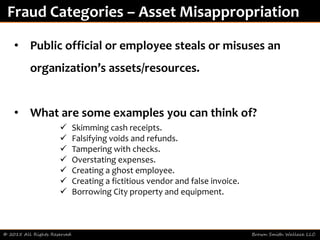

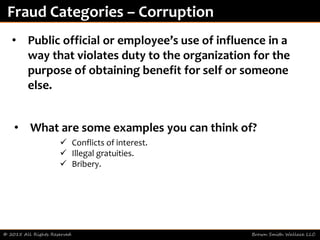

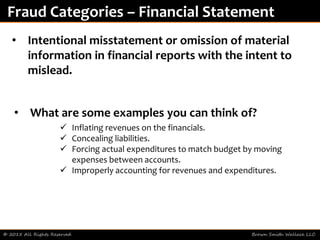

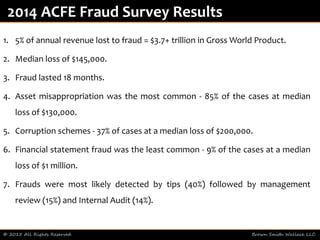

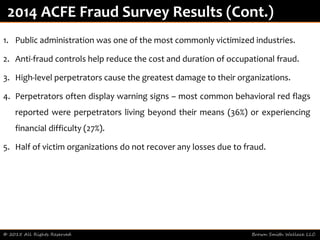

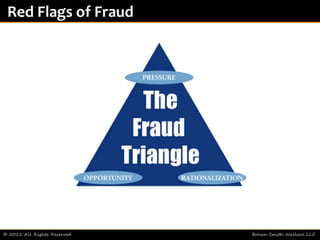

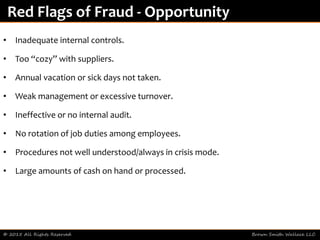

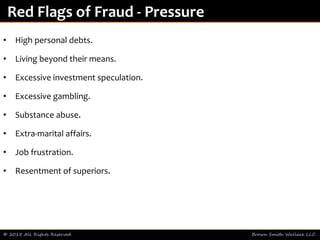

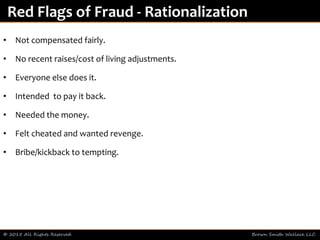

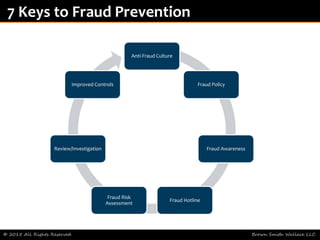

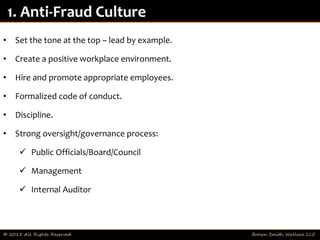

The document provides an overview of a presentation on fraud prevention for public sector organizations. It includes definitions of occupational fraud and common fraud categories. It summarizes results from a fraud survey regarding typical fraud schemes, detection methods, and costs. The presentation identifies red flags for fraud opportunity, pressure, and rationalization. It outlines seven keys to fraud prevention: developing an anti-fraud culture, implementing a fraud policy and training, enabling fraud reporting, conducting risk assessments, reviewing reported fraud concerns, improving controls, and performing self-assessments. Attendees are guided through interactive discussions on these topics.