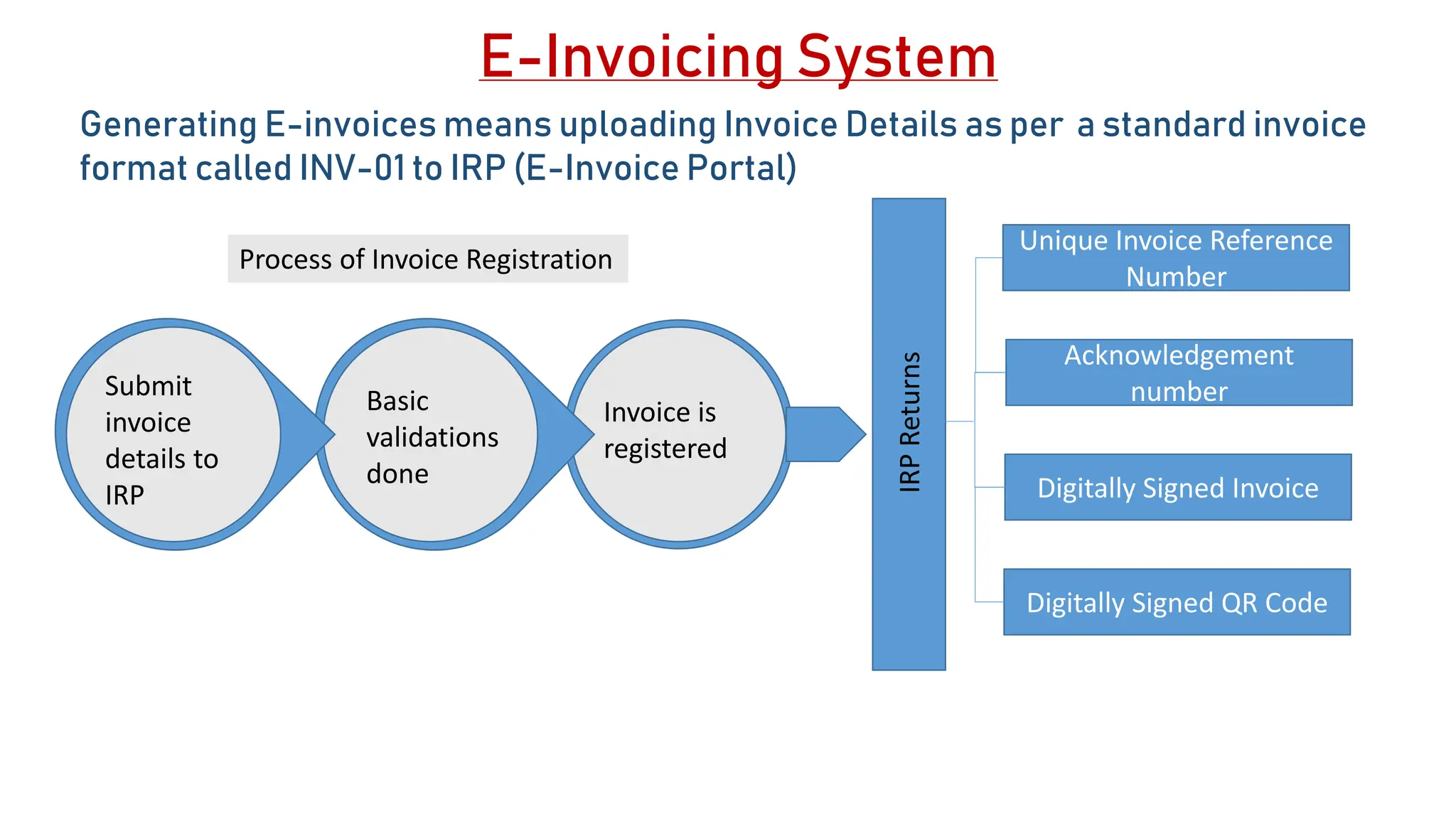

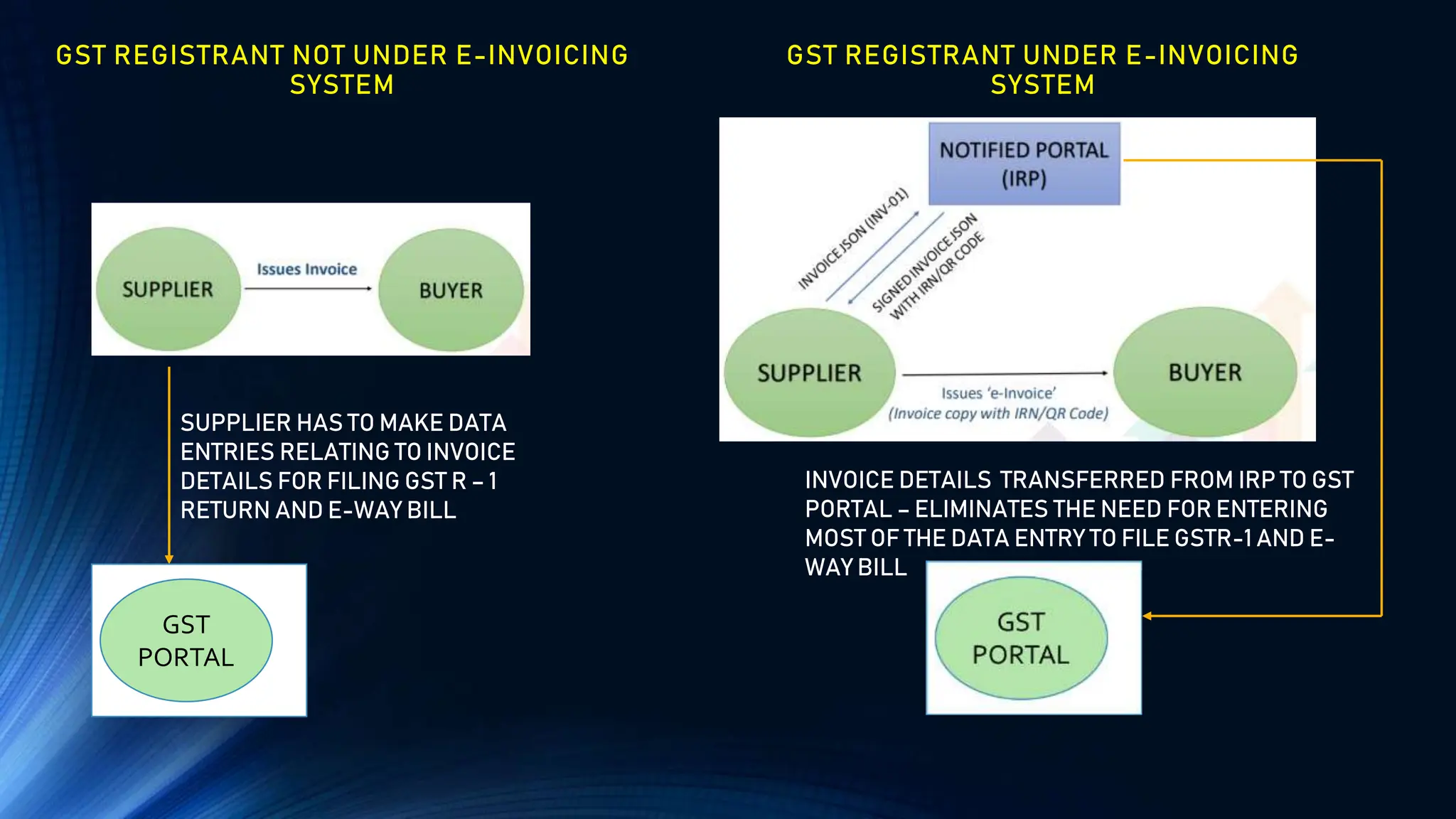

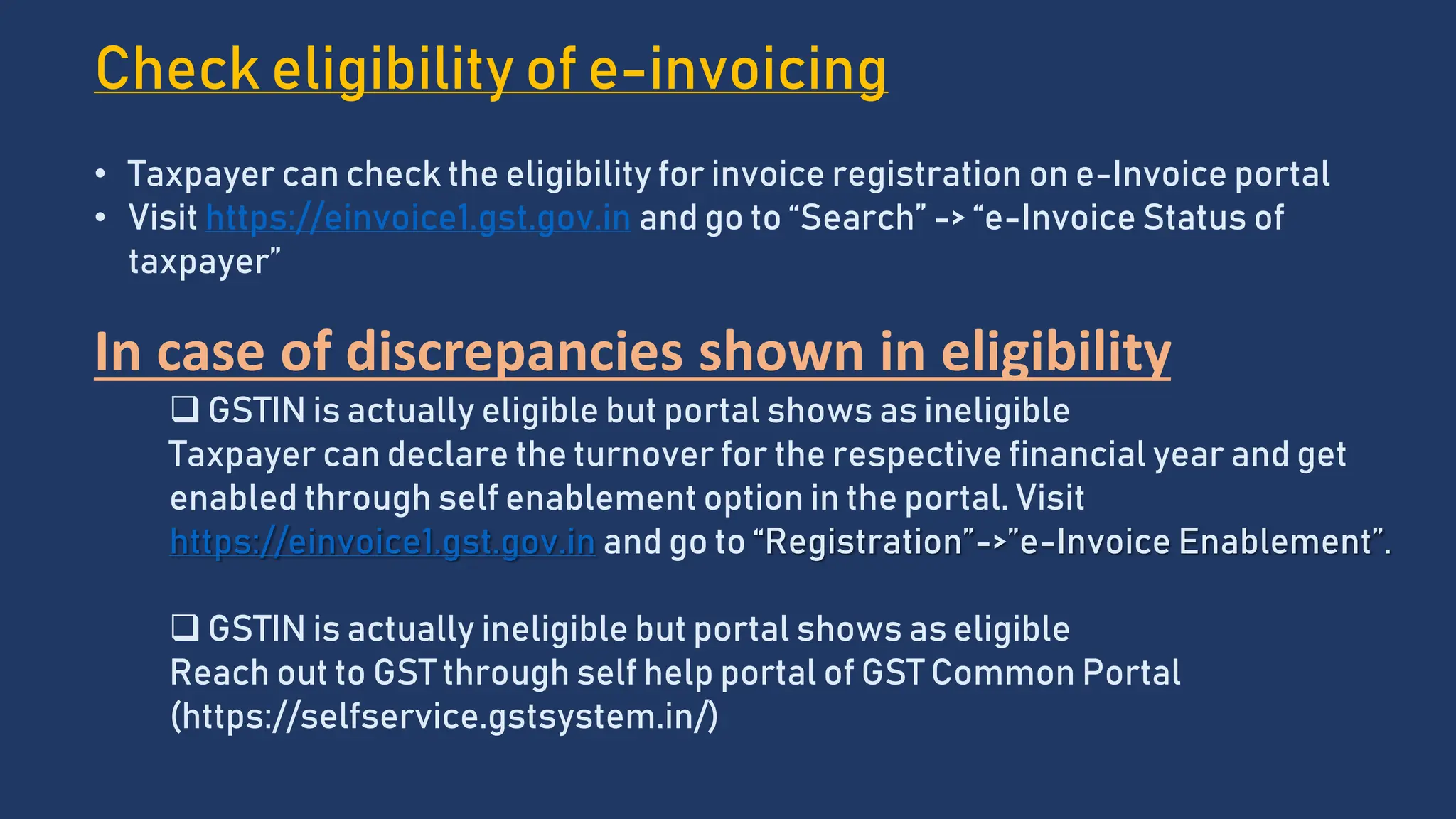

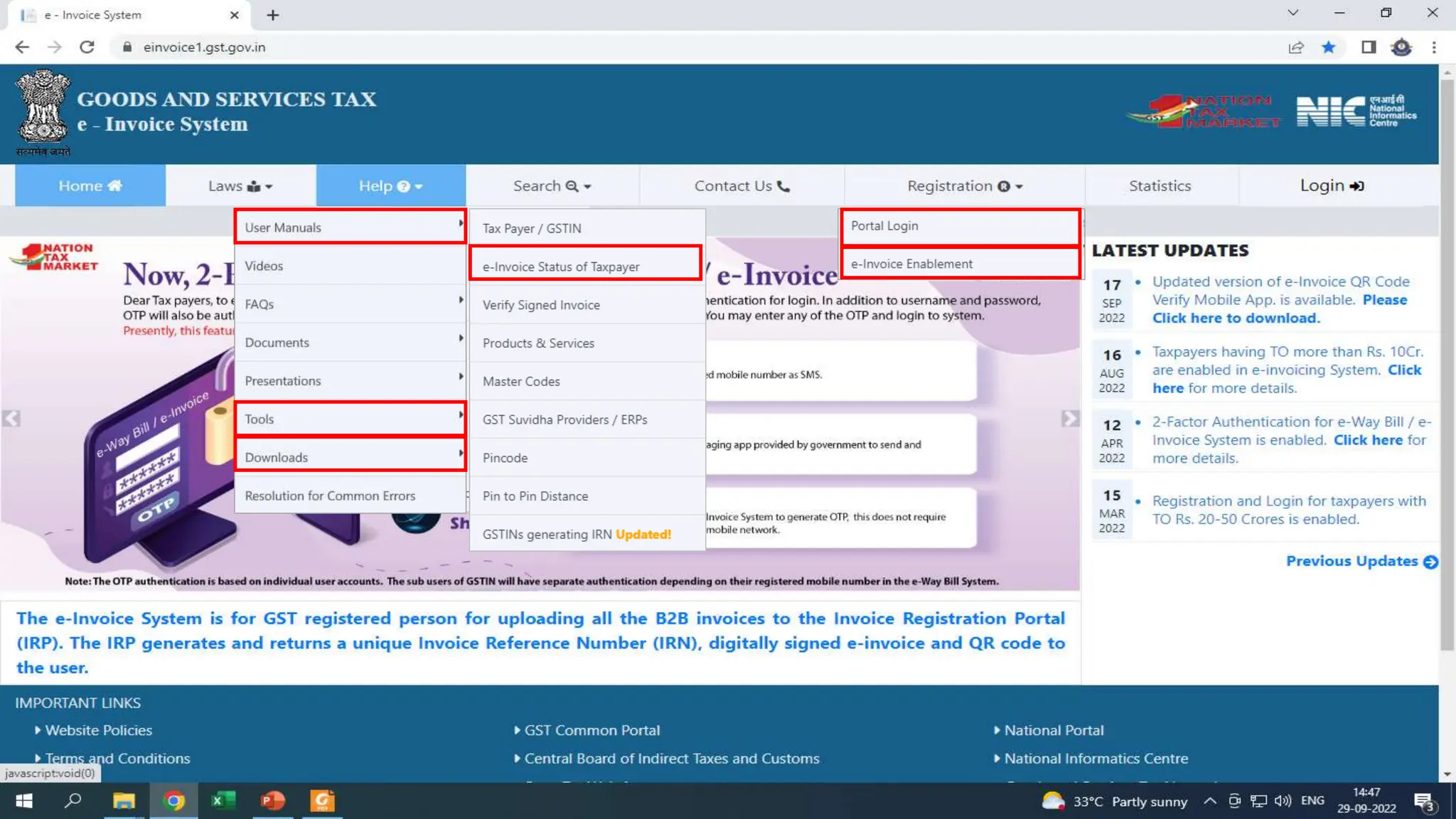

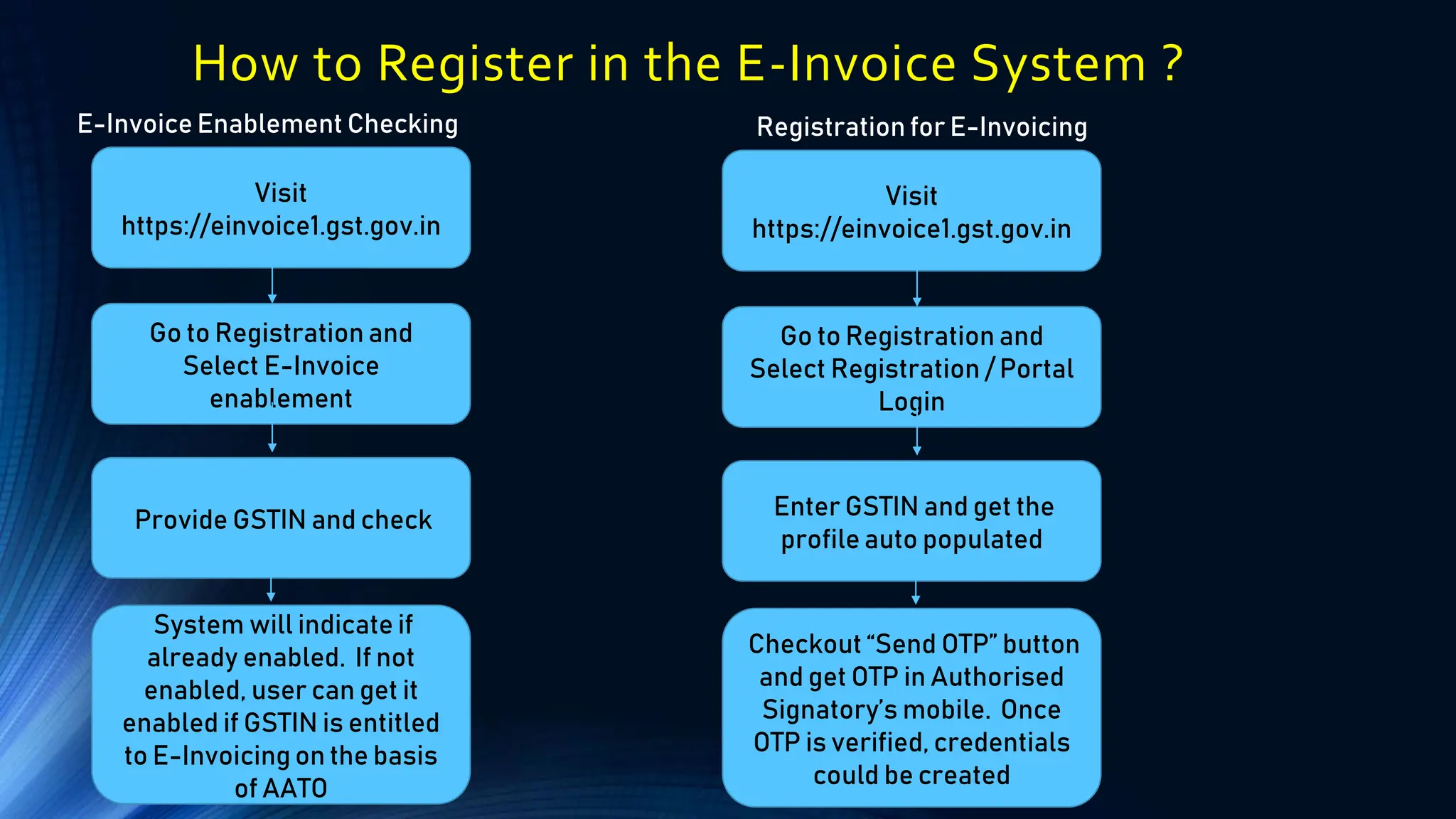

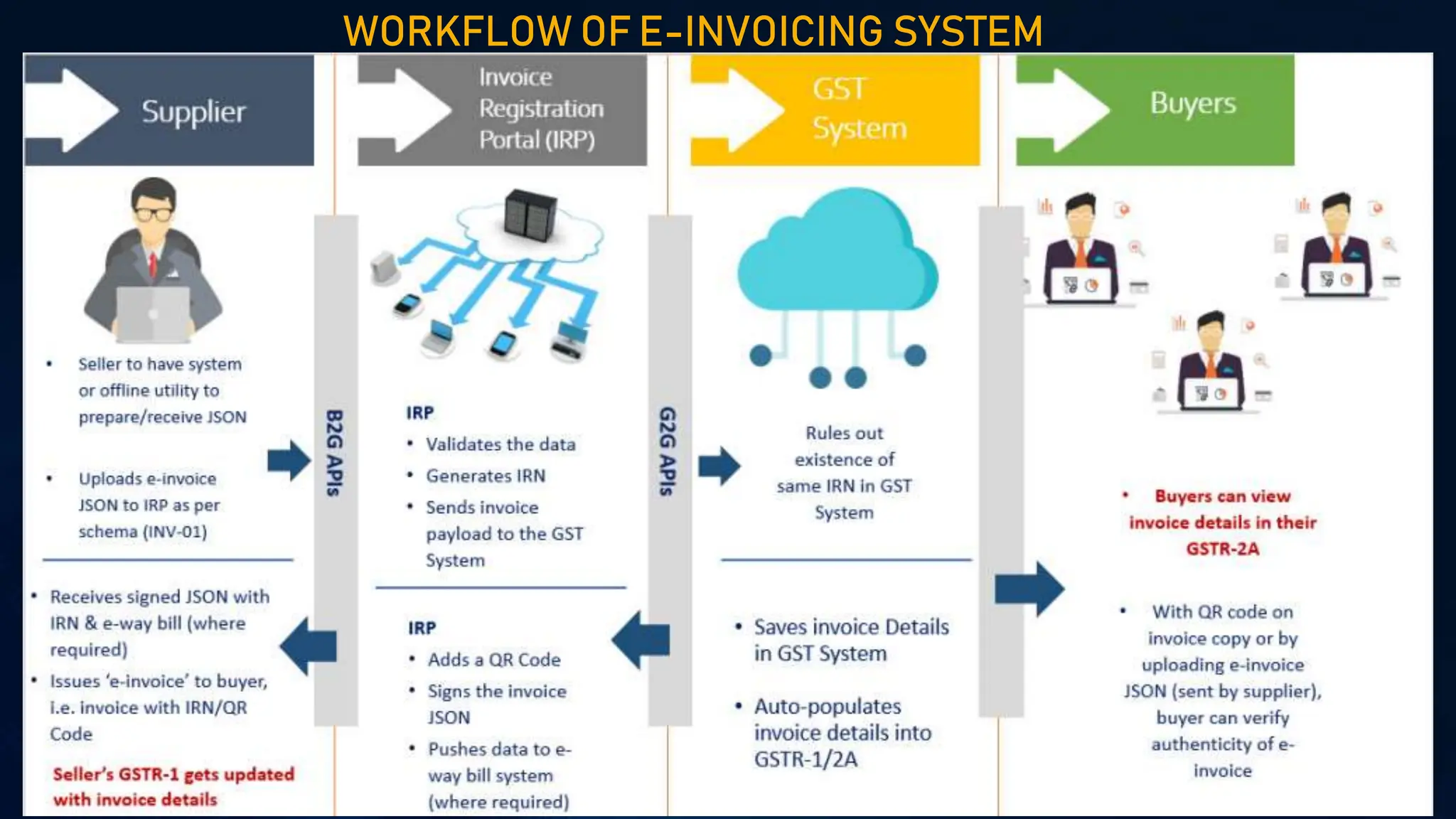

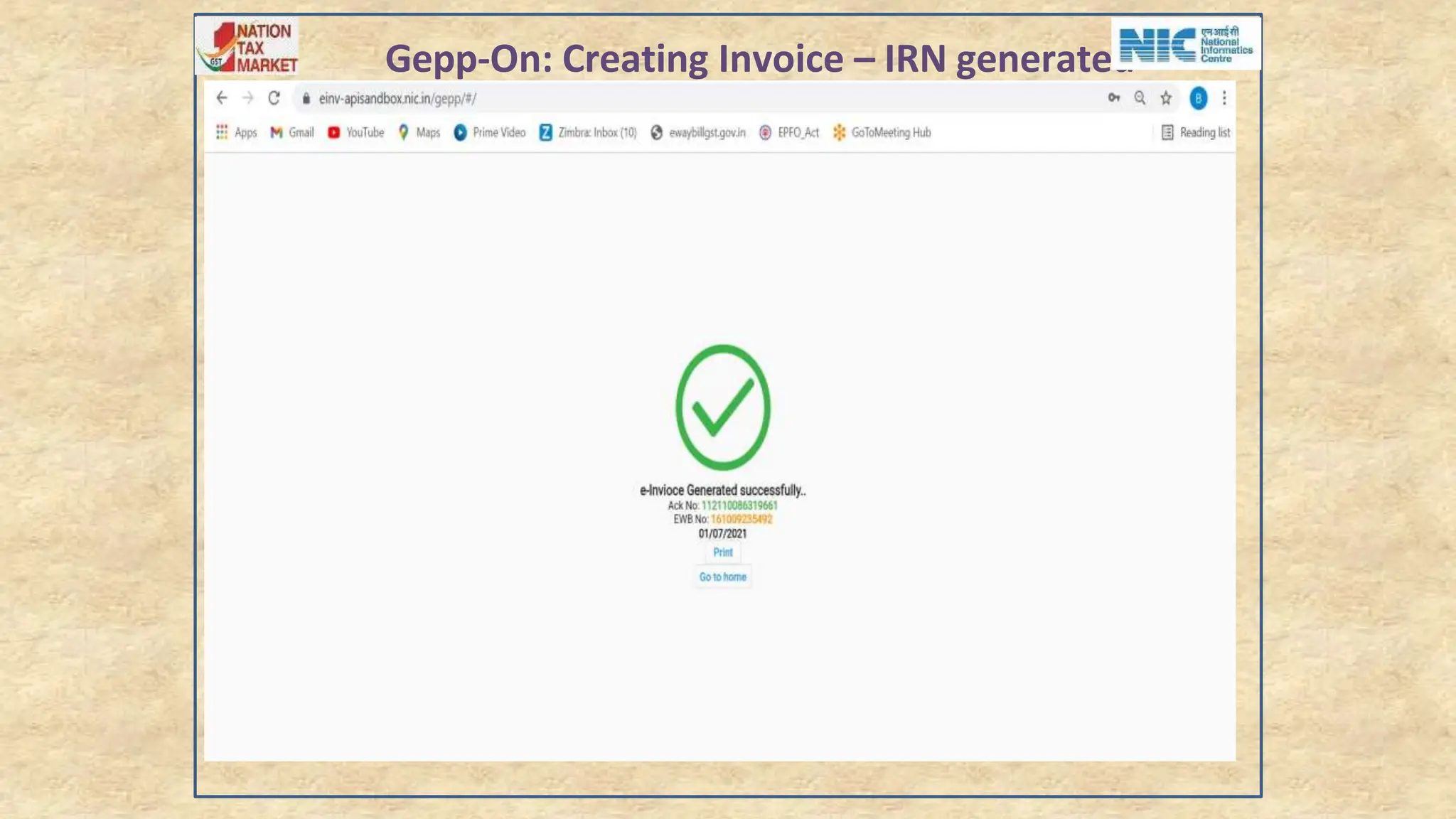

1. The document describes the process of e-invoicing in India, including generating e-invoices by uploading invoice details to the IRP portal and integrating e-invoicing with the GST portal.

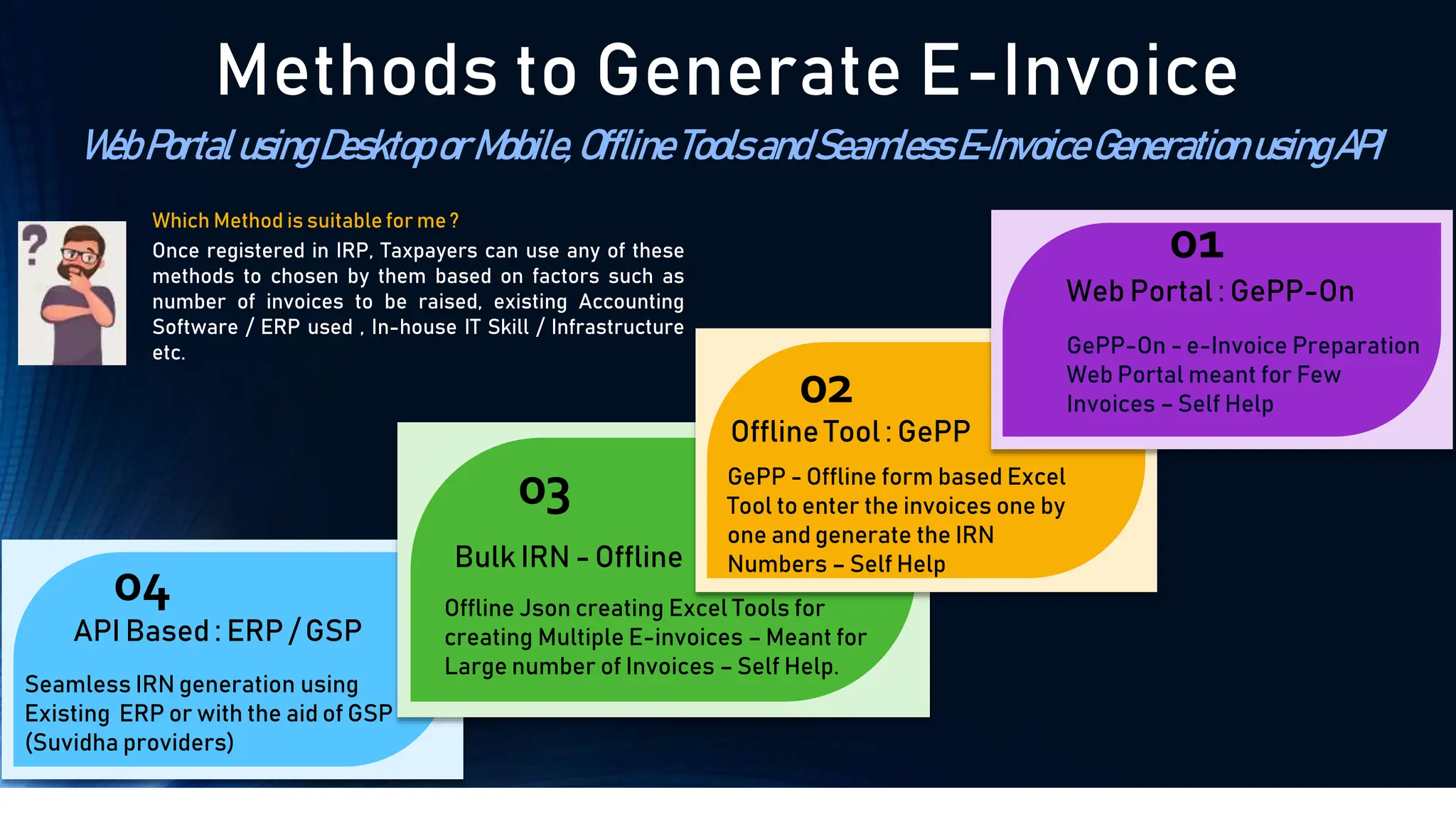

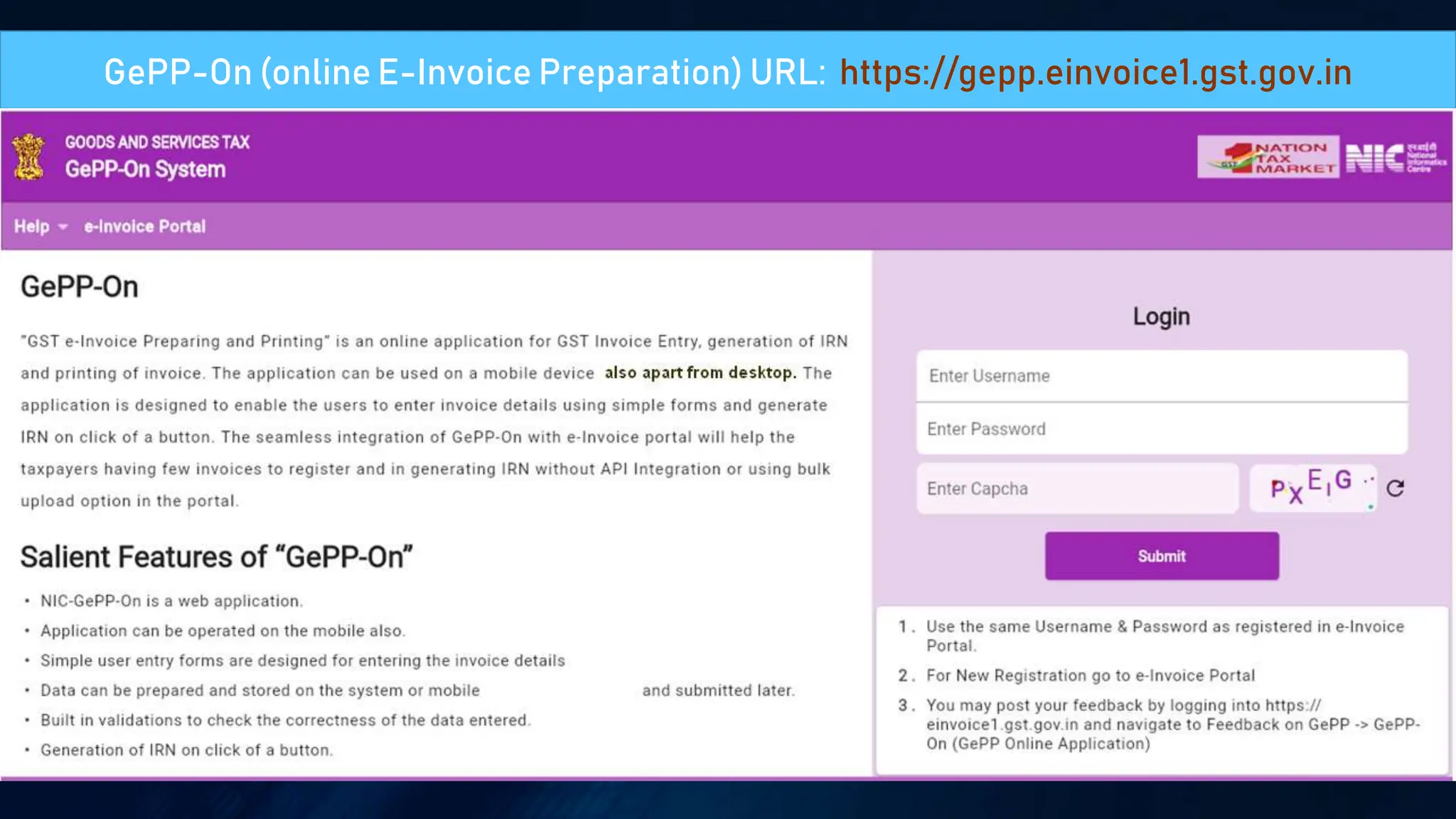

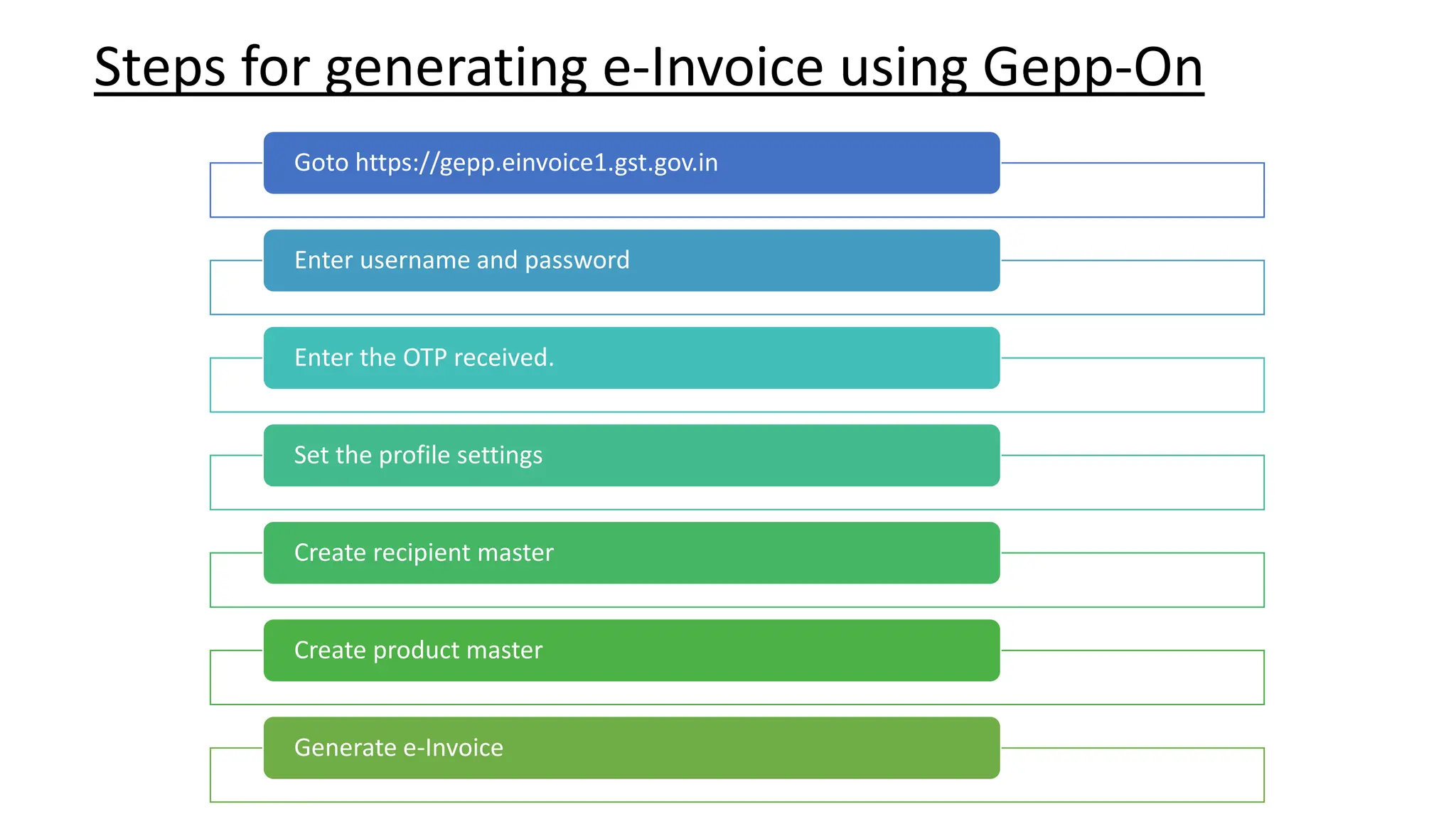

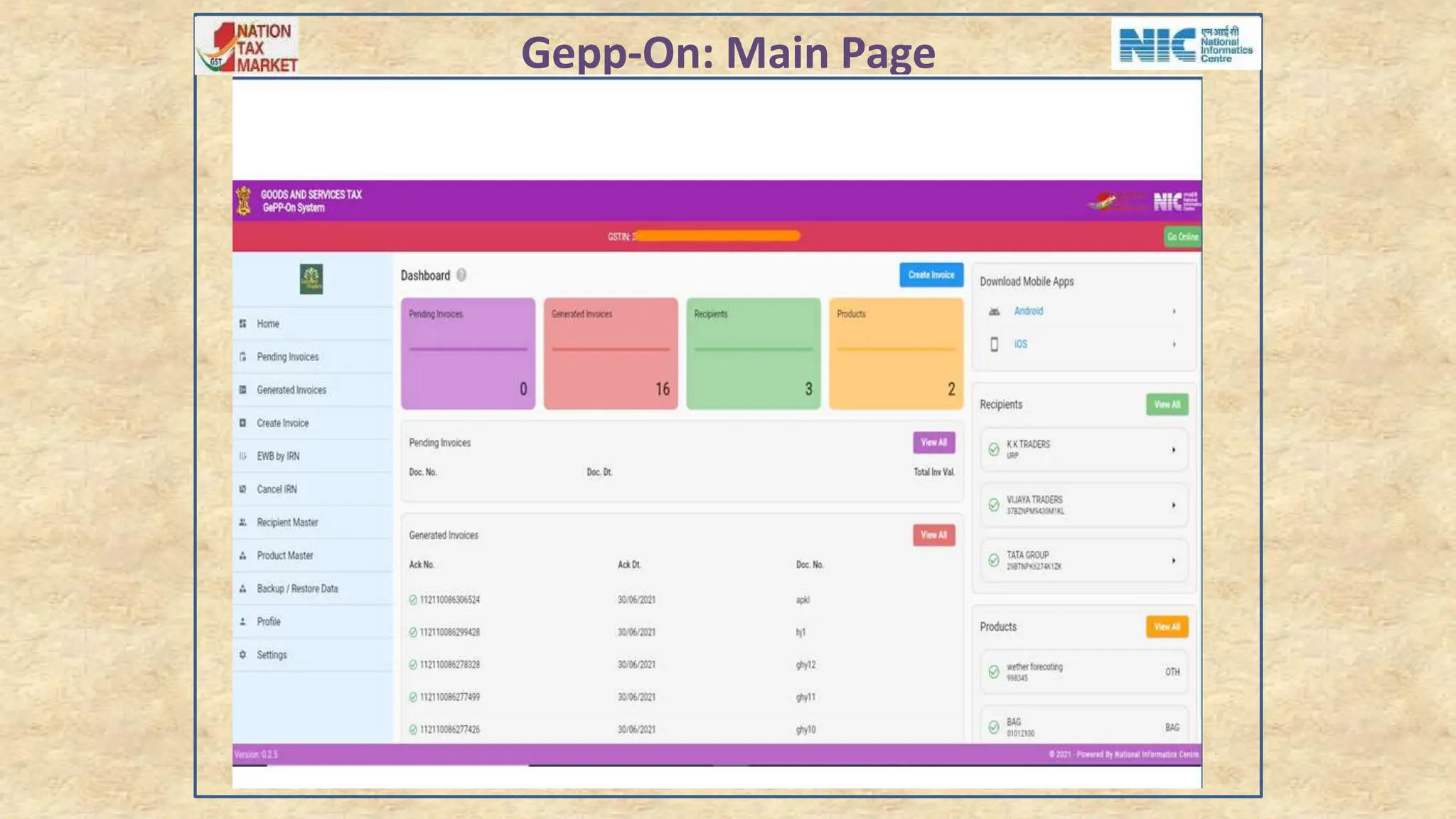

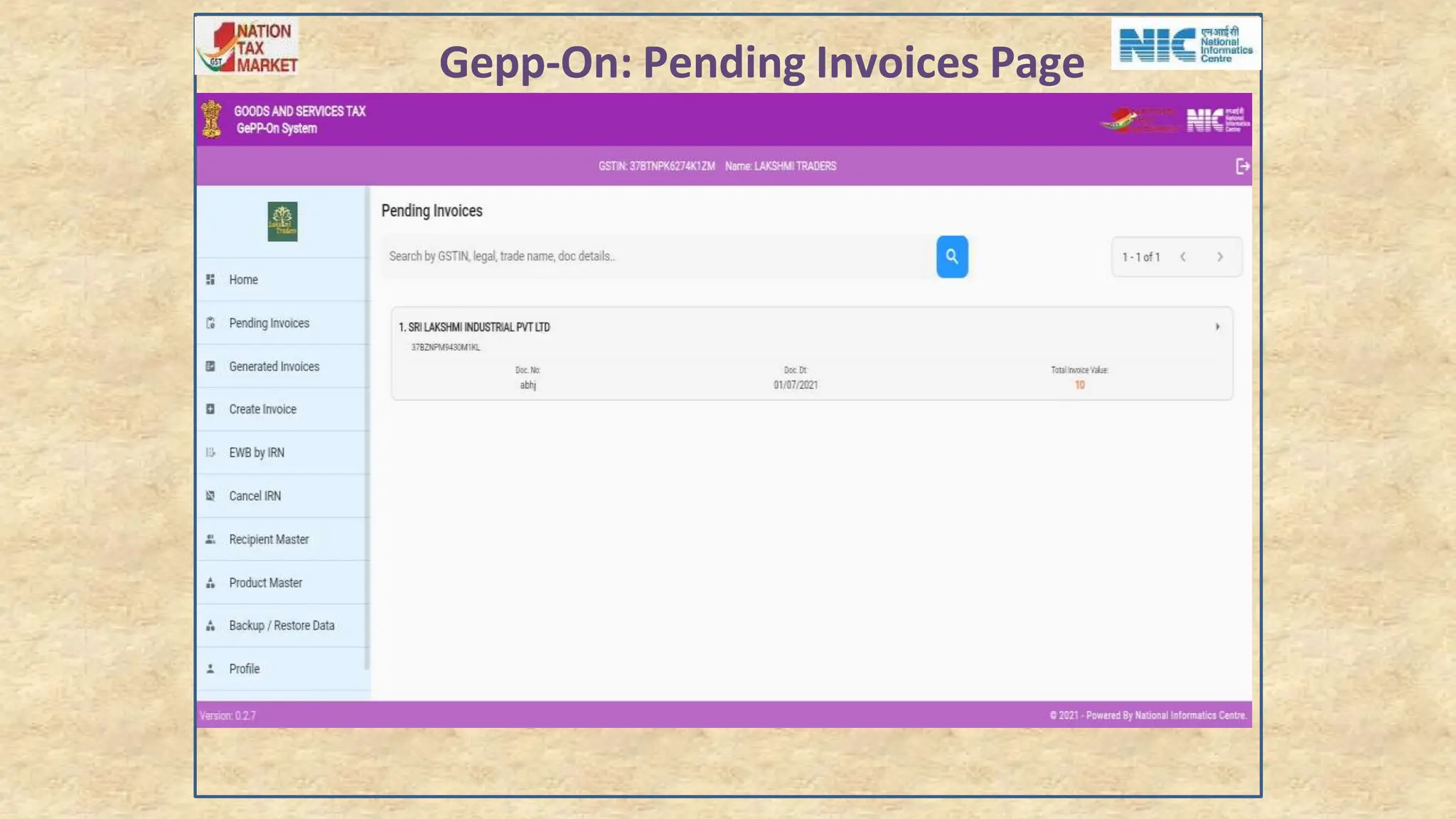

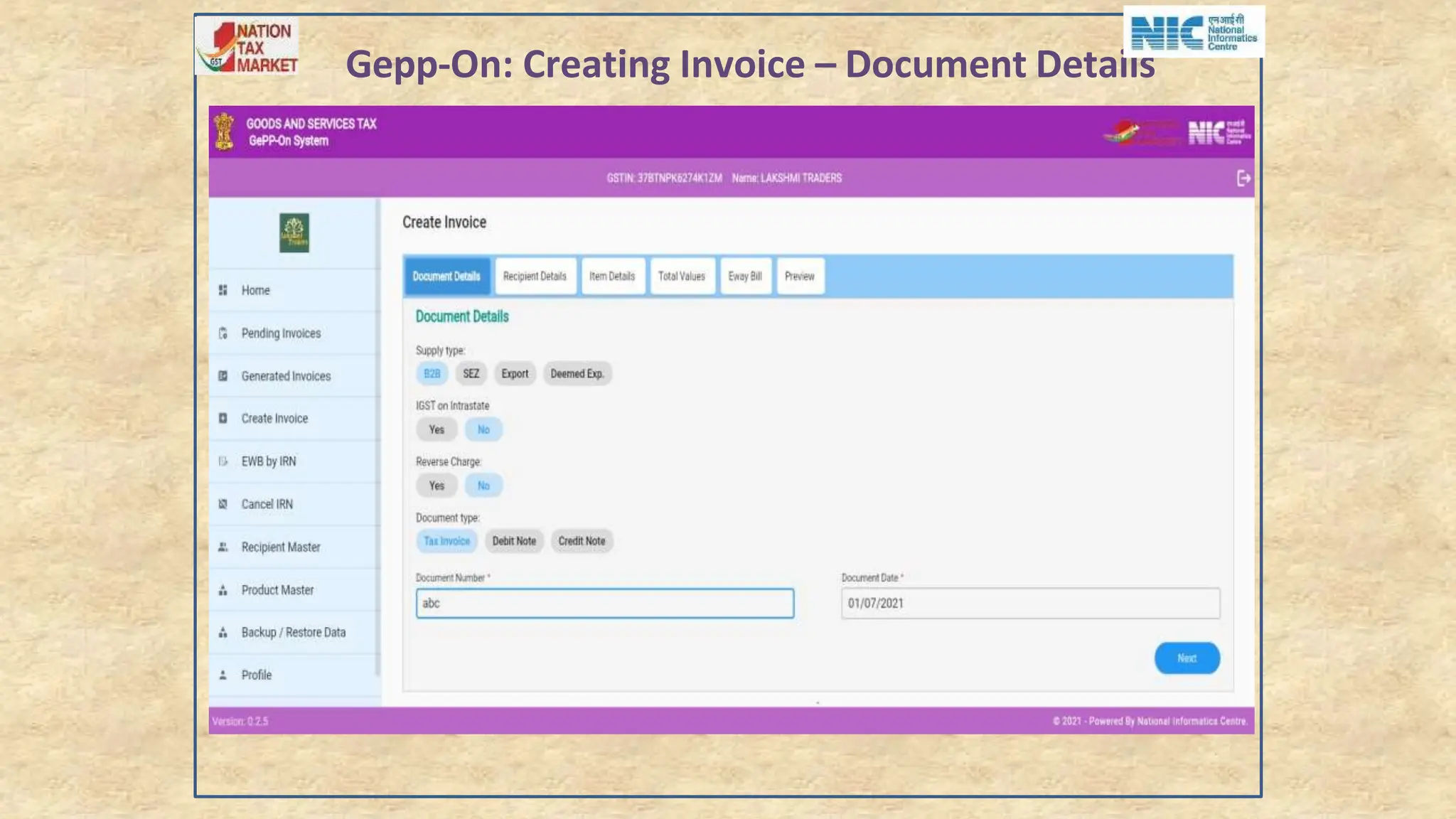

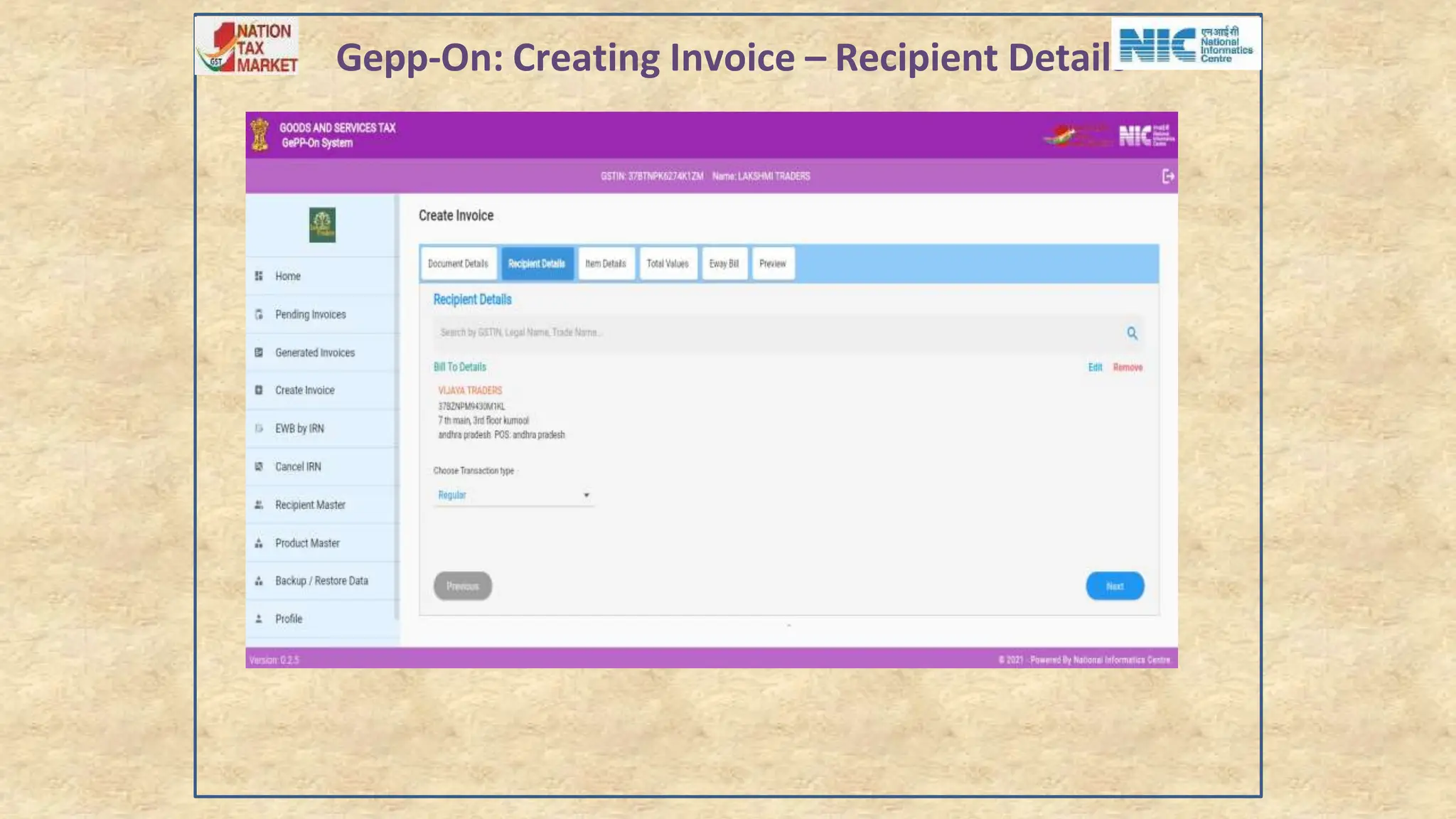

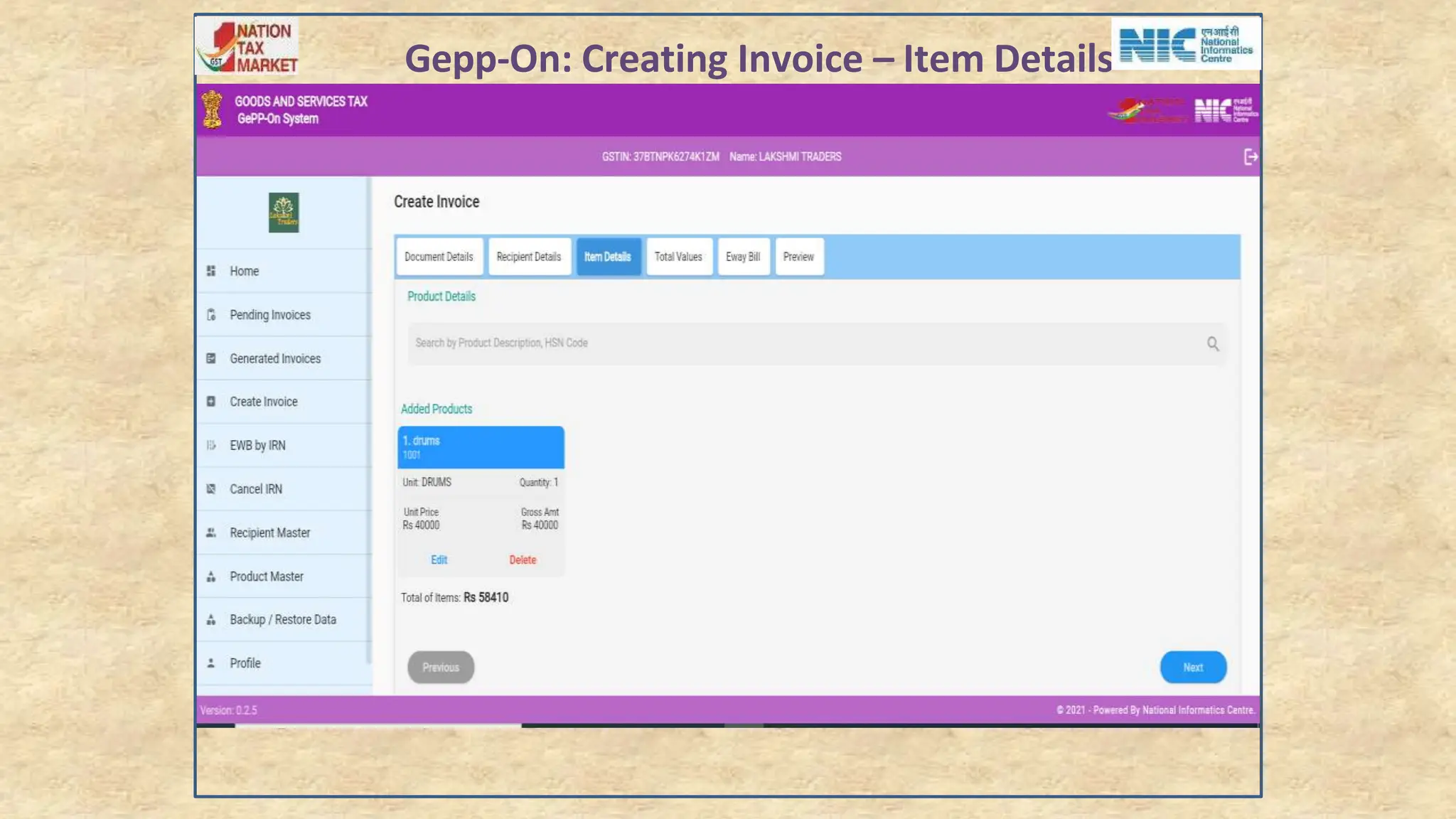

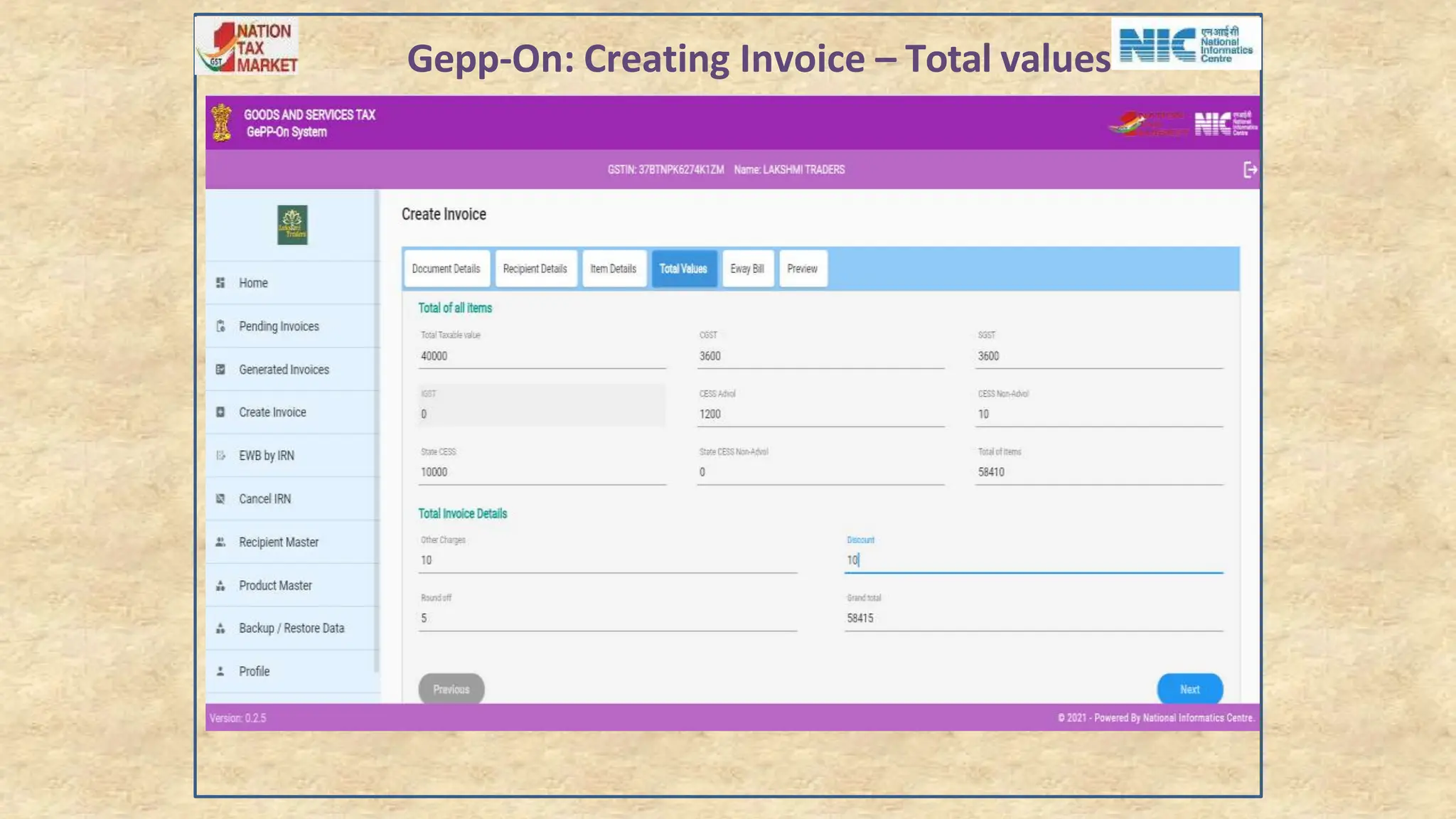

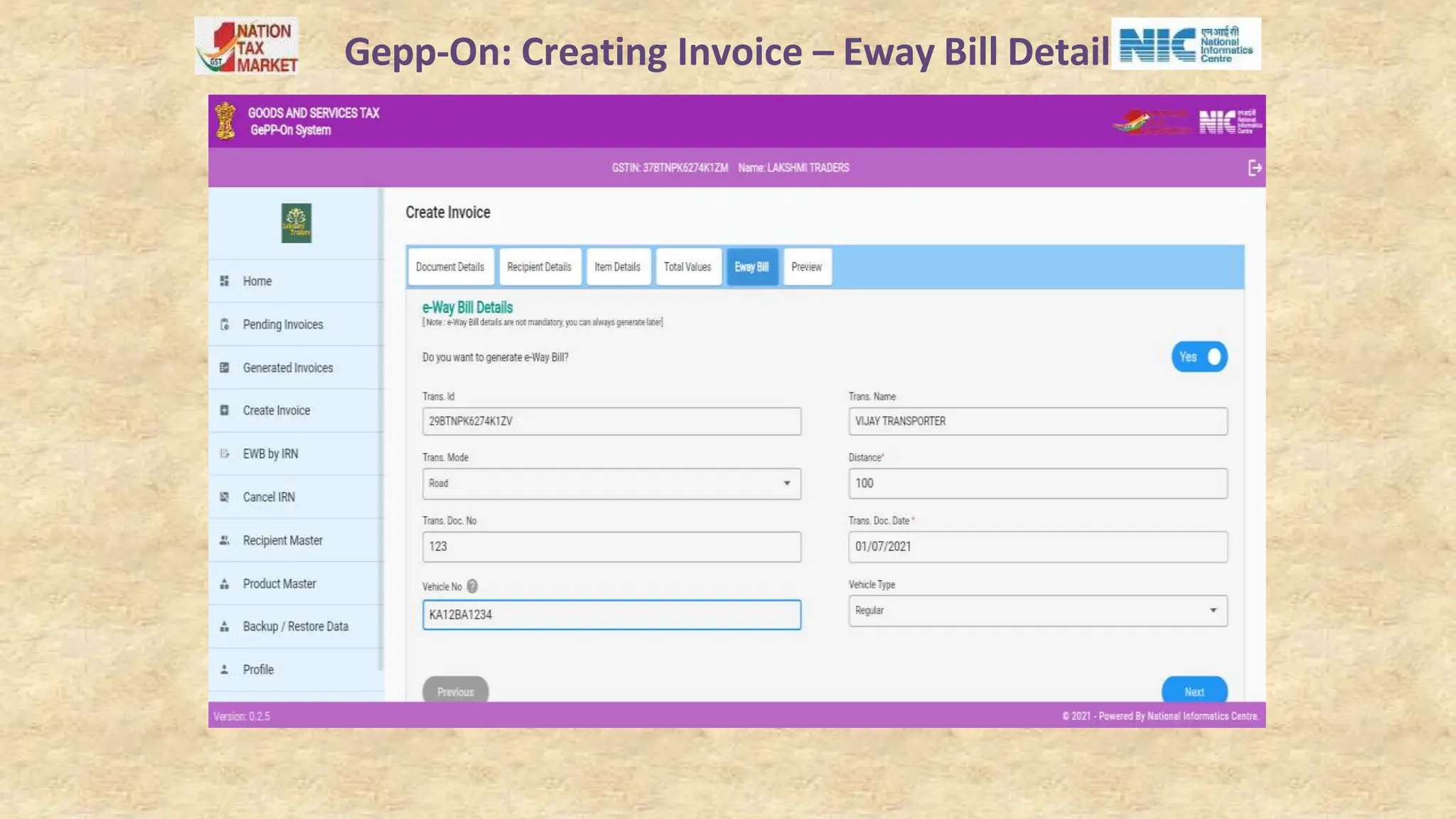

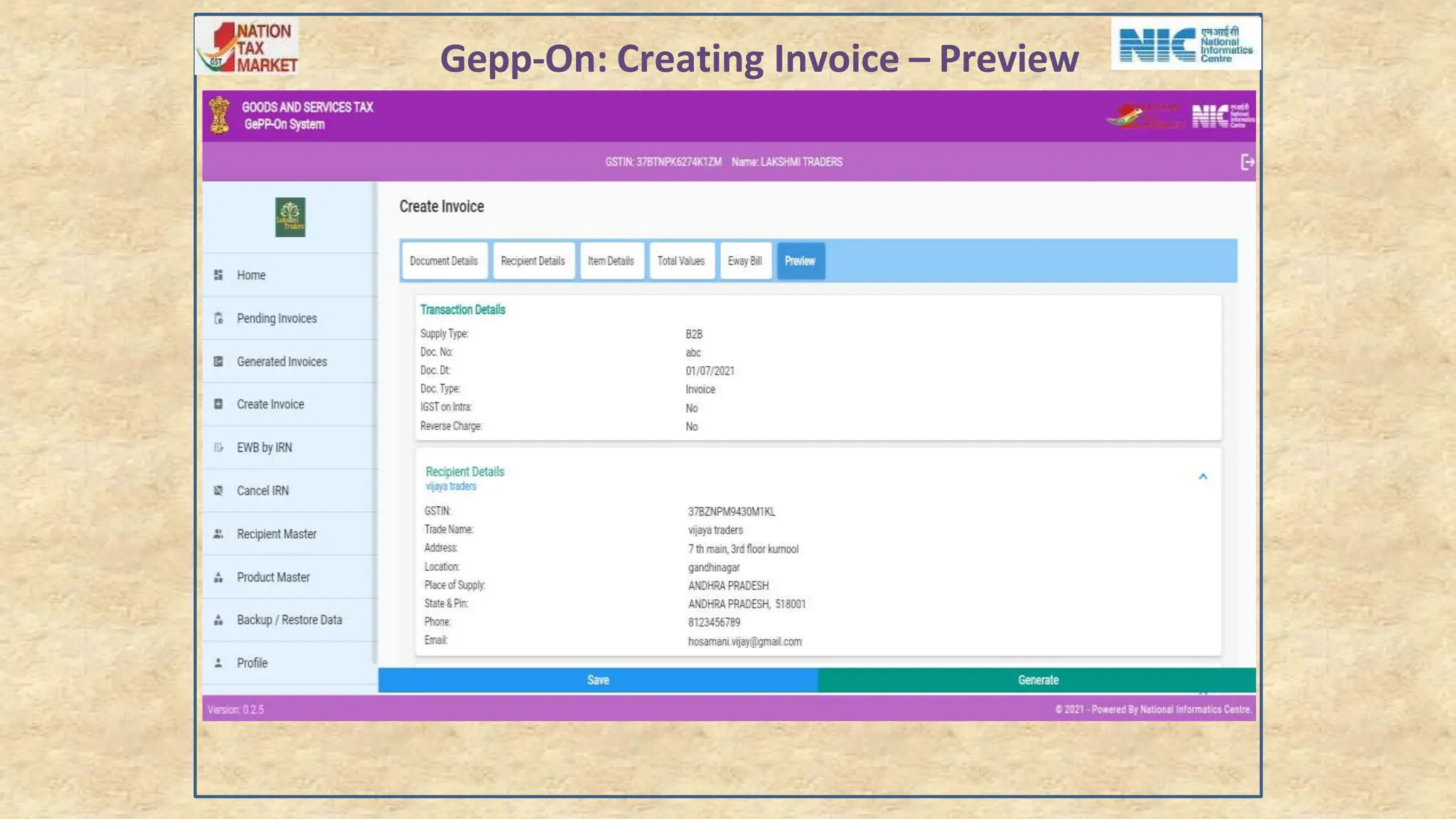

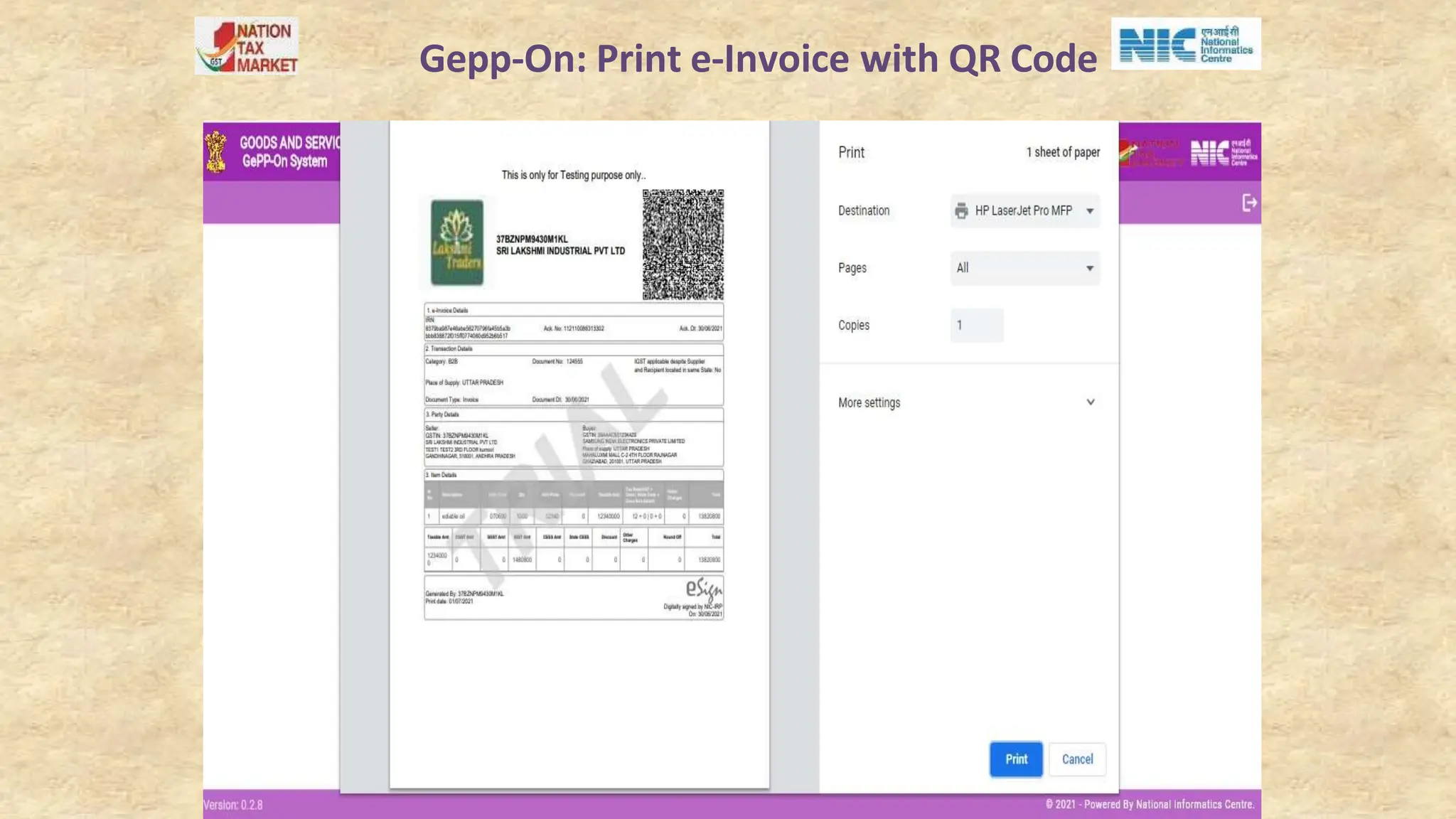

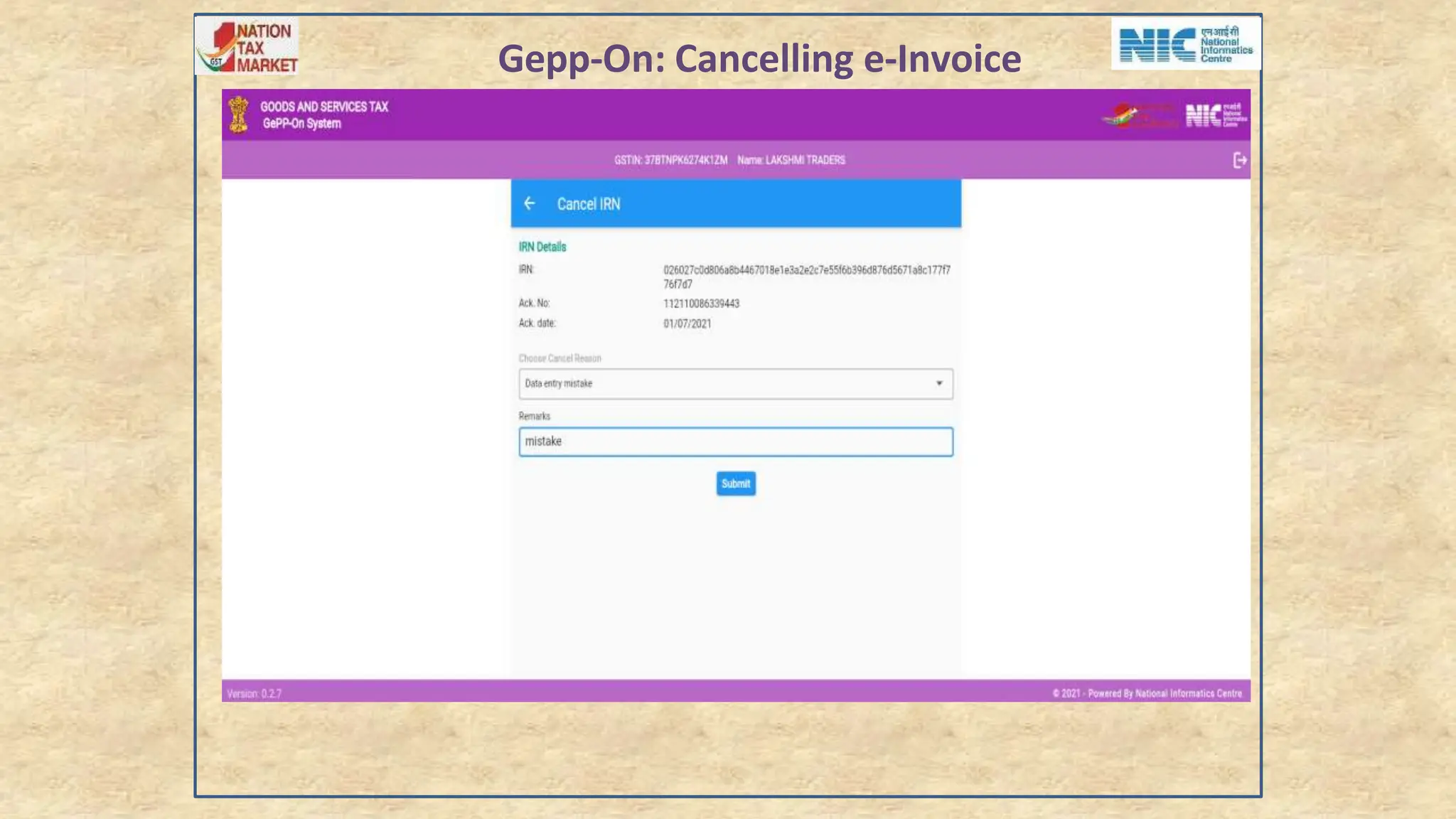

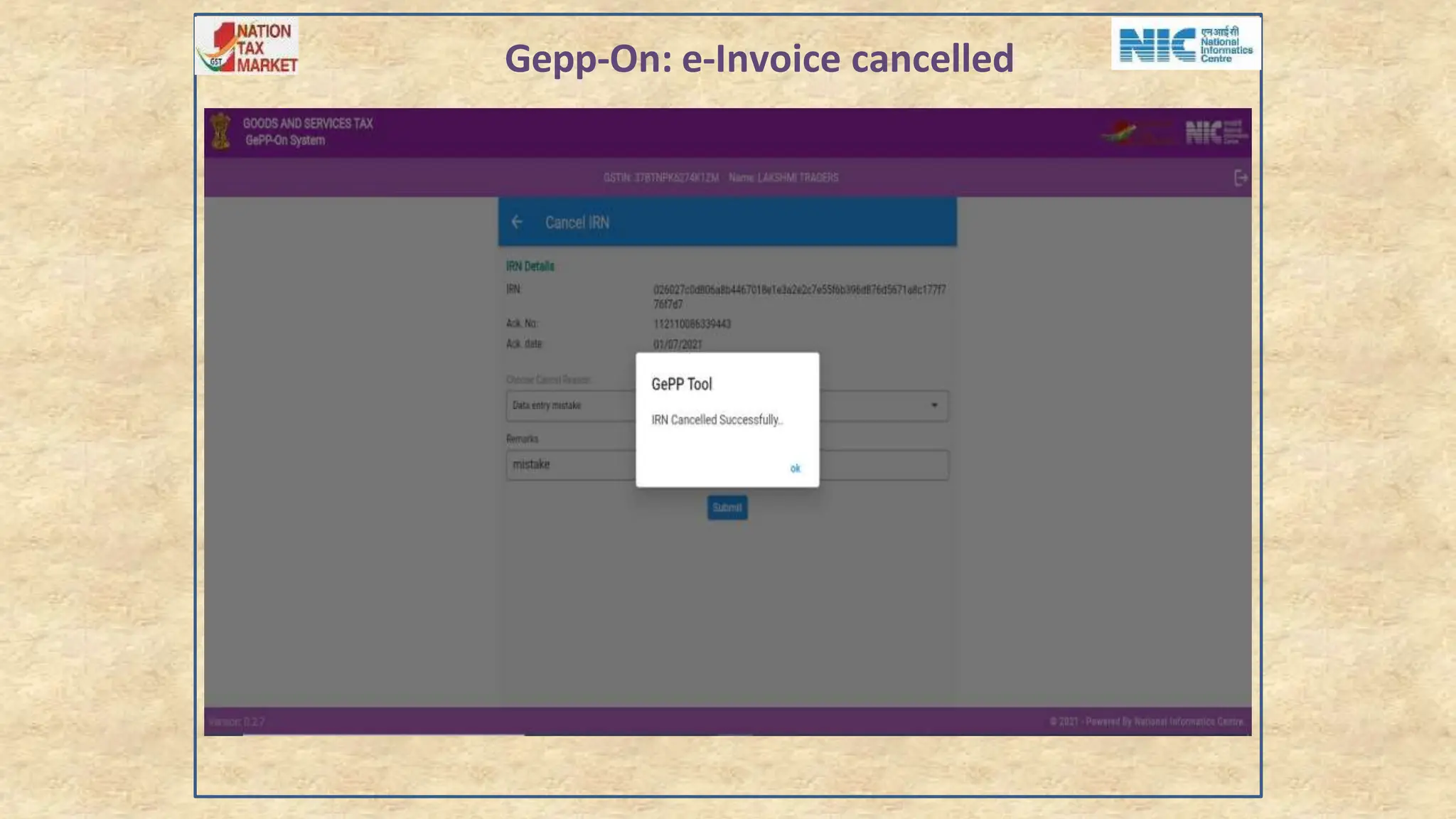

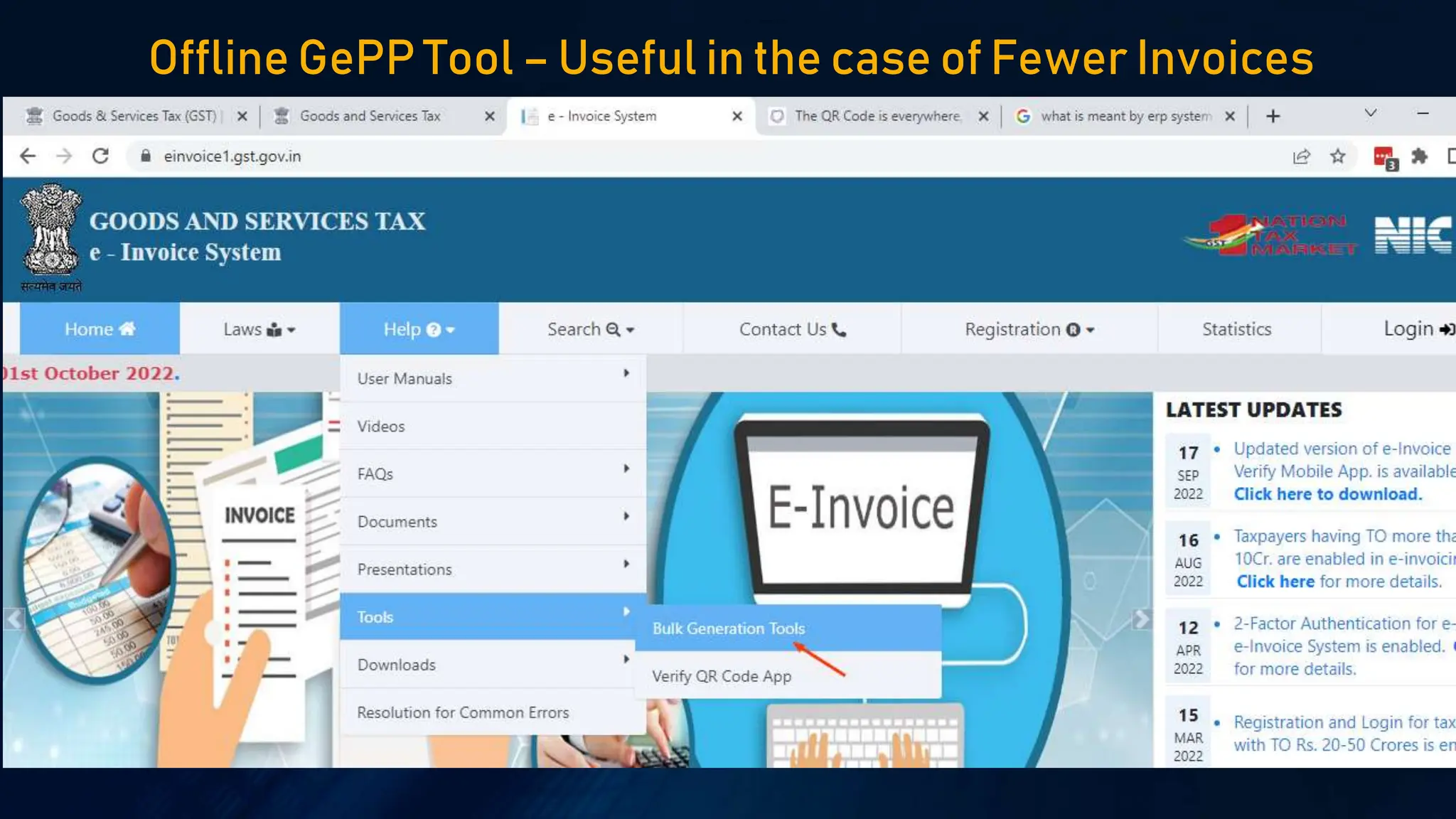

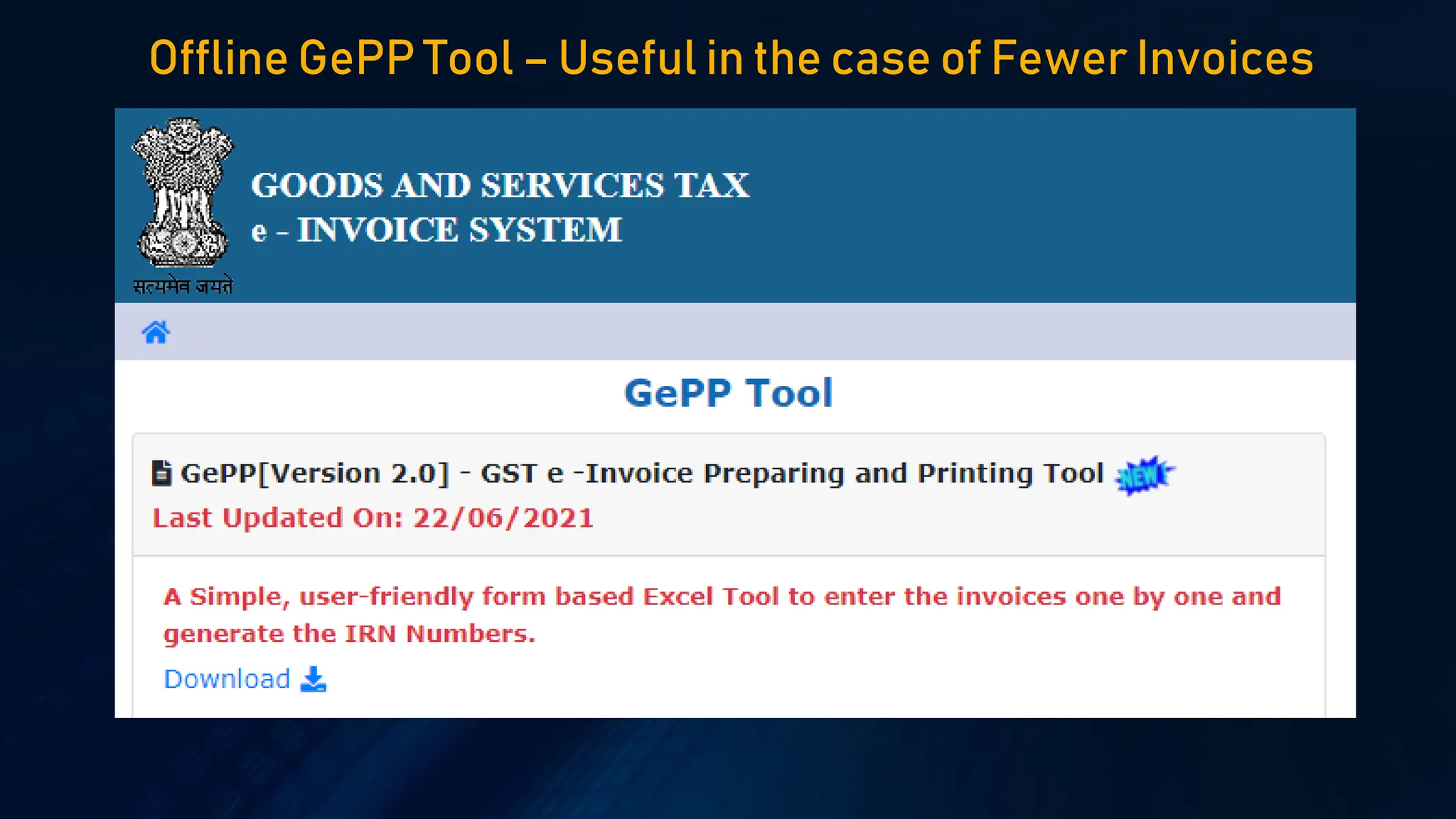

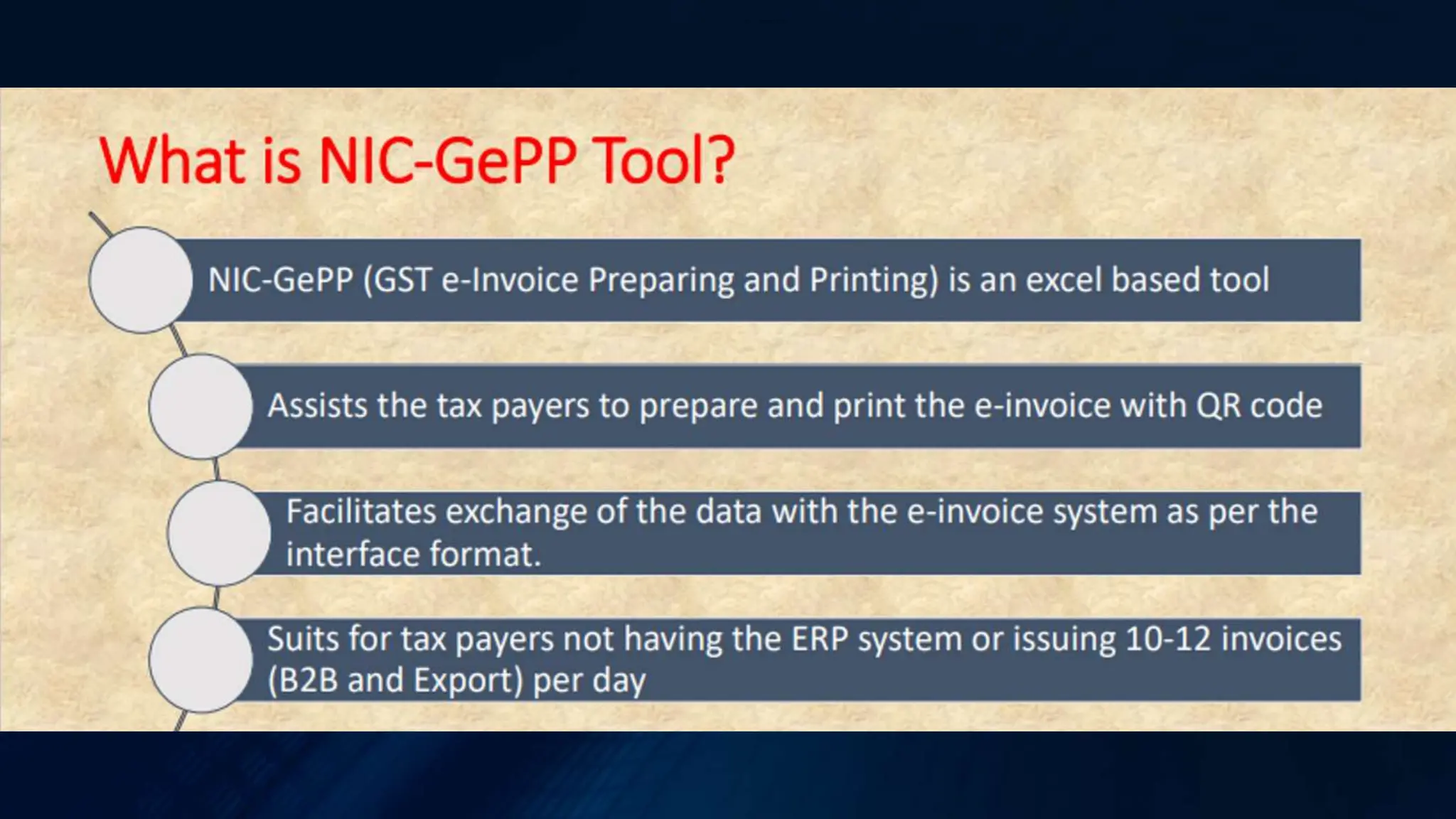

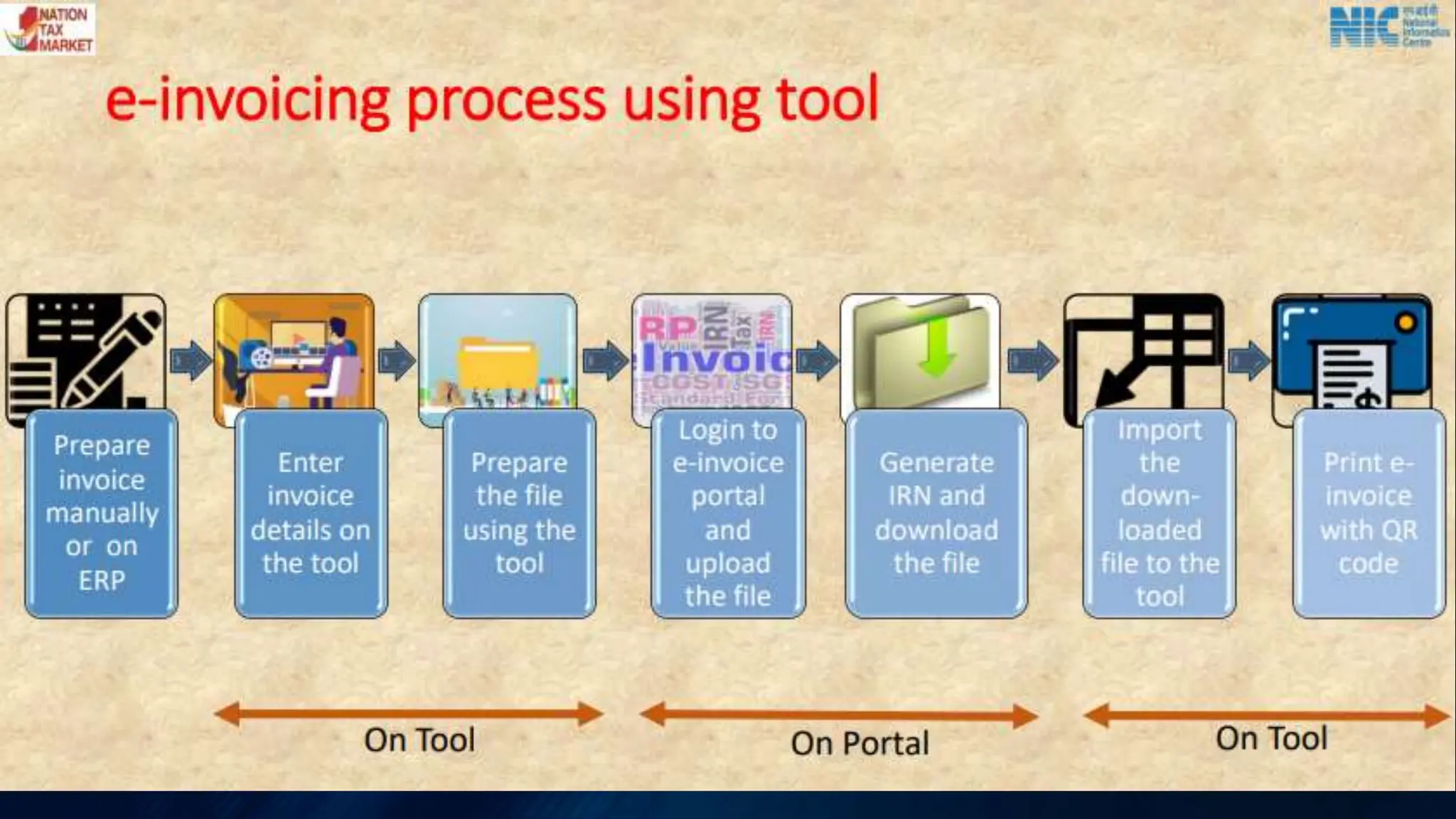

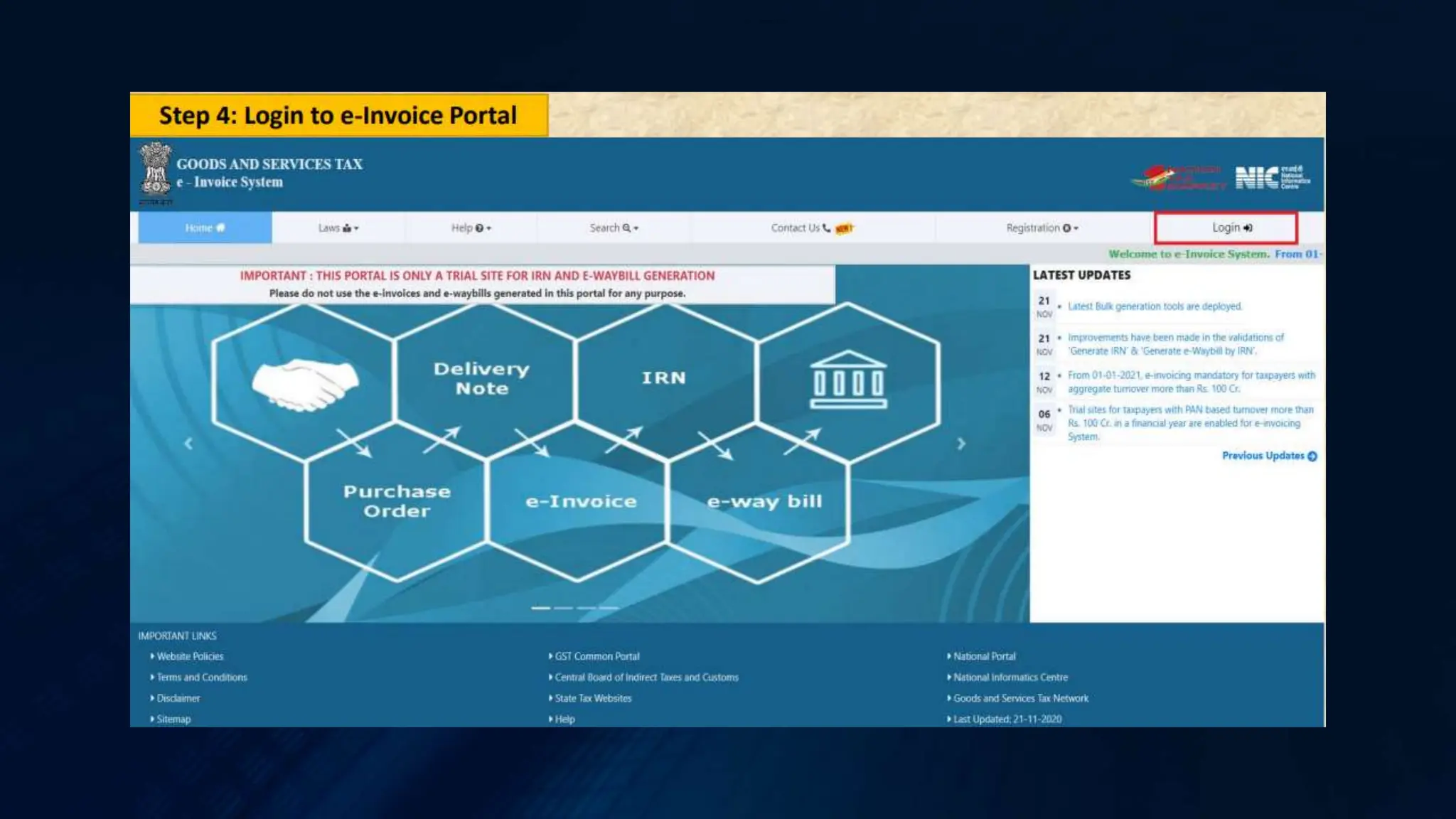

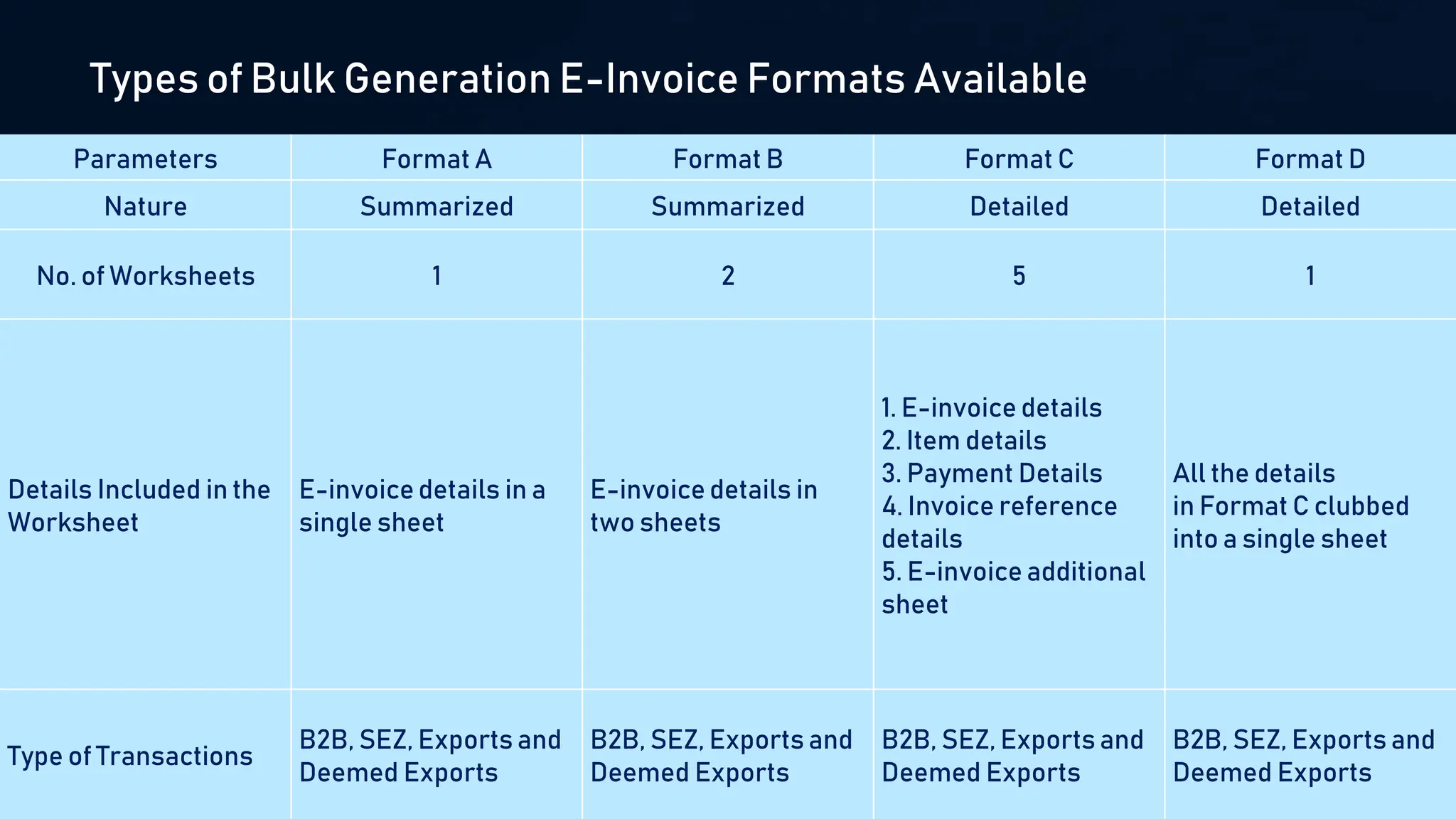

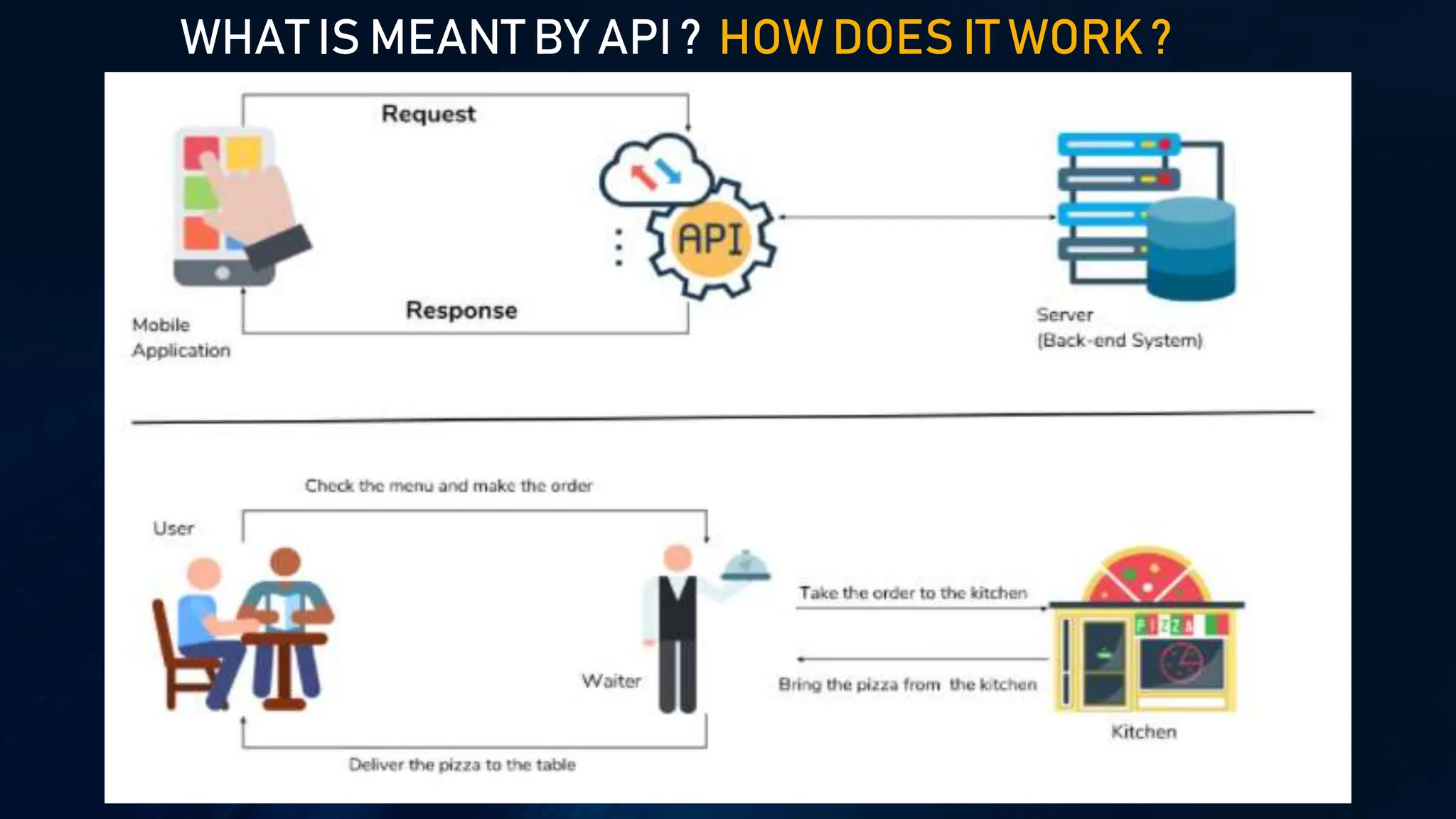

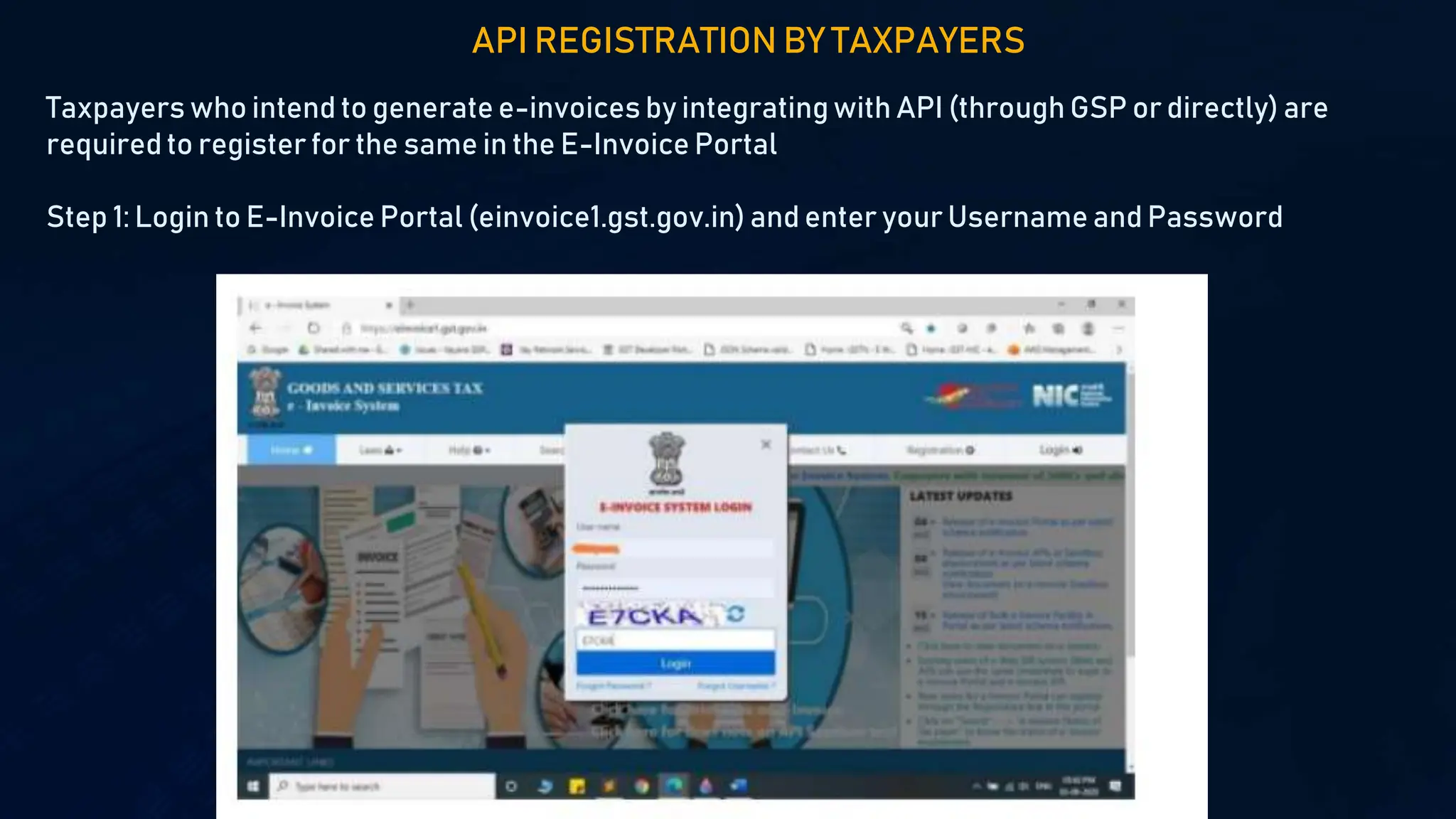

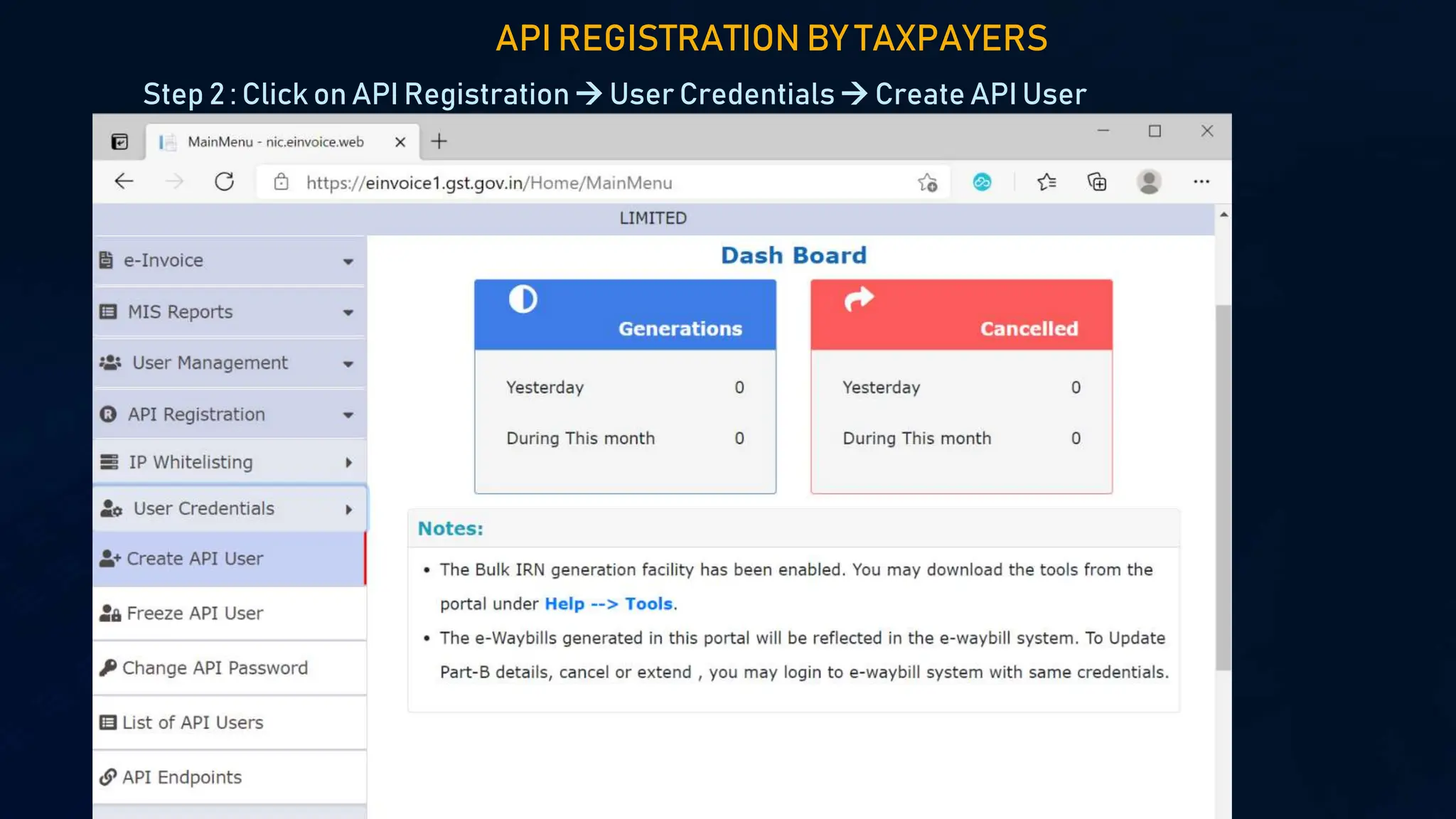

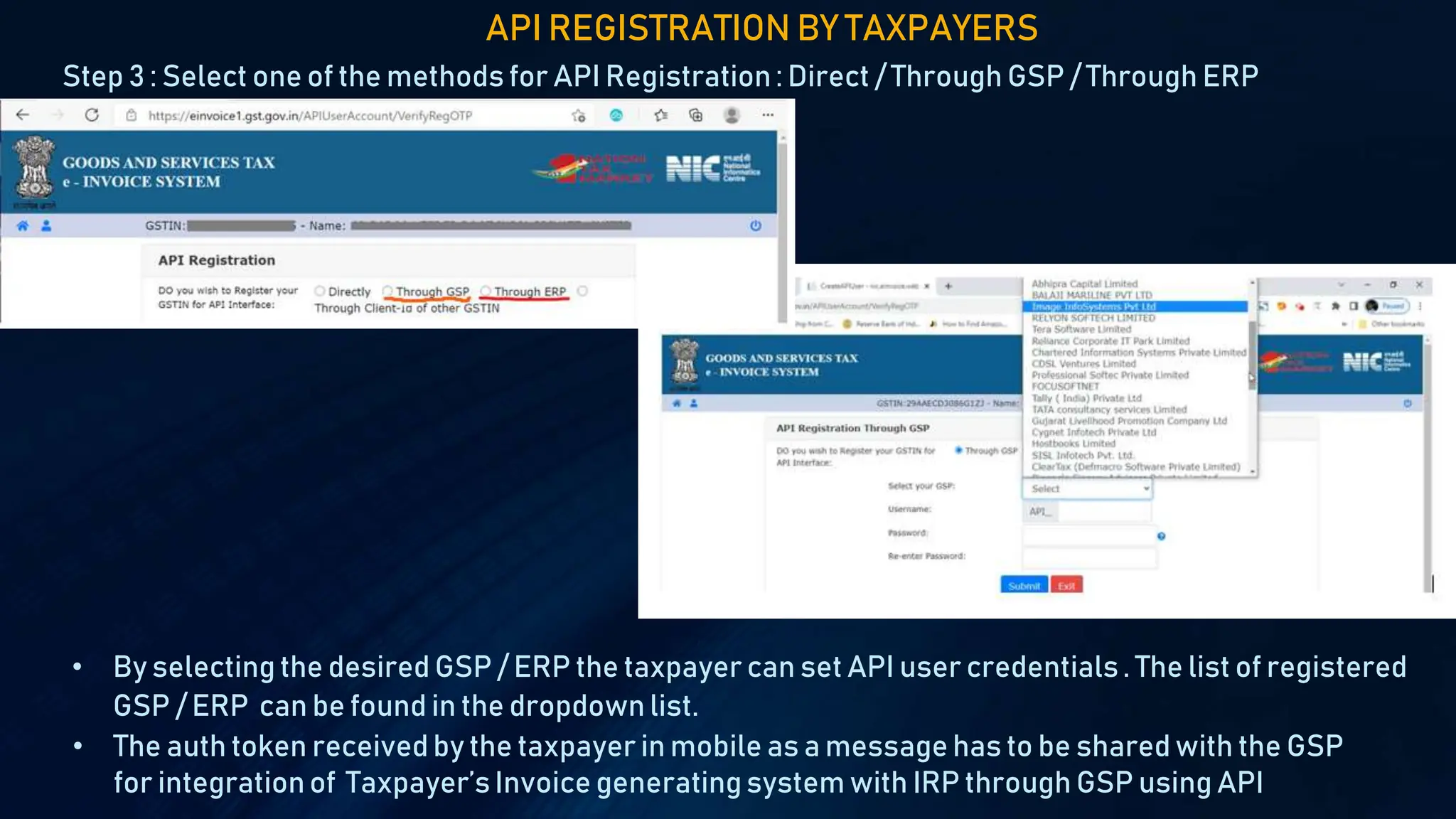

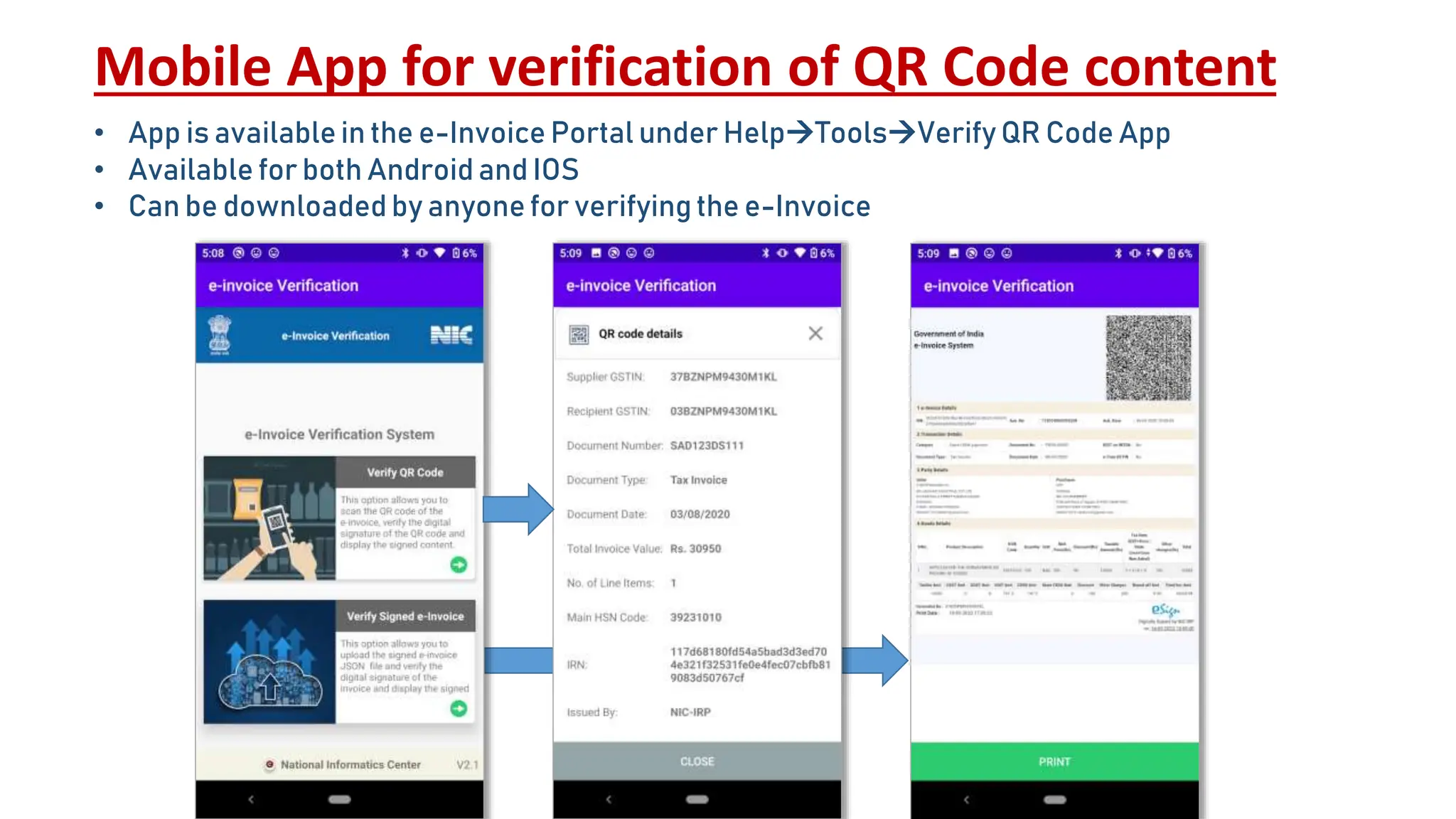

2. It provides information on different methods for generating e-invoices including via the web portal, offline tools, and APIs.

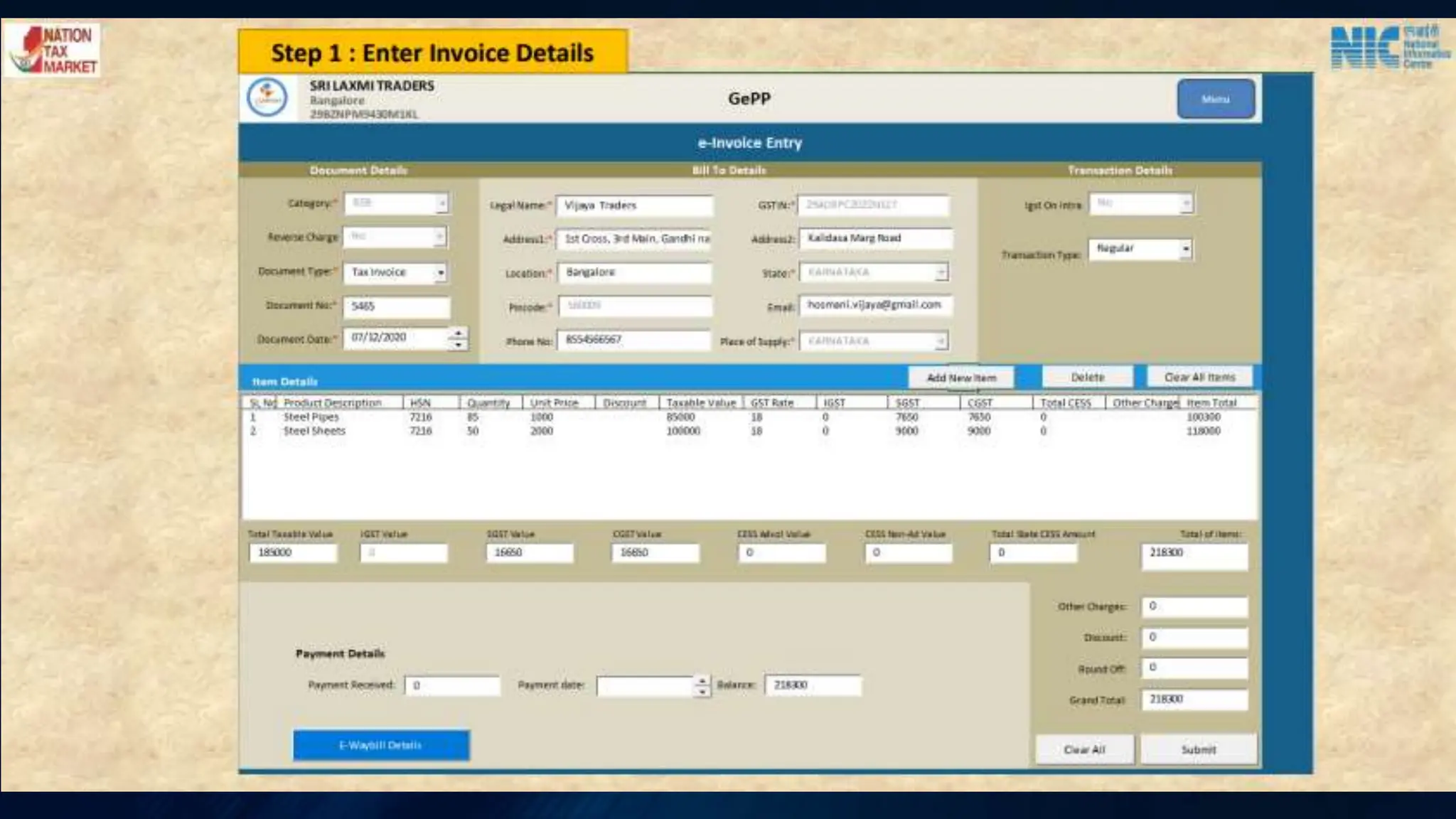

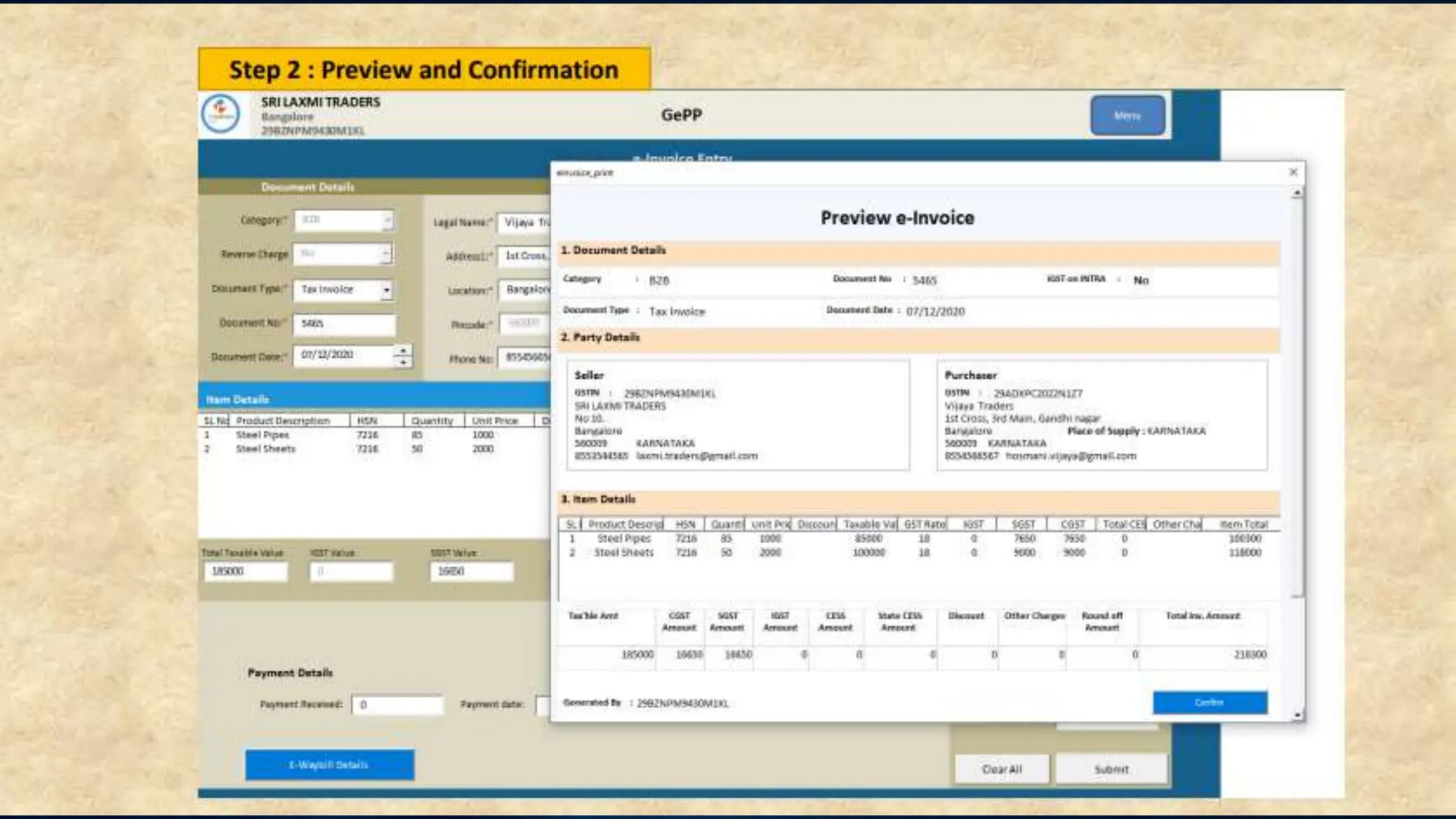

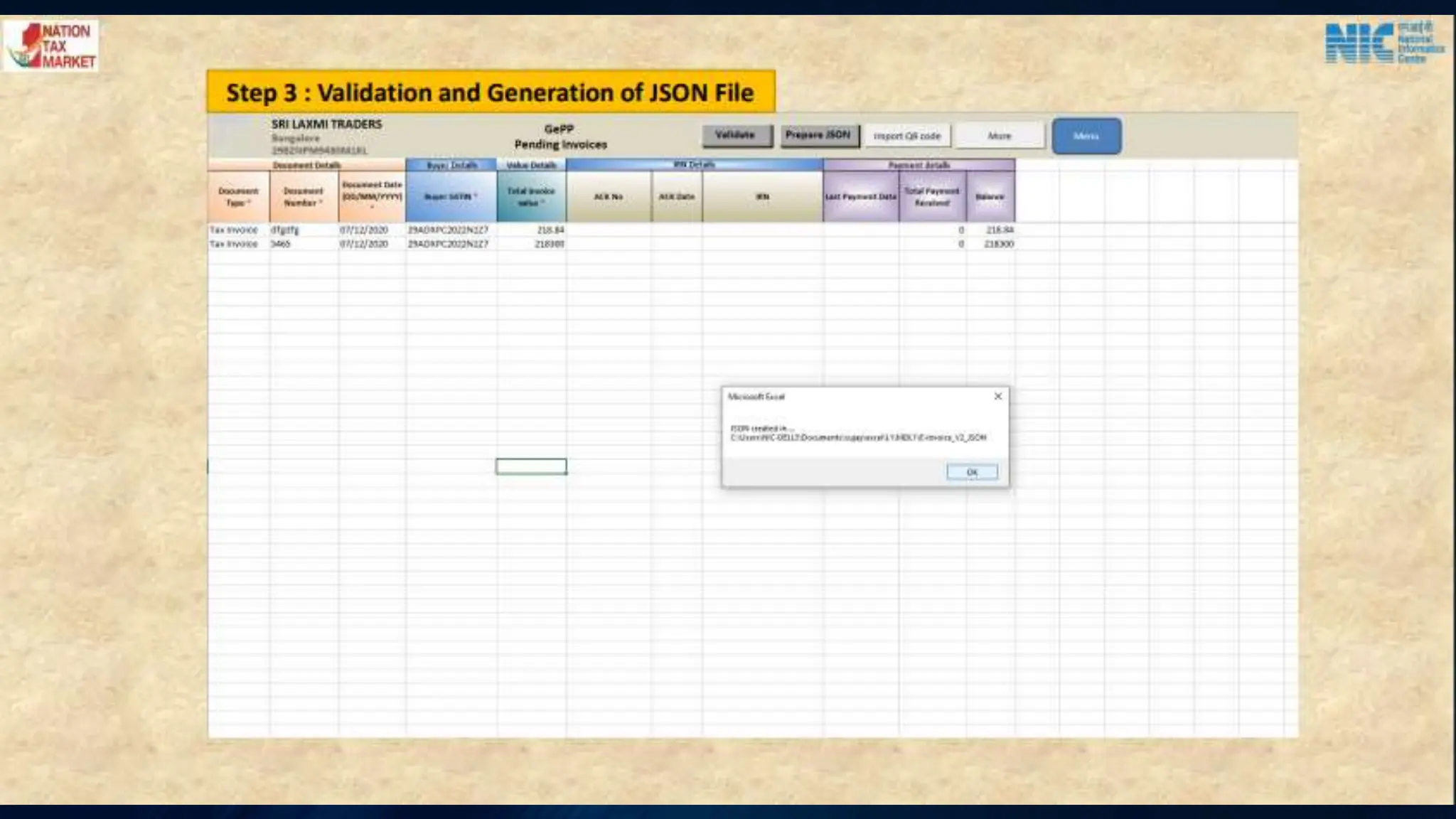

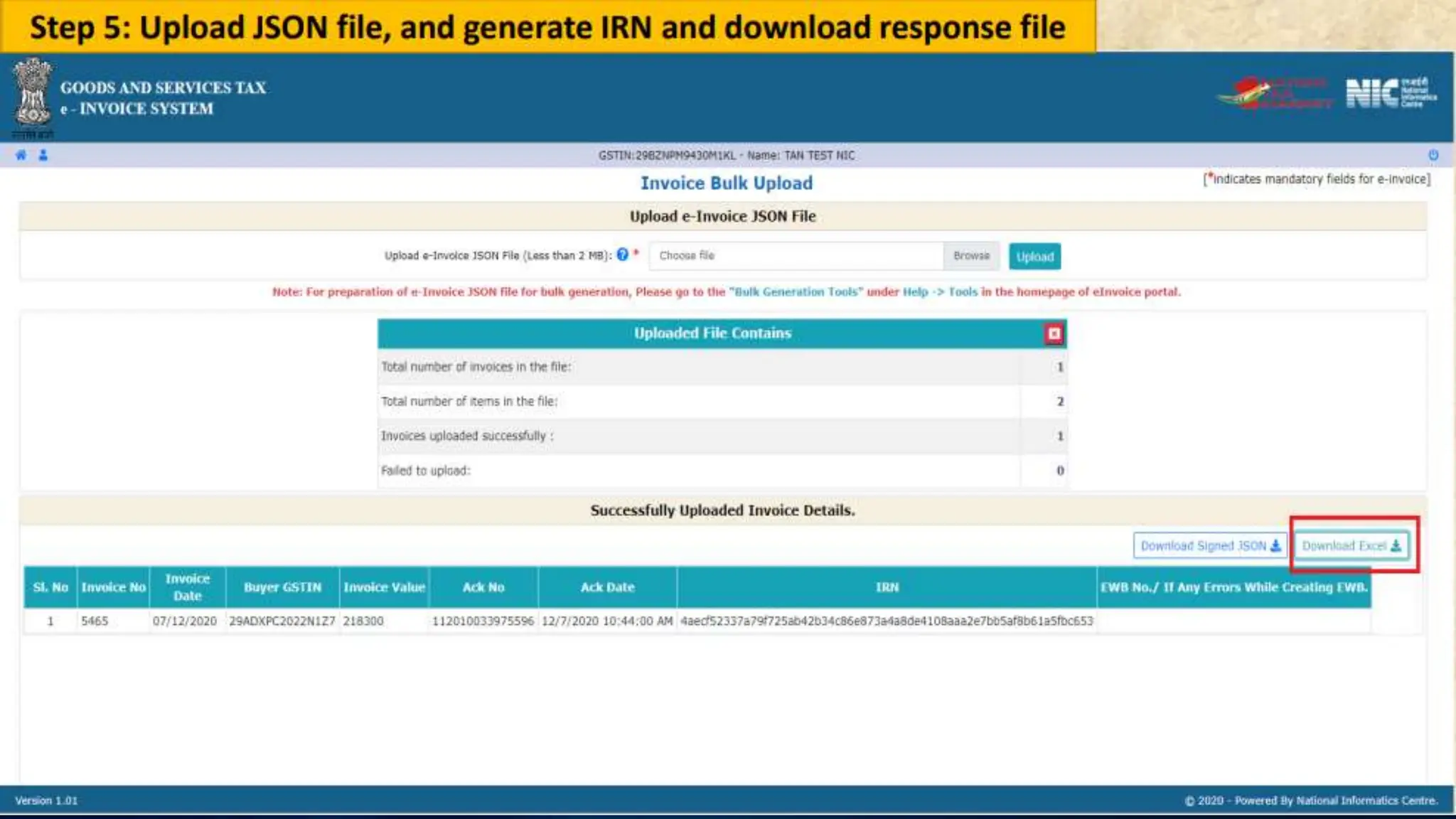

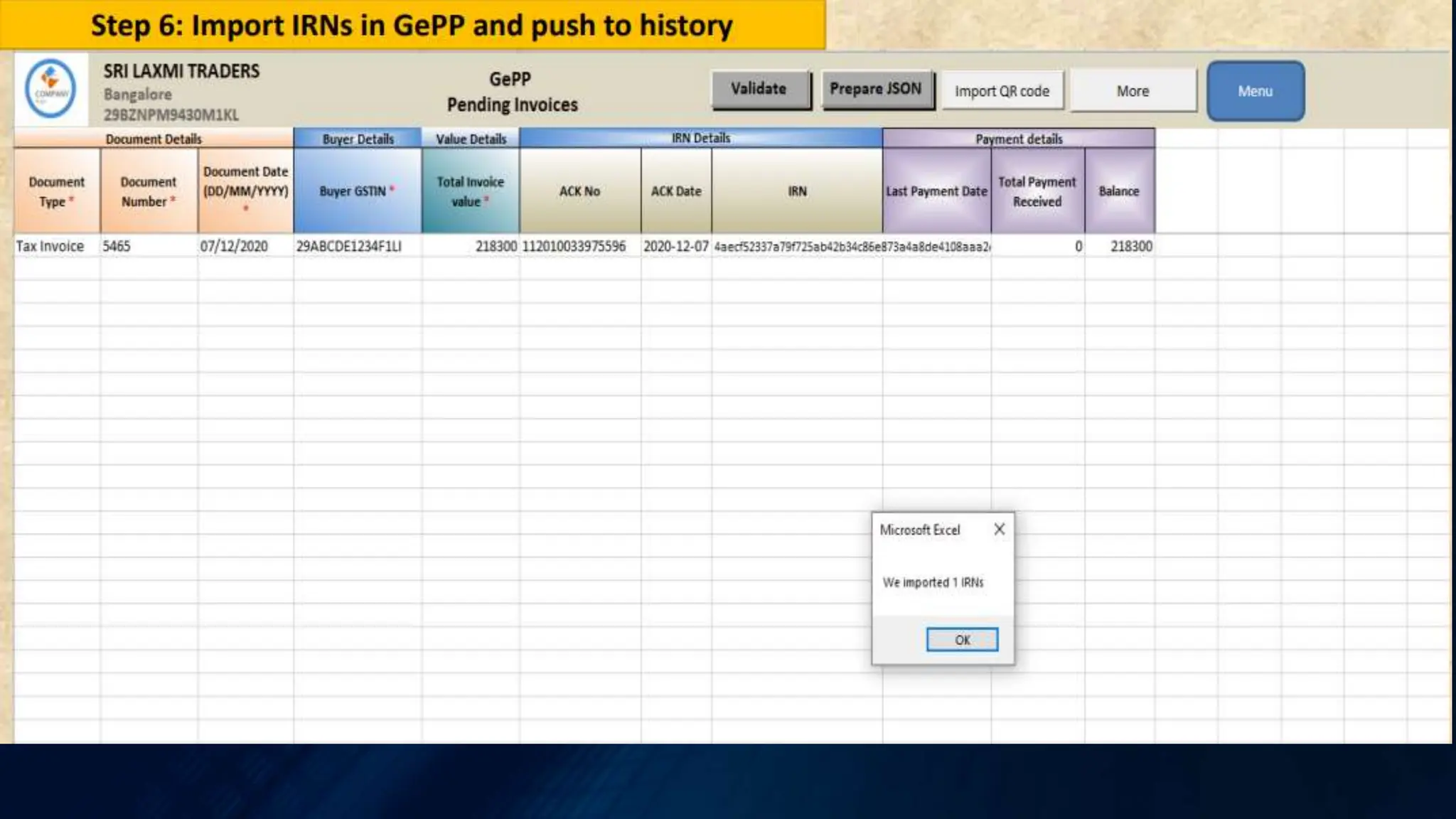

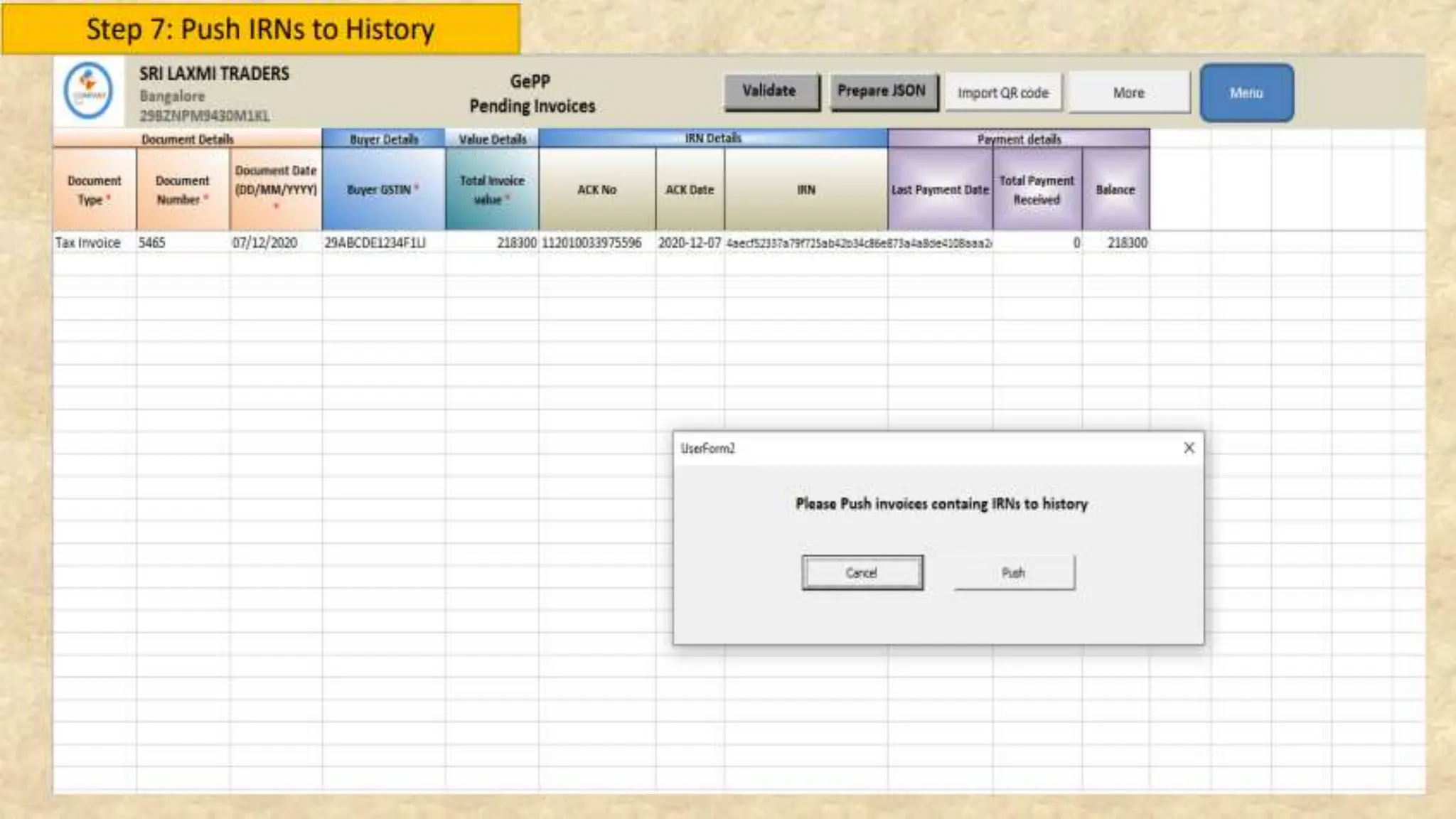

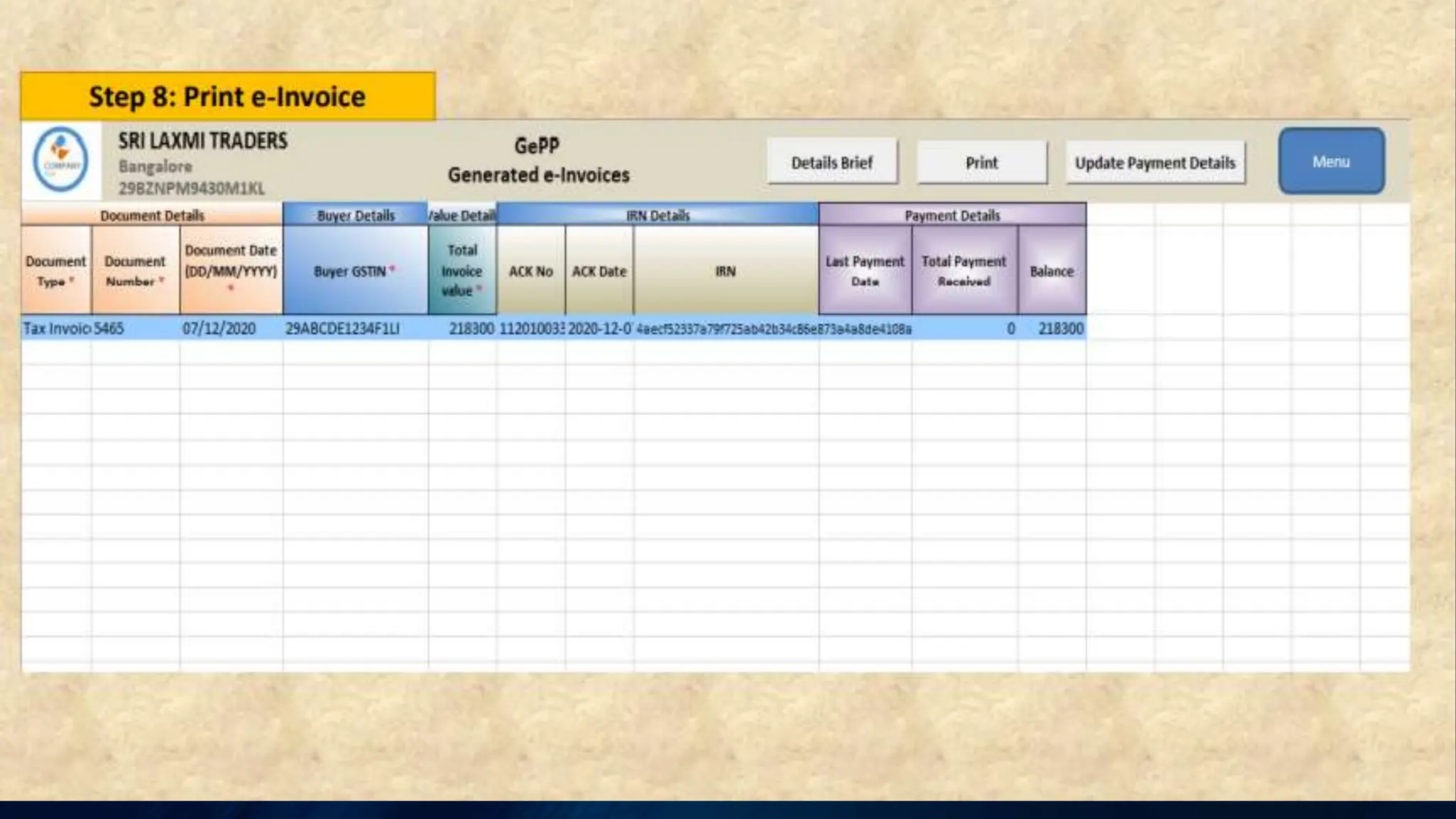

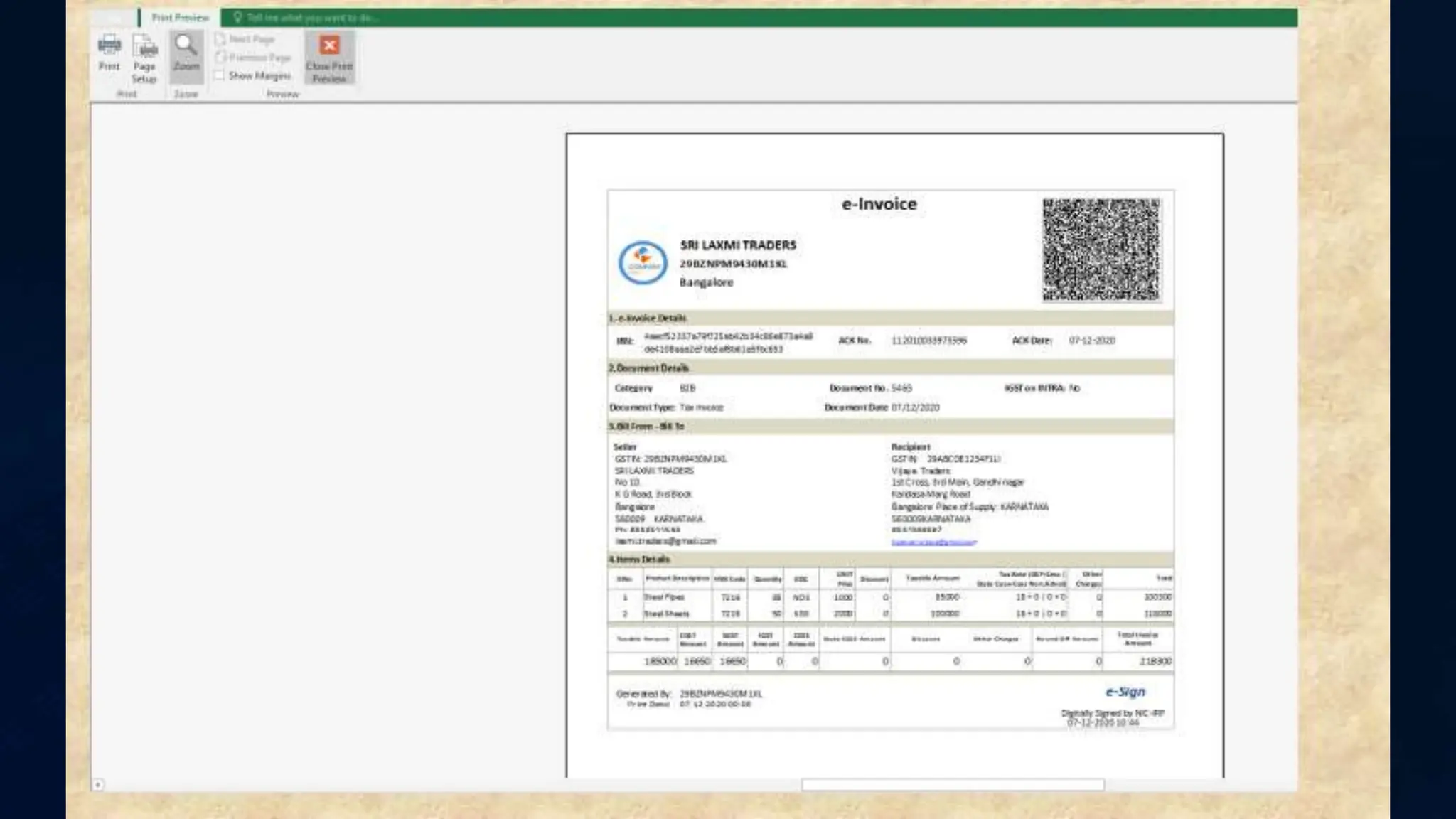

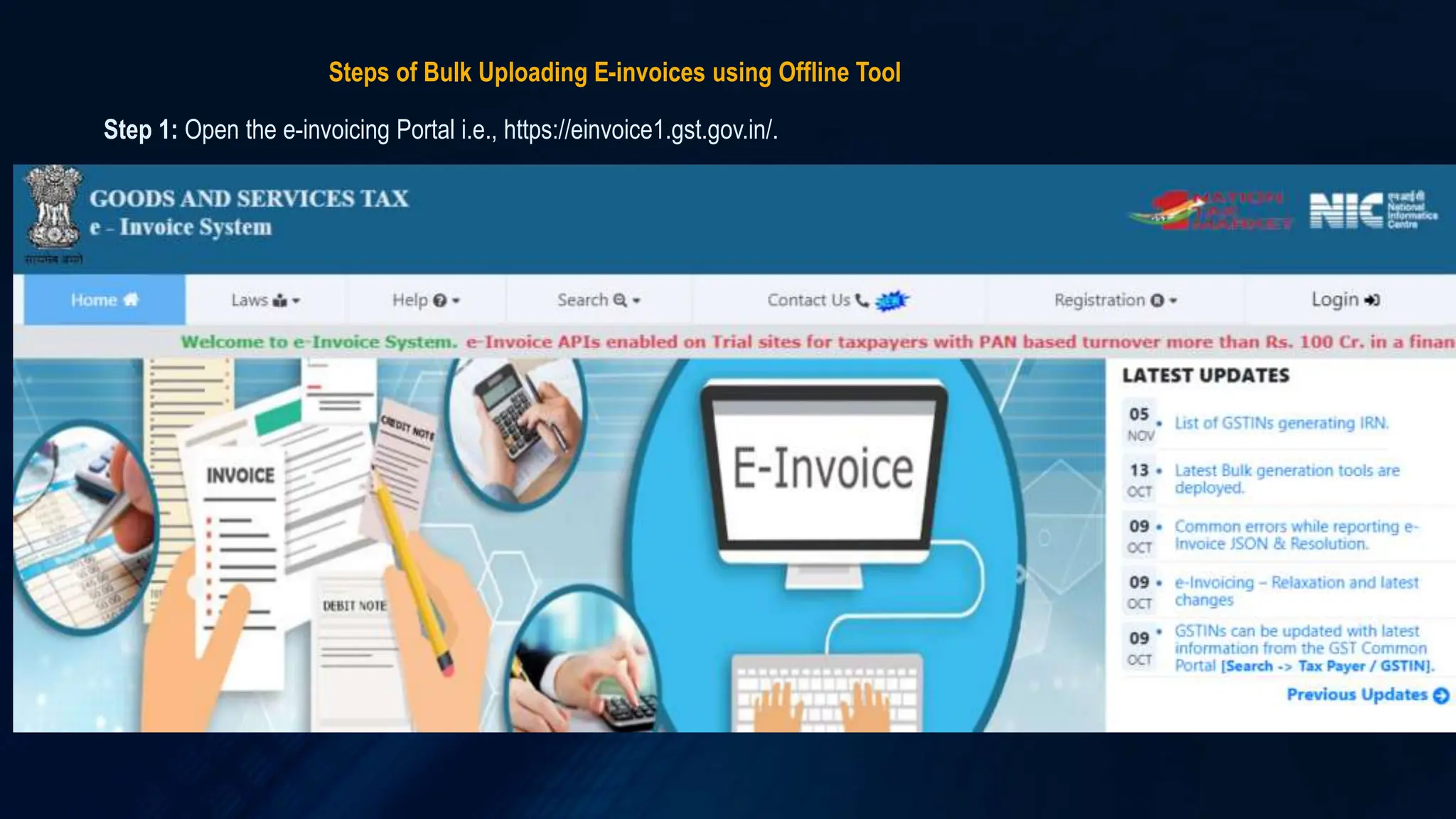

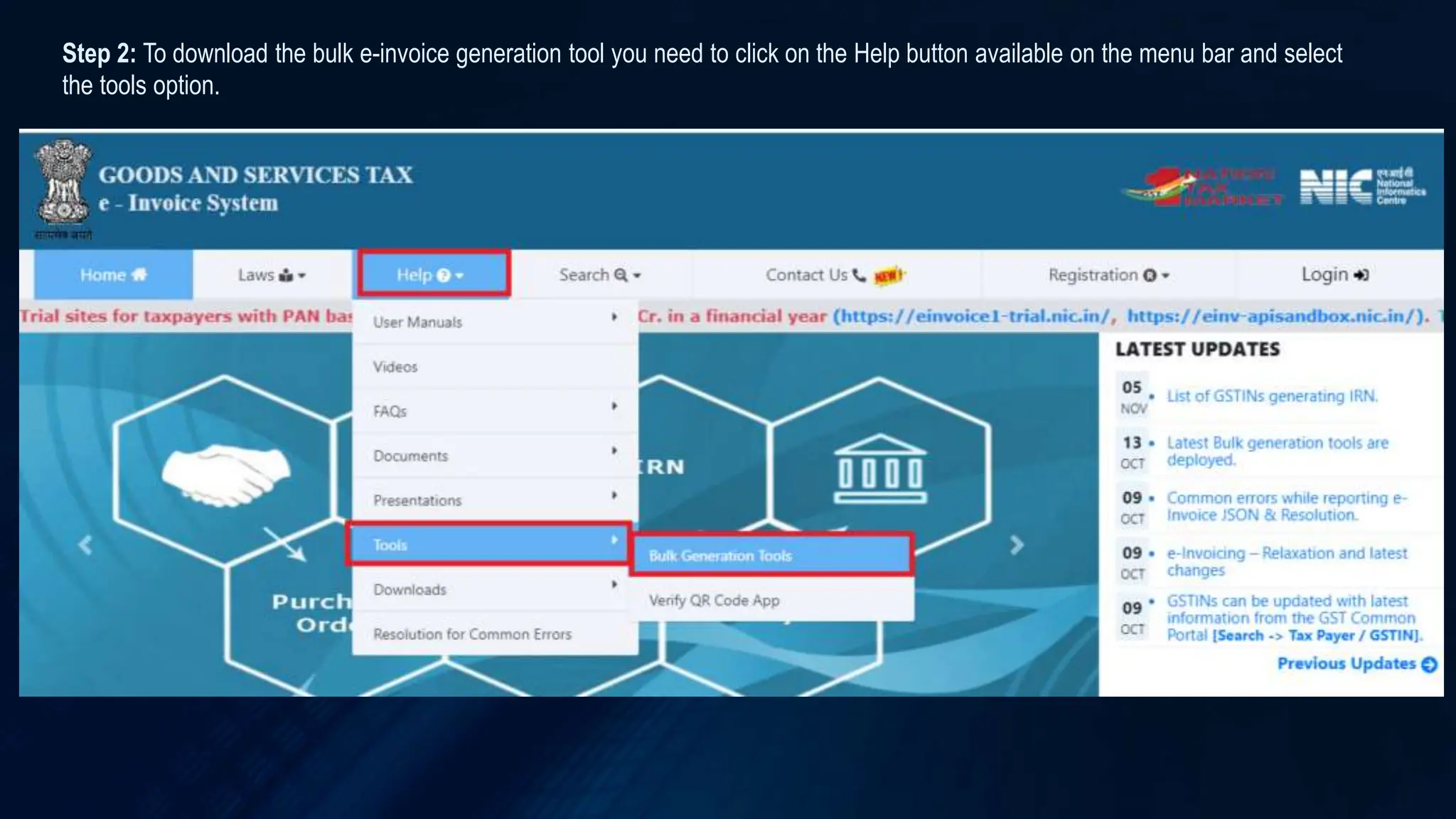

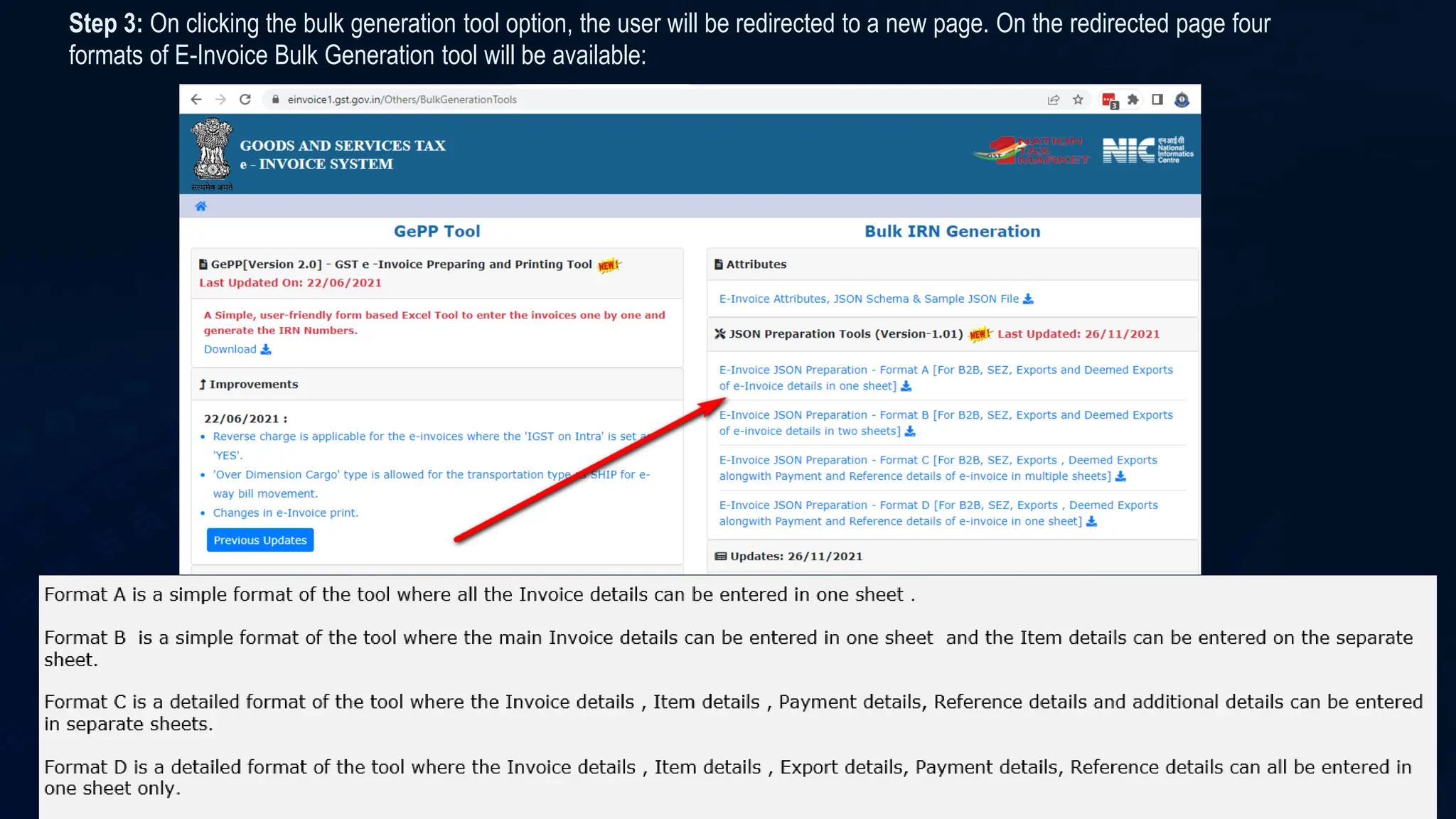

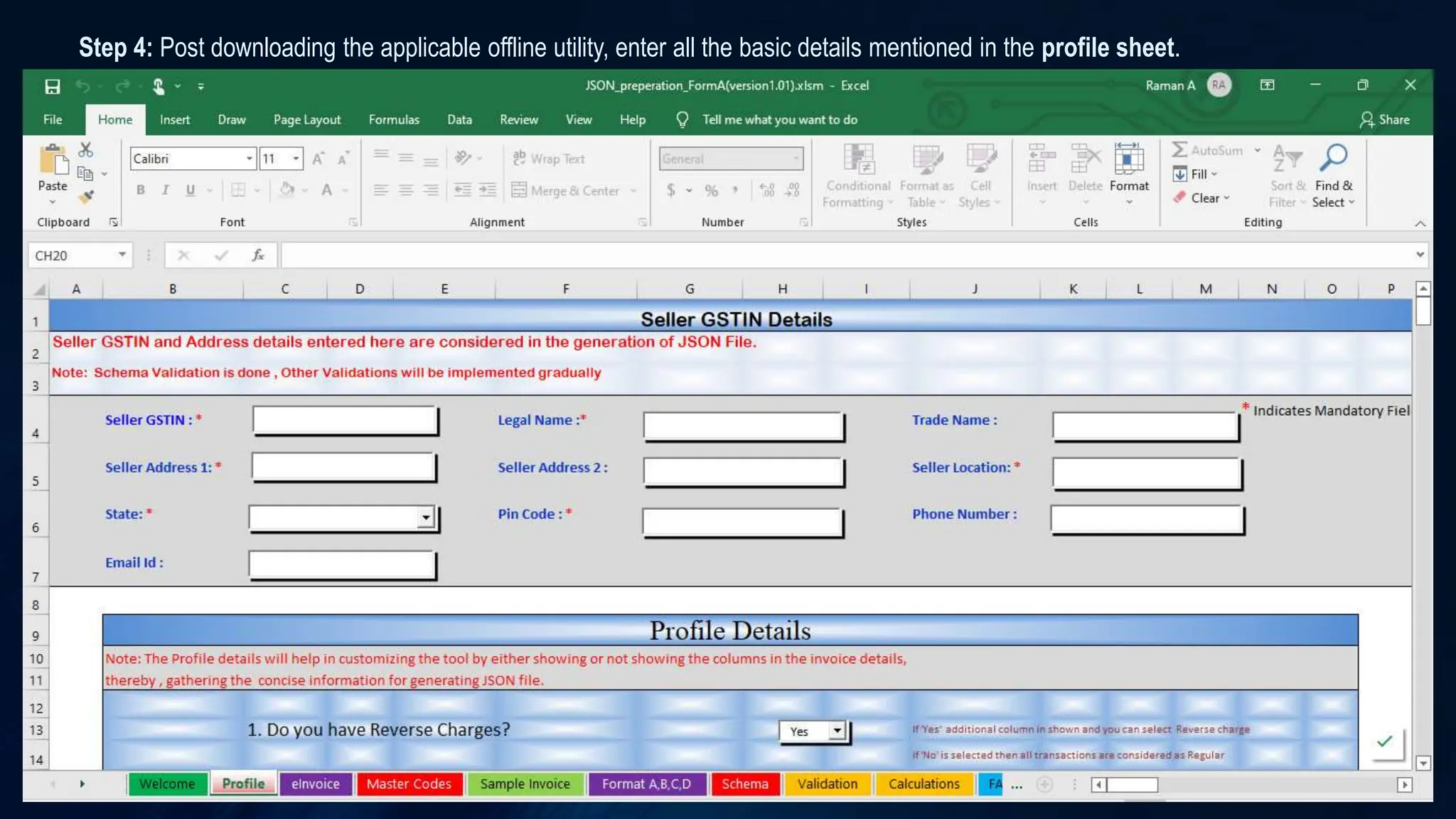

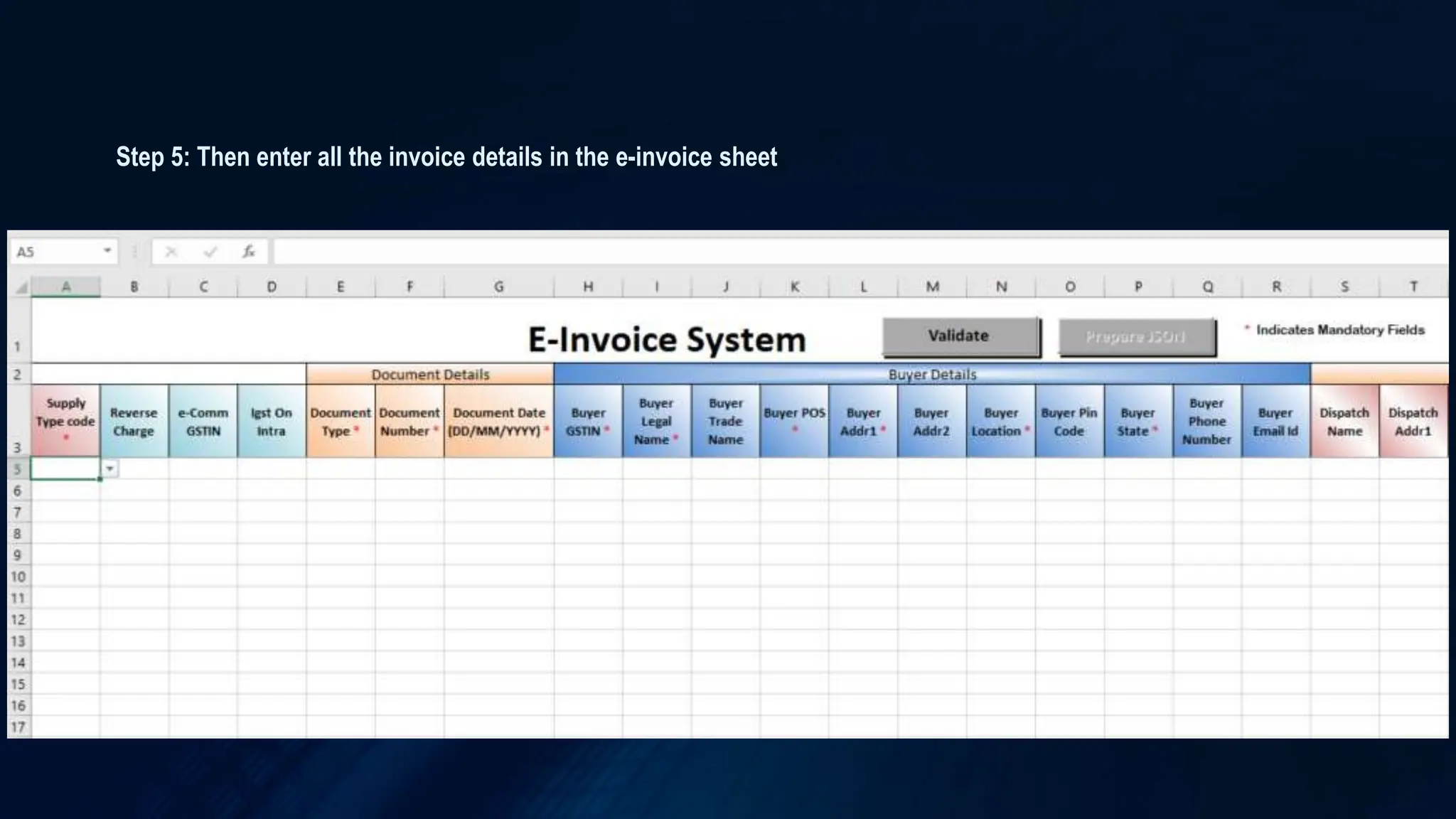

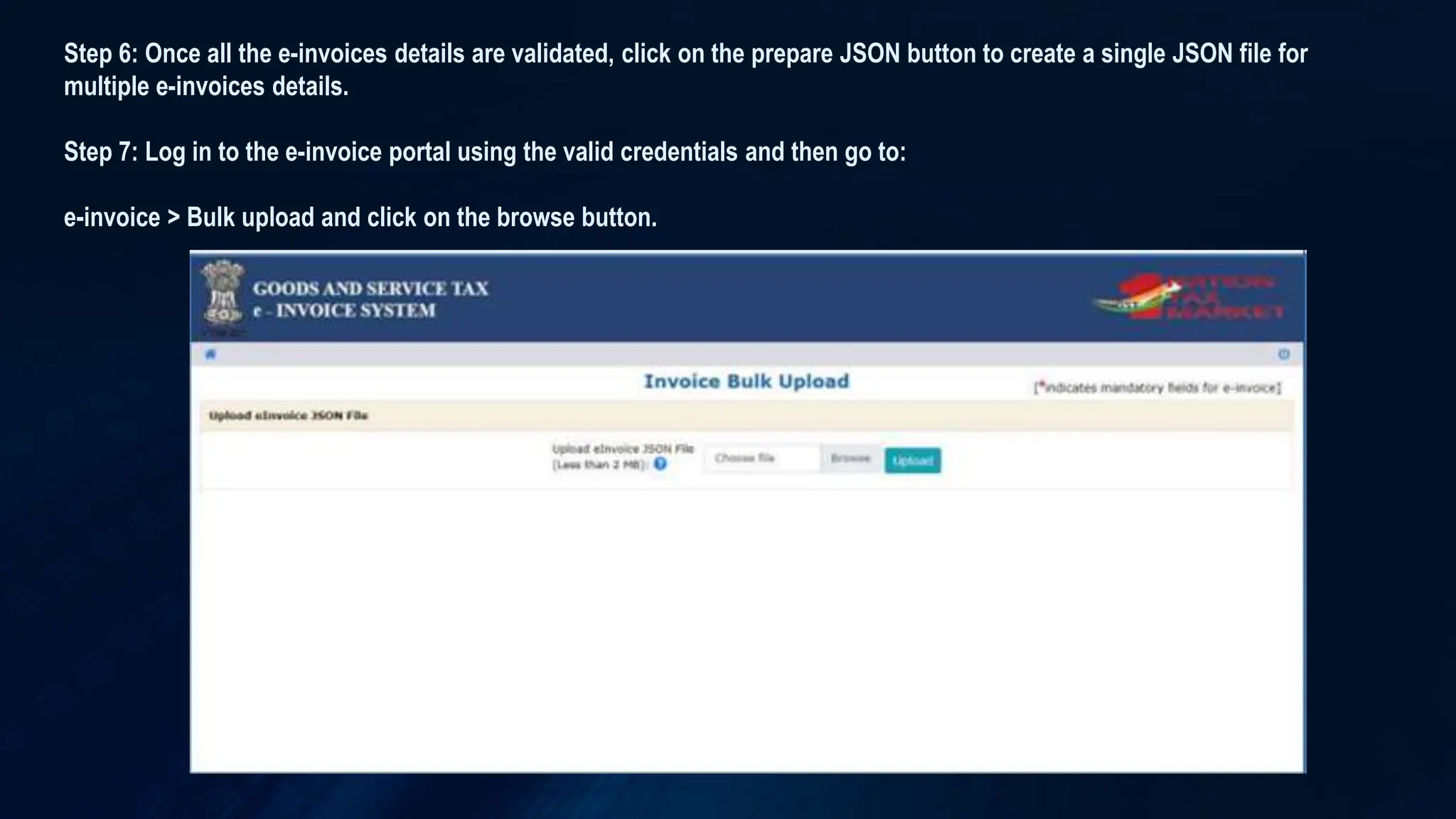

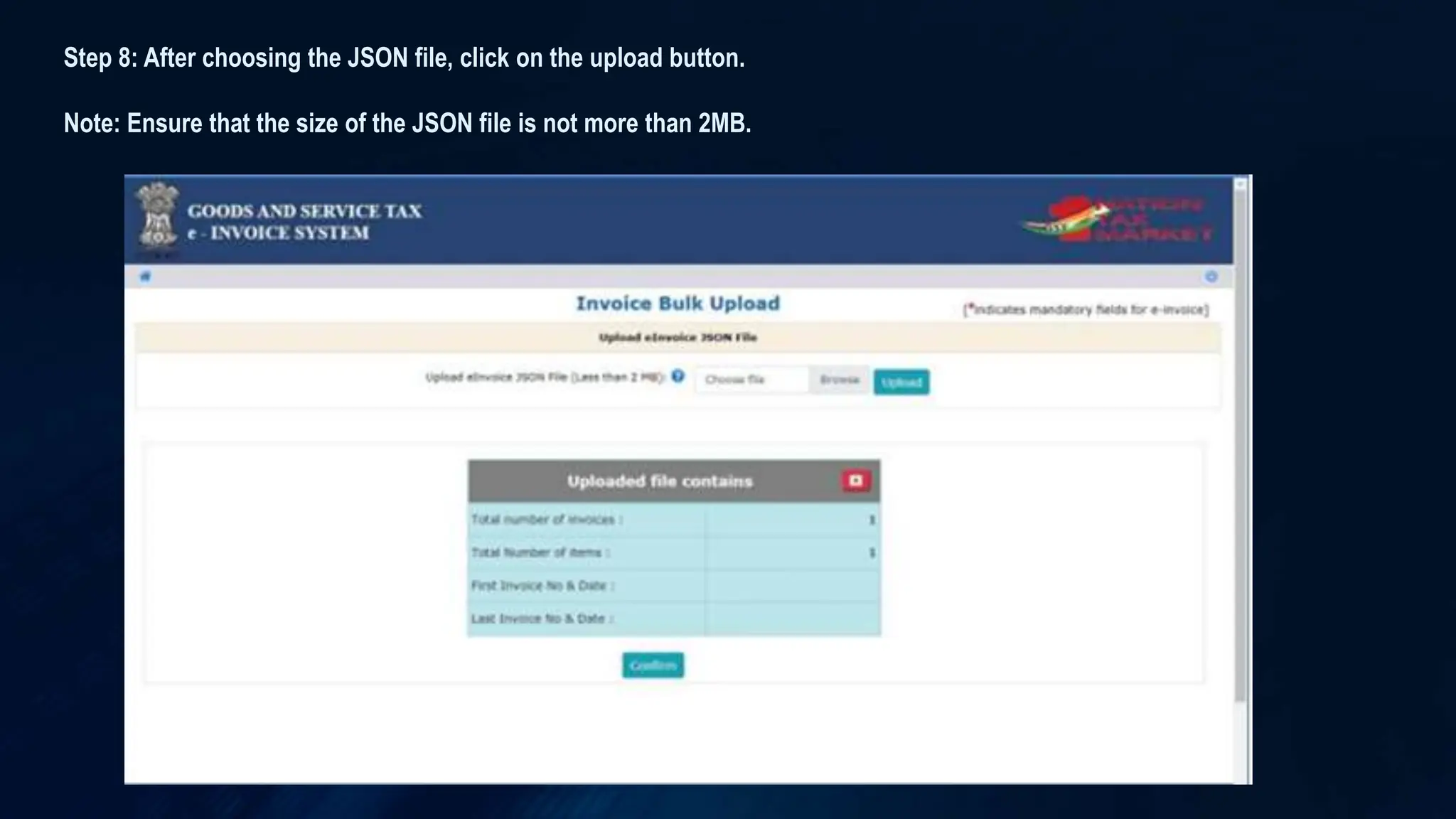

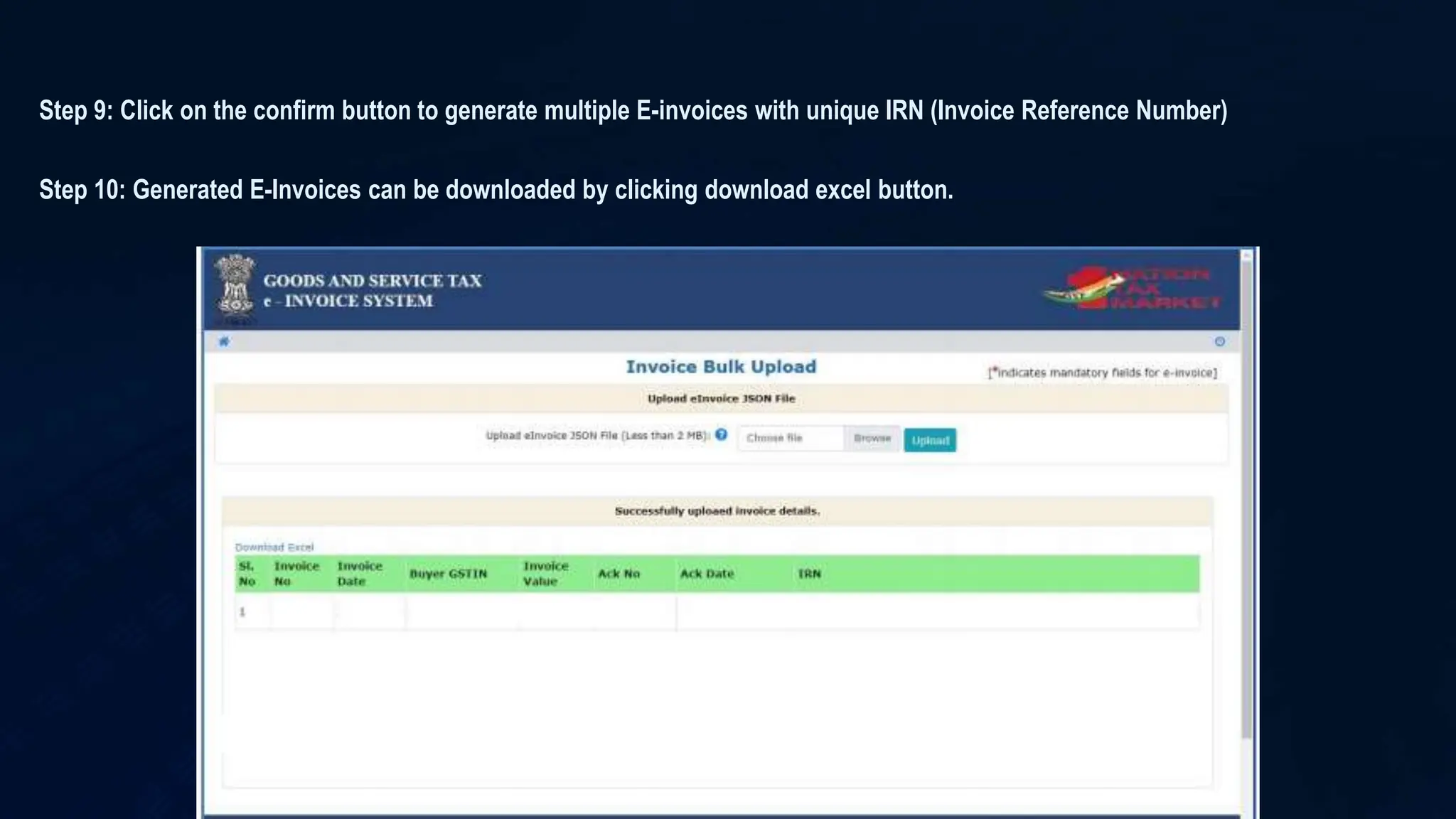

3. Steps are outlined for bulk uploading of e-invoices using the offline tool as well as direct and indirect API integration methods.