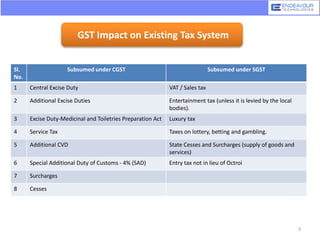

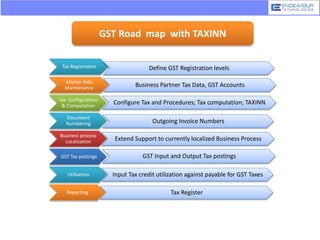

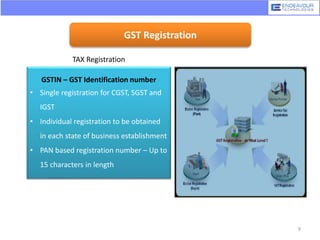

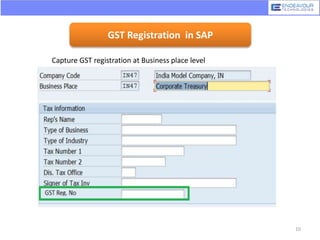

The document provides an overview of the proposed roadmap for implementing GST in SAP. It discusses key aspects like the GST components, impact on existing tax systems, prerequisites for implementation in SAP, the process for migrating from TAXINJ to TAXINN, required master data changes, tax configuration, business processes, reporting, and the role of GSTN and GSPs in the digital infrastructure. The implementation will require resources across various SAP modules and involve changes to taxation, billing, purchasing, and reporting processes.