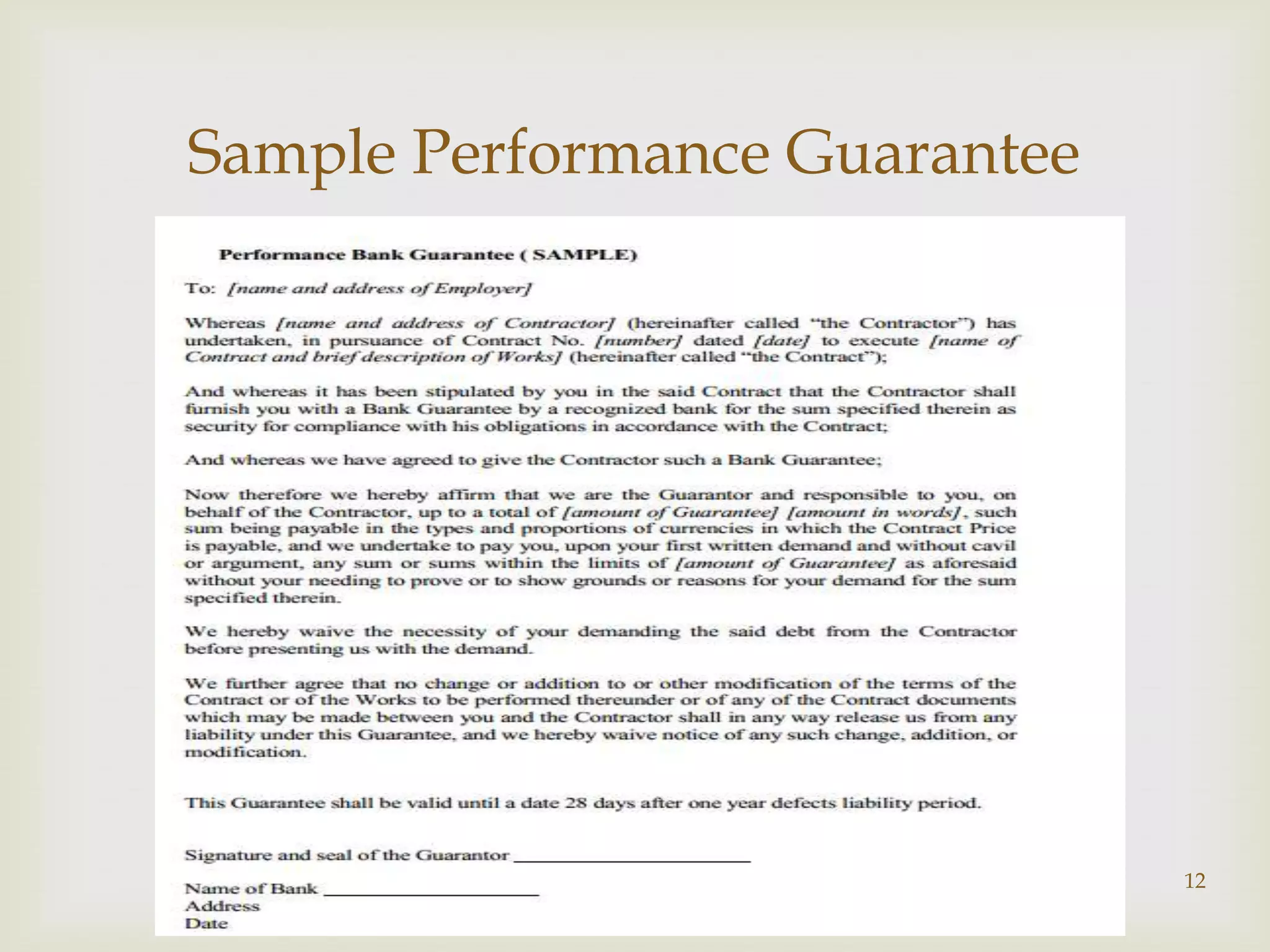

This document discusses bank guarantees and co-acceptance of bills. It provides details on what a bank guarantee is, the parties involved, types of guarantees, how guarantees are used in export business and safeguards for issuing guarantees. It also discusses guidelines for guarantee business, precautions for issuing guarantees, and how banks can provide co-acceptance of bills as a facility for their customers.