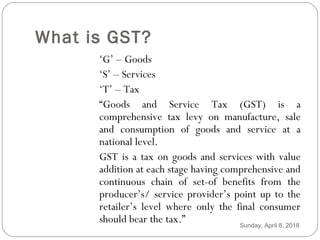

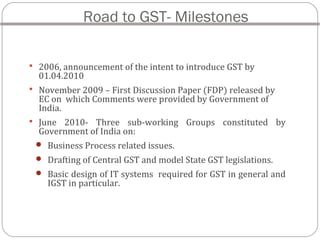

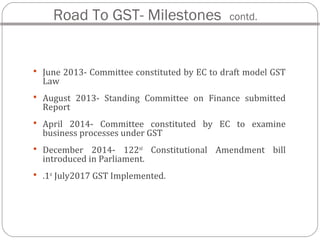

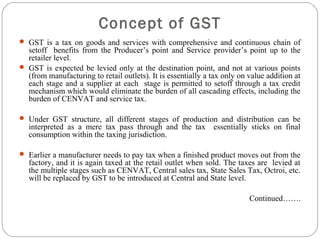

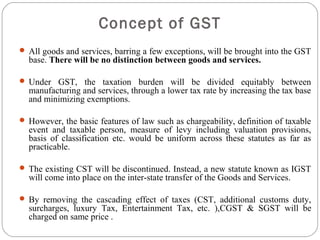

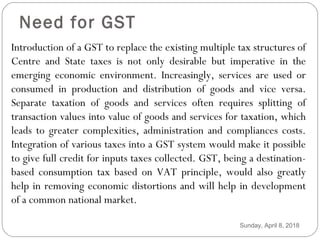

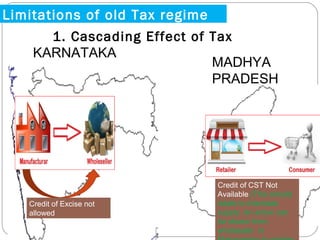

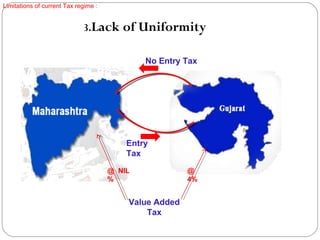

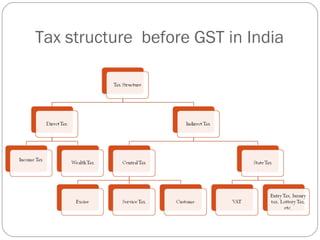

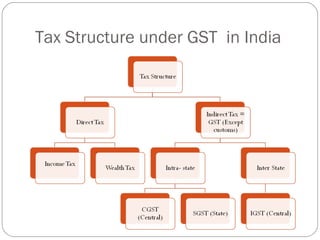

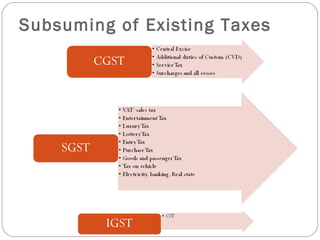

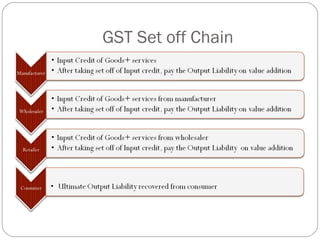

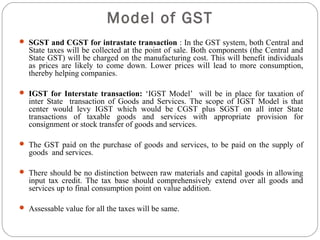

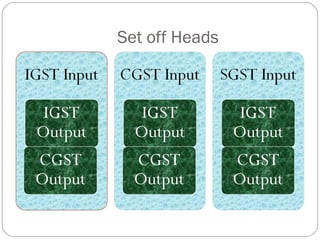

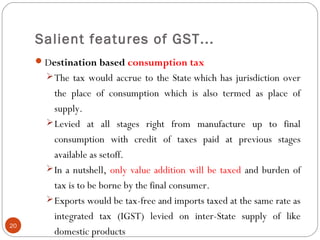

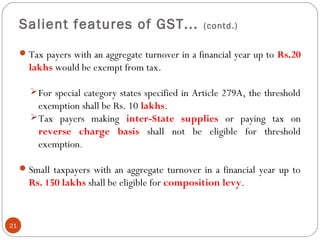

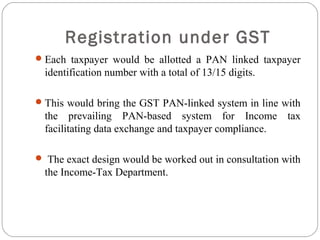

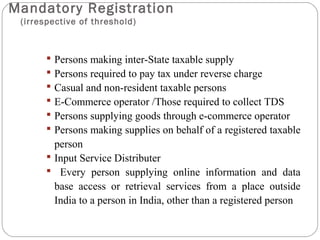

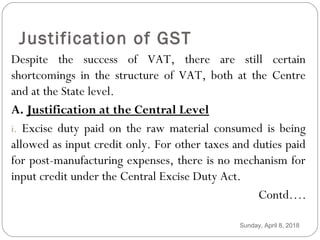

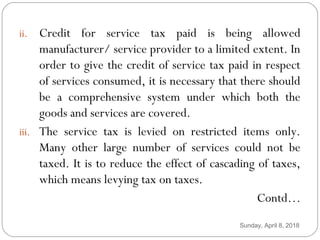

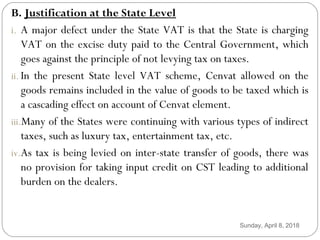

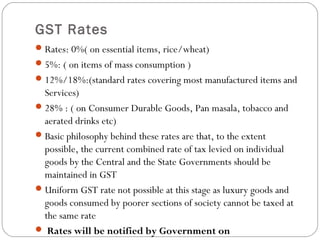

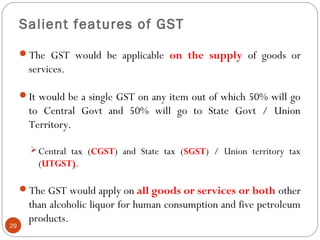

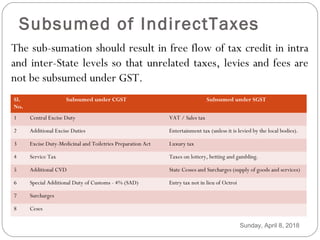

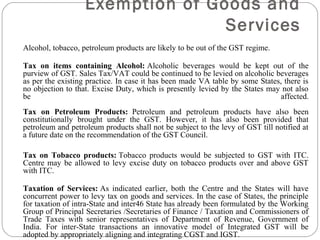

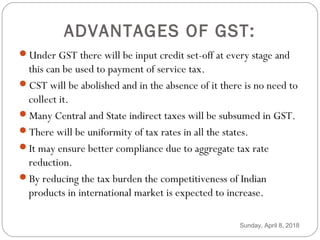

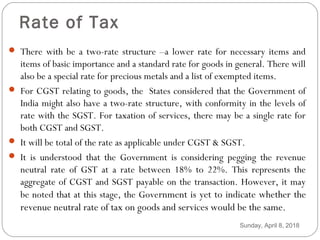

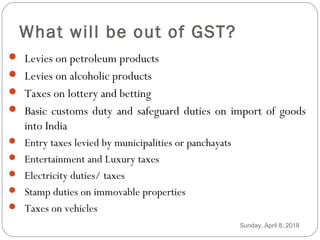

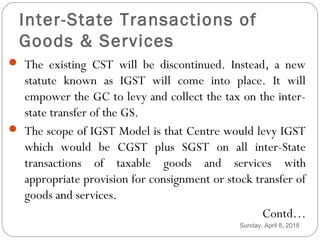

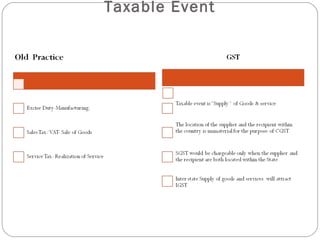

The document provides a comprehensive overview of the Goods and Services Tax (GST) in India, detailing its introduction, structure, and implications for the economy. It highlights the need for GST to simplify the existing tax regime, facilitate seamless input tax credits, and promote a unified market by subsuming various indirect taxes. Key features include a dual GST model, the implementation of a tax only on value addition, and specifics regarding exemptions and tax rates.