Embed presentation

Downloaded 208 times

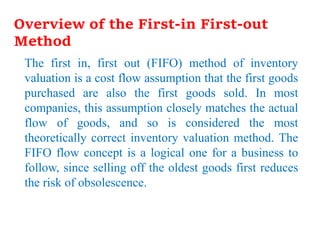

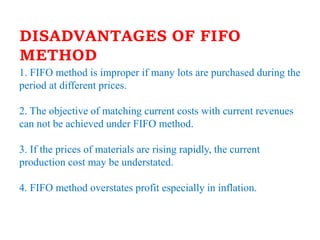

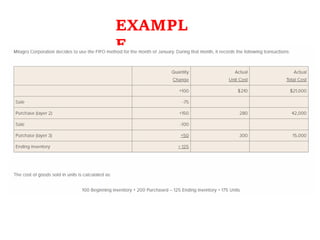

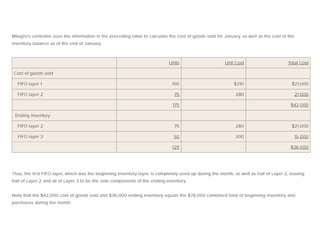

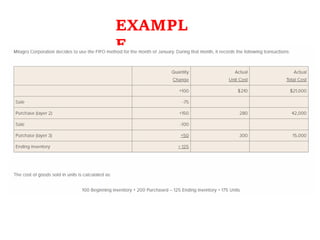

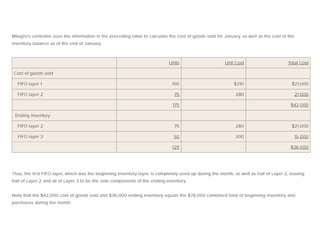

The FIFO (first-in, first-out) inventory valuation method assumes the first goods purchased are the first goods sold. This assumption closely matches reality for most companies. FIFO reduces the risk of obsolete inventory by selling older goods first. It is easy to understand and operate, suitable when prices are falling or for bulky materials, and helps avoid deterioration and reflect current market prices. However, it may not properly match costs and revenues if lots are purchased at different prices or prices are rising rapidly.