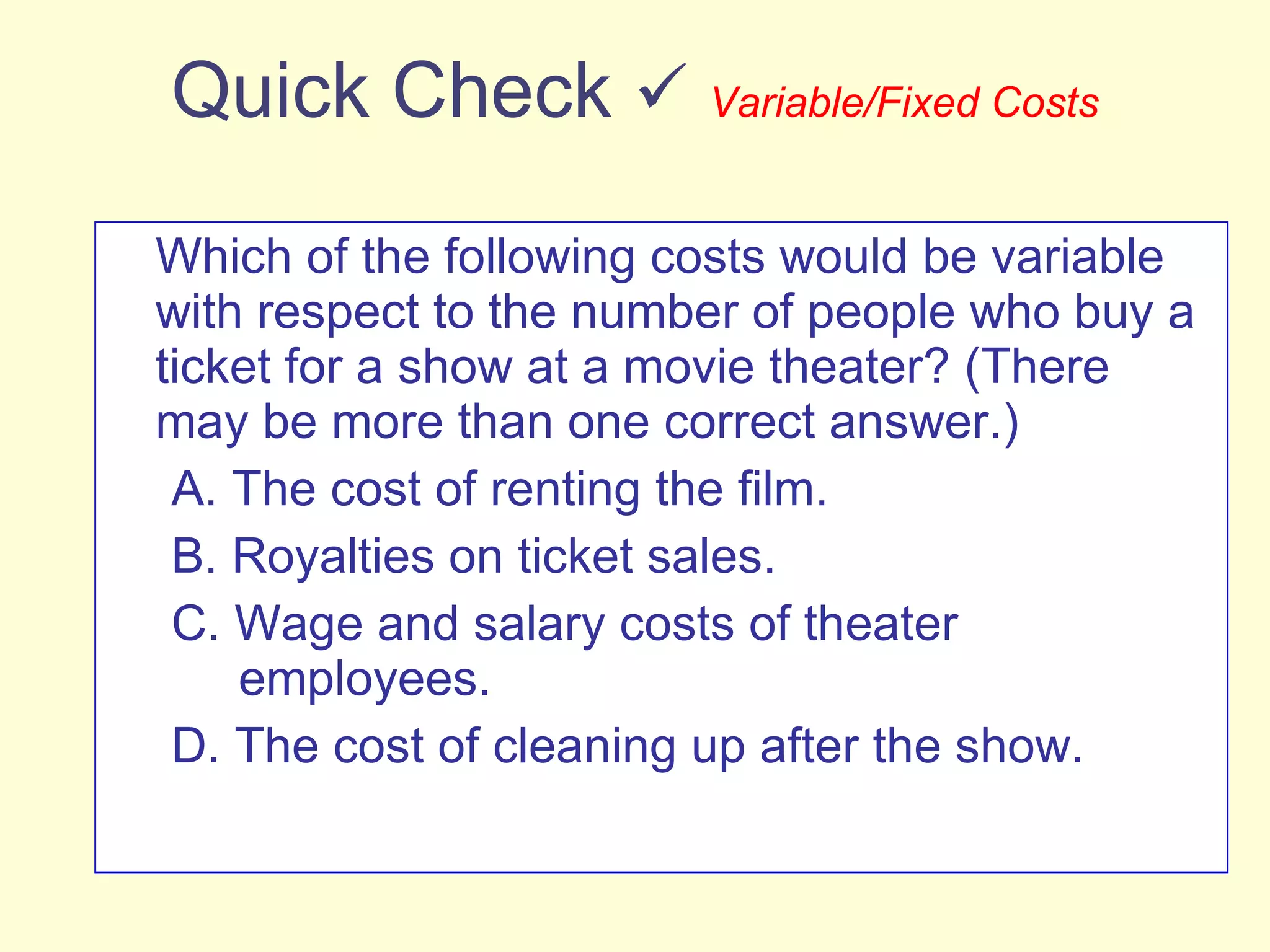

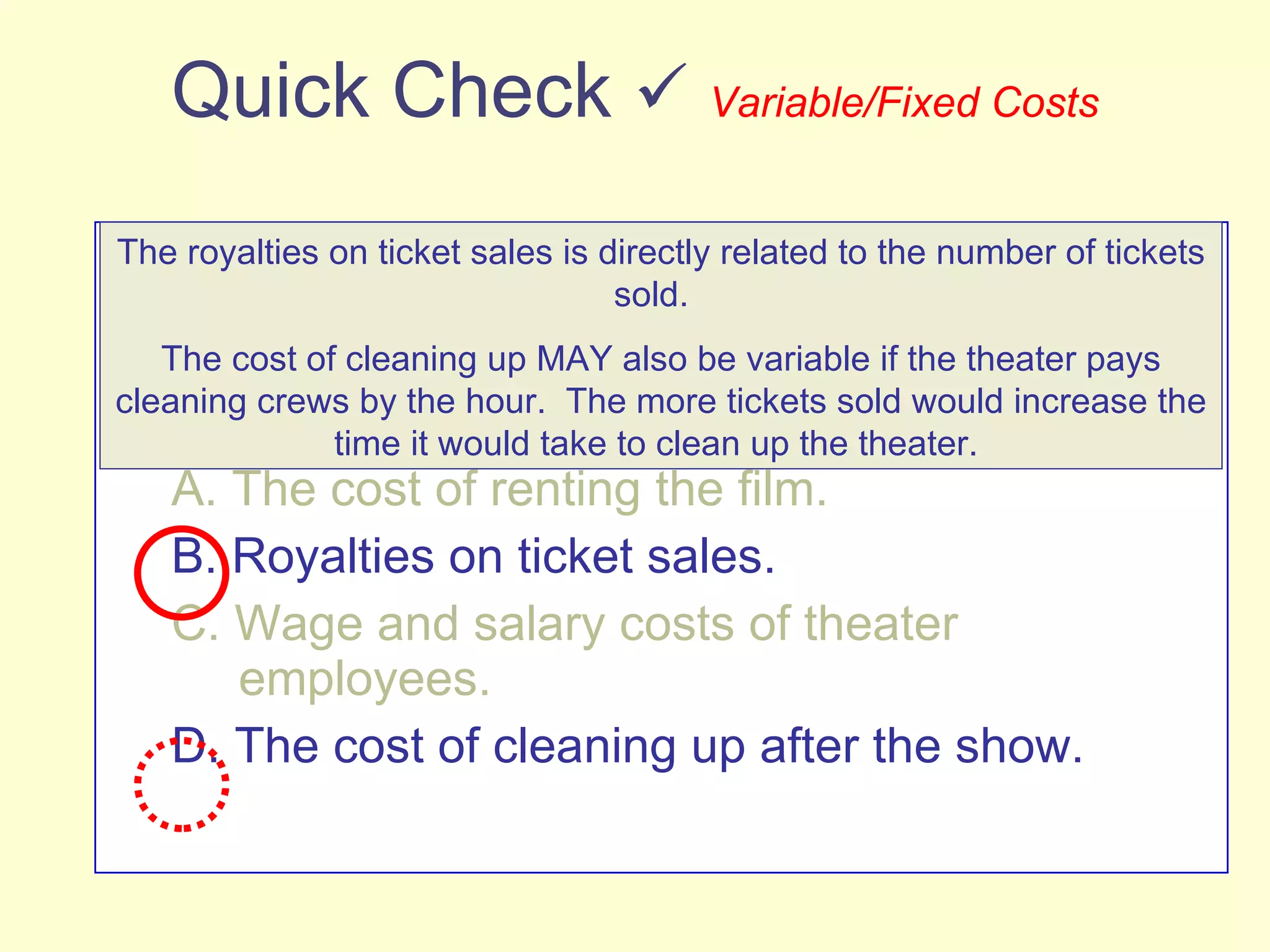

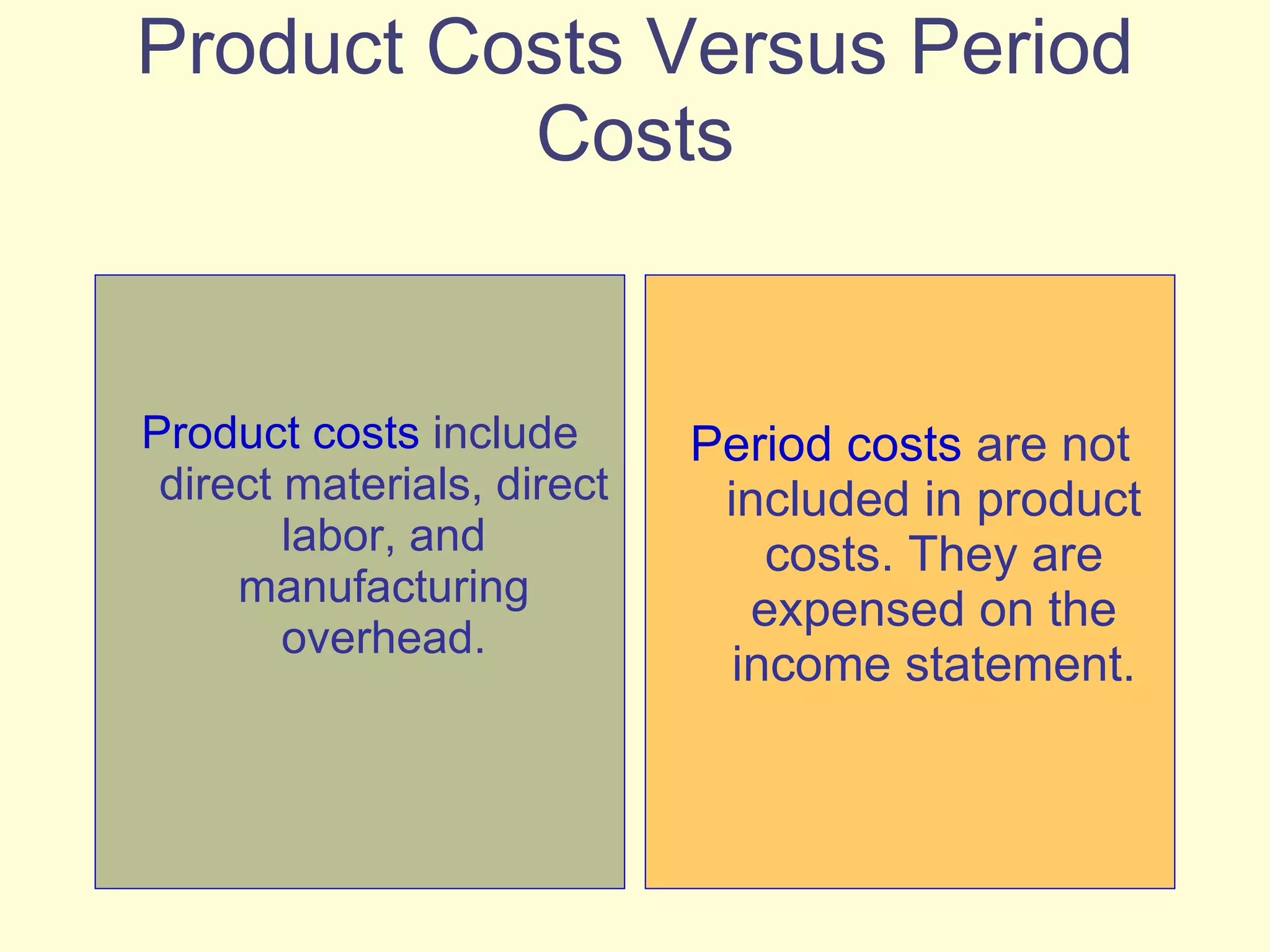

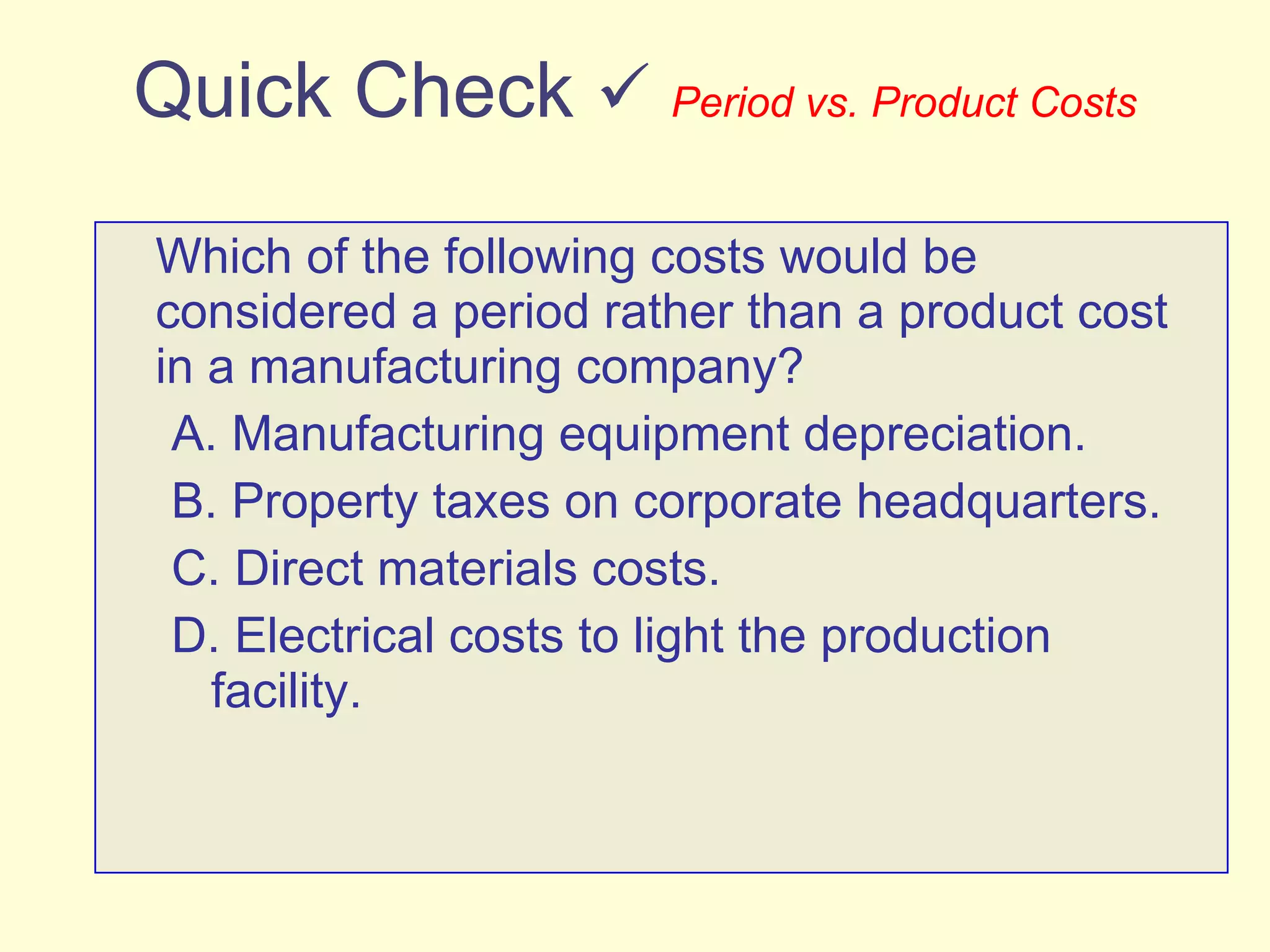

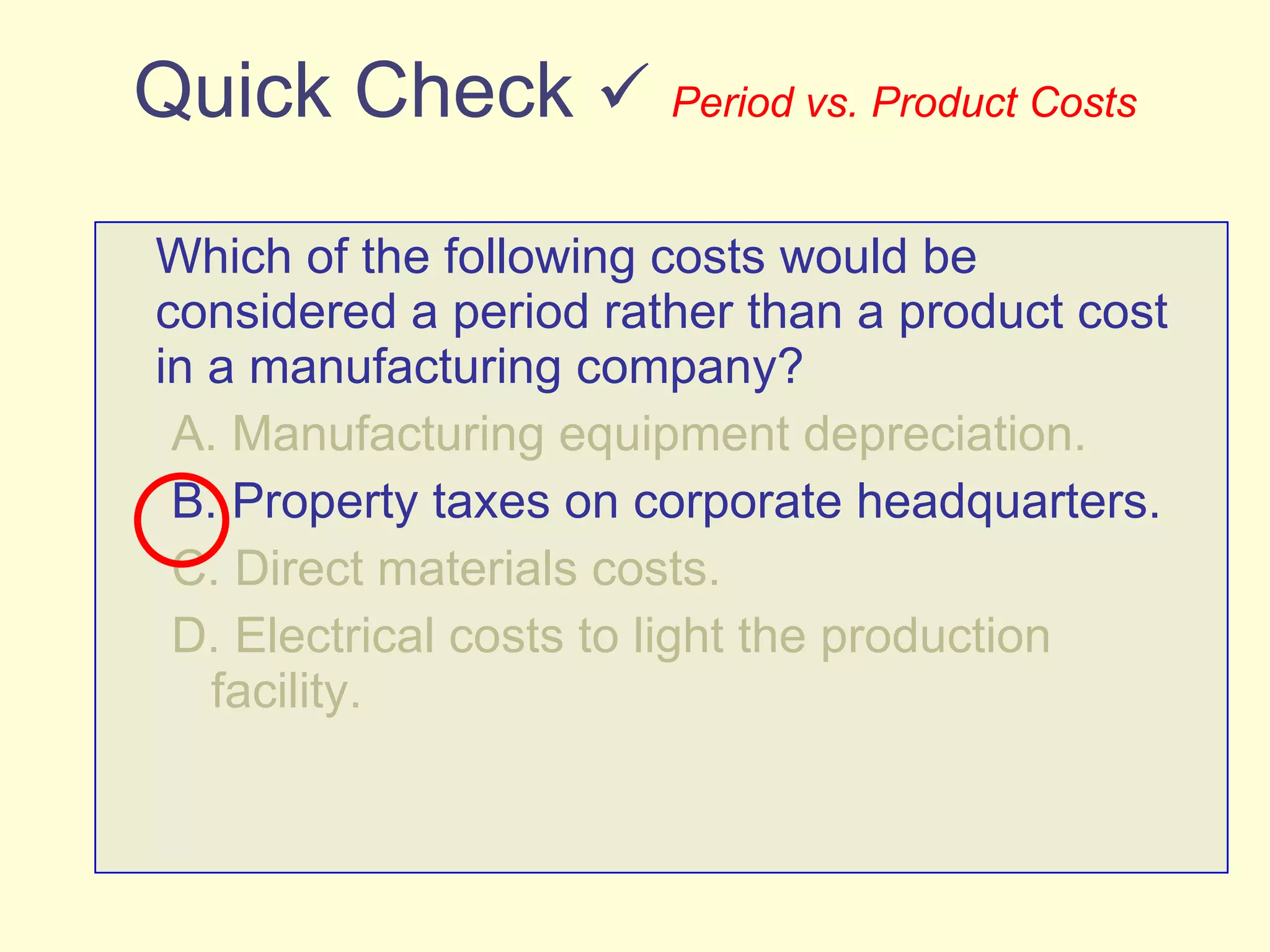

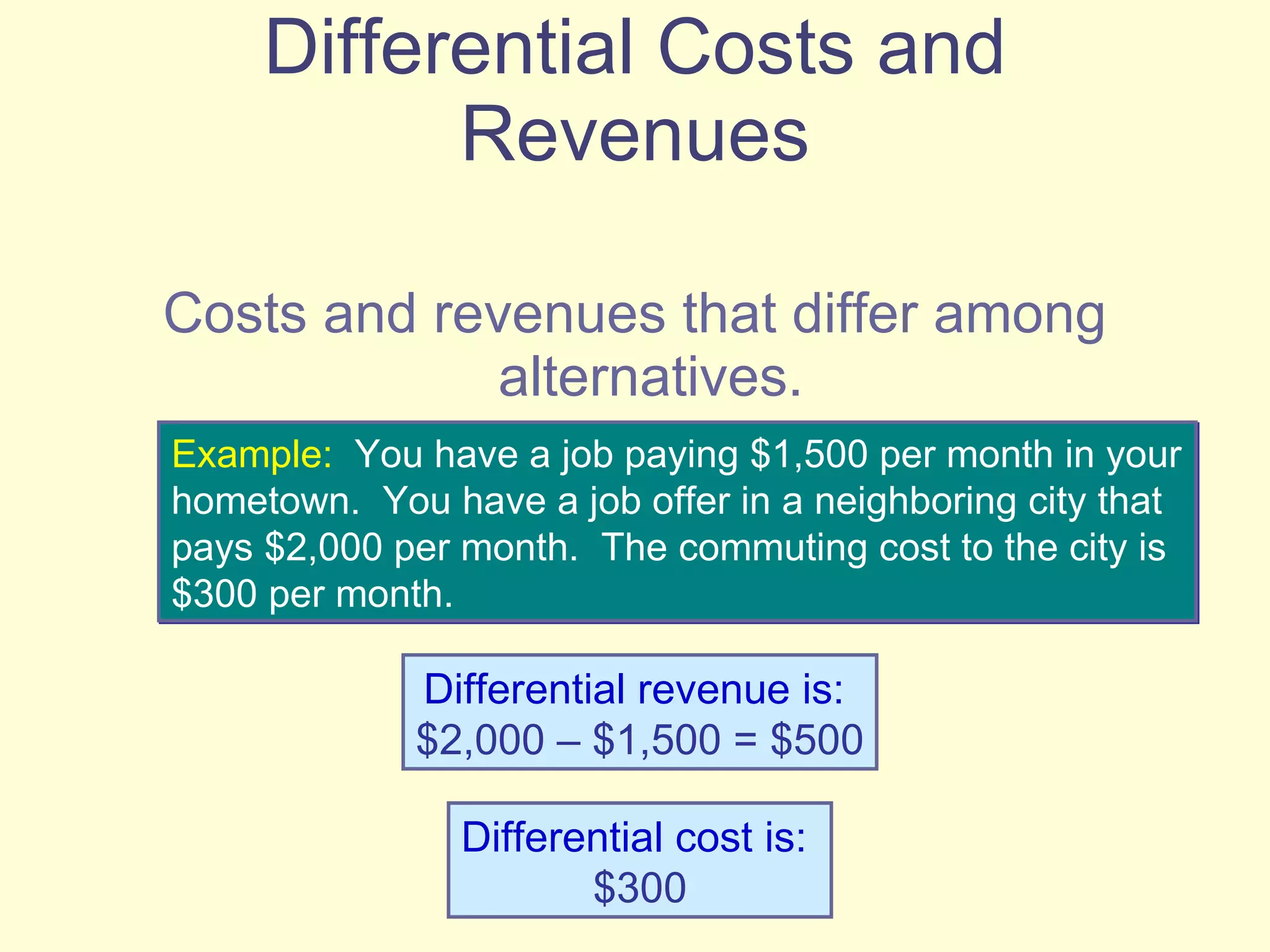

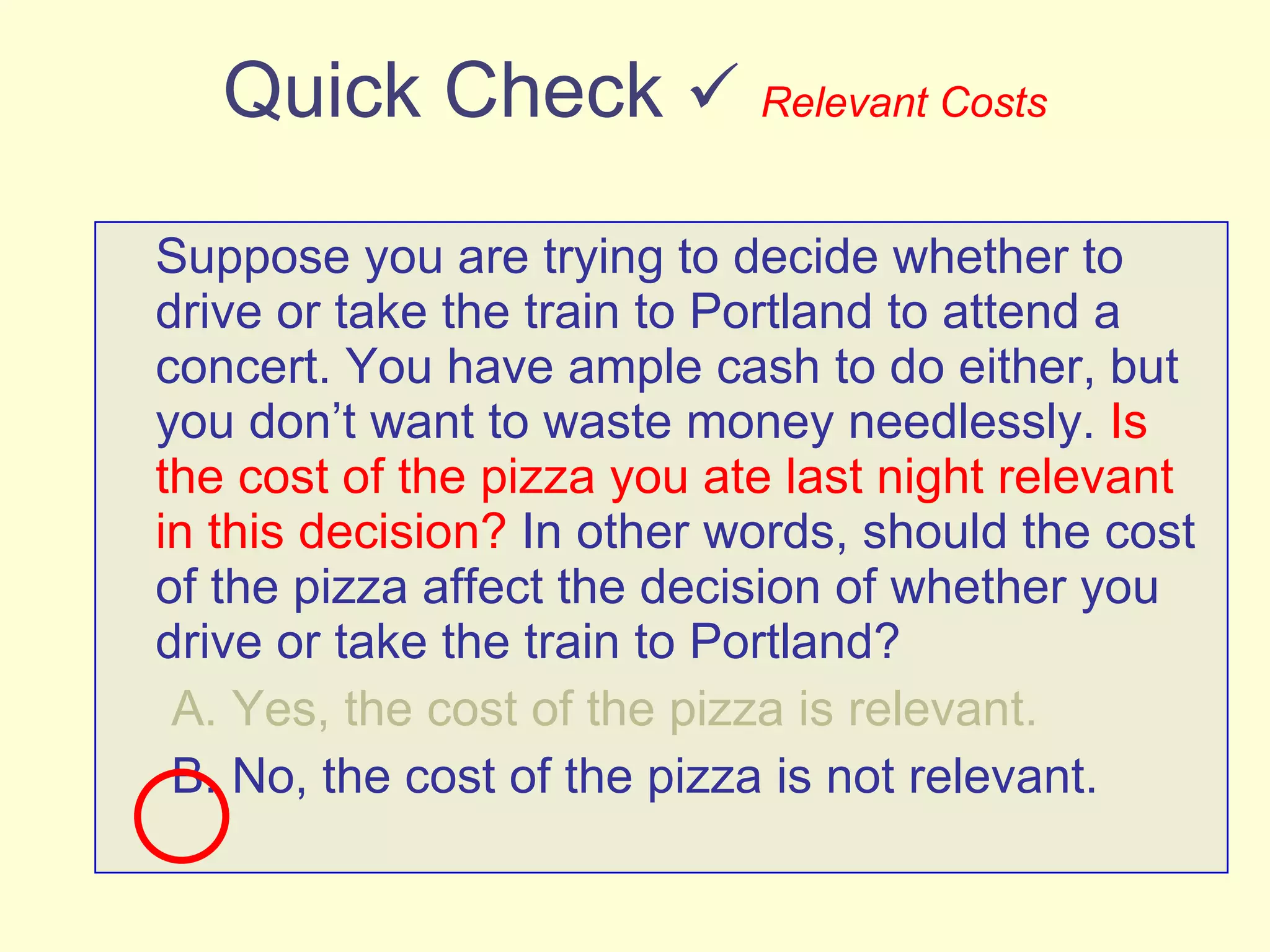

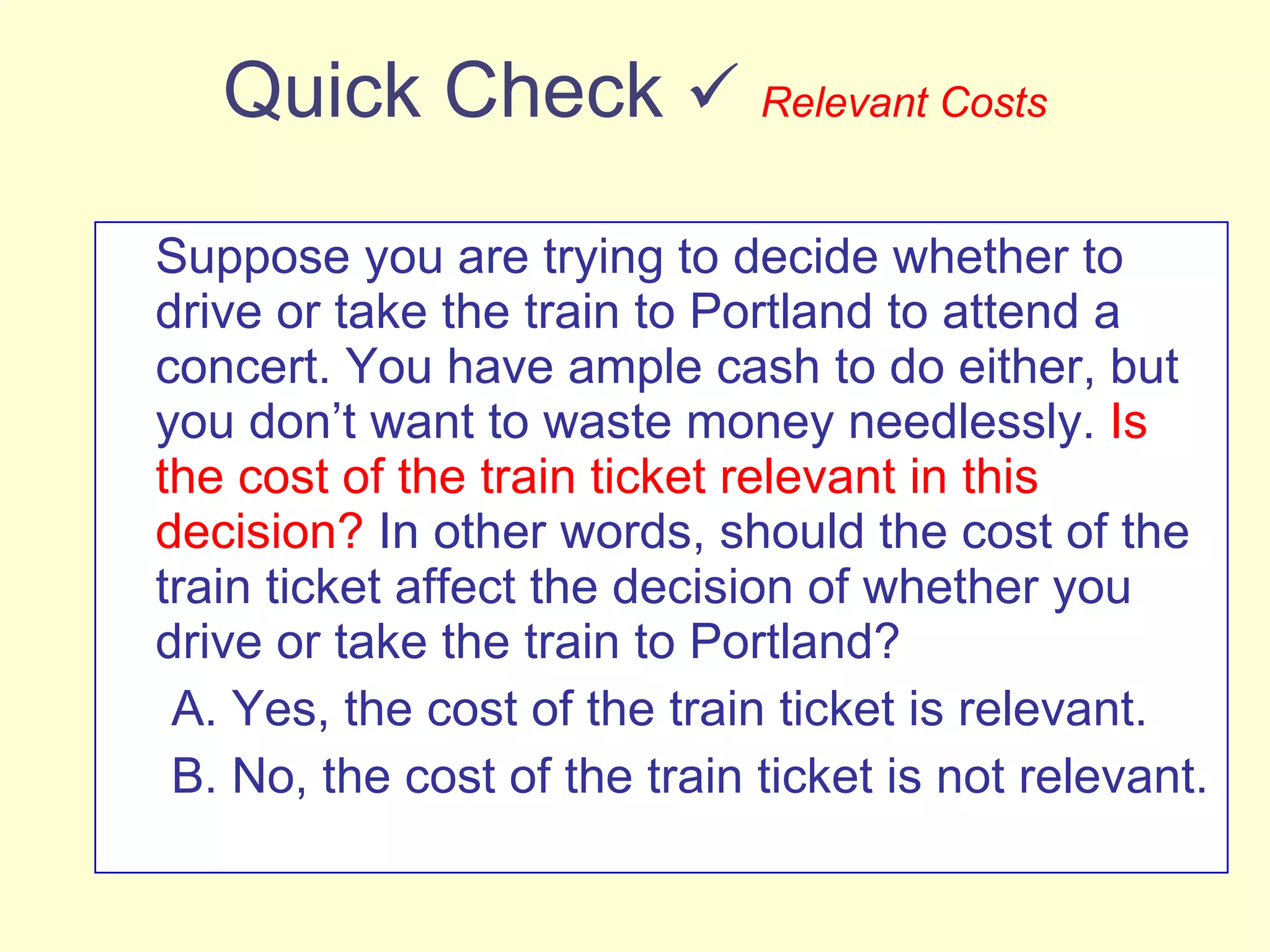

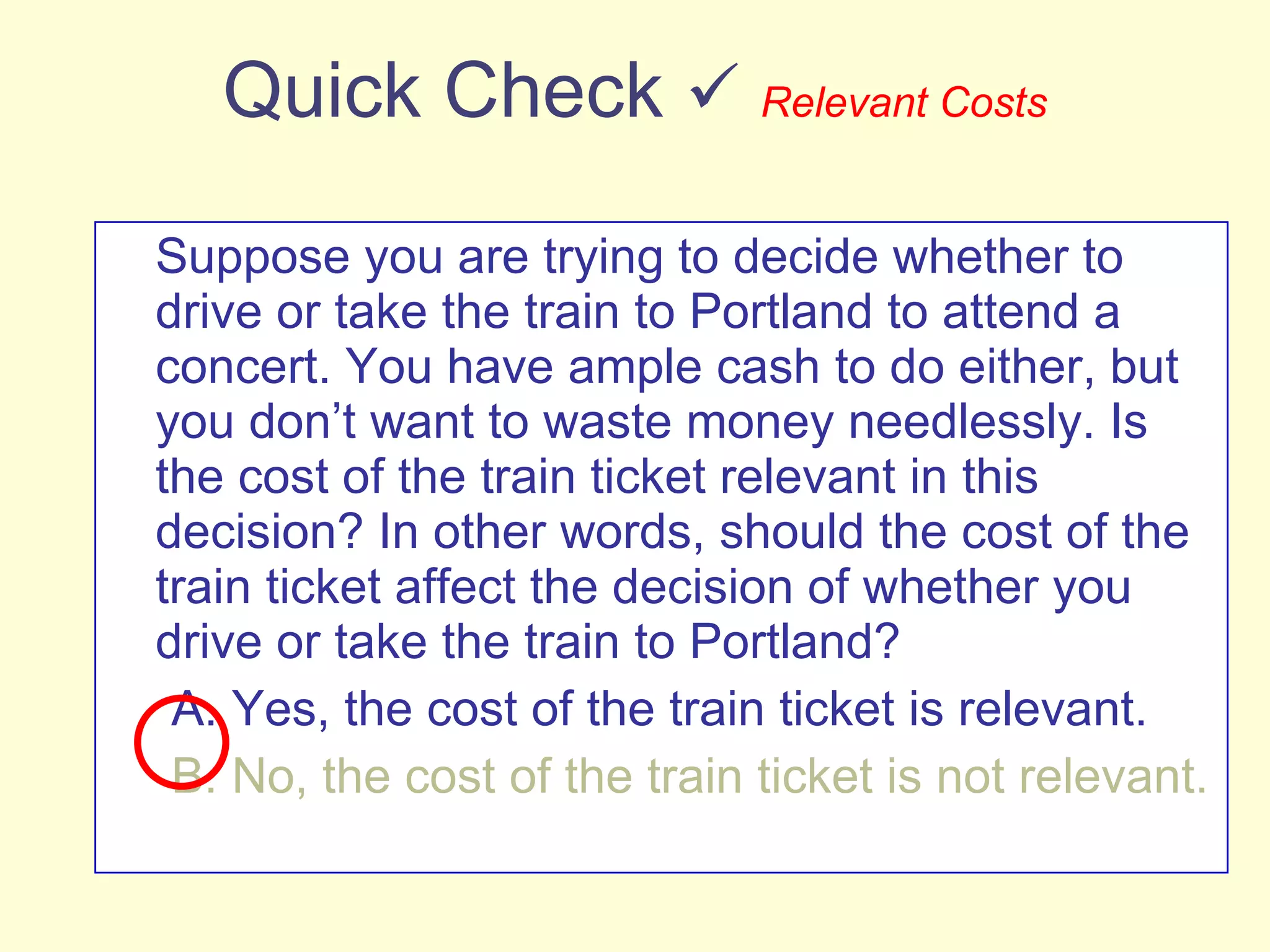

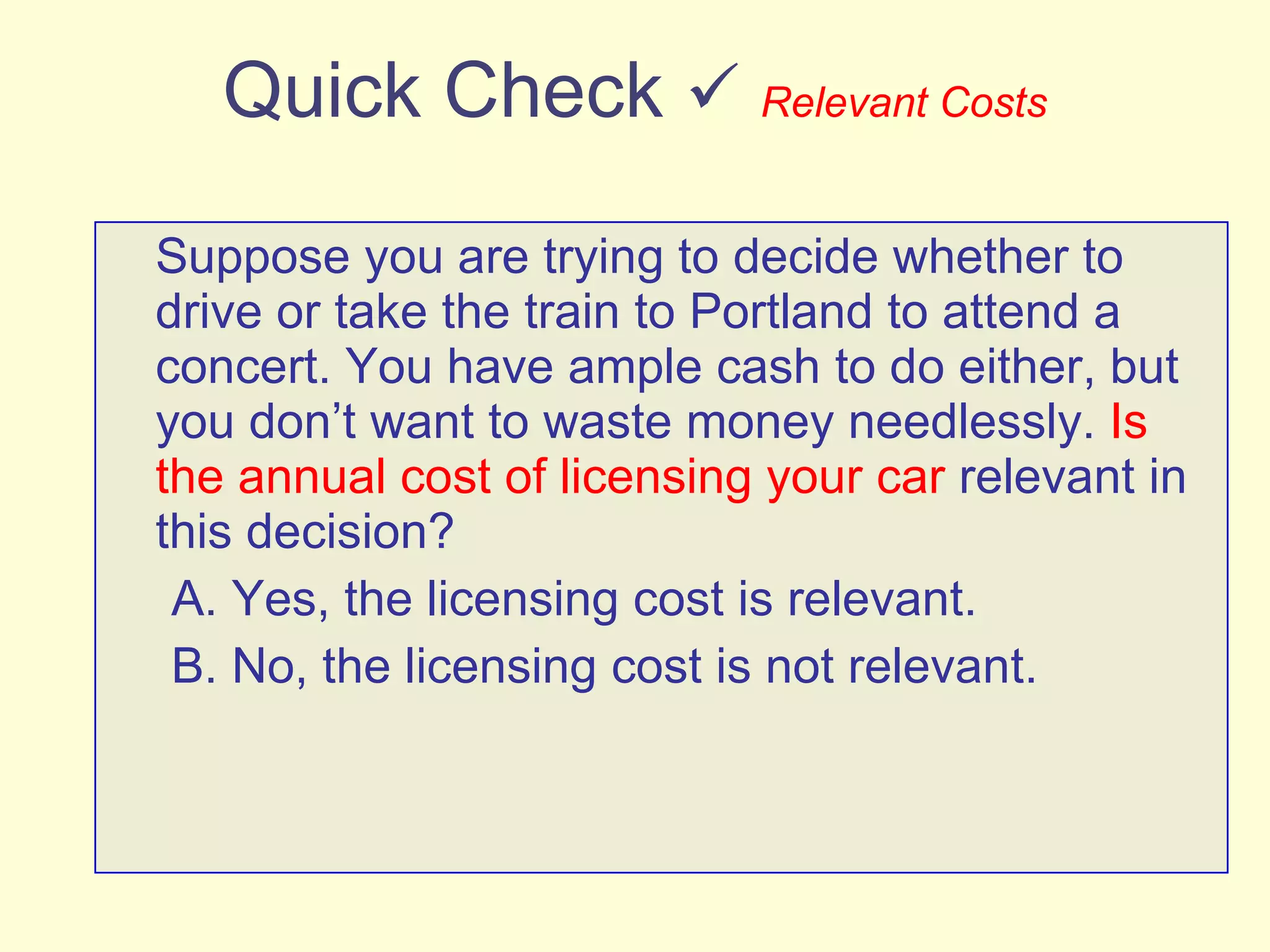

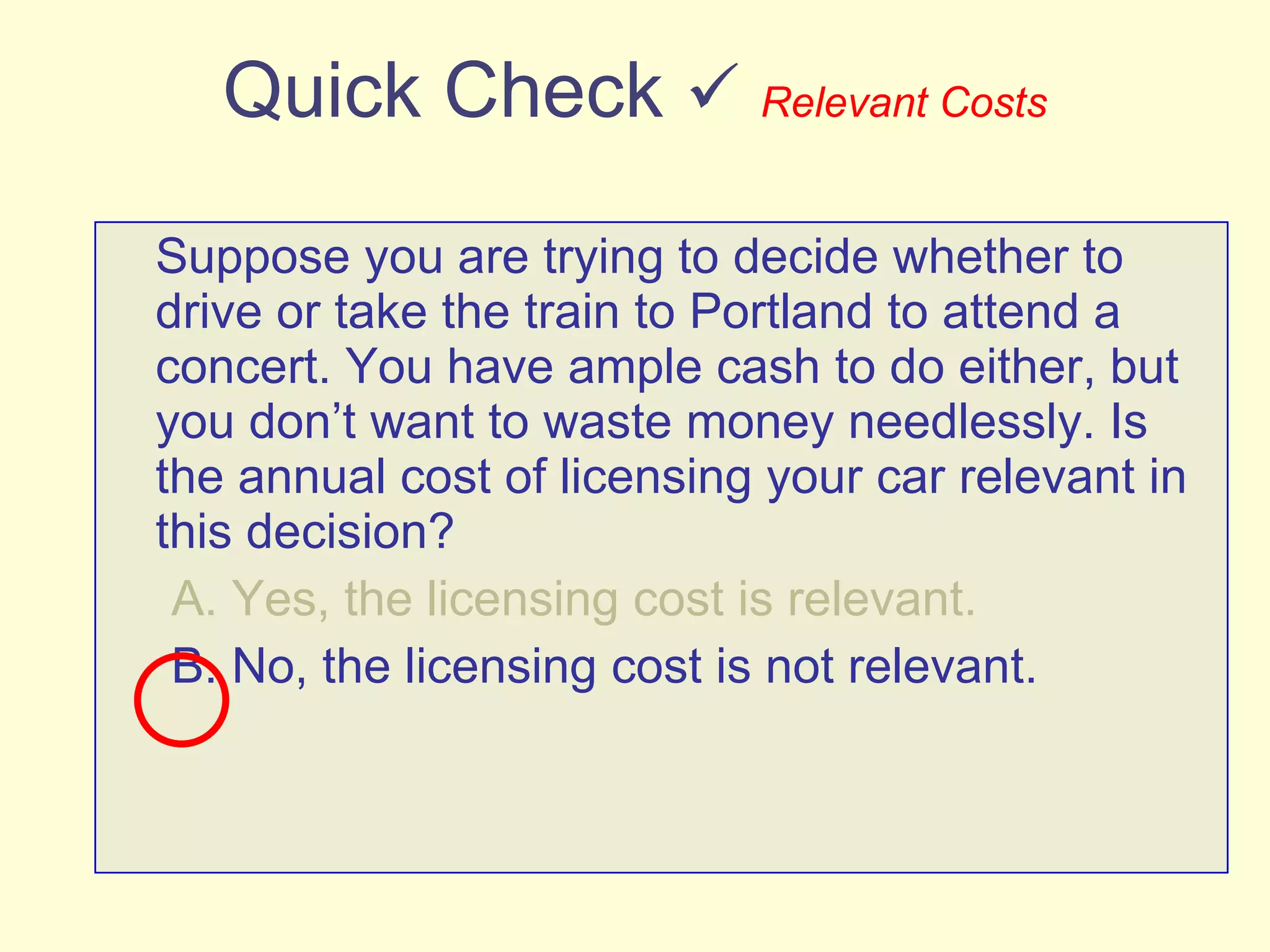

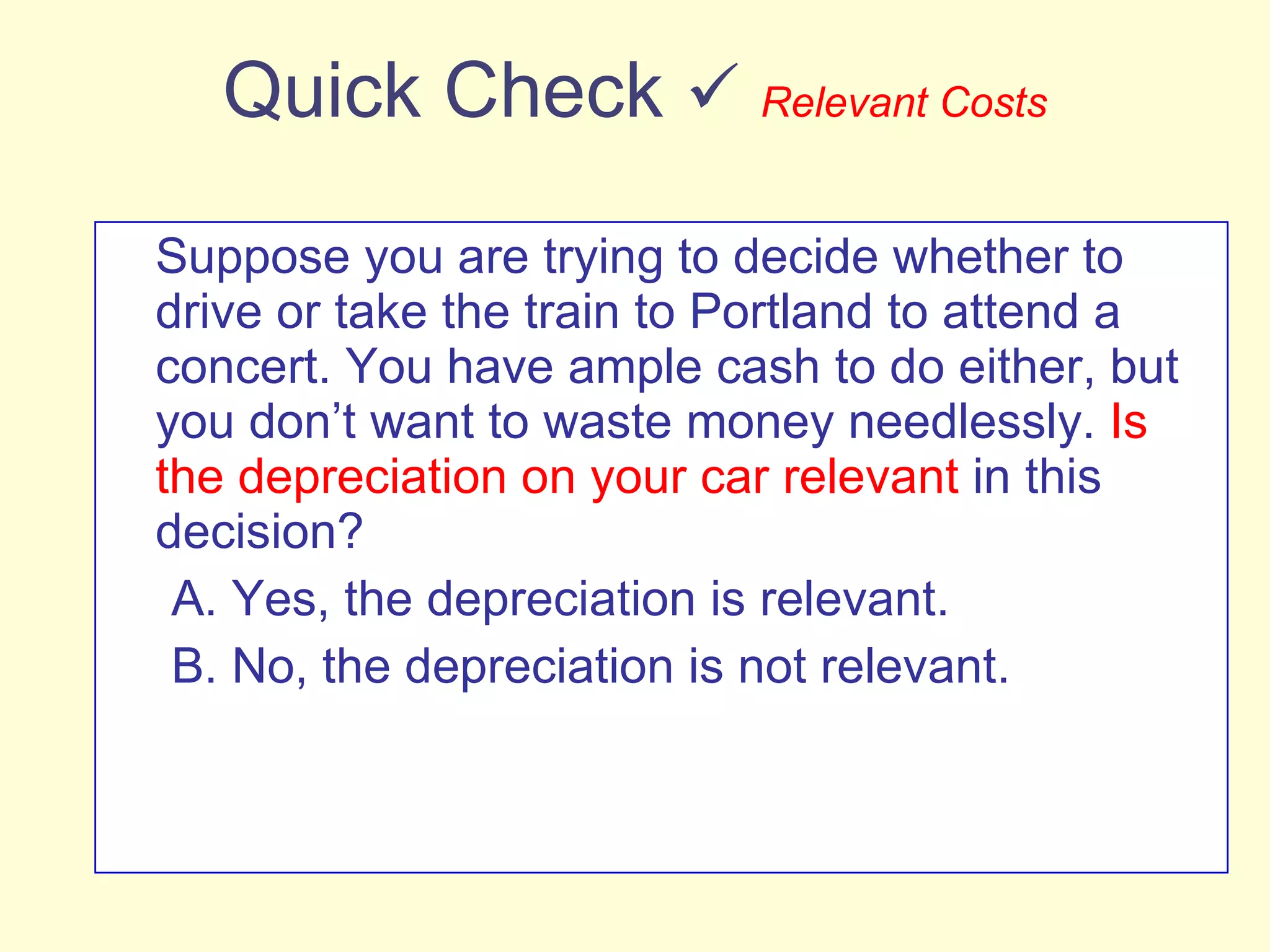

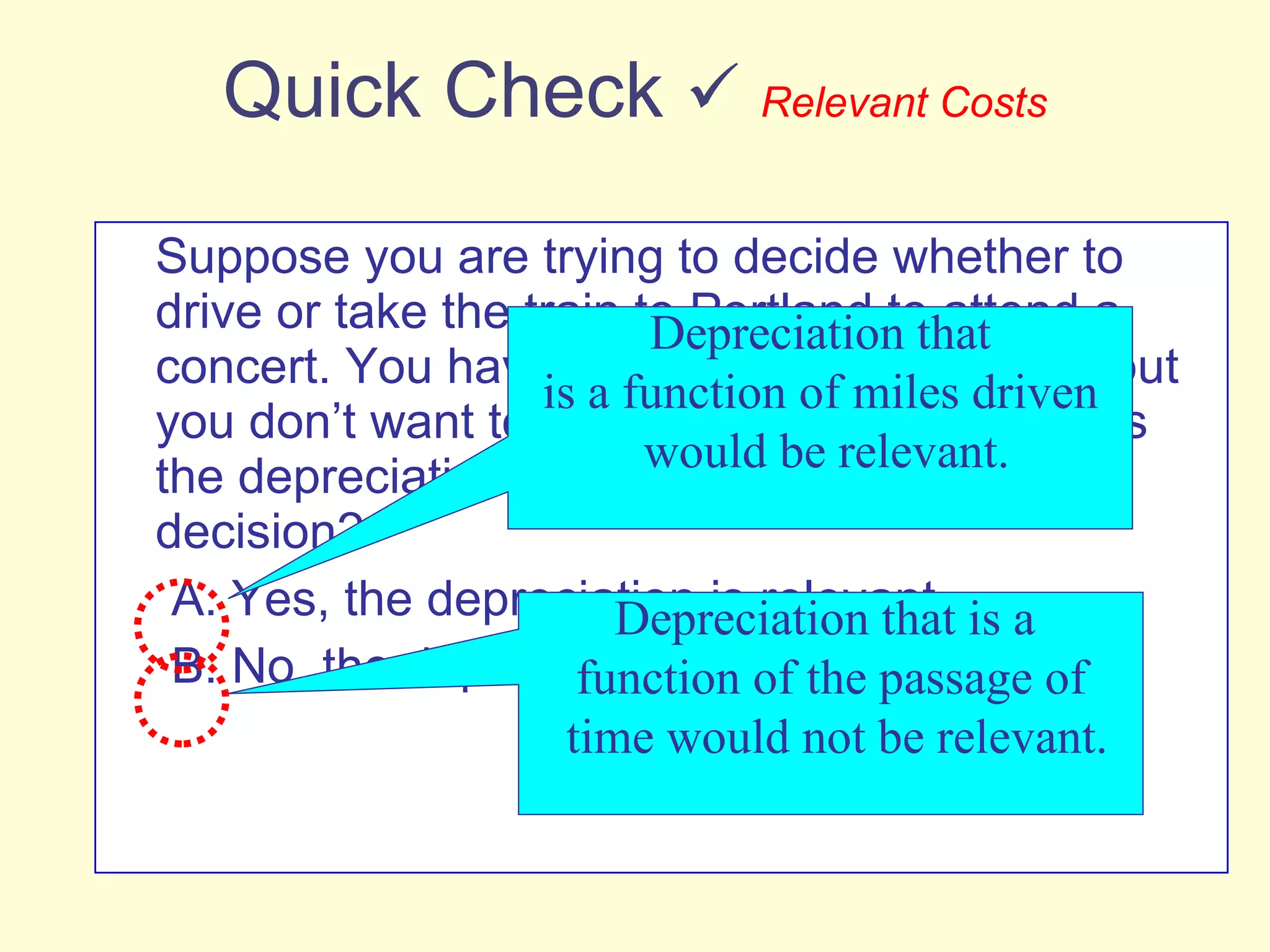

This document discusses various ways to classify costs, including by nature, function, traceability, behavior, and relevance to decision making. It defines different types of costs such as direct and indirect materials, direct and indirect labor, variable and fixed costs, and relevant versus irrelevant costs. It provides examples to illustrate concepts like direct versus indirect costs, variable versus fixed costs, and relevant versus irrelevant costs in decision making.