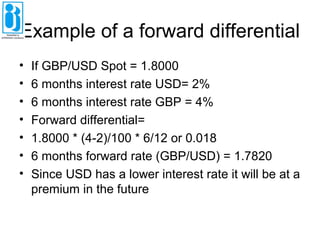

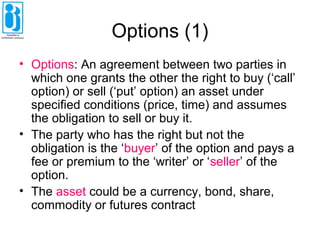

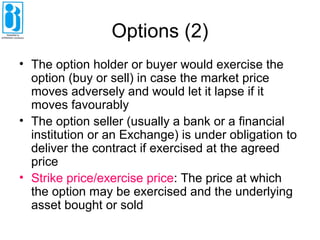

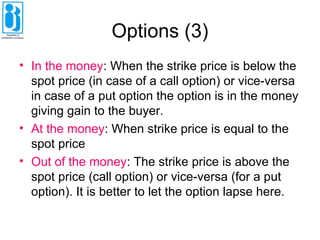

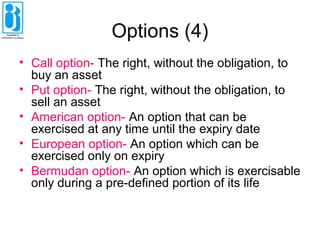

This document discusses risk management and derivatives in foreign exchange dealings. It covers the functions of a bank's foreign exchange dealing room, the types of risks involved like market risk, liquidity risk, and credit risk. It then discusses various derivative instruments like forwards, futures, options, and swaps. It provides examples and explanations of how these derivatives work. It also outlines RBI guidelines for risk management in foreign exchange and the evolution of derivatives markets in India.