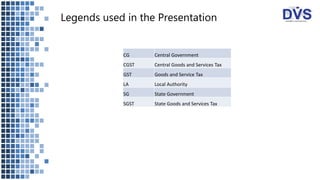

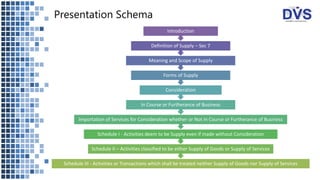

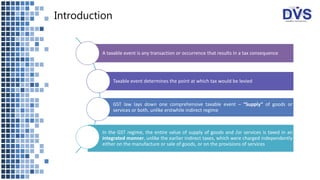

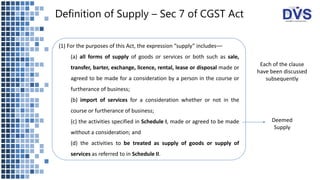

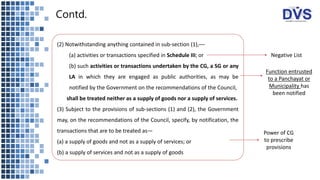

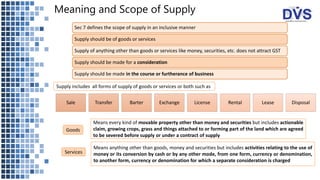

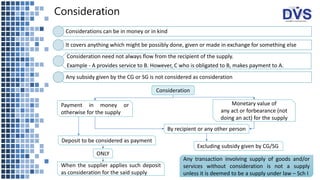

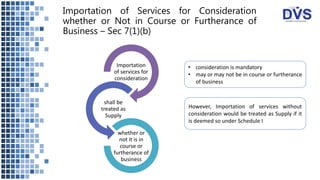

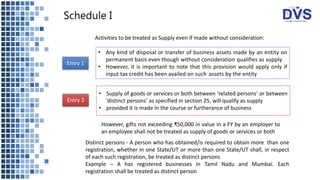

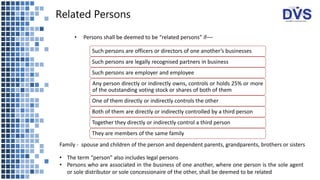

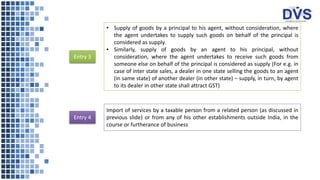

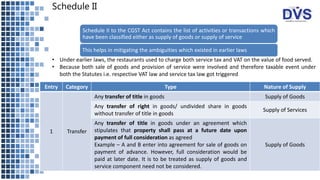

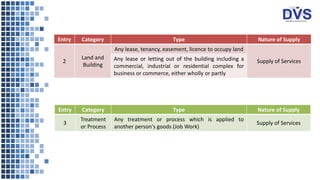

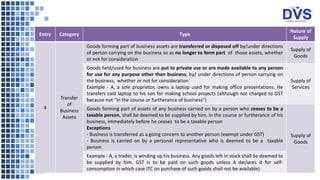

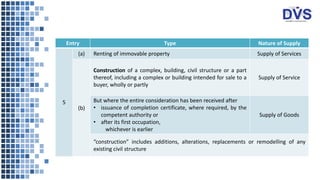

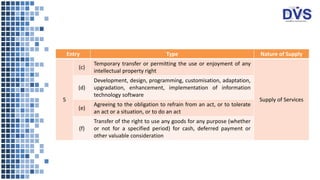

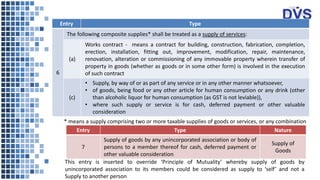

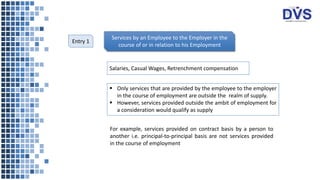

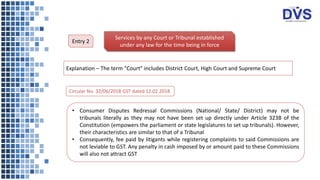

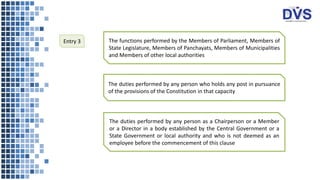

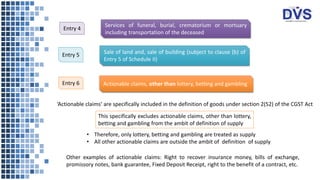

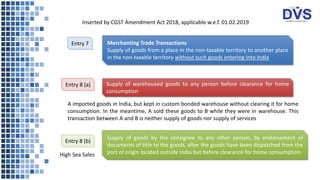

The document discusses the scope and definitions related to the supply of goods and services under the GST regime, outlining taxable events and the classification of various transactions. It includes explanations of what constitutes supply, including sale, transfer, and importation, as well as detailing the distinction between different forms of supply and exceptions for non-supply activities. Additionally, it references relevant schedules from the CGST Act for specific classifications and rules.