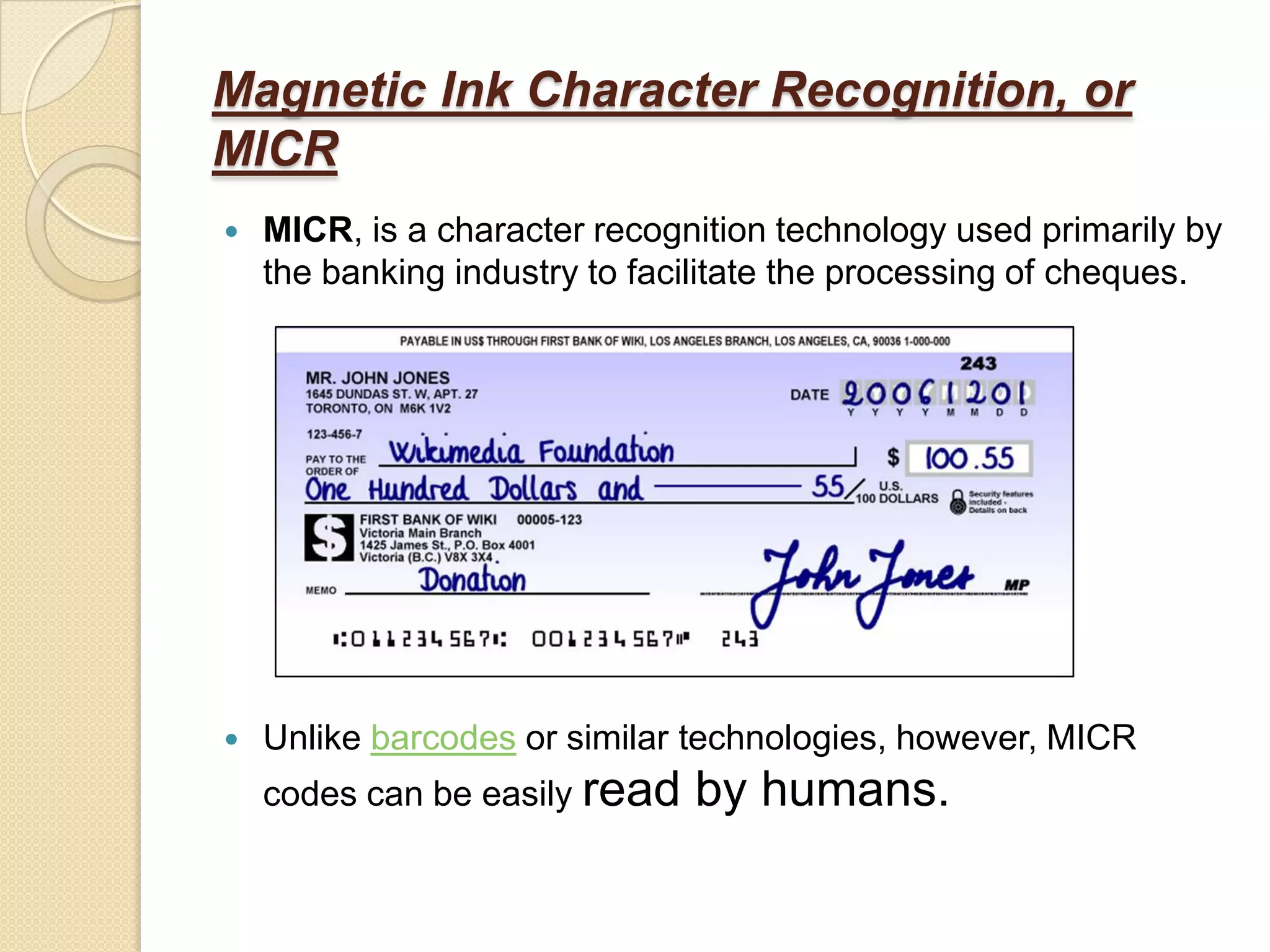

The Saraf Committee was appointed by the RBI in 1994 to recommend ways to modernize the Indian banking system through new technologies. The committee recommended establishing an Electronic Funds Transfer system and electronic clearing services. It also suggested expanding the use of Magnetic Ink Character Recognition and introducing online inter-bank clearing. The recommendations helped modernize Indian banking and introduce online banking services.