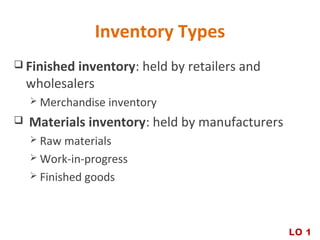

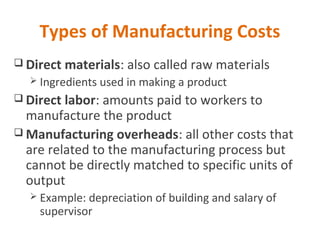

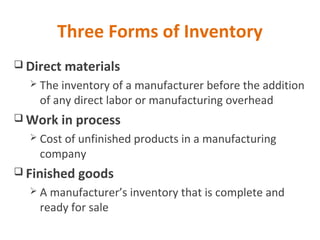

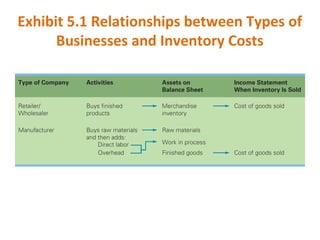

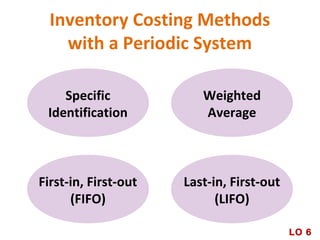

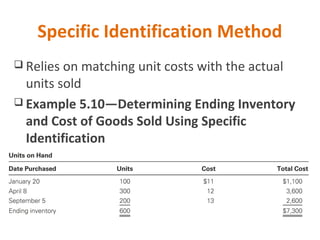

This document provides an overview of inventory costing and valuation methods. It defines different types of inventory like finished goods, work in progress, and raw materials. It also defines direct costs, manufacturing overheads and different inventory costing methods like FIFO, LIFO, weighted average. The key points covered are:

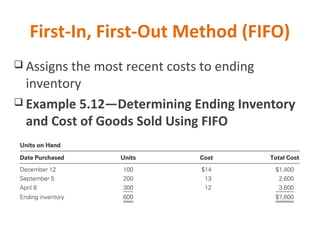

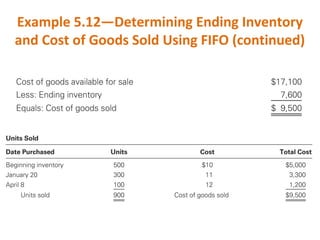

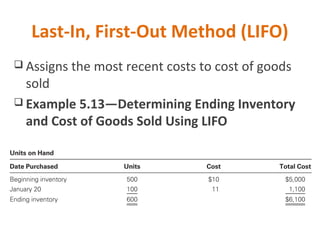

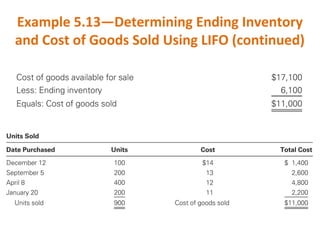

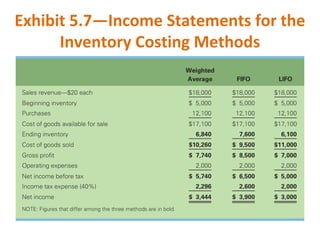

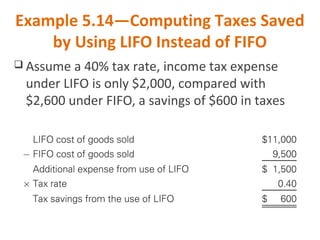

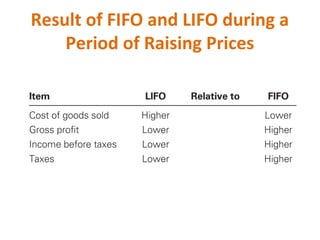

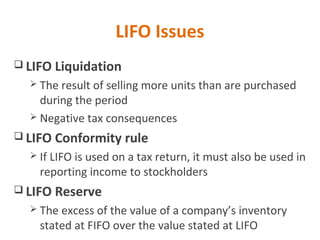

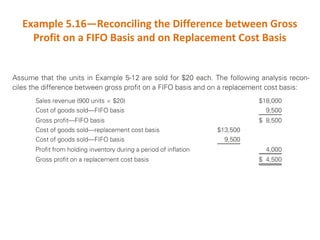

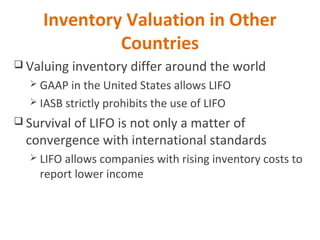

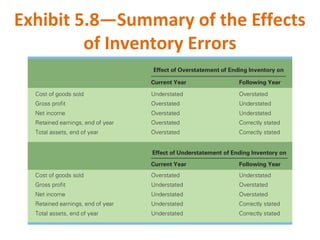

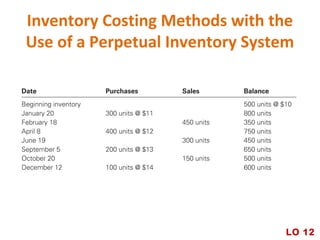

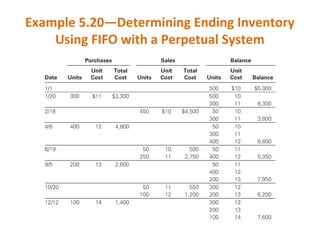

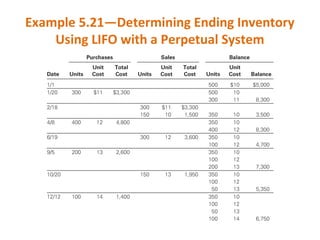

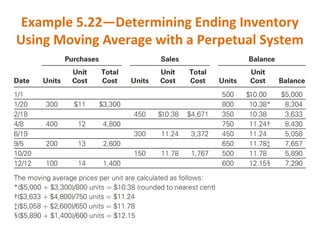

- FIFO assigns most recent costs to ending inventory while LIFO assigns most recent costs to cost of goods sold.

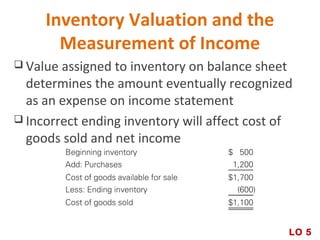

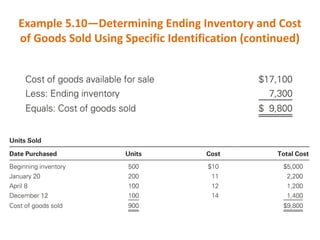

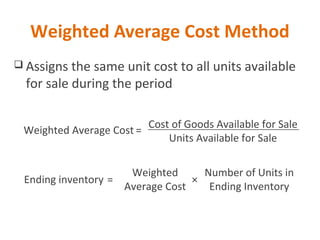

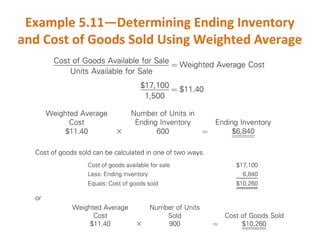

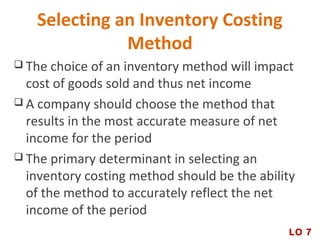

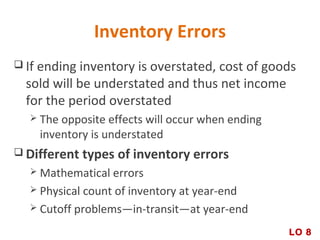

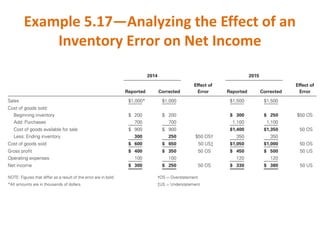

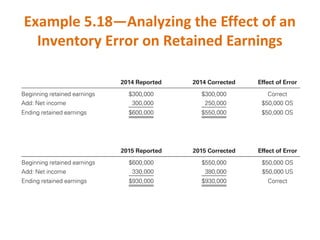

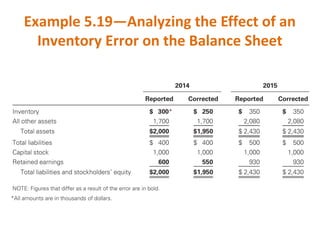

- The choice of inventory costing method impacts reported income as different methods yield different cost of goods sold and ending inventory values.

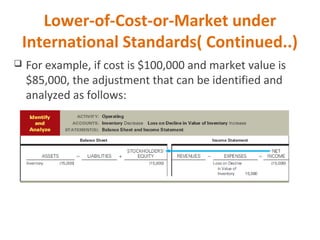

- Lower of cost or market rule requires inventory to be written down to the lower of historical cost or net realizable value.