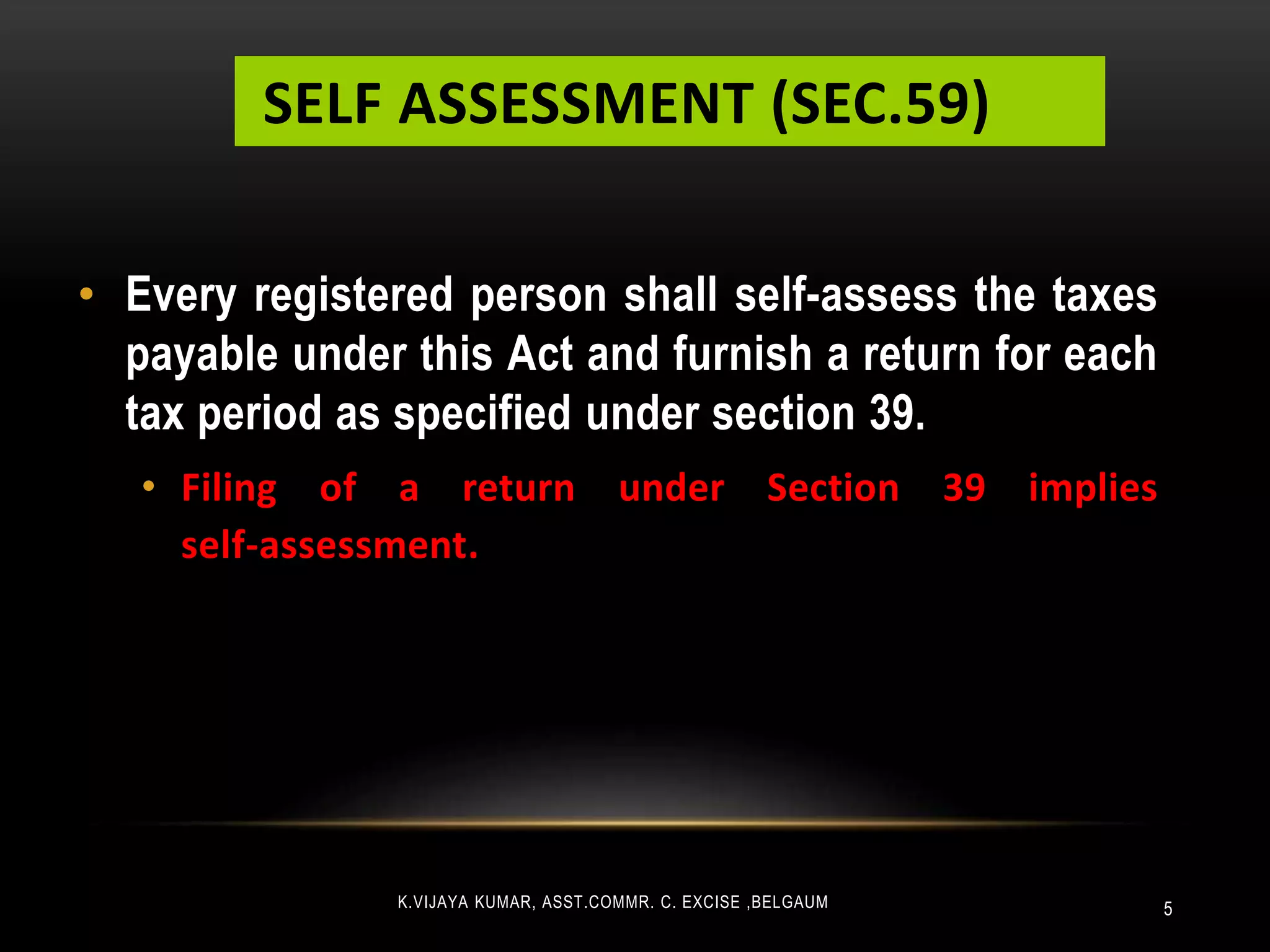

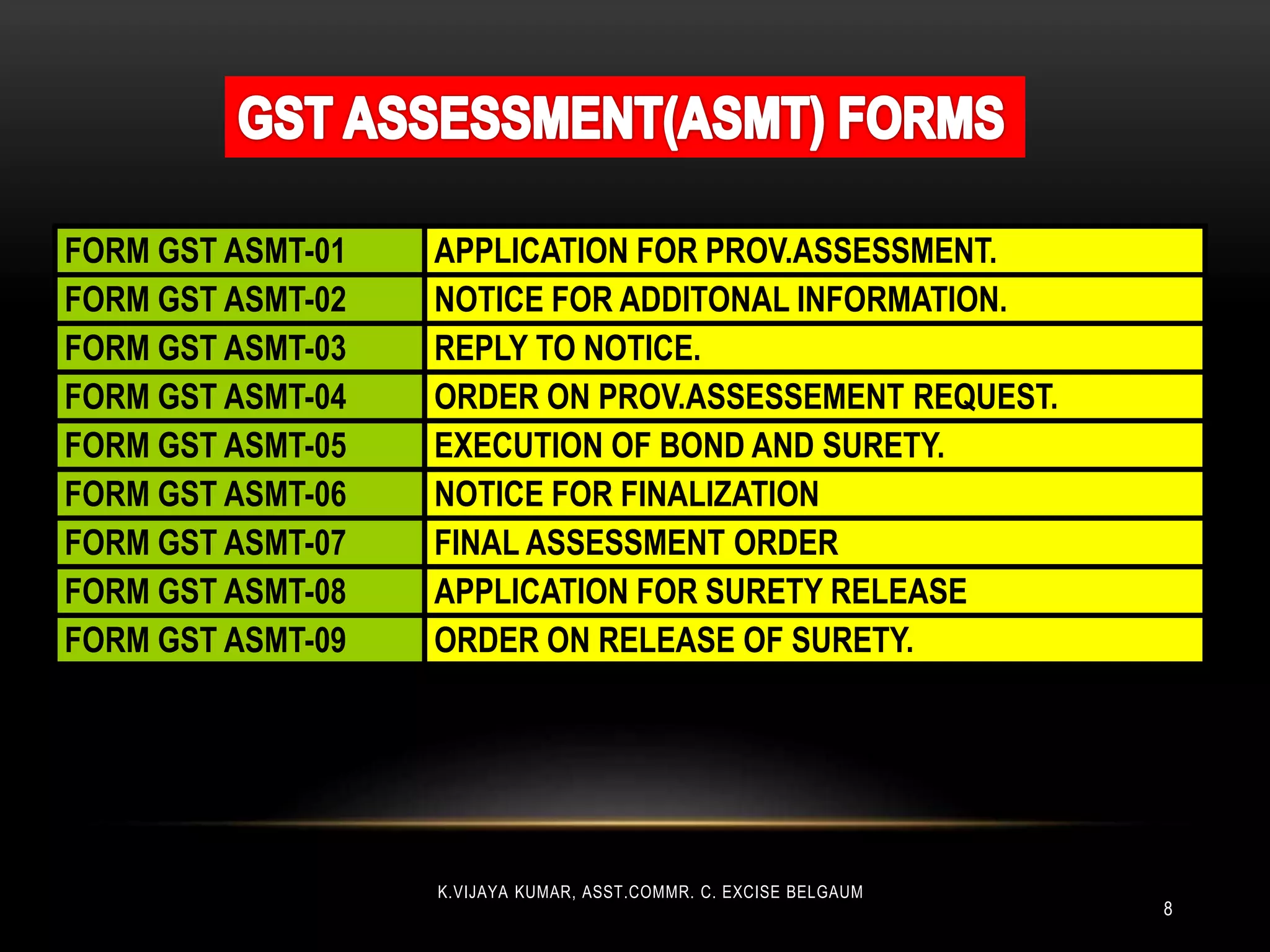

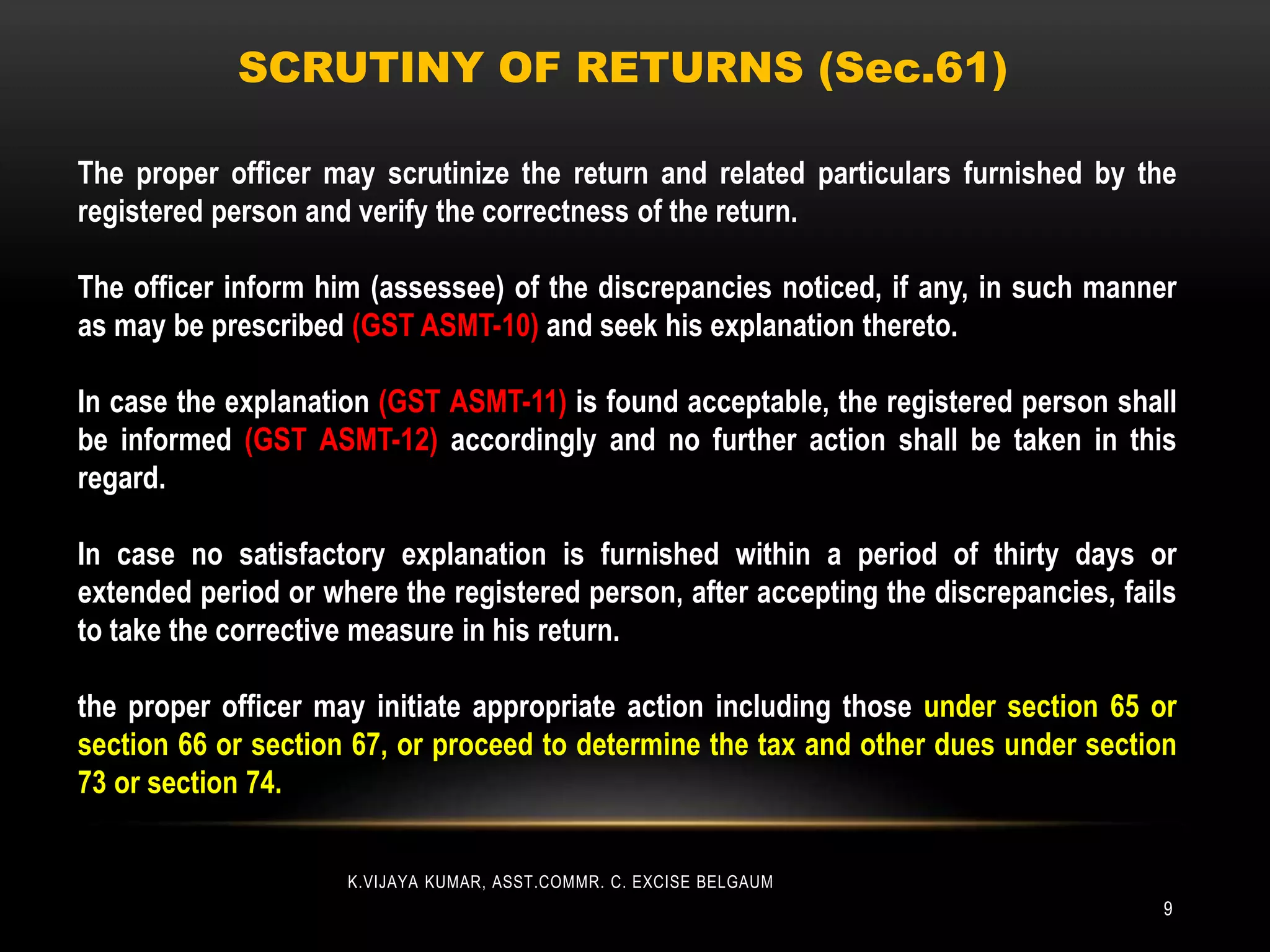

Self-assessment, provisional assessment, scrutiny of returns, assessment of non-filers and unregistered persons, and summary assessment are the main types of assessments under the Act. The proper officer may conduct audit of registered persons to verify correctness of returns filed. Special audit can also be ordered if the officer feels value or credit availed requires further verification. Audit report findings can initiate proceedings for recovery of short paid tax or erroneously claimed credits.

![ASSESSMENT OF UN-REGISTERED PERSONS

11

• If a taxable person fails to obtain registration even

though he is liable to do so. The proper officer shall

issue notice (FORM GST ASMT-14).

• Proper officer may pass a best judgment assessment

order (FORM GST ASMT-15) within 5 years of due

date of annual return.

• Such order to be passed only after granting an

opportunity of being heard to said person.

• [Section 62]

K.VIJAYA KUMAR, ASST.COMMR. C. EXCISE BELGAUM](https://image.slidesharecdn.com/assessmentandaudit-170517183930/75/Assessment-and-Audit-under-GST-11-2048.jpg)