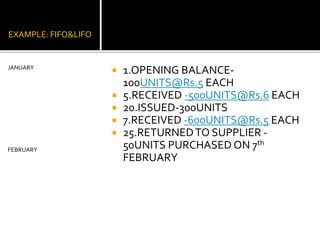

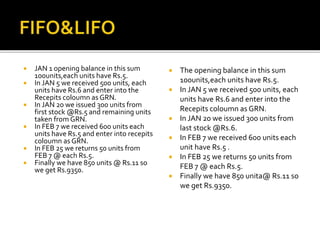

Inventory is goods and materials held by a business for resale. It is given a value for insurance purposes and to determine profit. There are different methods to value inventory, such as FIFO (first in, first out) which matches the earliest acquired inventory to cost of goods sold, and LIFO (last in, first out) which does the opposite. An example is provided to illustrate calculating inventory value under both FIFO and LIFO accounting methods. Both methods have pros and cons, with LIFO reducing reported profits during inflation but being more complicated, while FIFO is simpler but may inflate profits during inflation.