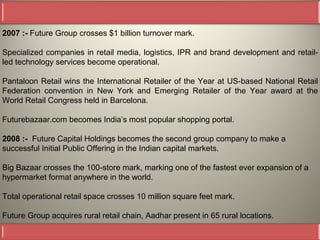

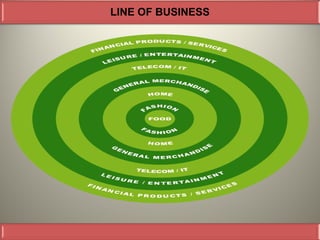

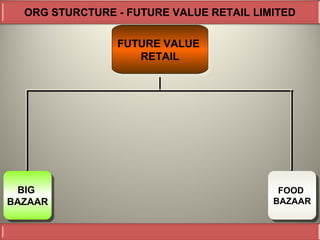

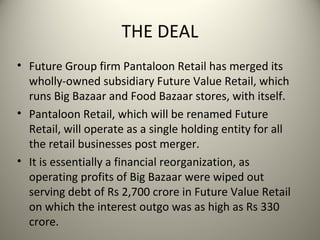

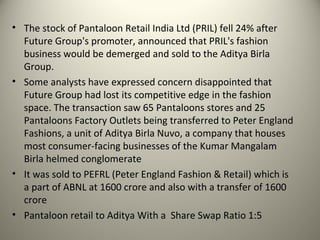

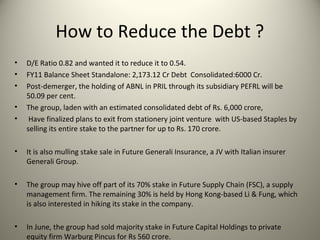

Future Group is an Indian conglomerate with interests in retail, infrastructure, and logistics. It operates popular retail chains like Big Bazaar and Food Bazaar. In 2007, Future Group crossed $1 billion in turnover. It acquired rural retail chain Aadhar in 2008. To reduce debt from Rs. 6,000 crore, Future Group demerged its fashion business and sold it to Aditya Birla Group for Rs. 1,600 crore. It also plans to exit other non-core businesses and joint ventures to further reduce debt. The restructuring aims to lower Future Group's debt-to-equity ratio and restore investor confidence.