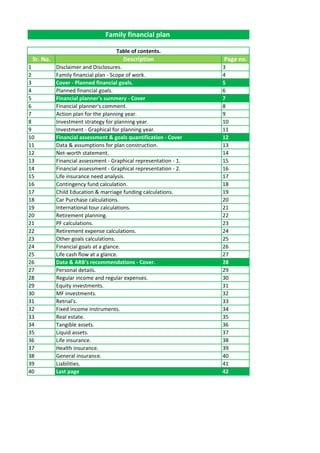

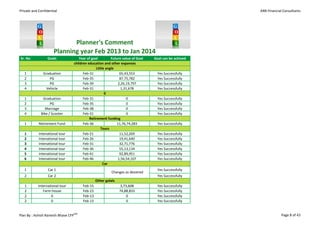

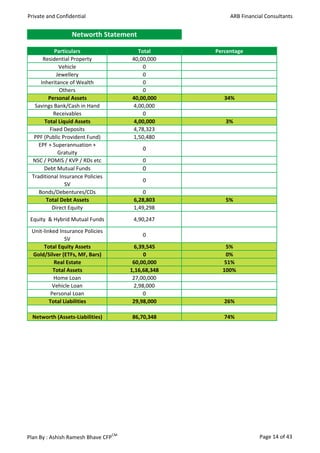

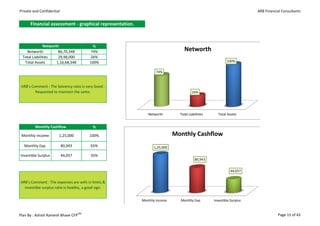

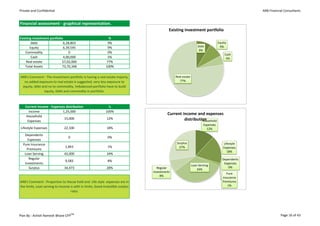

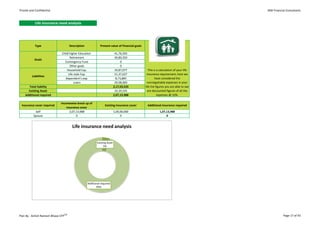

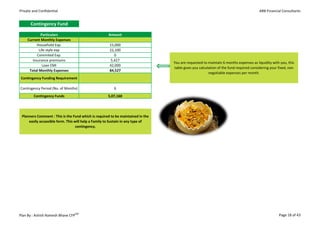

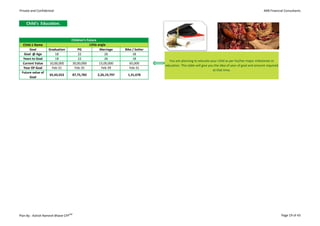

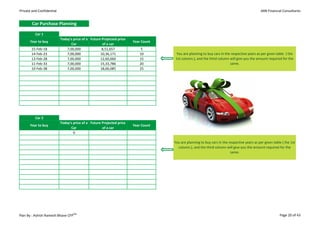

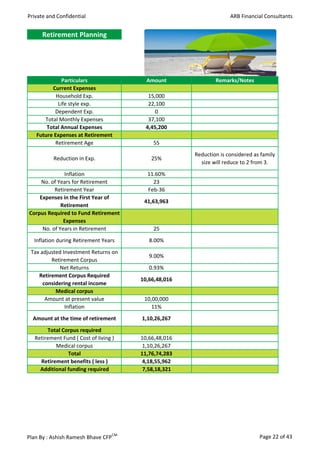

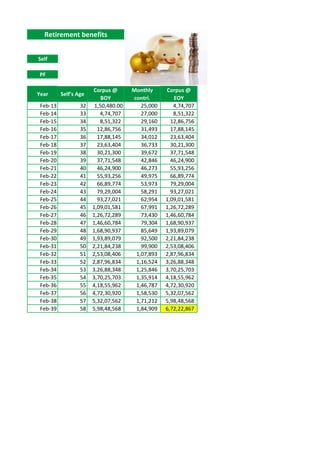

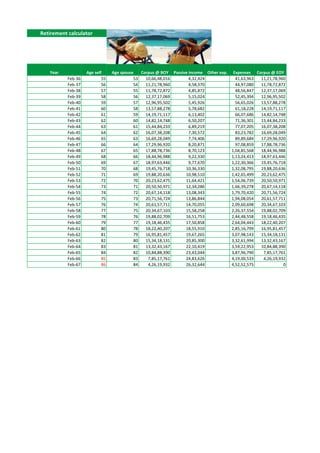

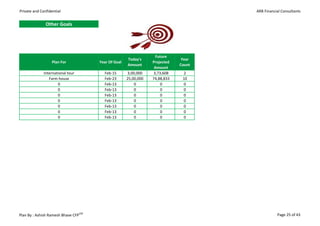

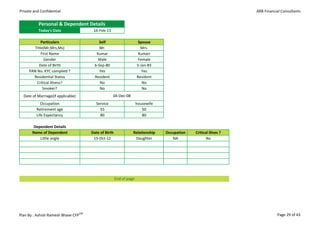

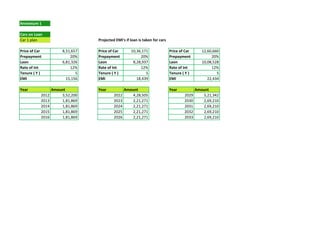

This document is a family financial plan created by ARB Financial Consultants for Kumar and Kumari. It includes an analysis of the family's current financial situation, goals, and recommendations for investments and insurance to help achieve the goals. Key goals analyzed include children's education, retirement, vacations, vehicle purchases, and a farm house. The financial planner concludes that with the recommended investment strategy, all of the family's financial goals for the planning period can be achieved successfully.