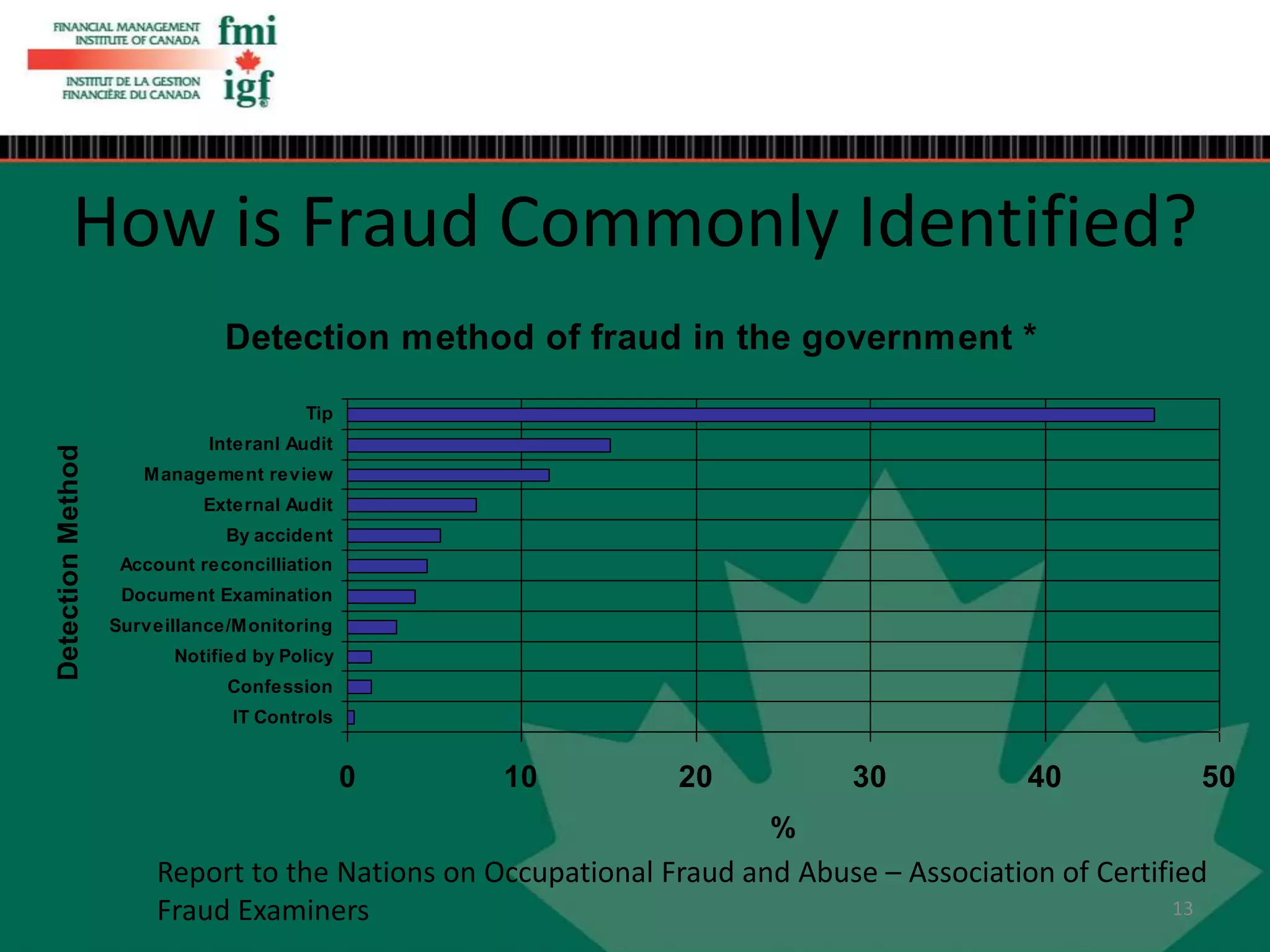

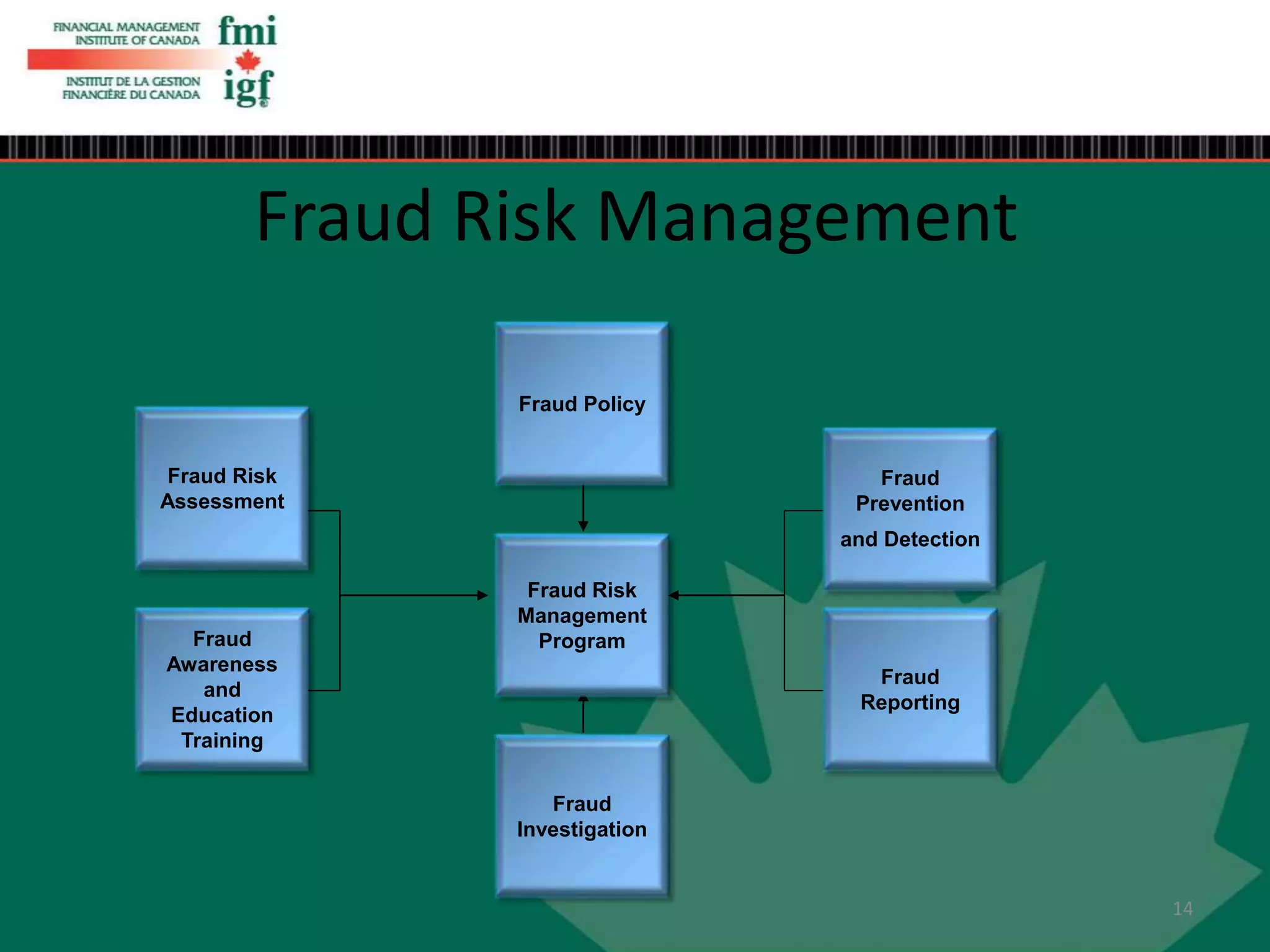

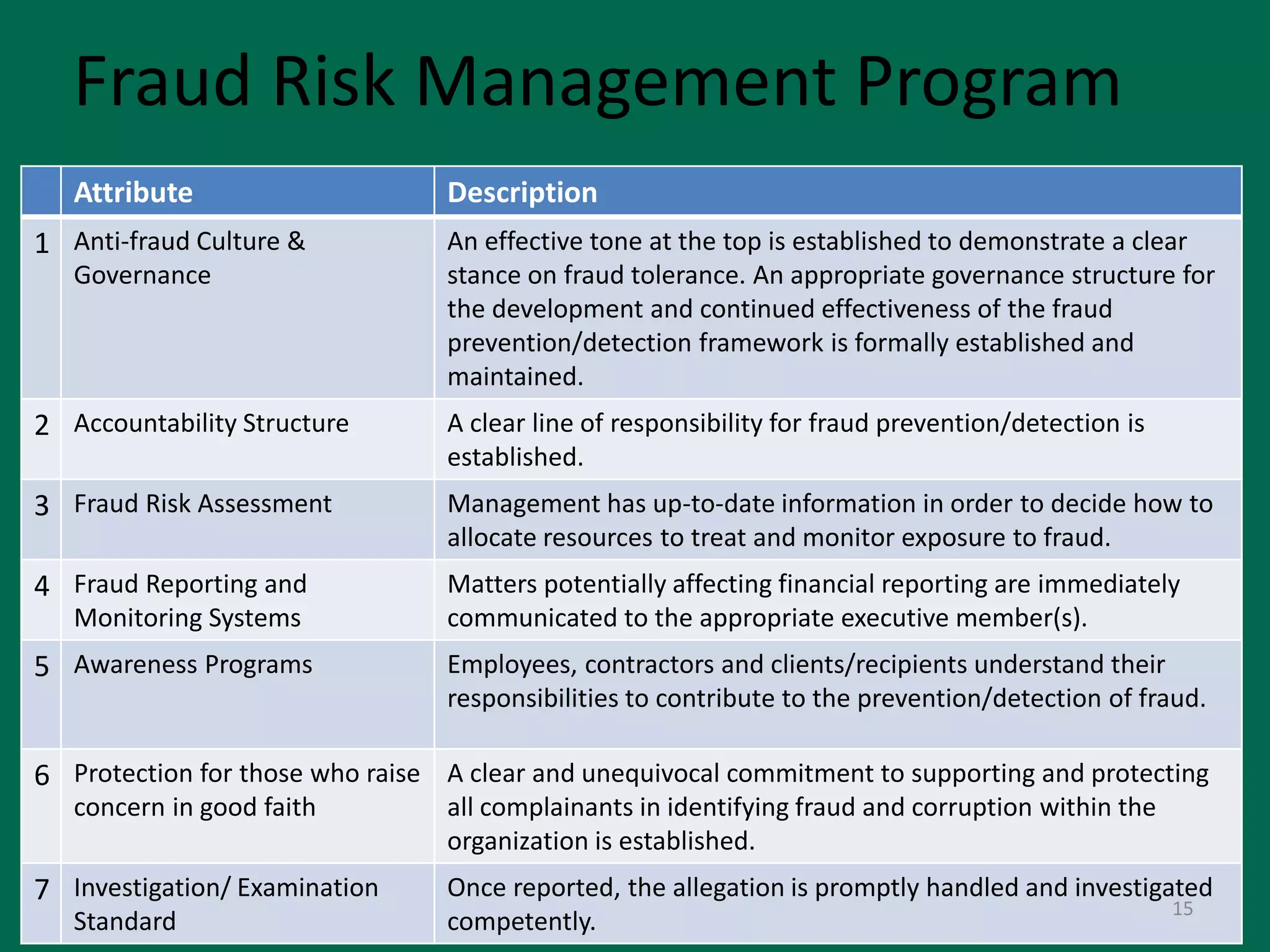

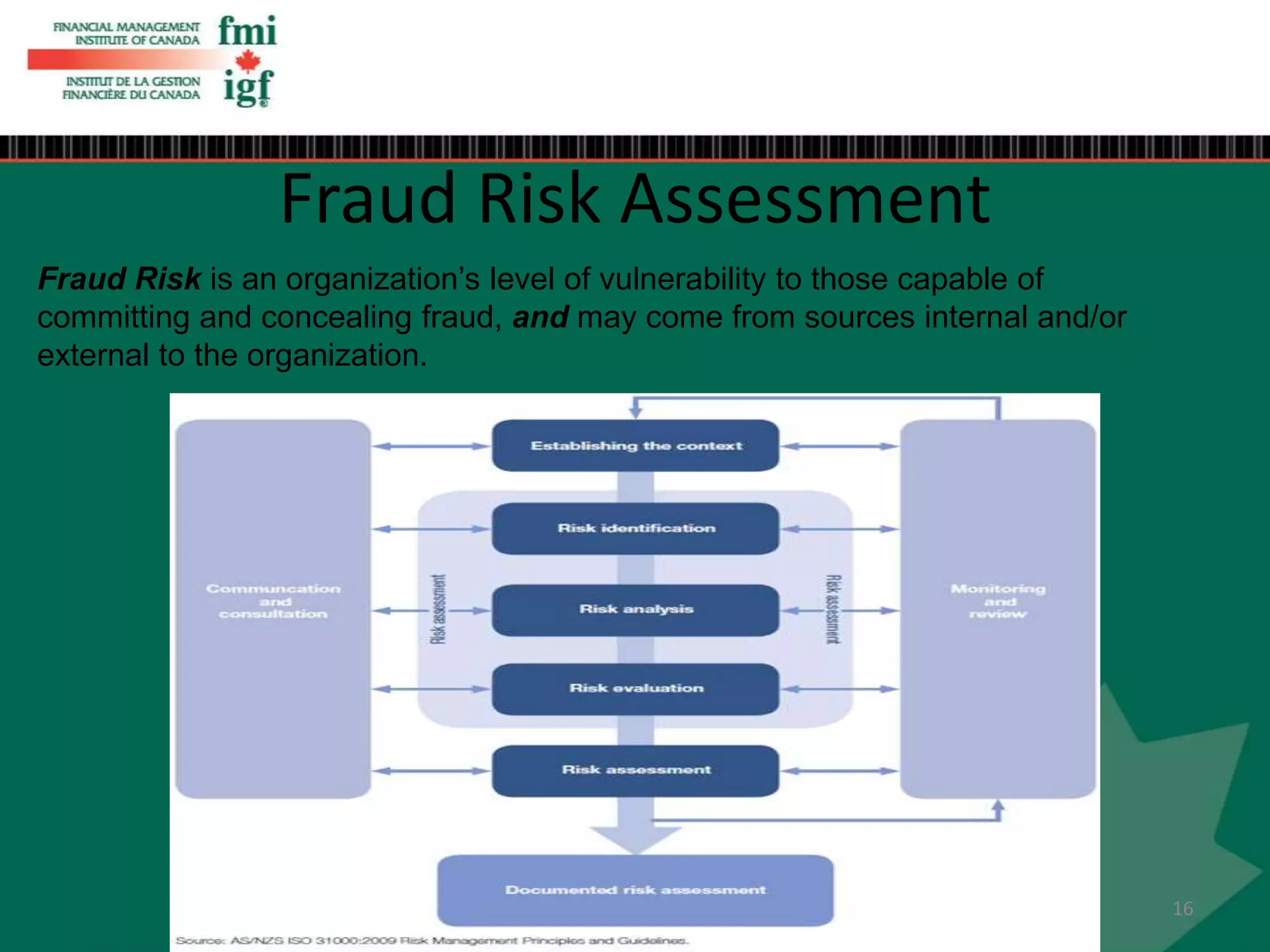

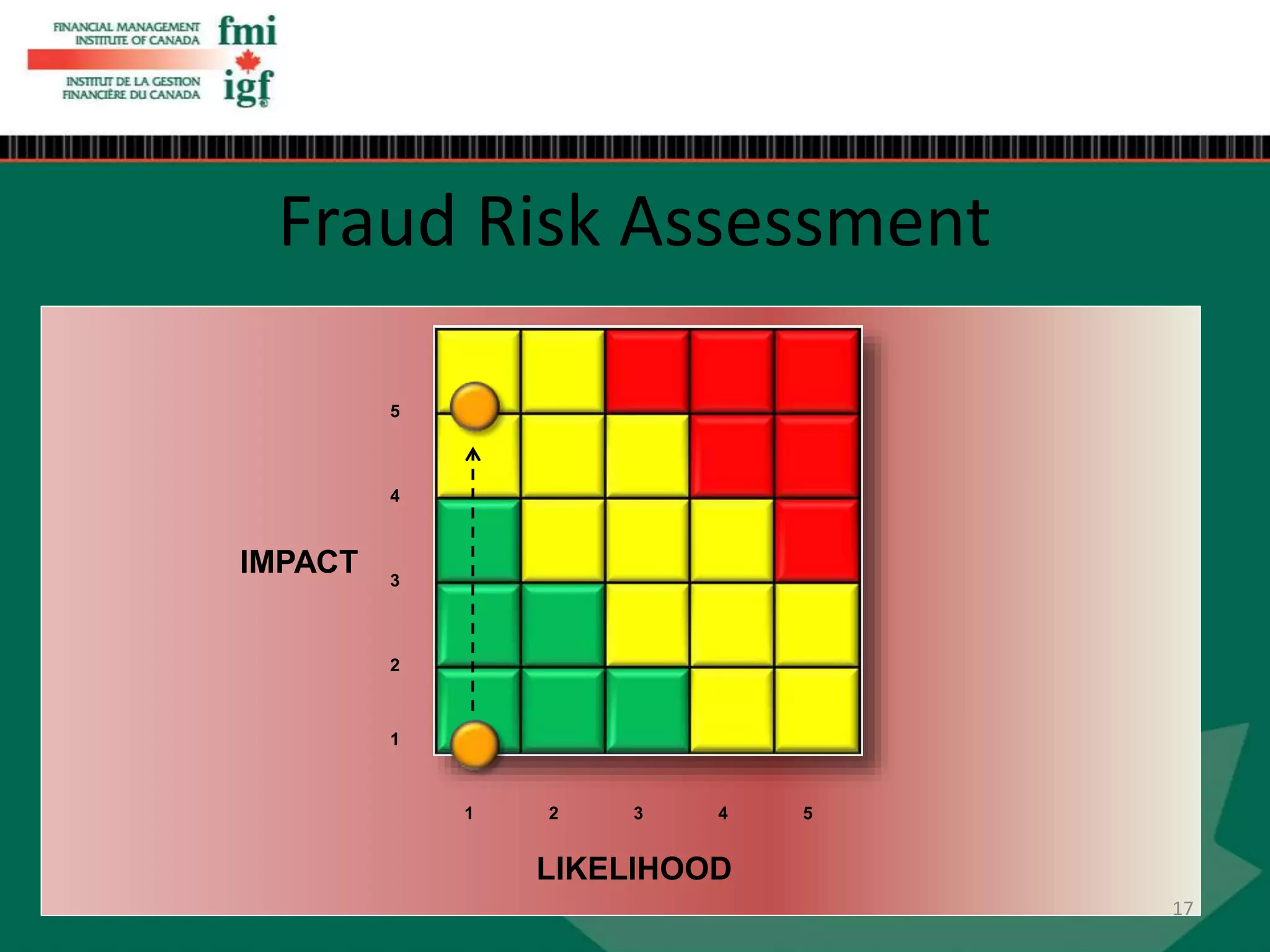

This document summarizes a webinar on fraud in the public sector. The webinar discusses the definition of fraud, sectors and industries most commonly impacted by fraud, who typically commits fraud, and reasons why fraud occurs. Specific examples of potential public sector fraud in Canada are provided. The webinar also outlines steps that can be taken to reduce fraud risk, such as establishing clear roles and responsibilities, implementing appropriate prevention and detection controls, and regularly communicating fraud management results. Common fraud detection methods and key elements of an effective fraud risk management program are also summarized.