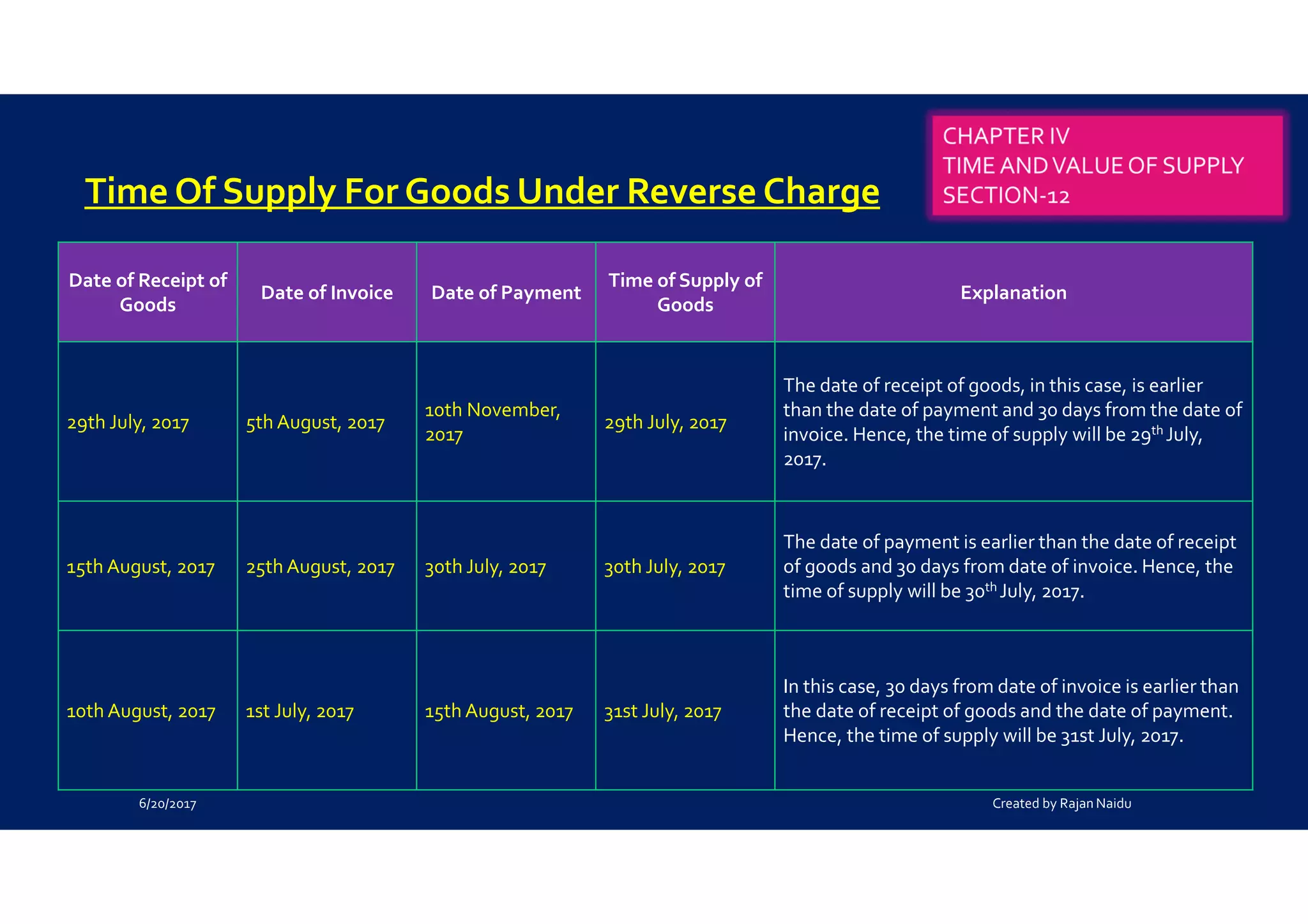

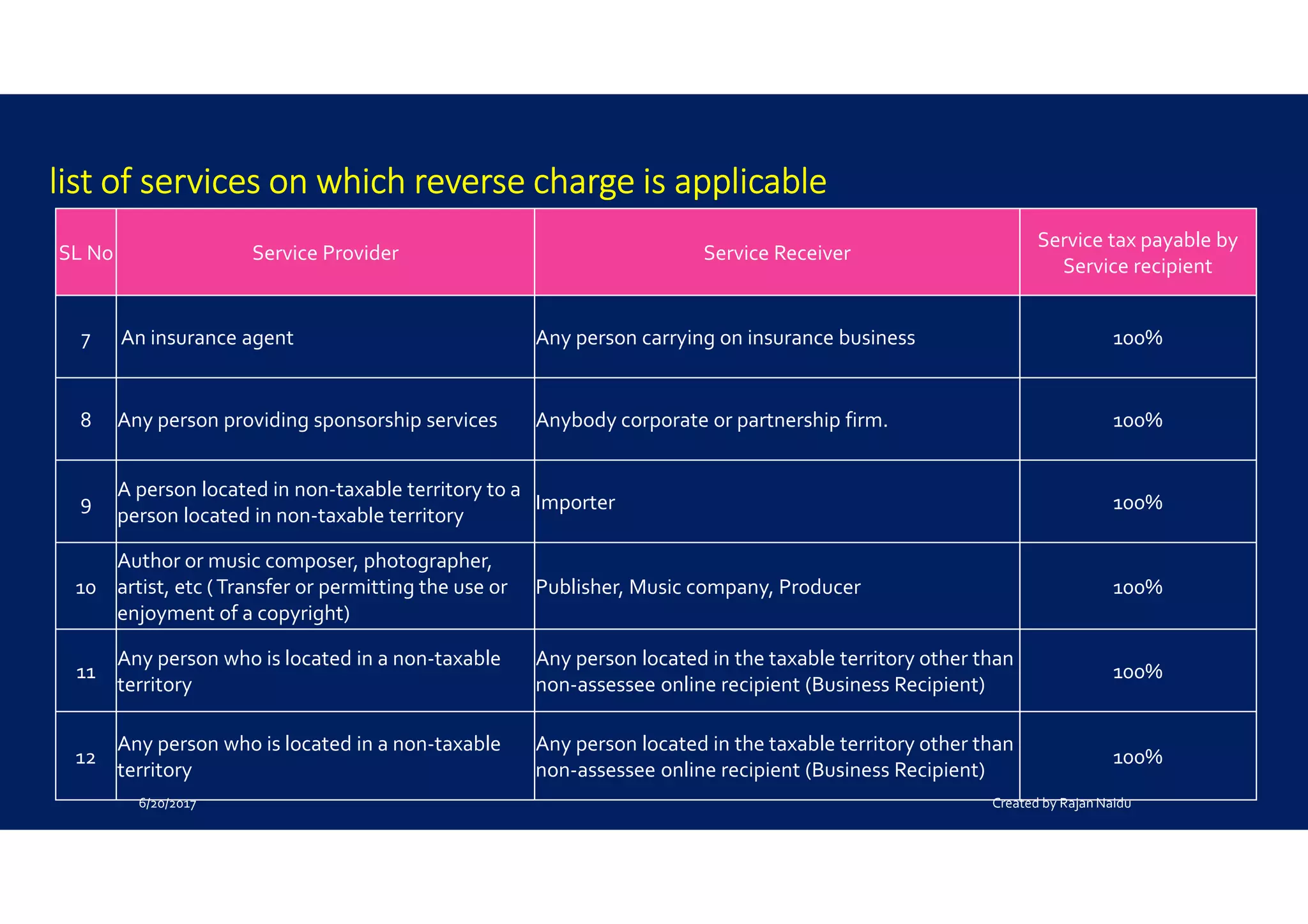

The document discusses the reverse charge mechanism under GST. Under reverse charge, the recipient of goods or services is responsible for paying the tax instead of the supplier. All persons liable for tax under reverse charge must register for GST regardless of turnover thresholds. Reverse charge applies in situations like unregistered dealers selling to registered dealers, services provided through e-commerce operators, and certain services specified by authorities. The document provides details on the time of supply and input tax credit availability for reverse charge transactions.

![GST REGISTRATION UNDER RCM

All persons who are required to pay tax

under reverse charge have to register for

GST irrespective of the threshold

[Threshold:- turnover in a financial year

exceeds Rs 20lakhs (Rs 10 lakhs for North

eastern and hill states)]

Section 22 of the CGST Act, 2017

6/20/2017 Created by Rajan Naidu](https://image.slidesharecdn.com/rcmundergst-170620061233/75/Rcm-under-gst-3-2048.jpg)