The document provides a comprehensive overview of derivatives, defining them as financial contracts whose value relies on underlying assets such as commodities and financial instruments. It outlines the main types, including options and forwards, their uses in hedging and speculation, and distinguishes between over-the-counter (OTC) and exchange-traded derivatives, noting their respective features, regulatory environments, and user bases. Additionally, it explains the roles of various investors, including individuals, institutions, and derivative dealers, emphasizing how derivatives serve as vital tools for risk management.

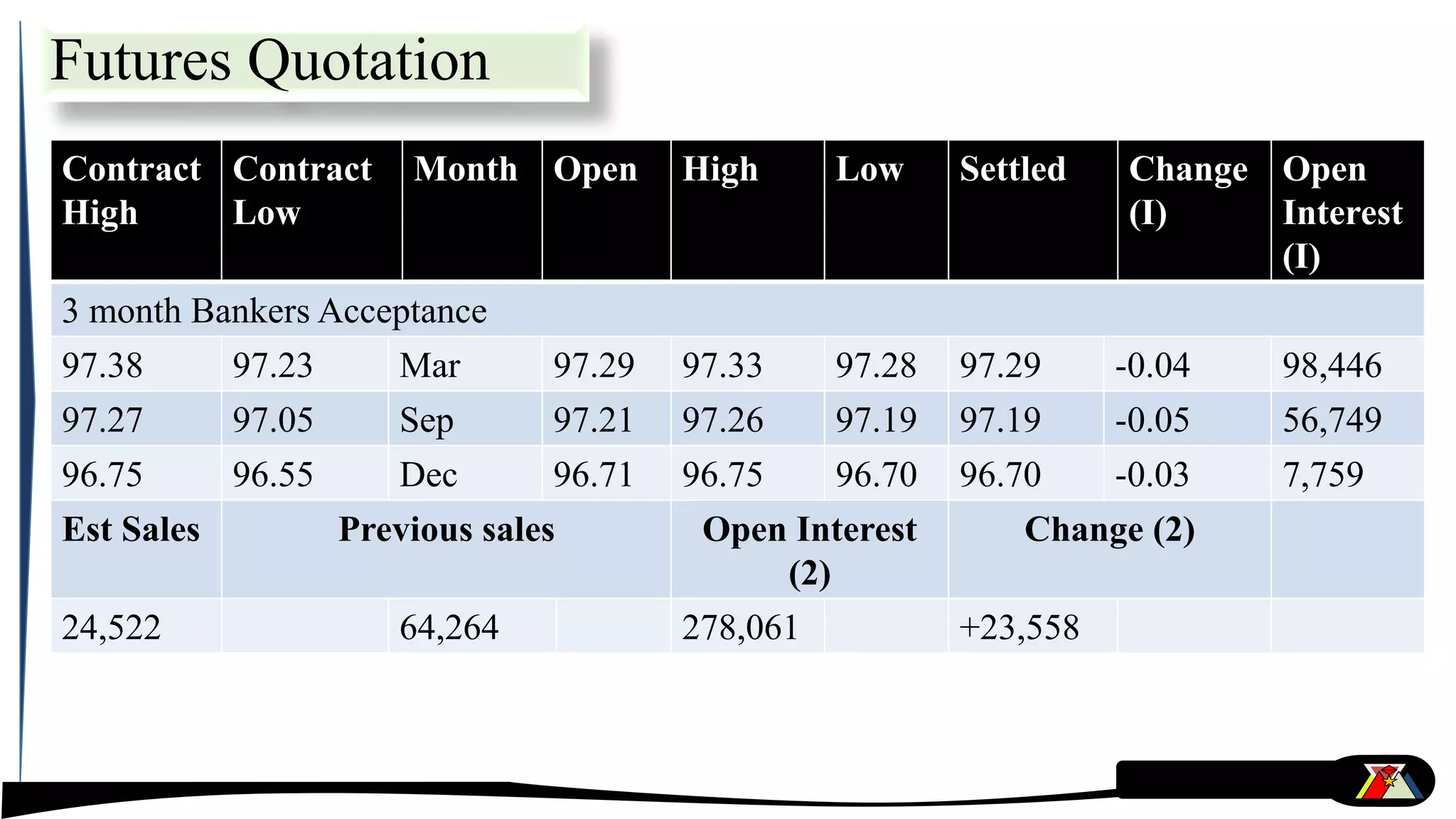

![Strategy #1: Selling Futures to Speculate

If an investor sells 5 December Government of Canada ten-year bond

futures at a price of 105. (- like prices in the bond market, prices of

bond futures contracts are quoted on a “per $100 of face value”

basis.)

Each bond futures contract has a $100,000 face value bond as its

underlying asset, thus the investor has agreed to sell a $500,000 face

value bond to the buyer on a specific date in December for total

proceeds of $525,000

([105 ÷ 100] × $100,000 bond × 5 contracts).](https://image.slidesharecdn.com/derivatives-160208125340/75/Derivatives-Fundamentals-112-2048.jpg)

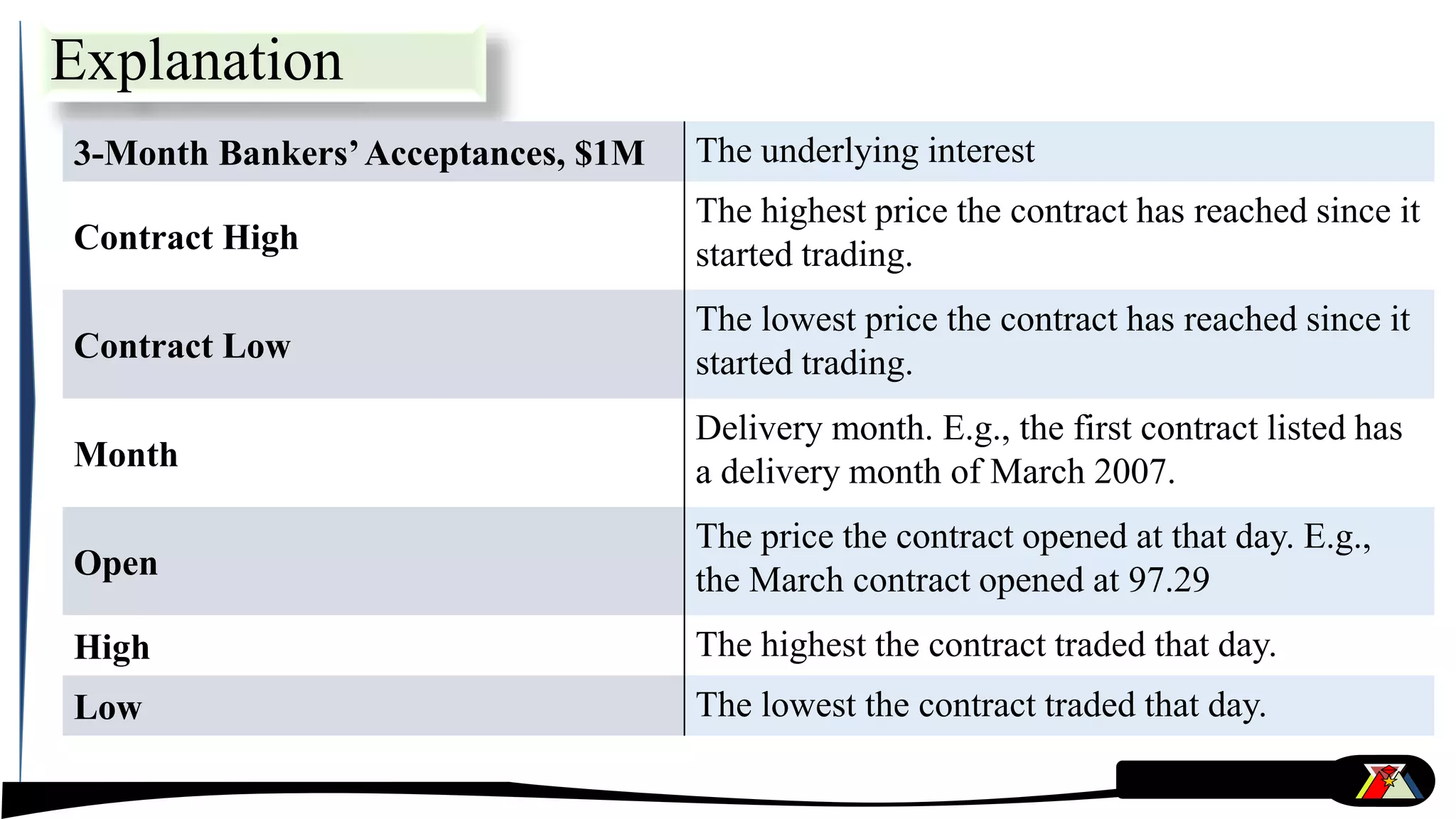

![Example: Strategy #1; Selling Futures to Speculate

if in early November the price of December bond futures have declined from

105 to 100, the investor could choose to buy back the futures at 100 and realize

a profit of 5 points, or $25,000 total

([5 ÷ 100] × $100,000 face value × 5 contracts).

If, however, December bond futures were trading at 107.50, the investor would

have to decide whether to buy the futures or hold on in the hope that the price

falls before the expiration date. If the investor decided to buy them back, a loss

equal to 2.5 points, or $12,500 total would be the result.

([2.5 ÷ 100] × $100,000 face value × 5 contracts)](https://image.slidesharecdn.com/derivatives-160208125340/75/Derivatives-Fundamentals-114-2048.jpg)