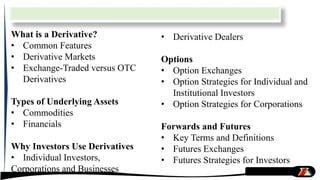

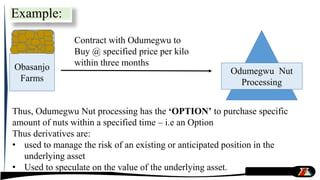

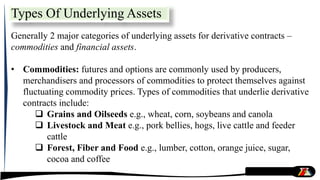

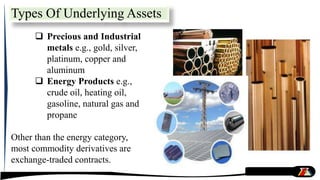

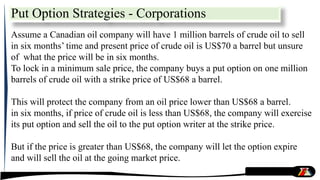

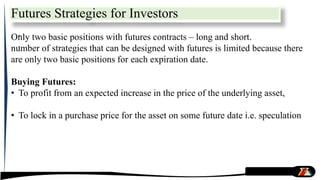

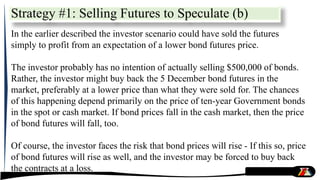

The document provides a comprehensive overview of derivatives, defining them as financial contracts whose value is derived from underlying assets such as commodities or financial instruments. It covers the main types of derivatives (options and forwards), their features, the markets they trade in (over-the-counter vs exchange-traded), and why various investors utilize them for hedging and speculation. Additionally, the document outlines the roles of individual and institutional investors, corporations, and derivative dealers in the derivatives market, along with the importance of risk management strategies.

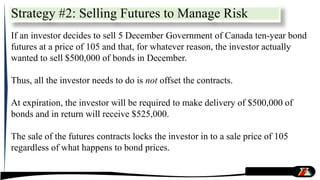

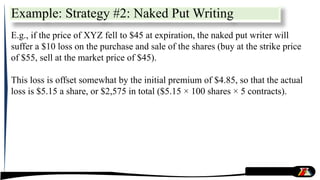

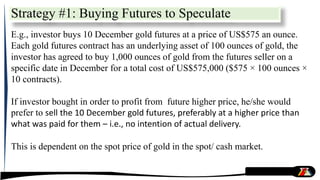

![Strategy #1: Selling Futures to Speculate

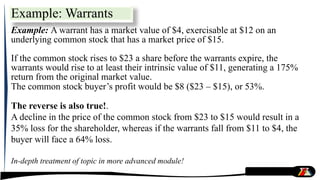

If an investor sells 5 December Government of Canada ten-year bond

futures at a price of 105. (- like prices in the bond market, prices of

bond futures contracts are quoted on a “per $100 of face value”

basis.)

Each bond futures contract has a $100,000 face value bond as its

underlying asset, thus the investor has agreed to sell a $500,000 face

value bond to the buyer on a specific date in December for total

proceeds of $525,000

([105 ÷ 100] × $100,000 bond × 5 contracts).](https://image.slidesharecdn.com/derivatives-160208122040/85/Derivatives-Fundamentals-113-320.jpg)

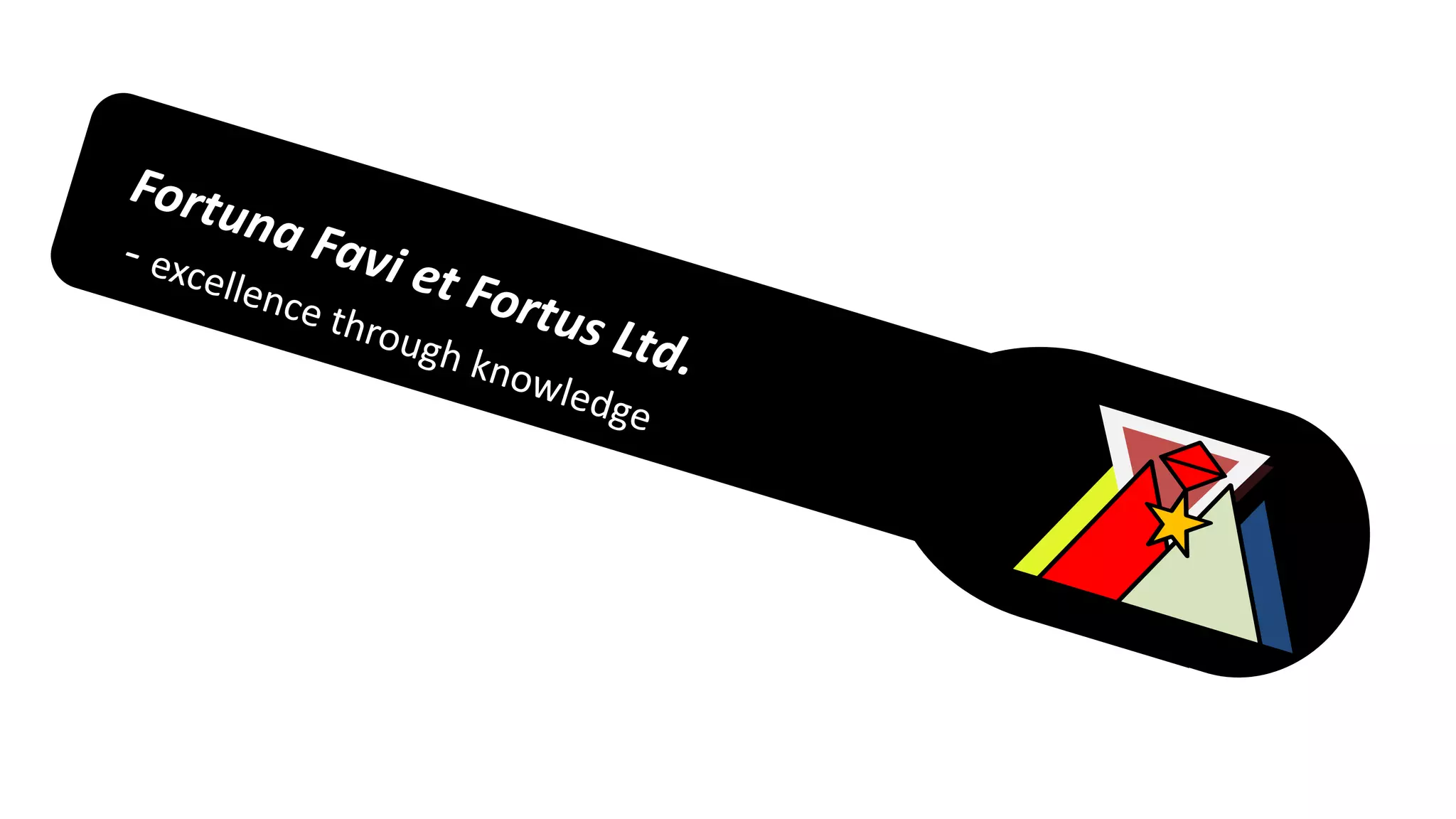

![Example: Strategy #1; Selling Futures to Speculate

if in early November the price of December bond futures have declined from

105 to 100, the investor could choose to buy back the futures at 100 and realize

a profit of 5 points, or $25,000 total

([5 ÷ 100] × $100,000 face value × 5 contracts).

If, however, December bond futures were trading at 107.50, the investor would

have to decide whether to buy the futures or hold on in the hope that the price

falls before the expiration date. If the investor decided to buy them back, a loss

equal to 2.5 points, or $12,500 total would be the result.

([2.5 ÷ 100] × $100,000 face value × 5 contracts)](https://image.slidesharecdn.com/derivatives-160208122040/85/Derivatives-Fundamentals-115-320.jpg)