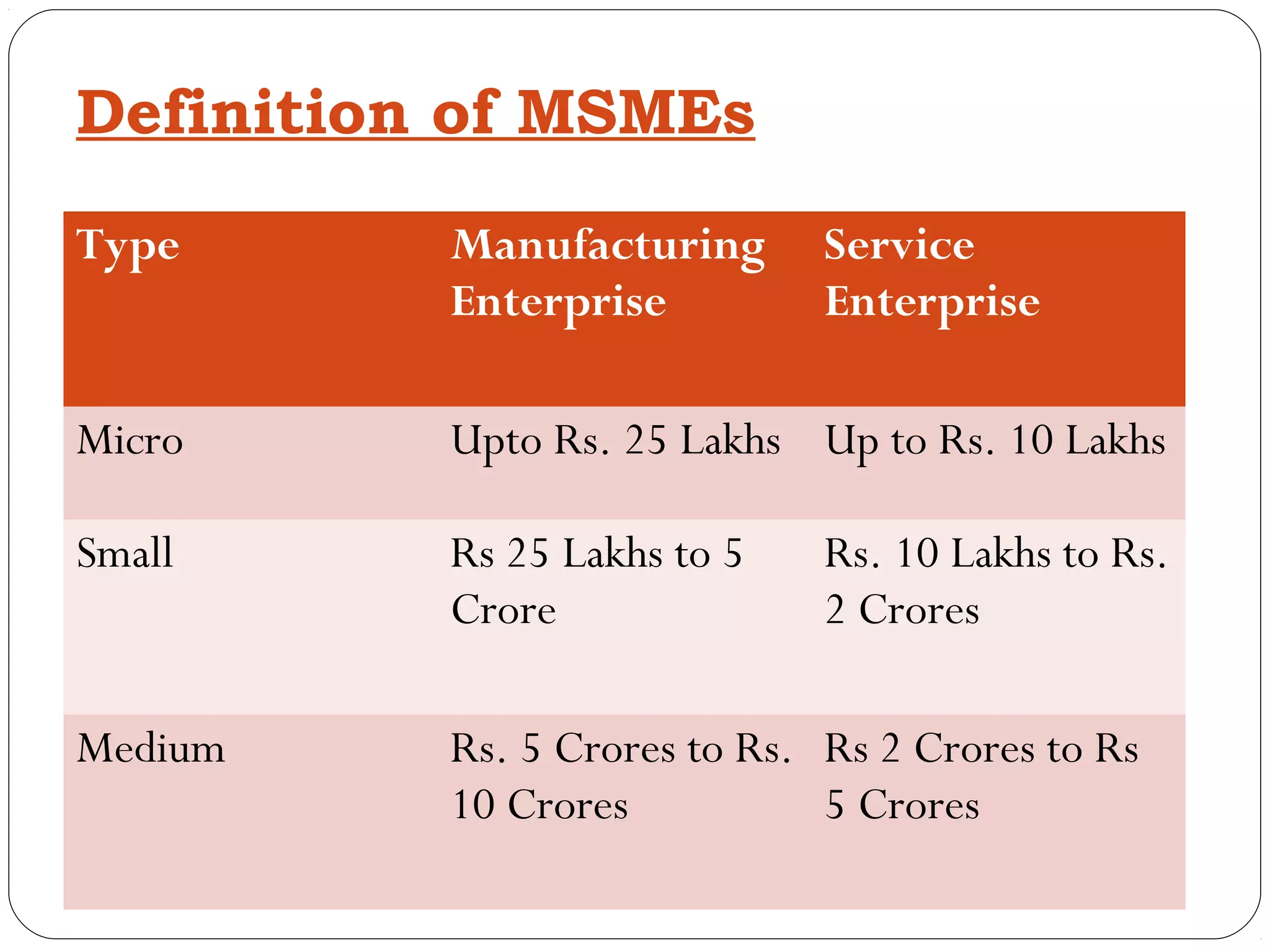

This document discusses financing for micro, small, and medium enterprises (MSMEs) in India. It defines MSMEs based on investment levels and classifies them under priority sectors. It outlines various manufacturing and service activities eligible for MSME financing. It also describes the types of credit facilities available to MSMEs, including term loans, cash credits, and letters of credit. Processing procedures for loan applications are explained, along with guidelines on maintaining application registers and rejecting proposals.