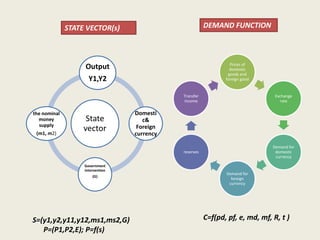

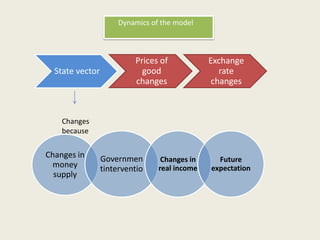

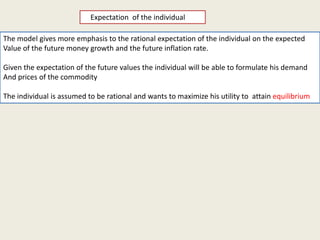

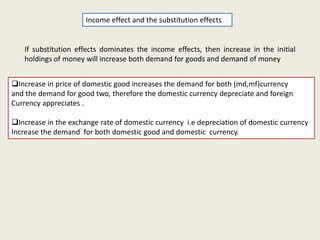

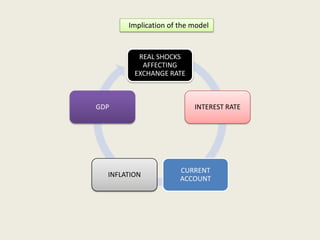

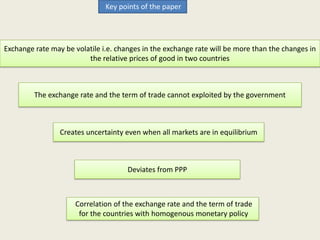

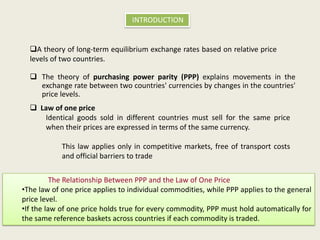

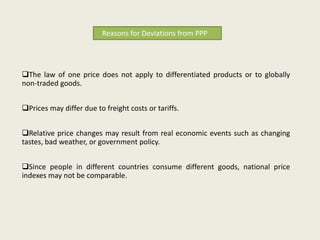

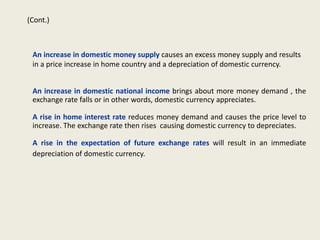

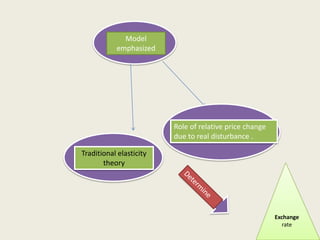

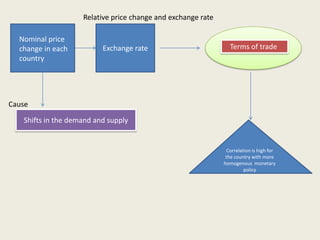

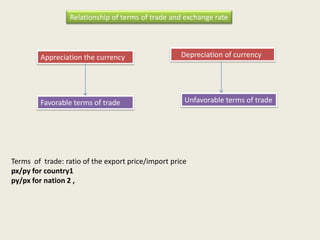

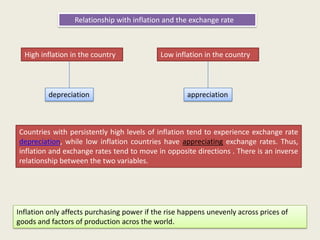

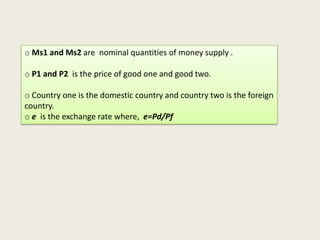

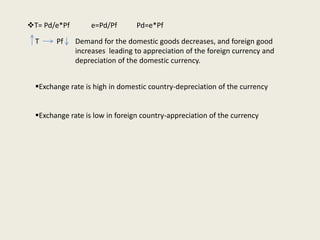

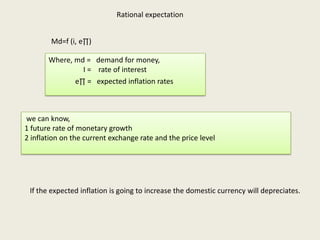

This paper develops an equilibrium model of the determination of exchange rates and prices of goods. Changes in relative prices due to supply or demand shifts induce changes in exchange rates and deviations from purchasing power parity. These changes may create a correlation between the exchange rate and the terms of trade, but this correlation cannot be exploited by governments to affect the terms of trade through foreign exchange market operations. The model emphasizes the role of relative price changes due to real disturbances and how these changes affect both exchange rates and the terms of trade through shifts in supply and demand. Government interventions in foreign exchange markets cannot influence exchange rates if the relationship between exchange rates and terms of trade is due to shifts in real supply and demand for domestic and foreign goods.

![Relationship between exchange rate and relative prices.

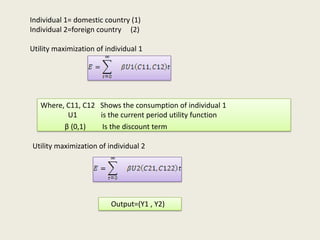

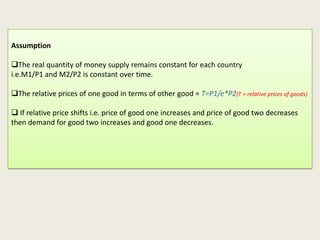

ASSUMPTION OF THE MODEL.

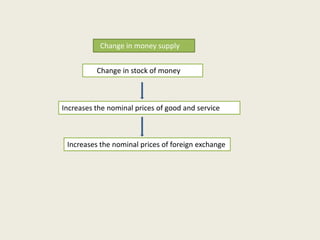

•Money is only used for precautionary purpose and transactioanary purpose

•Real demand for money is not constant .i.e. M1/P1 and M2/P2.]

• A change in relative price T is partially effected by e and partially effected byP1

and P2.

•Good1 is produce in country 1and good 2 is produce in country 2

•Goods are not stored.

•Complete specialization

•Shocks to production is independent across good and over time](https://image.slidesharecdn.com/exchangeratedetermination-131126011810-phpapp01/85/Exchange-rate-determination-28-320.jpg)