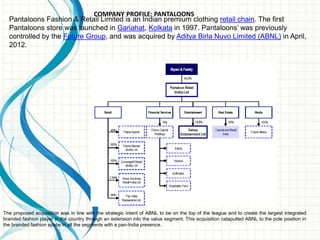

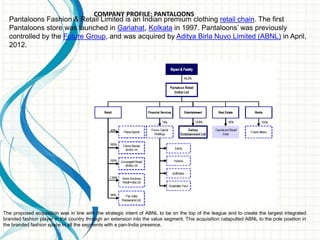

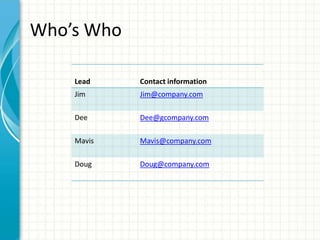

The document provides an overview of training for new employees. It begins with some definitions of mergers and demergers. It then discusses the case of PFRL and ABFRL, where Aditya Birla Nuvo Ltd announced consolidating its branded apparel businesses under Pantaloons Fashion & Retail Ltd through a series of mergers and demergers. This would create Aditya Birla Fashion & Retail Ltd and unlock shareholder value. It then provides profiles of Pantaloons, describing it as a premium retail chain and one of India's top fashion retailers. It discusses Pantaloons' acquisition and integration with ABNL to become a leading integrated fashion player in India.

![APPLICABLE INDIAN LAWS

Companies Act, 1956 – [Sec 391-394]

Listing Agreement

Accounting Standard - 14

SEBI Takeover Code (in case of acquisition by/of a listed

company)

Company Court Rules

FEMA (in case of merger of companies having foreign

capital)

Competition Act, 2002

Income Tax Act, 1961

Indian Stamp Act](https://image.slidesharecdn.com/pantaloons-150710155407-lva1-app6892/85/Pantaloons-4-320.jpg)