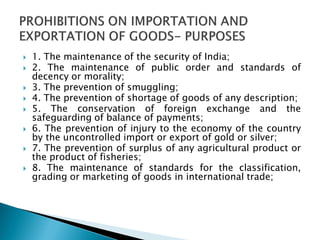

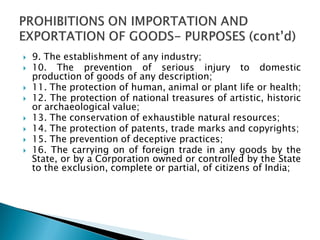

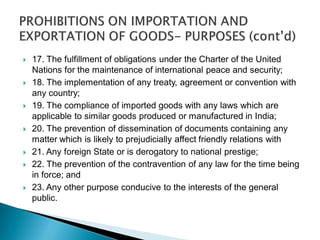

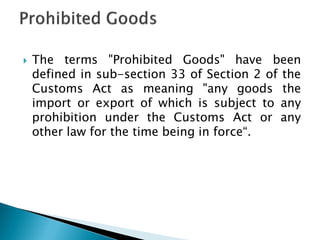

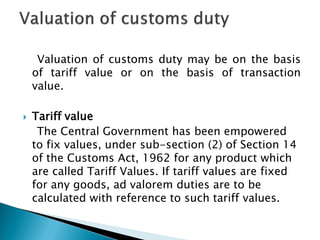

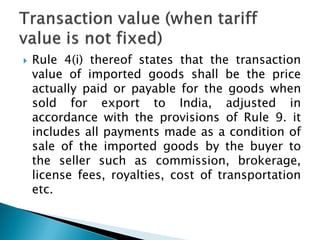

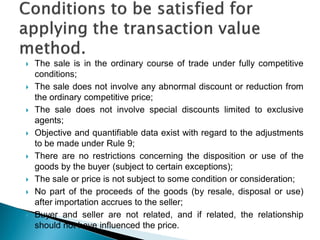

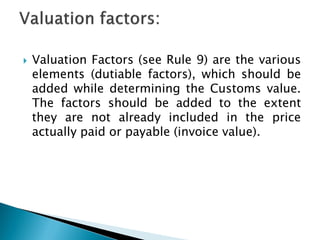

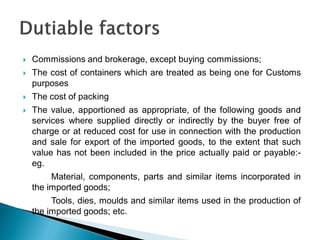

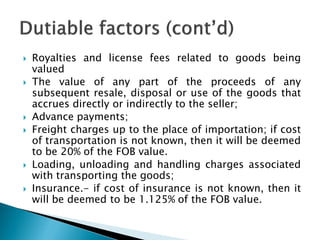

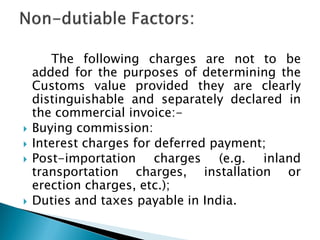

The document discusses customs duty in India. It defines customs duty and explains that duties are levied on imported and exported goods. The levy and rates are governed by the Customs Act of 1962 and Customs Tariff Act of 1975. Customs duty is intended to raise government revenue and protect domestic industries. Under GST, IGST is charged on imported goods based on value slabs. The document outlines various cases for determining the timing of duty based on if goods are cleared for home consumption or warehousing. It also discusses export duty timing and valuation methods for customs including transaction value, identical/similar goods, deductive value, computed value, and residual method.

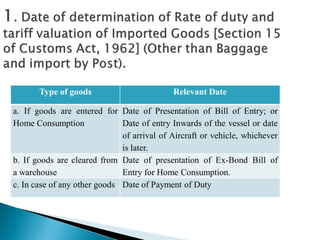

![1. Date of determination of Rate of duty and

tariff valuation of exported Goods [Section 15

of Customs Act, 1962] (Other than Baggage

and export by Post).

Type of goods Relevant Date

a. If goods are entered

for Export:

Date on which the Proper

Officer makes an order

permitting clearance and

loading of the goods under that

section.

b. In case of any other

goods

Date of Payment of Duty](https://image.slidesharecdn.com/customsduty-200420154121/85/Customs-duty-9-320.jpg)