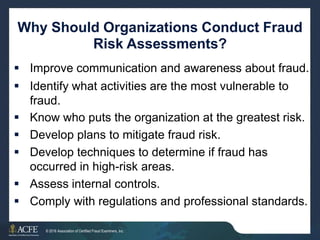

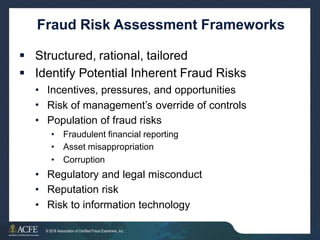

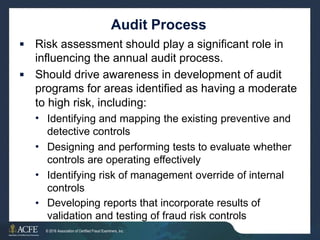

This document discusses fraud risk assessment and management. It defines fraud risk as the vulnerability an organization faces from individuals who can exploit the fraud triangle of opportunity, pressure/incentive, and rationalization. Fraud risks can come from internal and external sources. Factors influencing fraud risk include the nature of the business, operating environment, effectiveness of controls, and ethics of employees. A fraud risk assessment identifies vulnerabilities by analyzing these factors. Benefits of assessments include improved awareness, control evaluation, and regulatory compliance. Key aspects of effective assessments include collaboration, independence, and access to all organizational levels. Ongoing fraud risk management involves prevention, detection, and response policies and procedures to balance fraud deterrence with costs. Responsibilities are distributed