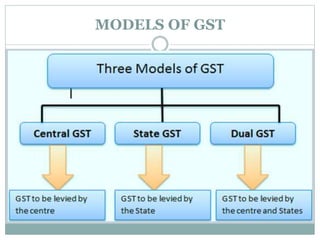

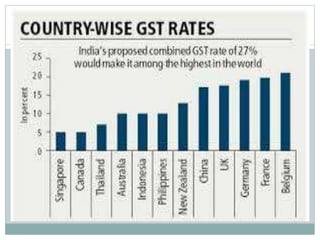

The document provides an overview of the Goods and Services Tax (GST) in India, detailing its history, objectives, advantages, and potential drawbacks. GST aims to streamline the indirect tax system by subsuming various taxes into a single tax to create a unified market across India. While it offers benefits like reduced compliance costs and increased competitiveness, challenges include potential revenue losses for states and increased compliance requirements for businesses.