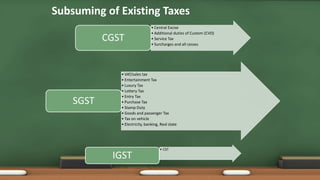

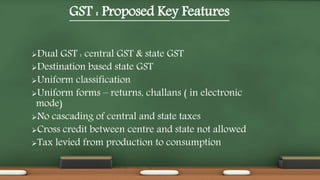

1. GST is an indirect tax that will combine multiple taxes into a single tax. It will have a dual structure with both central GST and state GST.

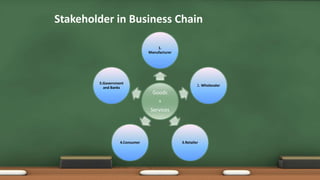

2. Under GST, tax will be collected at each point of sale with businesses able to claim credits for taxes paid on purchases. This will help reduce cascading of taxes and boost economic growth.

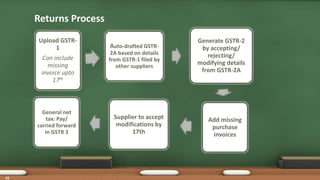

3. Compliance under GST will be primarily online with businesses required to file regular returns. Proper documentation of invoices and maintaining of records is important under GST.

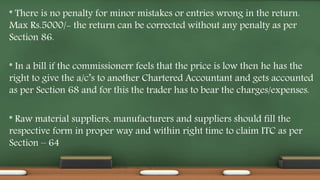

![•Returns under GST

RETURN

FORM

PARTICULARS DUE DATE APPLICABLE FOR

GSTR1 Outward Supplies 10th of the next month Normal/ Regular Taxpayer

GSTR2 Inward Supplies 15th of the next month Normal/ Regular Taxpayer

GSTR3 Monthly return [periodic] 20th of the next month Normal/ Regular Taxpayer

GSTR4 Return by compounding tax payers 18th of the month next to the quarter Compounding Taxpayer

GSTR5

Return by non resident tax payers

[foreigners]

a) 20 days after the end of a tax period

or

b) within 7 days after expiry of

registration

whichever is earlier.

Foreign Non-Resident Taxpayer

GSTR6 Return by input service distributors 13th of the next month Input Service Distributor

GSTR7 TDS return 10th of the next month Tax Deductor

GSTR8 Annual return 31st December next FY

Normal/ Regular Taxpayer,

Compounding Taxpayer

Ledgers ITC ledger, cash ledger, tax ledger On a continuous basis

9](https://image.slidesharecdn.com/gstanoverview-170704182032/85/Gst-an-overview-9-320.jpg)

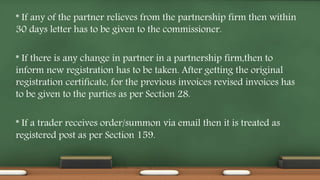

![* No Second sales i.e., Tax on every sale

* Return should be filed online only

* Within state – Rs.20L exempted.

* Return should be filed 3 times a month. [10th, 15th & 20th

respectively]

* Aggregated turnover = Taxable goods + Exempted goods +

Zero rated goods + Export goods

* i) SGST – State Goods and Services Tax

ii) CGST – Central Goods and Services Tax

iii) IGST – Integrated Goods and Service Tax [ SGST + CGST ]

automated mechanism to monitor the “Inter state

sales & supply of goods and services.](https://image.slidesharecdn.com/gstanoverview-170704182032/85/Gst-an-overview-26-320.jpg)

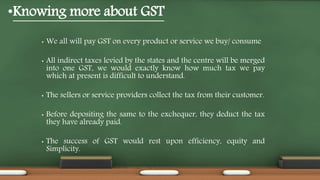

![* The person who purchases or sells taxable goods should file

his return duely/within the due date. Otherwise ITC cant be

claimed & the other party will also get affected.

* Tax rate should be mentioned separately in invoice. Invoices

should not contain words like Inclusive of tax etc., [While

calculating tax freight charges and packing charges need not

be included]

* 3 copies of invoices are to be maintained i.e., buyer,

transporter & seller.](https://image.slidesharecdn.com/gstanoverview-170704182032/85/Gst-an-overview-27-320.jpg)

![- People who buys & sells are eligible i.e., Manufacturers are not eligible.

- Traders under Composite Scheme can file quarterly.[ 3 months once ]

- Composite traders cannot make sell/ purchase outside the state.

- Traders under this scheme can trade only taxable goods. Restricted to

trade non taxable/ exempted goods.

- Taxable goods which are announced by GST Council.

- If they trade non taxable/ exempted goods & the cost of a product

exceedsRs.100/- as per Sec.28 (3b) in addition to invoice another bill has to be

produced.](https://image.slidesharecdn.com/gstanoverview-170704182032/85/Gst-an-overview-29-320.jpg)

![* GST tax payer can claim ITC from the transporter invoice [ While

delivering goods the transporter makes payment for the transport for

that ITC can be claimed ]

* In a month only Rs.10000/- can be paid as tax by cash, cheque or

DD. If the tax amount exceeds then internet banking, credit card,

debit card, RTGS & NEFT to be made. If payment madde by RTGS then

form along with the challan has to be given to bank for payment.](https://image.slidesharecdn.com/gstanoverview-170704182032/85/Gst-an-overview-33-320.jpg)